请问江西省考生ACCA国际会计师证书应该怎么注册呢?

发布时间:2020-01-09

首先,51题库考试学习网在这里告诉大家,ACCA国际会计师证书是不能够注册的,是需要通过一个难度较高的考试获得的,可以通过注册获得是ACCA会员资格,那么这个会员资格又是什么呢?其实这个ACCA会员资格是报考ACCA证书考试的一个条件之一,要成为ACCA会员才可以报考ACCA考试,那么接下来,51题库考试学习网就告诉大家关于ACCA会员注册资格的流程:

首先大家先了解一下ACCA会员的注册条件:

一、申请参加ACCA考试者,必须首先注册成为ACCA学员,注册需具备以下任一条件:

(1) 凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;(自考本科的学历也可以哦,只要有相应的学历证书)

(2) 教育部认可的高等院校在校生,顺利完成大一所有课程考试,即可报名成为ACCA的正式学员;(换句话说就是你在大一的时候成绩不挂科不重修,进入大二学期就可以报考ACCA了)

(3) 未符合1,2项报名资格的申请者,可以先申请参加FIA资格考试,通过FFA,FMA,FAB三门课程后,可以申请转入ACCA并且豁免F1-F3三门课程的考试,直接进入ACCA技能课程阶段的考试;需要注意的是在校大学生满足一些条件也可以申请免试哟,具体规定可以参考ACCA官网发布的相关文献。

温馨提示:注册报名成为ACCA的学员随时都可以进行,但注册时间的早晚,决定了第一次参加考试的

二、ACCA在注册时,需要准备和提交的资料:

在校学员所需准备的注册资料 (原件、复印件和译文)

(若有同学不清楚英文在读证明如何打印?在哪儿打印?建议自行在网上查询)

(1) 中英文在读证明(由学校教务部门开具,加盖公章,在读证明及成绩单加盖的公章必须一致),

(2) 中英文在校期间各年级成绩单,至少要提供大一成绩单,并加盖所在学校或学校教务部门公章(可先到学员辅导员处打印成绩单,再到学校的教务处盖章即可)

(3) 中英文个人身份证件或护照(护照办理一般和身份证办理在同一地点)

(4) 2寸彩色证件照一张 (建议多准备几张照片,以防出现意外情况)

(5) 注册报名费(现金代缴或信用卡支付)

非在校学员所需准备的注册资料 (原件、复印件和译文)

(1) 中英文个人身份证件或护照

(2) 中英文学历证明(毕业证及学位证) (大专及其以上的学历)

(3) 2寸彩色证件照一张(同样建议多备几张以备不时之需)

三、ACCA注册流程

第一步:准备注册所需材料(就是第二个步骤所准备的全部资料)

第二步:在全球官方网站进行注

(1) 在线注册地址http://www.accaglobal.com/en/qualifications/apply-now.html

(2) 填写相关个人信息(如姓名、性别、出生日期等)(注意:填写有效的信息,方便联系到你)

(3) 填写相关个人学历信息(如毕业院校、学历、专业等)

(4) 在线上传注册资料

(5) 若学员计划申请免试,在填写完毕Your Qualifications之后,系统便会自动显示学员有可能获得的免试科目,最终免试结果以注册成功后ACCA英国总部的审核结果为准;如需放弃免试,需点击相应科目Give Up选项(6) 若学员放弃牛津布鲁克斯大学的学位申请资格

需在Bsc Degree处勾选是否放弃第三步:支付注册费用

(1) 可使用VISA或MasterCard信用卡(见信用卡面logo)

(2) 可使用双币信用卡

(3) 双币信用卡可为人民币+美金,也可为人民币+英镑,美金版信用卡会将ACCA扣除的英镑自动转换为美金

(4) 卡面上无VISA或MasterCard的信用卡(如JCB、AmericanExpress等)皆不可用

(5) 可使用支付宝

(6) 可使用银联借记卡

四、到代表处办理报名注册程序

将填写完整的网上报名注册表(在英文网站上注册完成后可以打印出两页的PDF文件)、中文学员登记表请先打印再点击提交,以及其他相关材料交至代表处或直接寄往英国总部。北京、上海和广州的学员报名注册后,领取学员手册,外地学员通过邮寄到代表处注册的学员由当地代表处寄发。 (需要注意的事,因为相关注册表是寄往国外,因此花费的时间相对来说可能较长,请大家耐心等待)

