澳门考生:ACCA国际会计师报考条件中,具有高等专科以上学校毕业学历是什么意思?

发布时间:2020-01-10

既然选择了要走的路,就坚持下去,相信只要有信心,就一定能掌握自己的前途和命运。各位正在备考ACCA考试的小伙伴们,大家一定要坚持下去,攻克还有两个多月时间就要到来的ACCA考试。近期,有个小伙伴担心自己学历可能不够高,就问了51题库考试学习网一个关于报名的问题:考试条件中的高等专科学历是什么意思?是大专?高专?还是中专?51题库考试学习网就这个问题为大家答疑解惑:

想必有很多“资深”的ACCAer已经忘了报考条件是什么了吧?想必“萌新”的ACCAer还不清楚报考条件吧?不清楚自己是否符合报考条件吗?且随51题库考试学习网一起回忆一下关于报考ACCA考试的条件介绍:

报考国际注册会计师的条件有哪些?

报名国际注册会计师ACCA考试,具备以下条件之一即可:

1)凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

2)教育部认可的高等院校在校生,顺利完成大一的课程考试,即可报名成为ACCA的正式学员;

3)未符合1、2项报名资格的16周岁以上的申请者,也可以先申请参加FIA(Foundations in Accountancy)基础财务资格考试。在完成基础商业会计(FAB)、基础管理会计(FMA)、基础财务会计(FFA)3门课程,并完成ACCA基础职业模块,可获得ACCA商业会计师资格证书(Diploma in Accounting and Business),资格证书后可豁免ACCAF1-F3三门课程的考试,直接进入技能课程的考试。

一直以来,ACCA都以培养国际性的高级会计、财务管理专家著称,其高质量的课程设计,高标准的考试要求,不仅赢得了联合国和各大国际性组织的高度评价,更为众多跨国公司和专业机构所推崇。

以上就是关于报考ACCA考试的条件介绍,由此可以看出,其实报考ACCA考试的门槛条件是比较低的了,相对于国内的注册会计师考试而言,少了工作年限。因此,让不少大学生也纷纷去报名参加考试。而至于“高等专科以上”是什么意思,可以从上面的条件得知:大专。因此,报考ACCA考试的最低学历都是大专学历,中专不行哦!

同样的路,有人敢走,有人不敢。走不走,不是路说了算,是看自己有没有那个胆。有的人摔了一跤也许一辈子再也不敢站起来走了,有目标的人,就算是摔得遍体鳞伤,依然勇往直前。人和人其实也没什么太多的差异,只在思维一念之间,学会换位思考,成就自己人生。坚持信念,找对平台,跟对人,懂得感恩,诚信为人,坚持不懈,梦想终会成真。无论是初次备考ACCA还是多次备考ACCA的同学,51题库考试学习网相信你定会赢!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

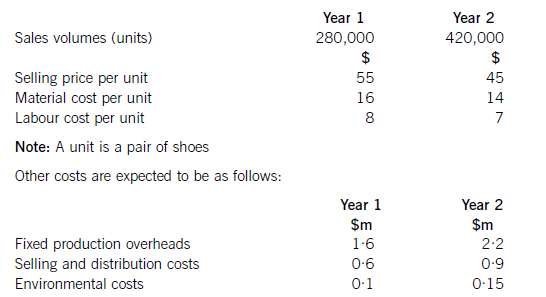

Shoe Co, a shoe manufacturer, has developed a new product called the ‘Smart Shoe’ for children, which has a built-in tracking device. The shoes are expected to have a life cycle of two years, at which point Shoe Co hopes to introduce a new type of Smart Shoe with even more advanced technology. Shoe Co plans to use life cycle costing to work out the total production cost of the Smart Shoe and the total estimated profit for the two-year period.

Shoe Co has spent $5·6m developing the Smart Shoe. The time spent on this development meant that the company missed out on the opportunity of earning an estimated $800,000 contribution from the sale of another product.

The company has applied for and been granted a ten-year patent for the technology, although it must be renewed each year at a cost of $200,000. The costs of the patent application were $500,000, which included $20,000 for the salary costs of Shoe Co’s lawyer, who is a permanent employee of the company and was responsible for preparing the application.

