2019年3月广东ACCA考试成绩查询时间为4月15日

发布时间:2019-03-20

2019年3月ACCA考试已经结束,3月考试季的成绩将会于4月15日公布。

具体时间会根据时间差而有所差异,请考生留意官网公告。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Advise Maureen on deregistration for the purposes of value added tax (VAT) and any possible alternative

strategy. (8 marks)

An additional mark will be awarded for the effectiveness with which the information is communicated.

(1 mark)

(b) Advice on Maureen’s VAT position

Deregistration

In order to voluntarily deregister for VAT you must satisfy HMRC that the value of your taxable supplies in the next twelve

months will not exceed £62,000. You will then be deregistered with effect from the date of your request or a later date as

agreed with HMRC.

On deregistering you are regarded as making a supply of all stocks and equipment in respect of which input tax has been

claimed. However, the VAT on this deemed supply need only be paid to HMRC if it exceeds £1,000.

Once you have deregistered, you must no longer charge VAT on your sales. You will also be unable to recover the input tax

on the costs incurred by your business. Instead, the VAT you pay on your costs will be allowable when computing your taxable

profits.

You should monitor your sales on a monthly basis; if your sales in a twelve-month period exceed £64,000 you must notify

HMRC within the 30 days following the end of the twelve-month period. You will be registered from the end of the month

following the end of the twelve-month period.

Flat rate scheme

Rather than deregistering you may wish to consider operating the flat rate scheme. This would reduce the amount of

administration as you would no longer need to record and claim input tax in respect of the costs incurred by your business.

Under the flat rate scheme you would continue to charge your customers VAT in the way that you do at the moment. You

would then pay HMRC a fixed percentage of your VAT inclusive turnover each quarter rather than calculating output tax less

input tax. This may be financially advantageous as compared with deregistering; I would be happy to prepare calculations for

you if you wish.

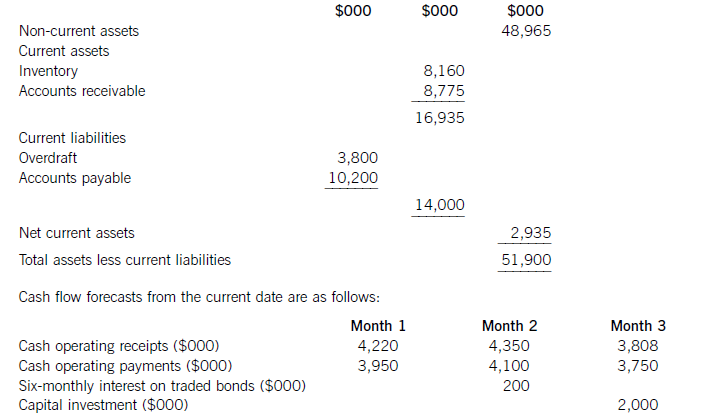

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts.

(b) Wallace Co; and (5 marks)

(b) Wallace Co

Being the audit manager, Valerie Hobson is clearly in a position to influence the outcome of the audit. She appears to have

entered into a private commercial transaction with her client. IFAC’s Code of Ethics for Professional Accountants does not

prohibit such commercial transactions so long as they are:

– In the normal course of business,

– At arm’s length, and

– The value is not material to either party.

In this case the transaction is in the normal course of business for the client. Rental of storage space is not the main business

of Wallace Co, but it appears that this type of transaction is quite common for the company. However the note on the invoice

indicates that a substantial discount has been offered and accepted, and so the transaction is not at arm’s length. The value

is not material to Wallace Co, but could represent a significant discount to normal commercial terms to the audit manager.

Goods and services can be received from an audit client, but only if the value is clearly insignificant.

A self-interest threat is clearly established. Valerie Hobson is benefiting financially from her position as audit manager. She

may compromise the audit approach – which has recently been planned – and furthermore she may compromise the audit

opinion to keep the client happy. She may also have other audit clients where bias could have occurred.

Action to be taken:

– The ethics partner will need to evaluate whether the value of the transaction and the discount received is ‘clearly

insignificant’.

– Her benefiting from a discount on services provided by Wallace Co, which was not disclosed, could result in disciplinary

action.

– Valerie should be removed from the audit immediately, and a new audit manager assigned to Wallace Co.

– The audit planning for year ended 31 May 2008 should be subject to independent review and amendments made where

necessary.

– The transaction should be disclosed to the audit committee of Wallace Co, or to those charged with governance.

– The ethics partner may wish to consider Valerie’s relationships with other audit clients for any evidence of transactions

or other indicators of potential bias.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-04-07

- 2020-10-18

- 2019-01-05

- 2021-04-07

- 2020-08-12

- 2021-04-04

- 2021-01-08

- 2019-03-20

- 2020-01-10

- 2019-01-05

- 2020-10-18

- 2021-01-08

- 2020-08-12

- 2020-08-12

- 2020-09-05

- 2020-10-19

- 2019-03-20

- 2021-01-06

- 2021-01-08

- 2021-01-06

- 2019-03-20

- 2020-10-19

- 2020-08-12

- 2020-09-04

- 2020-01-10

- 2019-01-05

- 2020-10-18

- 2020-01-10

- 2021-01-07

- 2019-01-05