怎么样?看了这么多,是不是感觉“国际注册会计师”资格证不容易获得呢?连注册一个会员都需要花费较长的时间。But,51题库考试学习网相信大家一定可以做到的。没有付出,哪来回报呢?证书再难,抵不过你一颗热情心,一双勤劳手。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

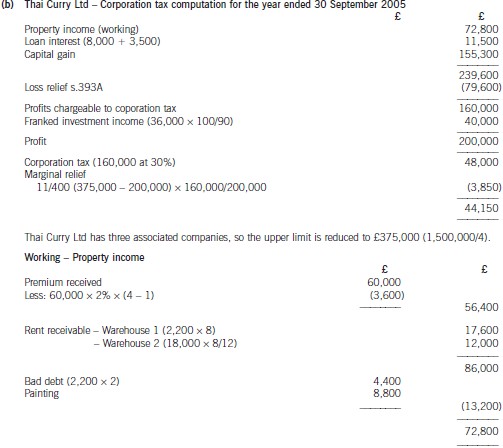

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

(c) Briefly describe three advantages to Bailey’s of counselling. (3 marks)

(c) For Bailey’s the advantages of counselling as a means of understanding and addressing the problems are that it provides a confidential service to the employee to discuss problems away from and not involving management or supervision. There is no obvious human resources policy at Bailey’s and counselling provides an opportunity to develop an appropriate policy from understanding individual problems.

This in turn will demonstrate organisational commitment to the employees that has been lacking in the past at Bailey’s and begin the process of better performance and increase in commitment.

At another level, counselling can provide a link to other external agencies to assist with personal problems that may be deemed too specific for resolution within Bailey’s.

(b) Describe the principal audit procedures to be carried out in respect of the following:

(i) The measurement of the share-based payment expense; (6 marks)

(b) (i) Principal audit procedures – measurement of share-based payment expense

– Obtain management calculation of the expense and agree the following from the calculation to the contractual

terms of the scheme:

– Number of employees and executives granted options

– Number of options granted per employee

– The official grant date of the share options

– Vesting period for the scheme

– Required performance conditions attached to the options.

– Recalculate the expense and check that the fair value has been correctly spread over the stated vesting period.

– Agree fair value of share options to specialist’s report and calculation, and evaluate whether the specialist report is

a reliable source of evidence.

– Agree that the fair value calculated is at the grant date.

Tutorial note: A specialist such as a chartered financial analyst would commonly be used to calculate the fair value

of non-traded share options at the grant date, using models such as the Black-Scholes Model.

– Obtain and review a forecast of staffing levels or employee turnover rates for the duration of the vesting period, and

scrutinise the assumptions used to predict level of staff turnover.

– Discuss previous levels of staff turnover with a representative of the human resources department and query why

0% staff turnover has been predicted for the next three years.

– Check the sensitivity of the calculations to a change in the assumptions used in the valuation, focusing on the

assumption of 0% staff turnover.

– Obtain written representation from management confirming that the assumptions used in measuring the expense

are reasonable.

Tutorial note: A high degree of scepticism must be used by the auditor when conducting the final three procedures

due to the management assumption of 0% staff turnover during the vesting period.

This information was taken from an internal newsletter of The Knowledge Partnership LLP (TKP), a company which offers project and software consultancy work for clients based in Zeeland. The newsletter was dated 2 November 2014 and describes two projects currently being undertaken by the partnership.