The following information is also available for the next two years:

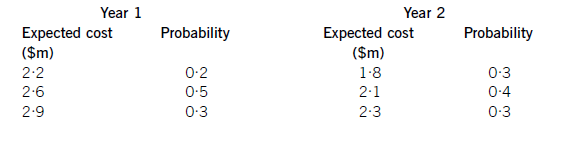

Shoe Co is still negotiating with marketing companies with regard to its advertising campaign, so is uncertain as to what the total marketing costs will be each year. However, the following information is available as regards the probabilities of the range of costs which are likely to be incurred:

Required:

Applying the principles of life cycle costing, calculate the total expected profit for Shoe Co for the two-year period.

(10 marks)

Totalsalesrevenue=(280,000x$55)+(420,000x$45)=$15·4m+18·9m=$34·3m.NoteTheexpectedprofithasbeencalculatedusinglifecyclecostingnotrelevantcosting.Hence,the$20,000salarycostincludedinpatentcostsshouldbeincludedinthelifecyclecost.Similarly,theopportunitycostof$800,000isnotincludedusinglifecyclecostingwhereasifrelevantcostingwasbeingusedtodecideonaparticularcourseofaction,theopportunitycostwouldbeincluded.Working1Expectedmarketingcostinyear1:(0·2x$2·2m)+(0·5x$2·6m)+(0·3x$2·9m)=$2·61mExpectedmarketingcostyear2:(0·3x$1·8m)+(0·4x$2·1m)+(0·3x$2·3m)=$2·07mTotalexpectedmarketingcost=$4·68m

(b) Misson has purchased goods from a foreign supplier for 8 million euros on 31 July 2006. At 31 October 2006,

the trade payable was still outstanding and the goods were still held by Misson. Similarly Misson has sold goods

to a foreign customer for 4 million euros on 31 July 2006 and it received payment for the goods in euros on

31 October 2006. Additionally Misson had purchased an investment property on 1 November 2005 for

28 million euros. At 31 October 2006, the investment property had a fair value of 24 million euros. The company

uses the fair value model in accounting for investment properties.

Misson would like advice on how to treat these transactions in the financial statements for the year ended 31

October 2006. (7 marks)

Required:

Discuss the accounting treatment of the above transactions in accordance with the advice required by the

directors.

(Candidates should show detailed workings as well as a discussion of the accounting treatment used.)

(b) Inventory, Goods sold and Investment property

The inventory and trade payable initially would be recorded at 8 million euros ÷ 1·6, i.e. $5 million. At the year end, the

amount payable is still outstanding and is retranslated at 1 dollar = 1·3 euros, i.e. $6·2 million. An exchange loss of

$(6·2 – 5) million, i.e. $1·2 million would be reported in profit or loss. The inventory would be recorded at $5 million at the

year end unless it is impaired in value.

The sale of goods would be recorded at 4 million euros ÷ 1·6, i.e. $2·5 million as a sale and as a trade receivable. Payment

is received on 31 October 2006 in euros and the actual value of euros received will be 4 million euros ÷ 1·3,

i.e. $3·1 million.

Thus a gain on exchange of $0·6 million will be reported in profit or loss.

The investment property should be recognised on 1 November 2005 at 28 million euros ÷ 1·4, i.e. $20 million. At

31 October 2006, the property should be recognised at 24 million euros ÷ 1·3, i.e. $18·5 million. The decrease in fair value

should be recognised in profit and loss as a loss on investment property. The property is a non-monetary asset and any foreign

currency element is not recognised separately. When a gain or loss on a non-monetary item is recognised in profit or loss,

any exchange component of that gain or loss is also recognised in profit or loss. If any gain or loss is recognised in equity ona non-monetary asset, any exchange gain is also recognised in equity.

(b) Discuss the key issues which will need to be addressed in determining the basic components of an

internationally agreed conceptual framework. (10 marks)

Appropriateness and quality of discussion. (2 marks)

(b) There are several issues which have to be addressed if an international conceptual framework is to be successfully developed.

These are:

(i) Objectives

Agreement will be required as to whether financial statements are to be produced for shareholders or a wide range of

users and whether decision usefulness is the key criteria or stewardship. Additionally there is the question of whether

the objective is to provide information in making credit and investment decisions.

