国际注册会计师的前景如何?

发布时间:2020-02-22

各位考生们,国际注册会计师(ACCA)考试大家都不陌生,很多人只知道它考试科目多,考试范围极其的广,总之就是国际注册会计师(ACCA)资格证书是很多人想要翻过的高山,很多人在努力的攀爬,但是有人也只看到了这座山的高度,就决定放弃了,若是知道了国际注册会计师(ACCA)资格证书的就业前景还会就这么轻松的放弃吗?

ACCA在国内称为"国际注册会计师",是当今最知名的国际性会计师组织之一。国际注册会计师ACCA资格被认为是"国际财会界的通行证"。国际注册会计师(ACCA)会员可从事审计、投资顾问和破产执行工作,并且在全球得到了许多国家的国立法许可。

先不说考取了这个证书的就业前景如何,单单是报考这个证书需要的都是很高的学历了,并且考试课程有13门之多,对每个考生的毅力就是一种检测了。考试过程中就淘汰掉了一批心智不坚定的,再通过考试淘汰了一批专业知识半罐水响叮当的,最后通过考试的就是大浪淘沙留下的精英, 国际注册会计师(ACCA)考试就是根据现时商务社会对财会人员的实际要求进行开发、设计的,最主要的就是培养考生的分析能力和在复杂条件下的决策、判断能力。考取国际注册会计师(ACCA)证书这个过程的本身就是对人的一个重新塑造,能够完全通过考取国际注册会计师13考试的考生才有真才实学,能适应各种环境,并能成为具有全面管理素质的高级财务管理专家。

据不完全统计,通过了国际注册会计师(ACCA)的人员的年薪主要在10万至100万之间,国际注册会计师(ACCA)的会员中26岁-30岁的人薪资范围集中在10万-50万,起薪都在5万以上;而年龄在31岁-40岁的国际注册会计师(ACCA)会员的薪资范围在30万——100万。

虽然在大家看来通过国际注册会计师(ACCA)考试有很好的就业前景,但是,不是每个人都适合考国际注册会计师ACCA。这个考试即使没有明确的要求英语水平达到6级以上,但考试、答题是全英文的,对大多数人来说英语水平确实是道尴尬的门槛。

所以,通过国际注册会计师(ACCA)考试确实是非常艰难的,但是翻过这座高山之后就是一路平坦了,国际注册会计师(ACCA)资格证书前途不可估量,51题库考试学习网祝各位一切顺利!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

You are the manager responsible for performing hot reviews on audit files where there is a potential disagreement

between your firm and the client regarding a material issue. You are reviewing the going concern section of the audit

file of Dexter Co, a client with considerable cash flow difficulties, and other, less significant operational indicators of

going concern problems. The working papers indicate that Dexter Co is currently trying to raise finance to fund

operating cash flows, and state that if the finance is not received, there is significant doubt over the going concern

status of the company. The working papers conclude that the going concern assumption is appropriate, but it is

recommended that the financial statements should contain a note explaining the cash flow problems faced by the

company, along with a description of the finance being sought, and an evaluation of the going concern status of the

company. The directors do not wish to include the note in the financial statements.

Required:

(b) Consider and comment on the possible reasons why the directors of Dexter Co are reluctant to provide the

note to the financial statements. (5 marks)

(b) Directors reluctance to disclose

The directors are likely to have several reasons behind their reluctance to disclose the note as recommended by the audit

manager. The first is that the disclosure of Dexter Co’s poor cash flow position and perilous going concern status may reflect

badly on the directors themselves. The company’s shareholders and other stakeholders will be displeased to see the company

in such a poor position, and the directors will be held accountable for the problems. Of course it may not be the case that

the directors have exercised poor management of the company – the problems could be caused by external influences outside

the control of the directors. However, it is natural that the directors will not want to highlight the situation in order to protect

their own position.

