ACCA准考证的下载方法

发布时间:2022-01-20

准考证是参加ACCA考试必须准备的一大证件,但一般情况下ACCA官方不会提供纸质版,每个报考ACCA的考生需自行登录ACCA官方网站进行下载和打印。接下来51题库考试学习网就给大家带来了一些ACCA考试打印准考证相关的内容,一起来看看吧!

1、打开ACCA全球官网,点击myACCA;

2、输入准考证号及密码进入后,在左侧找到“DOCKET“;

3、随后出现在页面,其中提到:准考证中将不再有照片(老版是有照片的);

4、点击“Access your docket”,在随后出现的页面中选择学习方式及培训机构,培训机构选择“。。。”;

5、点击Save;

6、然后页面跳转后会自动下载准考证。

需要提醒大家的是,官网会在考前2-3周开放准考证下载,过早无法下载,而太晚的话容易遇到网络高峰期,可能会导致网站崩溃,所以提醒大家适当的安排准考证下载时间是非常有必要的。

ACCA考过之后提供成绩单吗?首先,ACCA官方是不会像四六级考试那样在通过考试后发成绩单的,但是在通过全部科目后,ACCA学员可以通过官方网站下载ACCA准会员证书。然而各个科目虽然没有单科成绩单,但我们可以登录官网进行查看。登录my ACCA账户查看成绩单的主要方式:

1、登陆ACCA官网accaglobal . com,点击"my ACCA"进入学员个人页面;

2、输入个人的学员注册号码及密码后点击按钮"login"进入下一页面;

3、点击"EXAM ENTRY & RESULTS "进入下一页面;

4、点击"EXAM ATTENDANCE DOCKET "下面的"Download "按钮下载即可;

ACCA成绩查询的其他三种方法:

1、电子邮件(e-mail)——您可在myACCA内选择通过email接收考试成绩 2、邮寄—属于ACCA官方最正式的通知方法。每次考试的两个半月后由ACCA总部发出,您收到邮件的时间决定于邮局的工作速度。

3、在线查看考试成绩——所有在ACCA全球网站上登记的考生都可在线查看自己的考试成绩。

作为国际专业会计师组织,ACCA享有极高的全球声誉,与众多国际知名企业建立了密切的合作关系,包括跨国企业、各国地方企业、其他会计师组织、教育机构、以及联合国、世界银行等世界性组织。全球超过8500家雇主已经加入ACCA认证雇主计划,为ACCA学员和会员提供培训及发展机会。ACCA在中国拥有超过500家认可雇主企业,他们都优先录用及提升ACCA会员及学员,许多企业将ACCA作为晋升的凭证及要求之一。

ACCA学员毕业后的就职方向大部分为外资银行金融投资分析师;跨国公司的财务、内审、金融、风险控制人员;国际会计师事务所的审计师、咨询师;国内境外上市公司的财务、金融分析人员;国内审计师事务所的涉外部门主管等。总之,学习ACCA可取的令人尊敬的地位、令人羡慕的职位、令人心动的薪水!

小伙伴们再见了!想要了解更多ACCA考试相关的信息,请多多关注51题库考试学习网。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) Describe the main stages of a formal grievance procedure that Oliver should now pursue. (10 marks)

Part (c):

Grievance procedures must be accessible to all employees of Hoopers and Henderson at any level of the organisation and

regardless of their status. Managers must have suitable training in procedures and be provided with background as to how

grievances can occur in the first place. Grievance procedures must be regarded as beneficial and not threatening.

If an employee has a grievance, he or she should be able to pursue it and have the problem which has led to the grievance resolved.

A formal grievance procedure must be available, set out in writing and accessible to all employees. The procedure should consist

of five formal stages.

The first stage states the grade of employee or employees and their rights for each type of grievance.

The second stage details the actual procedures for pursuing a grievance, and is in four parts:

– The employee must discuss the grievance with his or her immediate supervisor or line manager.

– If the grievance can not be resolved at the first level, then the employee’s manager must become involved.

