请问海南省考生ACCA国际会计师证书应该怎么注册呢?

发布时间:2020-01-09

首先,51题库考试学习网在这里告诉大家,ACCA国际会计师证书是不能够注册的,是需要通过一个难度较高的考试获得的,可以通过注册获得是ACCA会员资格,那么这个会员资格又是什么呢?其实这个ACCA会员资格是报考ACCA证书考试的一个条件之一,要成为ACCA会员才可以报考ACCA考试,那么接下来,51题库考试学习网就告诉大家关于ACCA会员注册资格的流程:

首先大家先了解一下ACCA会员的注册条件:

一、申请参加ACCA考试者,必须首先注册成为ACCA学员,注册需具备以下任一条件:

(1) 凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;(自考本科的学历也可以哦,只要有相应的学历证书)

(2) 教育部认可的高等院校在校生,顺利完成大一所有课程考试,即可报名成为ACCA的正式学员;(换句话说就是你在大一的时候成绩不挂科不重修,进入大二学期就可以报考ACCA了)

(3) 未符合1,2项报名资格的申请者,可以先申请参加FIA资格考试,通过FFA,FMA,FAB三门课程后,可以申请转入ACCA并且豁免F1-F3三门课程的考试,直接进入ACCA技能课程阶段的考试;需要注意的是在校大学生满足一些条件也可以申请免试哟,具体规定可以参考ACCA官网发布的相关文献。

温馨提示:注册报名成为ACCA的学员随时都可以进行,但注册时间的早晚,决定了第一次参加考试的

二、ACCA在注册时,需要准备和提交的资料:

在校学员所需准备的注册资料 (原件、复印件和译文)

(若有同学不清楚英文在读证明如何打印?在哪儿打印?建议自行在网上查询)

(1) 中英文在读证明(由学校教务部门开具,加盖公章,在读证明及成绩单加盖的公章必须一致),

(2) 中英文在校期间各年级成绩单,至少要提供大一成绩单,并加盖所在学校或学校教务部门公章(可先到学员辅导员处打印成绩单,再到学校的教务处盖章即可)

(3) 中英文个人身份证件或护照(护照办理一般和身份证办理在同一地点)

(4) 2寸彩色证件照一张 (建议多准备几张照片,以防出现意外情况)

(5) 注册报名费(现金代缴或信用卡支付)

非在校学员所需准备的注册资料 (原件、复印件和译文)

(1) 中英文个人身份证件或护照

(2) 中英文学历证明(毕业证及学位证) (大专及其以上的学历)

(3) 2寸彩色证件照一张(同样建议多备几张以备不时之需)

三、ACCA注册流程

第一步:准备注册所需材料(就是第二个步骤所准备的全部资料)

第二步:在全球官方网站进行注

(1) 在线注册地址http://www.accaglobal.com/en/qualifications/apply-now.html

(2) 填写相关个人信息(如姓名、性别、出生日期等)(注意:填写有效的信息,方便联系到你)

(3) 填写相关个人学历信息(如毕业院校、学历、专业等)

(4) 在线上传注册资料

(5) 若学员计划申请免试,在填写完毕Your Qualifications之后,系统便会自动显示学员有可能获得的免试科目,最终免试结果以注册成功后ACCA英国总部的审核结果为准;如需放弃免试,需点击相应科目Give Up选项(6) 若学员放弃牛津布鲁克斯大学的学位申请资格

需在Bsc Degree处勾选是否放弃第三步:支付注册费用

(1) 可使用VISA或MasterCard信用卡(见信用卡面logo)

(2) 可使用双币信用卡

(3) 双币信用卡可为人民币+美金,也可为人民币+英镑,美金版信用卡会将ACCA扣除的英镑自动转换为美金

(4) 卡面上无VISA或MasterCard的信用卡(如JCB、AmericanExpress等)皆不可用

(5) 可使用支付宝

(6) 可使用银联借记卡

四、到代表处办理报名注册程序

将填写完整的网上报名注册表(在英文网站上注册完成后可以打印出两页的PDF文件)、中文学员登记表请先打印再点击提交,以及其他相关材料交至代表处或直接寄往英国总部。北京、上海和广州的学员报名注册后,领取学员手册,外地学员通过邮寄到代表处注册的学员由当地代表处寄发。 (需要注意的事,因为相关注册表是寄往国外,因此花费的时间相对来说可能较长,请大家耐心等待)

怎么样?看了这么多,是不是感觉“国际注册会计师”资格证不容易获得呢?连注册一个会员都需要花费较长的时间。But,51题库考试学习网相信大家一定可以做到的。没有付出,哪来回报呢?证书再难,抵不过你一颗热情心,一双勤劳手。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Donald actually decided to operate as a sole trader. The first year’s results of his business were not as he had

hoped, and he made a trading loss of £8,000 in the year to 31 March 2007. However, trading is now improving,

and Donald has sufficient orders to ensure that the business will make profits of at least £30,000 in the year to

31 March 2008.

In order to raise funds to support his business over the last 15 months, Donald has sold a painting which was

given to him on the death of his grandmother in January 1998. The probate value of the painting was £3,200,

and Donald sold it for £8,084 (after deduction of 6% commission costs) in November 2006.

He also sold other assets in the year of assessment 2006/07, realising further chargeable gains of £8,775 (after

indexation of £249 and taper relief of £975).