Secondly, the note could itself trigger further financial distress for the company. Dexter Co is trying to raise finance, and it is

probable that the availability of further finance will be detrimentally affected by the disclosure of the company’s financial

problems. In particular, if the cash flow difficulties are highlighted, providers of finance will consider the company too risky

an investment, and are not likely to make funds available for fear of non-repayment. Existing lenders may seek repayment of

their funds in fear that the company may be unable in the future to meet repayments.

In addition, the disclosures could cause operational problems, for example, suppliers may curtail trading relationships as they

become concerned that they will not be paid, or customers may be deterred from purchasing from the company if they feel

that there is no long-term future for the business. Unfortunately the mere disclosure of financial problems can be self-fulfilling,

and cause such further problems for the company that it is pushed into non-going concern status.

The directors may also be concerned that if staff were to hear of this they may worry about the future of the company and

seek alternative employment, which could lead in turn to the loss of key members of staff. This would be detrimental to the

business and trigger further operational problems.

Finally, the reluctance to disclose may be caused by an entirely different reason. The directors could genuinely feel that the

cash flow and operational problems faced by the company do not constitute factors affecting the going concern status. They

may be confident that although a final decision has not been made regarding financing, the finance is likely to be forthcoming,

and therefore there is no long-term material uncertainty over the future of the company. However audit working papers

conclude that there is a significant level of doubt over the going concern status of Dexter Co, and therefore it seems that the

directors may be over optimistic if they feel that there is no significant doubt to be disclosed in the financial statements.

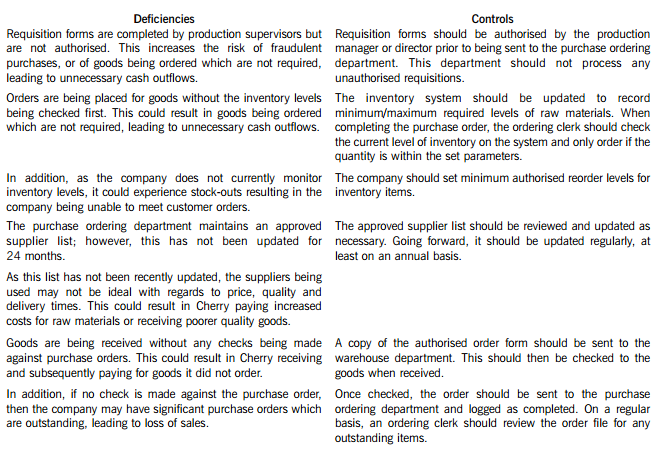

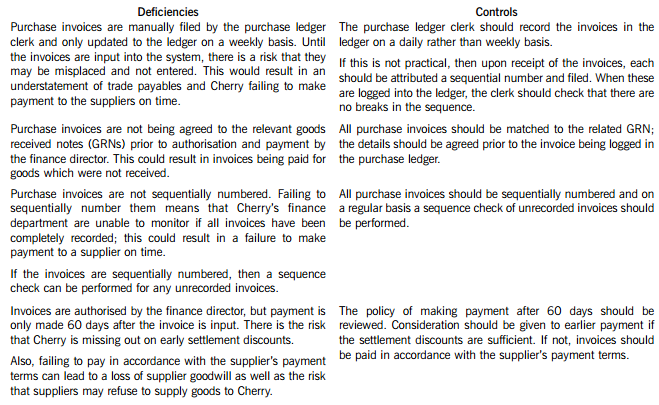

Cherry Blossom Co (Cherry) manufactures custom made furniture and its year end is 30 April. The company purchases its raw materials from a wide range of suppliers. Below is a description of Cherry’s purchasing system.

When production supervisors require raw materials, they complete a requisition form. and this is submitted to the purchase ordering department. Requisition forms do not require authorisation and no reference is made to the current inventory levels of the materials being requested. Staff in the purchase ordering department use the requisitions to raise sequentially numbered purchase orders based on the approved suppliers list, which was last updated 24 months ago. The purchasing director authorises the orders prior to these being sent to the suppliers.

When the goods are received, the warehouse department verifies the quantity to the suppliers despatch note and checks that the quality of the goods received are satisfactory. They complete a sequentially numbered goods received note (GRN) and send a copy of the GRN to the finance department.