– The interview between the employee and manager takes place with the employee being allowed a representative if desired.

– If the grievance remains unresolved then the matter must be referred to a higher manager.

The third stage (referral to a higher manager) requires that the Human Resources Department or, in the case of Hoopers and

Henderson the partner responsible, must be informed.

The fourth stage is that written records must be kept and be available to all employees.

Finally, the procedure must be time limited.

Allowance must be made for the involvement of a trade union, staff association or individual support (if desired) at an appropriate

stage in the procedure.

At Hoopers and Henderson, Oliver has attempted to discuss the issue with his immediate manager (David Morgan) but without

success. He has therefore followed the procedure, but to continue correctly, Oliver must have taken up his grievance with the

manager next in seniority to David Morgan, who in this case is the partner responsible for human resources.

3 You are the manager responsible for the audit of Volcan, a long-established limited liability company. Volcan operates

a national supermarket chain of 23 stores, five of which are in the capital city, Urvina. All the stores are managed in

the same way with purchases being made through Volcan’s central buying department and product pricing, marketing,

advertising and human resources policies being decided centrally. The draft financial statements for the year ended

31 March 2005 show revenue of $303 million (2004 – $282 million), profit before taxation of $9·5 million (2004

– $7·3 million) and total assets of $178 million (2004 – $173 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) On 1 May 2005, Volcan announced its intention to downsize one of the stores in Urvina from a supermarket to

a ‘City Metro’ in response to a significant decline in the demand for supermarket-style. shopping in the capital.

The store will be closed throughout June, re-opening on 1 July 2005. Goodwill of $5·5 million was recognised

three years ago when this store, together with two others, was bought from a national competitor. It is Volcan’s

policy to write off goodwill over five years. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Volcan for the year ended

31 March 2005.

NOTE: The mark allocation is shown against each of the three issues.

3 VOLCAN

(a) Store impairment

(i) Matters

■ Materiality

? The cost of goodwill represents 3·1% of total assets and is therefore material.

? However, after three years the carrying amount of goodwill ($2·2m) represents only 1·2% of total assets –

and is therefore immaterial in the context of the balance sheet.

? The annual amortisation charge ($1·1m) represents 11·6% profit before tax (PBT) and is therefore also

material (to the income statement).

? The impact of writing off the whole of the carrying amount would be material to PBT (23%).

Tutorial note: The temporary closure of the supermarket does not constitute a discontinued operation under IFRS 5

‘Non-Current Assets Held for Sale and Discontinued Operations’.

■ Under IFRS 3 ‘Business Combinations’ Volcan should no longer be writing goodwill off over five years but

subjecting it to an annual impairment test.

■ The announcement is after the balance sheet date and is therefore a non-adjusting event (IAS 10 ‘Events After the

Balance Sheet Date’) insofar as no provision for restructuring (for example) can be made.

■ However, the event provides evidence of a possible impairment of the cash-generating unit which is this store and,

in particular, the value of goodwill assigned to it.

■ If the carrying amount of goodwill ($2·2m) can be allocated on a reasonable and consistent basis to this and the

other two stores (purchased at the same time) Volcan’s management should have applied an impairment test to

the goodwill of the downsized store (this is likely to show impairment).

■ If more than 22% of goodwill is attributable to the City Metro store – then its write-off would be material to PBT

(22% × $2·2m ÷ $9·5m = 5%).

■ If the carrying amount of goodwill cannot be so allocated; the impairment test should be applied to the

cash-generating unit that is the three stores (this may not necessarily show impairment).

■ Management should have considered whether the other four stores in Urvina (and elsewhere) are similarly

impaired.

■ Going concern is unlikely to be an issue unless all the supermarkets are located in cities facing a downward trend

in demand.

Tutorial note: Marks will be awarded for stating the rules for recognition of an impairment loss for a cash-generating

unit. However, as it is expected that the majority of candidates will not deal with this matter, the rules of IAS 36 are

not reproduced here.