(ii) Qualitative Characteristics

The qualities to be sought in making decisions about financial reporting need to be determined. The decision usefulness

of financial reports is determined by these characteristics. There are issues concerning the trade-offs between relevance

and reliability. An example of this concerns the use of fair values and historical costs. It has been argued that historical

costs are more reliable although not as relevant as fair values. Additionally there is a conflict between neutrality and the

traditions of prudence or conservatism. These characteristics are constrained by materiality and benefits that justify

costs.

(iii) Definitions of the elements of financial statements

The principles behind the definition of the elements need agreement. There are issues concerning whether ‘control’

should be included in the definition of an asset or become part of the recognition criteria. Also the definition of ‘control’

is an issue particularly with financial instruments. For example, does the holder of a call option ‘control’ the underlying

asset? Some of the IASB’s standards contravene its own conceptual framework. IFRS3 requires the capitalisation of

goodwill as an asset despite the fact that it can be argued that goodwill does not meet the definition of an asset in the

Framework. IAS12 requires the recognition of deferred tax liabilities that do not meet the liability definition. Similarly

equity and liabilities need to be capable of being clearly distinguished. Certain financial instruments could either be

liabilities or equity. For example obligations settled in shares.

(iv) Recognition and De-recognition

The principles of recognition and de-recognition of assets and liabilities need reviewing. Most frameworks have

recognition criteria, but there are issues over the timing of recognition. For example, should an asset be recognised when

a value can be placed on it or when a cost has been incurred? If an asset or liability does not meet recognition criteria

when acquired or incurred, what subsequent event causes the asset or liability to be recognised? Most frameworks do

not discuss de-recognition. (The IASB’s Framework does not discuss the issue.) It can be argued that an item should be

de-recognised when it does not meet the recognition criteria, but financial instruments standards (IAS39) require other

factors to occur before financial assets can be de-recognised. Different attributes should be considered such as legal

ownership, control, risks or rewards.

(v) Measurement

More detailed discussion of the use of measurement concepts, such as historical cost, fair value, current cost, etc are

required and also more guidance on measurement techniques. Measurement concepts should address initial

measurement and subsequent measurement in the form. of revaluations, impairment and depreciation which in turn

gives rise to issues about classification of gains or losses in income or in equity.

(vi) Reporting entity

Issues have arisen over what sorts of entities should issue financial statements, and which entities should be included

in consolidated financial statements. A question arises as to whether the legal entity or the economic unit should be the

reporting unit. Complex business arrangements raise issues over what entities should be consolidated and the basis

upon which entities are consolidated. For example, should the basis of consolidation be ‘control’ and what does ‘control’

mean?

(vii) Presentation and disclosure

Financial reporting should provide information that enables users to assess the amounts, timing and uncertainty of the

entity’s future cash flows, its assets, liabilities and equity. It should provide management explanations and the limitations

of the information in the reports. Discussions as to the boundaries of presentation and disclosure are required.

Faithful representation is a fundamental characteristic of useful information within the IASB’s Conceptual framework for financial reporting.

Which of the following accounting treatments correctly applies the principle of faithful representation?

A.Reporting a transaction based on its legal status rather than its economic substance

B.Excluding a subsidiary from consolidation because its activities are not compatible with those of the rest of the group

C.Recording the whole of the net proceeds from the issue of a loan note which is potentially convertible to equity shares as debt (liability)

D.Allocating part of the sales proceeds of a motor vehicle to interest received even though it was sold with 0% (interest free) finance

The substance is that there is no ‘free’ finance; its cost, as such, is built into the selling price.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-09

- 2020-02-26

- 2020-01-09

- 2020-02-23

- 2020-01-10

- 2020-01-01

- 2020-01-09

- 2021-09-12

- 2020-01-03

- 2020-02-26

- 2021-06-27

- 2020-01-10

- 2020-02-28

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-02-23

- 2019-01-17

- 2020-02-26

- 2020-02-28

- 2021-08-21

- 2020-02-28

- 2020-01-04

- 2020-01-09

- 2019-12-27

- 2020-04-28

- 2019-01-06

- 2019-01-06