Purchase invoices are sent directly to the purchase ledger clerk, who stores them in a manual file until the end of each week. He then inputs them into the purchase ledger using batch controls and gives each invoice a unique number based on the supplier code. The invoices are reviewed and authorised for payment by the finance director, but the actual payment is only made 60 days after the invoice is input into the system.

Required:

In respect of the purchasing system of Cherry Blossom Co:

(i) Identify and explain FIVE deficiencies; and

(ii) Recommend a control to address each of these deficiencies.

Note: The total marks will be split equally between each part.

Cherry Blossom Co’s (Cherry) purchasing system deficiencies and controls

8 Which of the following statements about accounting concepts and conventions are correct?

(1) The money measurement concept requires all assets and liabilities to be accounted for at historical cost.

(2) The substance over form. convention means that the economic substance of a transaction should be reflected in

the financial statements, not necessarily its legal form.

(3) The realisation concept means that profits or gains cannot normally be recognised in the income statement until

realised.

(4) The application of the prudence concept means that assets must be understated and liabilities must be overstated

in preparing financial statements.

A 1 and 3

B 2 and 3

C 2 and 4

D 1 and 4.

(b) Peter, one of Linden Limited’s non-executive directors, having lived and worked in the UK for most of his adult

life, sold his home near London on 22 March 2006 and, together with his wife (a French citizen), moved to live

in a villa which she owns in the south of France. Peter is now demanding that the tax deducted from his director’s

fees, for the board meetings held on 18 April and 16 May 2006, be refunded, on the grounds that, as he is no

longer resident in the UK, he is no longer liable to UK income tax. All of the company’s board meetings are held

at its offices in Cambridge.

Despite Peter’s assurance that none of the other companies of which he is a director has disputed his change of

tax status, Damian is uncertain whether he should make the refunds requested. However, as Peter is a friend of

the company’s founder, Linden Limited’s managing director is urging him to do so, stating that if the tax does

have to be paid, then Linden Limited could always bear the cost.

Required:

Advise Damian whether Peter is correct in his assertion regarding his tax position and in the case that there

is a UK tax liability the implications of the managing director’s suggestion. You are not required to consider

national insurance (NIC) issues. (4 marks)

(b) Peter will have been resident and ordinarily resident in the UK. When such individuals leave the UK for a purpose other than

to take up full time employment abroad, they normally continue to still be so regarded unless their absence spans a complete

tax year. But, where someone intends to live permanently abroad or to do so for a period of at least three tax years, they may

be treated as non-resident and non-ordinarily resident from the day after the date of their departure, if they can provide

evidence to HMRC of that intention. Selling a residence in the UK and setting up home abroad will normally constitute such

evidence. However to retain non-resident status the intention must actually be fulfilled, and visits to the UK must not exceed

182 days in any tax year or average more than 90 days per year over a period of four tax years. Given that Peter would appear

to have several company directorships in the UK, it is possible that he might fail to satisfy the 90 day average ‘substantial

visits’ rule.

Even if Peter is classed as non-resident, any remuneration earned in the UK will still be liable to UK income tax, and subject

to PAYE, unless it is for duties incidental to an overseas employment, which is unlikely to be the case for fees paid to a nonexecutive

director for attending board meetings. Thus, income tax should still be deducted from the fees under PAYE. Where

PAYE should have been deducted from a director’s emoluments and it has not been, but the tax is nevertheless accounted

for by the company to HMRC, then to the extent that the tax is not reimbursed by the director, he will be treated as receiving

a benefit equivalent to the amount of tax.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-02-20

- 2021-02-26

- 2020-05-20

- 2020-01-10

- 2020-02-04

- 2020-04-07

- 2020-03-21

- 2020-01-29

- 2020-02-01

- 2020-01-10

- 2020-01-10

- 2020-05-19

- 2020-01-09

- 2020-01-10

- 2020-02-22

- 2020-01-10

- 2020-04-21

- 2020-04-08

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-04-29

- 2020-01-03