Project One

In this project, one of our clients was just about to place a contract for a time recording system to help them monitor and estimate construction contracts when we were called in by the Finance Director. He was concerned about the company supplying the software package. ‘They only have an annual revenue of $5m’, he said, ‘and that worries me.’ TKP analysed software companies operating in Zeeland. It found that 200 software companies were registered in Zeeland with annual revenues of between $3m and $10m. Of these, 20 went out of business last year. This compared to a 1% failure rate for software companies with revenues of more than $100m per year. We presented this information to the client and suggested that this could cause a short-term support problem. The client immediately re-opened the procurement process. Eventually they bought a solution from a much larger well-known software supplier. It is a popular software solution, used in many larger companies.

The client has now asked us to help with the implementation of the package. A budget for the project has been agreed and has been documented in an agreed, signed-off, business case. The client has a policy of never re-visiting its business cases once they have been accepted; they see this as essential for effective cost control. We are currently working with the primary users of the software – account managers (using time and cost data to monitor contracts) and the project support office (using time and cost data to improve contract estimating) – to ensure that they can use the software effectively when it is implemented. We have also given ‘drop in’ briefing sessions for the client’s employees who are entering the time and cost data analysed by the software. They already record this information on a legacy system and so all they will see is a bright new user interface, but we need to keep them informed about our implementation. We are also looking at data migration from the current legacy system. We think some of the current data might be of poor quality, so we have established a strategy for data cleansing (through offshore data input) if this problem materialises. We currently estimate that the project will go live in May 2015.

Project Two

In this project, the client is the developer of the iProjector, a tiny phone-size projector which is portable, easy to use and offers high definition projection. The client was concerned that their product is completely dependent on a specialist image-enhancing chip designed and produced by a small start-up technology company. They asked TKP to investigate this company. We confirmed their fears. The company has been trading for less than three years and it has a very inexperienced management team. We suggested that the client should establish an escrow agreement for design details of the chip and suggested a suitable third party to hold this agreement. We also suggested that significant stocks of the chip should be maintained. The client also asked TKP to look at establishing patents for the iProjector throughout the world. Again, using our customer contacts, we put them in touch with a company which specialises in this. We are currently engaged with the client in examining the risk that a major telephone producer will launch a competitive product with functionality and features similar to the iProjector.

The iProjector is due to be launched on 1 May 2015 and we have been engaged to give advice on the launch of the product. The launch has been heavily publicised, a prestigious venue booked and over 400 attendees are expected. TKP have arranged for many newspaper journalists to attend. The product is not quite finished, so although orders will be taken at the launch, the product is not expected to ship until June 2015.

Further information:

TKP only undertakes projects in the business culture which it understands and where it feels comfortable. Consequently, it does not undertake assignments outside Zeeland.

TKP has $10,000,000 of consultant’s liability insurance underwritten by Zeeland Insurance Group (ZIG).

Required:

(a) Analyse how TKP itself and the two projects described in the scenario demonstrate the principles of effective risk management. (15 marks)

(b) Describe the principle of the triple constraint (scope, time and cost) on projects and discuss its implications in the two projects described in the scenario. (10 marks)

(a) The first stages of risk management are the identification, descriptions and assessment of the risk. This assessment is primarily concerned with the likelihood of them occurring and the severity of impact on the organisation or project should they occur. Sometimes the likelihood is a subjective probability, the opinions of experienced managers or experts in the field. On other occasions, there is some statistical evidence on which to base the assessment. For example, in project 1, TKP identified that 20 IT software companies with annual revenues between $3m and $10m went out of business last year. This represented 10% of the total number of software companies reporting such revenues. Its report to the client suggested that there was a 10% chance of the current preferred supplier (who had a turnover of $5m) ceasing business and this would have a significant short-term support implication. This compared to a business failure rate of 1% for software companies with an annual revenue exceeding $100m. The client felt that the probability of supplier failure was too high, so eventually bought a software solution from a much larger, well-known, software supplier. In this case, the likelihood of the risk led the client to changing its procurement decision. The risk itself does not go away, large companies also fail, but the probability of the risk occurring is reduced.

The avoidance (or prevention) of a risk is a legitimate risk response. In project 1, the client could avoid the risk ‘failure of the supplier’ by commissioning an in-house bespoke solution. Similarly, TKP itself avoids the risks associated with trading in different cultures, by restricting its projects to clients based in Zeeland.