(ii) Audit evidence

■ Board minutes approving the store’s ‘facelift’ and documenting the need to address the fall in demand for it as a

supermarket.

■ Recomputation of the carrying amount of goodwill (2/5 × $5·5m = $2·2m).

■ A schedule identifying all the assets that relate to the store under review and the carrying amounts thereof agreed

to the underlying accounting records (e.g. non-current asset register).

■ Recalculation of value in use and/or fair value less costs to sell of the cash-generating unit (i.e. the store that is to

become the City Metro, or the three stores bought together) as at 31 March 2005.

Tutorial note: If just one of these amounts exceeds carrying amount there will be no impairment loss. Also, as

there is a plan NOT to sell the store it is most likely that value in use should be used.

■ Agreement of cash flow projections (e.g. to approved budgets/forecast revenues and costs for a maximum of five

years, unless a longer period can be justified).

■ Written management representation relating to the assumptions used in the preparation of financial budgets.

■ Agreement that the pre-tax discount rate used reflects current market assessments of the time value of money (and

the risks specific to the store) and is reasonable. For example, by comparison with Volcan’s weighted average cost

of capital.

■ Inspection of the store (if this month it should be closed for refurbishment).

■ Revenue budgets and cash flow projections for:

– the two stores purchased at the same time;

– the other stores in Urvina; and

– the stores elsewhere.

Also actual after-date sales by store compared with budget.

5 Ambush, a public limited company, is assessing the impact of implementing the revised IAS39 ‘Financial Instruments:

Recognition and Measurement’. The directors realise that significant changes may occur in their accounting treatment

of financial instruments and they understand that on initial recognition any financial asset or liability can be

designated as one to be measured at fair value through profit or loss (the fair value option). However, there are certain

issues that they wish to have explained and these are set out below.

Required:

(a) Outline in a report to the directors of Ambush the following information:

(i) how financial assets and liabilities are measured and classified, briefly setting out the accounting

method used for each category. (Hedging relationships can be ignored.) (10 marks)

5 Report to the Directors of Ambush, a public limited company

(a) The following report sets out the principal aspects of IAS 39 in the designated areas.

(i) Classification of financial instruments and their measurement

Financial assets and liabilities are initially measured at fair value which will normally be the fair value of the

consideration given or received. Transaction costs are included in the initial carrying value of the instrument unless it

is carried at ‘fair value through profit or loss’ when these costs are recognised in the income statement.

Financial assets should be classified into four categories:

(i) financial assets at fair value through profit or loss

(ii) loans and receivables

(iii) held-to-maturity investments (HTM)

(iv) available-for-sale financial assets (AFS).

The first category above has two sub categories which are ‘held for trading’ and those designated to this category at

inception/initial recognition. This latter designation is irrevocable.

Financial liabilities have two categories: those at fair value through profit or loss, and ‘other’ liabilities. As with financial

assets those liabilities designated as at fair value through profit or loss have two sub categories which are the same as

those for financial assets.

Reclassifications between categories are uncommon and restricted under IAS 39 and are prohibited into and out of the

fair value through profit or loss category. Reclassifications between AFS and HTM are possible but it is not possible from

loans and receivables to AFS. The held to maturity category is limited in its application as if the company sells or

reclassifies more than an immaterial amount of the portfolio, it is barred from using the category for at least two years.

Also all remaining HTM investments would be reclassified to AFS.

Subsequent measurement of financial assets and liabilities depends on the classification. The following tablesummarises the position:

Amortised cost is the cost of an asset or liability adjusted to achieve a constant effective interest rate over the life of the

asset or liability.

It is not possible to compute amortised cost for instruments that do not have fixed or determinable payments, such as

for equity instruments, and such instruments therefore cannot be classified into these categories.

A company must apply the effective interest rate method in the measurement of amortised cost. The effective interest

rate method determines how much interest income or interest expense should be reported in profit and loss.

