解答!2020年整个ACCA考下来一共要多少钱,ACCA最快多久能够全部考完

发布时间:2020-01-02

刚进入大学的同学可能会通过各种途径了解到ACCA这样一个财会证书。学长学姐们也会用自己的血泪史来提醒接下来准备入坑ACCA的学弟学妹们,学习ACCA是多么痛苦的一件事!学习ACCA将意味着接下来的几年大学生涯,大部分时间将要在图书馆里度过了!但是,更让大家好奇的是这样一张国际财会证书,考出来到底需要付出多少金钱?对于这个问题51题库考试学习网来为大家进行解答。

ACCA费用主要包括:注册费,年费,报名费

下面根据ACCA官网公布的2020年ACCA费用来计算:

注册费:79£,一次性。

年费:112£,每年。每年5月8号前注册缴纳,5月8号之后注册次年1月1号缴纳。建议5月8号以后注册。

ACCA注册费,年费:注册费79£为一次性费用,由于大部分ACCA学员学习ACCA一般都需要三到四年,就按照四年年费来计算,为112*4=448英镑,一共为527£约等于4848RMB。

ACCA考试费用:(注:所有考试费用都以早期缴费为准。)F1-F3由于是随即机考,价格是各个机考中心定价,不过不会很贵,就按整数算100£*3=300£,F4-F9一共6门,114*6=684£,SBL为188£,SBR为147£,P4-P7选二门为147*2,所有的加起来为300+684+188+147*2≈13487元。

注:汇率取1£=¥9.2,随时会有变化,请同学们注意。

ACCA教材费用:13科科目的教材,每科以350计算,共4550。

额外可能遇到的费用:全部一次通过ACCA科目基本是不现实的,偶尔的挂科是在所难免的,就不给大家设限了,尽量做到少挂。

每年ACCA的考试费,年费,注册费都会有不同情况的上涨,上面的ACCA考试费用是2020年3月最新的计算费用。

那么,在不参加任何培训的情况下,基本上ACCA全部考下来的费用基本上就出炉了,ACCA注册费+年费+ACCA考试费用+ACCA教材费用+额外可能遇到的费用就为4121+13487+4550约等于22158元。

ACCA最快多久能够全部考完?

首先需要知道ACCA考试科目一共13门,如果是从理论上上来说ACCA考试一年最多考过8门,如果你具备免考资格一年就可以考完。但是实际在考试的时候学员可能会遇到考试挂科,考试退考缺考等事宜,所以一般考试在两到三年的偏多,如果学习进度实在是太慢也需要在7年有效期内考完。

首先,ACCA的学习不是一蹴而就的。只要付出的复习时间足够,理论上每个人都能顺利通过ACCA全科考试。希望51题库考试学习网为大家分享的内容能给大家带来帮助,也祝各位考生都能取得优异成绩!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(iii) Identify and discuss an alternative strategy that may assist in improving the performance of CTC with

effect from 1 May 2009 (where only the products in (a) and (b) above are available for manufacture).

(4 marks)

(iii) If no new products are available then CTC must look to boost revenues obtained from its existing product portolio whilst

seeking to reduce product specific fixed overheads and the company’s other fixed overheads. In order to do this attention

should be focused on the marketing activities currently undertaken.

CTC should consider selling all of its products in ‘multi product’ packages as it might well be the case that the increased

contribution achieved from increased sales volumes would outweigh the diminution in contribution arising from

reductions in the selling price per unit of each product.

CTC could also apply target costing principles in order to reduce costs and thereby increase the margins on each of its

products. Value analysis should be undertaken in order to evaluate the value-added features of each product. For

example, the use of non-combustible materials in manufacture would be a valued added feature of such products

whereas the use of pins and metal fastenings which are potentially harmful to children would obviously not comprise

value added features. CTC should focus on delivering ‘value’ to the customer and in attempting to do so should seek to

identify all non-value activities in order that they may be eliminated and hence margins improved.

(d) Comment on THREE factors other than NPV that the directors of ITL should consider when deciding whether

to manufacture the Snowballer. (3 marks)

(d) Factors that should be considered by the directors of ITL include:

(i) The cash flows are estimated. How accurate they are requires detailed consideration.

(ii) The cost of capital used by the finance director might be inappropriate. For example if the Snowballer proposal is less

risky than other projects undertaken by ITL then a lower cost of capital should be used.

(iii) The rate of inflation may vary from the anticipated rate of 4% per annum.

(iv) How strong is the Olympic brand name? The directors are proposing to pay royalties equivalent to 6% of sales revenue

during the six years of the anticipated life of the project. Should they market the Snowballer themselves?

(v) Would competitors enter the market and what would be the likely effect on sales volumes and selling prices?

N.B: Only three factors were required.

(c) Explain the possible impact of RBG outsourcing its internal audit services on the audit of the financial

statements by Grey & Co. (4 marks)

(c) Impact on the audit of the financial statements

Tutorial note: The answer to this part should reflect that it is not the external auditor who is providing the internal audit

services. Thus comments regarding objectivity impairment are not relevant.

■ As Grey & Co is likely to be placing some reliance on RBG’s internal audit department in accordance with ISA 610

Considering the Work of Internal Auditing the degree of reliance should be reassessed.