Required:

(i) Calculate the chargeable gain on the disposal of the painting in November 2006. (4 marks)

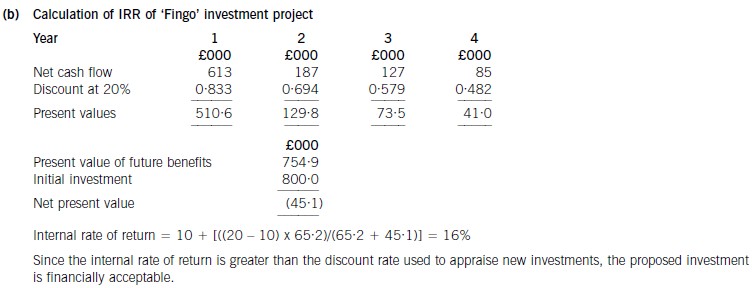

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

4 Assume today’s date is 15 May 2005.

In March 1999, Bob was made redundant from his job as a furniture salesman. He decided to travel round the world,

and did so, returning to the UK in May 2001. Bob then decided to set up his own business selling furniture. He

started trading on 1 October 2001. After some initial success, the business made losses as Bob tried to win more

customers. However, he was eventually successful, and the business subsequently made profits.

The results for Bob’s business were as follows:

Period Schedule D Case I

Trading Profits/(losses)

£

1 October 2001 – 30 April 2002 13,500

1 May 2002 – 30 April 2003 (18,000)

1 May 2003 – 30 April 2004 28,000

Bob required funds to help start his business, so he raised money in three ways:

(1) Bob is a keen cricket fan, and in the 1990s, he collected many books on cricket players. To raise money, Bob

started selling books from his collection. These had risen considerably in value and sold for between £150 and

£300 per book. None of the books forms part of a set. Bob created an internet website to advertise the books.

Bob has not declared this income, as he believes that the proceeds from selling the books are non-taxable.

(2) He disposed of two paintings and an antique silver coffee set at auction on 1 December 2004, realising

chargeable gains totalling £23,720.

(3) Bob took a part time job in a furniture store on 1 January 2003. His annual salary has remained at £12,600

per year since he started this employment.

Bob has 5,000 shares in Willis Ltd, an unquoted trading company based in the UK. He subscribed for these shares

in August 2000, paying £3 per share. On 1 December 2004, Bob received a letter informing him that the company

had gone into receivership. As a result, his shares were almost worthless. The receivers dealing with the company

estimated that on the liquidation of the company, he would receive no more than 10p per share for his shareholding.

He has not yet received any money.

Required:

(a) Write a letter to Bob advising him on whether or not he is correct in believing that his book sales are nontaxable.

Your advice should include reference to the badges of trade and their application to this case.

(9 marks)

(a) Evidence of trading

[Client address]

[Own address]

[Date]

Dear Bob,

I note that you have been selling some books in order to raise some extra income. While you believe that the sums are not

taxable, I believe that there may be a risk of the book sales being treated as a trade, and therefore taxable under Schedule D

Case I. We need to refer to guidance in the form. of a set of principles known as the ‘badges of trade’. These help determine

whether or not a trade exists, and need to be looked at in their entirety. The badges are as follows.

1. The subject matter

Some assets can be enjoyed by themselves as an investment, while others (such as large amounts of aircraft linen) are

clearly not. It is likely that such assets are acquired as trading stock, and are therefore a sign of trading. Sporting books

can be an investment, and so this test is not conclusive.

2. Frequency of transactions

Where transactions are frequent (not one-offs), this suggests trading. You have sold several books, which might suggest

trading, although you have only done this for a short period - between one and two years.

3. Length of ownership

Where items are bought and sold soon afterwards, this indicates trading. You bought your books in the 1990s, and the

length of time between acquisition and sale would not suggest trading.

4. Supplementary work and marketing

You are actively marketing the books on your internet website, which is an indication of trading.

5. Profit motive

A motive to make profit suggests trading activity. You sold the books to raise funds for your property business, and not

to make a profit as such, which suggests that your motive was to raise cash, and not make profits.

6. The way in which the asset sold was acquired.

Selling assets which were acquired unintentionally (such as a gift) is not usually seen as trading. You acquired the books

for your collection over a period of time, and while these were intentional acquisitions, the reasons for doing so were for

your personal pleasure.

By applying all of these tests, it should be possible to argue that you were not trading, merely selling some assets in

order to generate short-term cash for your business.

The asset disposals will be taxed under the capital gain tax rules, but as the books are chattels and do not form. part of

a set, they will be exempt from capital gains tax.

Yours sincerely

A N. Accountant

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-02-29

- 2019-03-20

- 2019-07-20

- 2020-01-09

- 2020-01-09

- 2019-07-20

- 2020-01-09

- 2020-01-09

- 2019-07-20

- 2019-07-20

- 2019-07-20

- 2020-09-04

- 2019-07-20

- 2020-02-29

- 2019-07-20

- 2019-07-20

- 2019-07-20

- 2019-07-20

- 2020-01-09

- 2020-02-29

- 2019-03-20

- 2020-01-09

- 2020-05-20

- 2020-01-09

- 2019-07-20

- 2019-07-20

- 2019-07-20

- 2019-07-20

- 2020-02-29

- 2020-01-09