For financial assets at fair value through profit or loss and financial liabilities at fair value through profit or loss, all

changes in fair value are recognised in profit or loss when they occur. This includes unrealised holding gains and losses.

For available-for-sale financial assets, unrealised holding gains and losses are deferred in reserves until they are realised

or impairment occurs. Only interest income and dividend income, impairment losses, and certain foreign currency gains

and losses are recognised in profit or loss.

Investments in unquoted equity instruments that cannot be reliably measured at fair value are subsequently measureat cost. Unrealised holding gains/losses are not normally recognised in profit/loss.

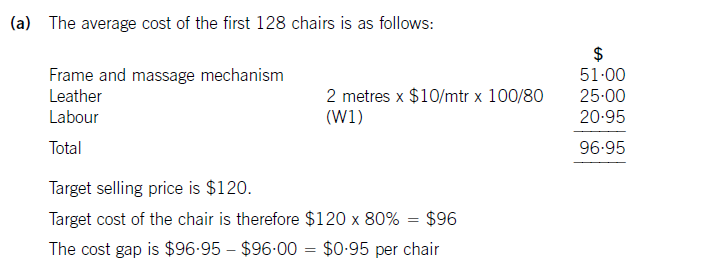

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

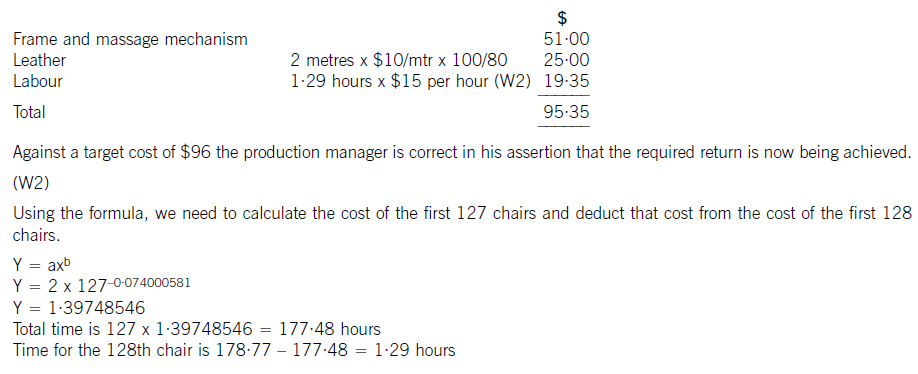

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

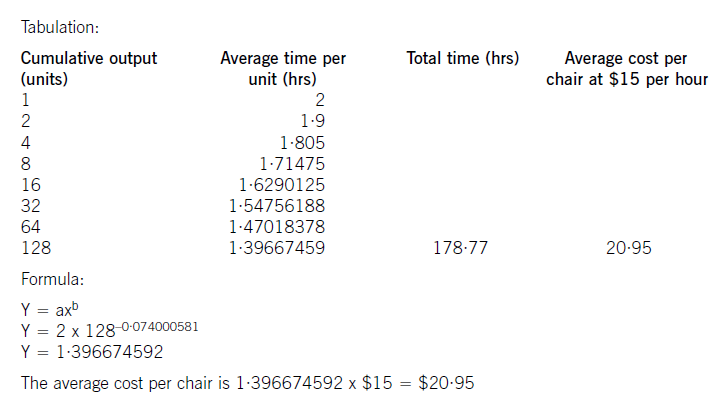

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-06-27

- 2020-08-15

- 2020-09-04

- 2020-01-10

- 2020-01-10

- 2020-12-24

- 2020-09-04

- 2021-04-09

- 2020-01-10

- 2020-04-11

- 2020-08-14

- 2020-12-24

- 2020-12-24

- 2020-01-10

- 2020-01-08

- 2020-01-08

- 2020-09-04

- 2020-01-10

- 2021-01-01

- 2020-01-10

- 2020-01-09

- 2020-09-04

- 2021-06-30

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-09-04

- 2020-01-10

- 2020-09-05

- 2020-01-10