湖北省2019年12月ACCA考试成绩公布时间定了!

发布时间:2020-01-10

2019年ACCA最后一次考试(12月考季)已然落下帷幕,很多同学都在关注着自己的考试结果。据悉,ACCA官方将于2020年1月13日(明天)公布本次考试成绩。届时,大家可以在第一时间查询到自己的成绩。下面的ACCA成绩查询方法及流程希望对你有所帮助。

ACCA考试成绩查询方法

1.电子邮件(e-mail)

您可以在 MY ACCA 内选择通过 E-mail 接收考试成绩。

2.短信接收(SMS)

您可以在 MY ACCA 内选择通过 SMS 接收考试成绩。

3.在线查看考试成绩

所有在ACCA全球网站上登记的考生都可以在线查看自己的考试成绩。

在线查询成绩具体操作流程指导

(1)进入ACCA官网点击右上角My ACCA进行登录;

(2)输入账号、密码登录后进入主页面,点击 Exam status & Results;

(3)跳转页面后选择View your status report;

以上就是关于ACCA成绩查询的相关信息,51题库考试学习网在这里祝大家欧皇附体,成功通过考试!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

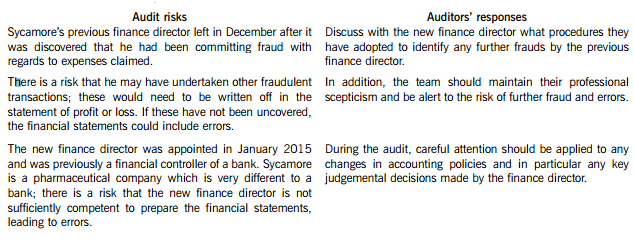

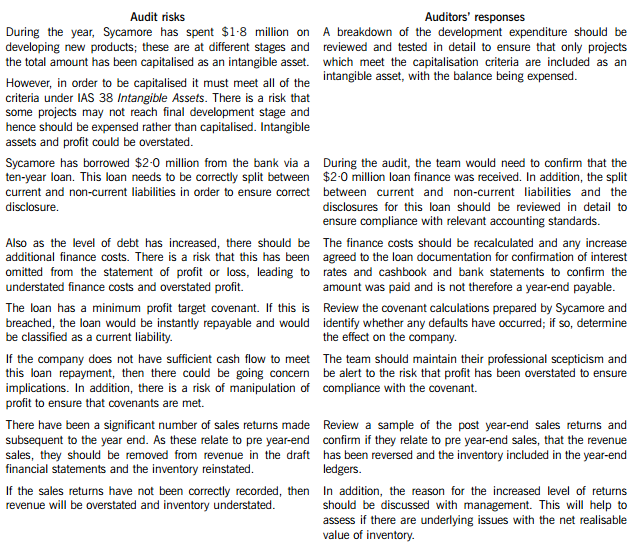

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

(iii) State how your answer in (ii) would differ if the sale were to be delayed until August 2006. (3 marks)

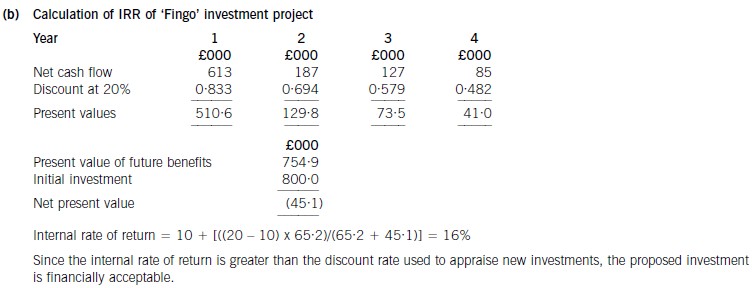

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

(b) Explain how the process of developing scenarios might help John better understand the macro-environmental

factors influencing Airtite’s future strategy. (8 marks)

(b) Carrying out a systematic PESTEL analysis is a key step in developing alternative scenarios about the future. Johnson and

Scholes define scenarios as ‘detailed and plausible views of how the business environment of an organisation might develop

in the future based on groupings of key environmental influences and drivers of change about which there is a high level of

uncertainty’. In developing scenarios it is necessary to isolate the key drivers of change, which have the potential to have a

significant impact on the company and are associated with high levels of uncertainty. Development of scenarios enables

managers to share assumptions about the future and the key variables shaping that future. This provides an opportunity for

real organisational learning. They are then in a position to monitor these key variables and amend strategies accordingly. It

is important to note that different stakeholder groups will have different expectations about the future and each may provide

a key input to the process of developing scenarios. By their very nature scenarios should not attempt to allocate probabilities

to the key factors and in so doing creating ‘spurious accuracy’ about those factors. A positive scenario is shown below and

should provide a shared insight into the external factors most likely to have a significant impact on Airtite‘s future strategy.

For most companies operating in global environments the ability to respond flexibly and quickly to macro-environmental

change would seem to be a key capability.

The scenario as illustrated below, clearly could have a major impact on the success or otherwise of Airtite’s strategy for the

future. The key drivers for change would seem to be the link between technology and global emissions, fuel prices and the

stability of the global political environment. Through creating a process which considers the drivers which will have most

impact on Airtite and which are subject to the greatest uncertainty, Airtite will have a greater chance of its strategy adaptingto changing circumstances.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-09-05

- 2021-04-04

- 2020-08-12

- 2021-01-08

- 2020-08-12

- 2020-08-12

- 2020-08-12

- 2020-10-18

- 2021-04-04

- 2021-01-06

- 2019-03-20

- 2019-03-20

- 2019-01-05

- 2019-01-05

- 2019-01-05

- 2021-01-08

- 2021-04-07

- 2020-04-03

- 2021-01-08

- 2021-05-22

- 2020-04-11

- 2021-04-04

- 2021-01-21

- 2020-01-10

- 2020-10-18

- 2020-09-05

- 2020-10-19

- 2019-03-20

- 2020-10-19

- 2021-04-04