■ The appointment will include an evaluation of organisational risk. The results of this will provide Grey with evidence,

for example:

– supporting the appropriateness of the going concern assumption;

– of indicators of obsolescence of goods or impairment of other assets.

■ As the quality of internal audit services should be higher than previously, providing a stronger control environment, the

extent to which Grey may rely on internal audit work could be increased. This would increase the efficiency of the

external audit of the financial statements as the need for substantive procedures should be reduced.

■ However, if internal audit services are performed on a part-time basis (e.g. fitting into the provider’s less busy months)

Grey must evaluate the impact of this on the prevention, detection and control of fraud and error.

■ The internal auditors will provide a body of expertise within RBG with whom Grey can consult on contentious matters.

Tutorial note: Appropriate credit will be given for arguing that less reliance may be placed on internal audit in this year of

change of provider.

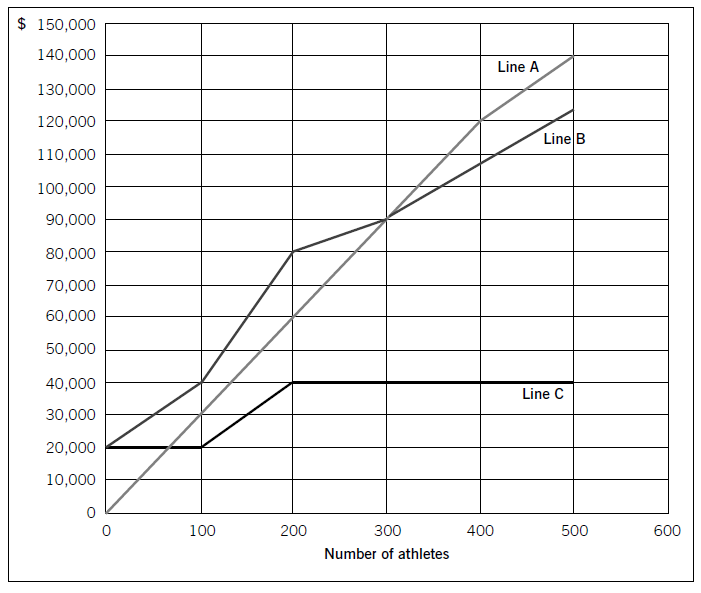

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

(a)ThebreakevensalesrevenueforSwimCois$90,000.Thecompany’sprofit,tothenearest$10,000,if500athletesattendthecourseis$20,000($140,000–$120,000).(Fromthegraph,itisclearthatthepreciseamountwillbenearer$17,000,i.e.$140,000–approximately$123,000.)(b)CoststructureFromthechart,itisclearthatLineCrepresentsfixedcosts,LineBrepresentstotalcostsandLineArepresentstotalrevenue.LineCshowsthatinitially,fixedcostsare$20,000evenifnoathletesattendthecourse.Thisleveloffixedcostsremainsthesameif100athletesattendbutoncethenumberofattendeesincreasesabovethislevel,fixedcostsincreaseto$40,000.LineBrepresentstotalcosts.If100athletesattend,totalcostsare$40,000($400perathlete).Since$20,000ofthisrelatestofixedcosts,thevariablecostperathletemustbe$200.Whenfixedcostsstepupbeyondthispointatthelevelof200athletes,totalcostsobviouslyincreaseaswellandLineBconsequentlygetsmuchsteeper.However,sincetherearenow200athletestoabsorbthefixedcosts,thecostperathleteremainsthesameat$400perathlete($80,000/200),eventhoughfixedcostshavedoubled.If300athletesattendthecourse,totalcostperathletebecomes$300each($90,000/300).Sincefixedcostsaccountfor$40,000ofthistotalcost,variablecoststotal$50,000,i.e.$166·67perathlete.So,economiesofscaleariseatthislevel,asdemonstratedbythefactthatLineBbecomesflatter.At400athletes,thegradientofthetotalcostslineisunchangedfrom300athleteswhichindicatesthatthevariablecostshaveremainedthesame.Thereisnofurtherchangeat500athletes;fixedandvariablecostsremainsteady.RevenuestructureAsregardstherevenuestructure,itcanbeseenfromLineAthatfor100–400athletesthepriceremainsthesameat$300perathlete.However,if500athletesattend,thepricehasbeenreducedasthetotalrevenuelinebecomesflatter.$140,000/500meansthatthepricehasgonedownto$280perathlete.Thiswasobviouslynecessarytoincreasethenumberofattendeesandatthispoint,profitismaximised.1

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-03-01

- 2021-06-19

- 2020-01-10

- 2020-04-15

- 2020-04-27

- 2020-04-29

- 2020-01-30

- 2020-01-09

- 2020-02-15

- 2020-04-16

- 2019-08-01

- 2020-01-09

- 2020-01-09

- 2019-07-21

- 2020-01-09

- 2020-01-09

- 2020-01-10

- 2020-03-13

- 2021-04-24

- 2020-02-28

- 2019-01-09

- 2019-07-21

- 2020-04-10

- 2020-01-14

- 2020-01-10

- 2020-01-09

- 2020-05-09

- 2019-03-17

- 2020-05-07