There are three further responses to risks.

Risk mitigation (or risk contingency) actions are what the organisation will do to counter the risk, should the risk take place. Mitigation actions are designed to lessen the impact on the organisation of the risk occurring. In project 2, TKP recommends that the producers of the iProjector should establish an escrow agreement with the company which produces the chip which enhances the quality of the projected image. It was agreed that design details of this chip should be lodged with a third party who would make them available to the producers of the iProjector should the company which owned the enhanced image technology cease trading. This is a mitigation approach to the risk ‘failure of the supplier’. The supplier is relatively high risk (less than three years of trading, inexperienced management team), and the product (the iProjector) is completely dependent upon the supply of the image enhancing chip. The failure of the business supplying the chips would have significant impact on iProjector production. If the escrow agreement had to be enacted, then it would take the producers of the iProjector some time to establish alternative production. Consequently (and TKP have suggested this), it might be prudent to hold significant stocks of the chips to ensure continued production. In such circumstances, the need to mitigate risk is more important than implementing contemporary just-in-time supply practices. In some instances a mitigation action can be put in place immediately. In other instances risk mitigation actions are only enacted should the risk occur. The risk has been recognised and the organisation has a rehearsed or planned response. For example, in project 1, TKP has identified ‘poor quality of current data’ as a risk associated with the migration of data from the current systems to the proposed software package solution. It has established a strategy for data cleansing if that risk actually materialises. Importantly, the client knows in advance how to respond to a risk. It avoids making a hasty, ill-thought out response to an unforeseen event.

Risk transfer actions are concerned with transferring the risk and the assessment and consequences of that risk to another party. This can be done in a number of ways. TKP itself has liability insurance which potentially protects the company from the financial consequences of being sued by clients for giving poor advice. TKP has identified this as a risk, but is unlikely to be able to assess either the probability of that risk occurring or establishing meaningful mitigation measures to minimise the effect of that risk. Consequently, the responsibility for both of these is transferred to an insurance company. They establish the risk, through a series of questions, and compute a premium which reflects the risk and the compensation maximum which will have to be paid if that risk occurs. TKP pays the insurance premiums. TKP itself also transfers risks in project 2. It is unsure about how to establish patents and so it refers the client to another company. Transferring avoids the risk associated with ‘establishing the patent incorrectly’ and the financial consequences of this.

Finally, risk may be identified but just accepted as part of doing business. Risk acceptance is particularly appropriate when the probability of the risk is low or the impact of that risk is relatively insignificant. Risks may also be accepted when there are no realistic mitigation or transfer actions. In project 2, the producers of the iProjector are concerned that there is ‘a risk that a major telephone producer will launch a product with features and functionality similar to ours’. This is a risk, but there is little that can be done about it. Risks of competition are often best accepted.

The discussion above is primarily concerned with deciding what action to take for each risk. Once these actions are agreed, then a plan may be required to put them into place. For example, establishing an escrow agreement will require certain activities to be done.

Risks must also be monitored. For example, in project 2, the risk of supplier failure can be monitored through a company checking agency. Many of these companies offer a continuous monitoring service which evaluates financial results, share prices and other significant business movements. Reports are produced, highlighting factors which may be of particular concern. Risks will also disappear once certain stages of the project have been completed and, similarly, new ones will appear, often due to changes in the business environment. Many organisations use a risk register or risk log to document and monitor risks and such logs often specify a risk owner, a person responsible for adequate management of the risk.

(b) Every project is constrained in some way by its scope, time and cost. These limitations are often called the triple constraint. The scope concerns what has to be delivered by the project, time is when the project should deliver by, and cost is concerned with how much can be spent on achieving the deliverable (the budget). Quality is also an important feature of projects. Some authors include quality in their triple constraint (instead of scope), others add it as a further constraint (quadruple constraint), whilst others believe that quality considerations are inherent in setting the scope, time and cost goals of a project. How a particular project is managed depends greatly on the pressures in the triple constraint.

In project 1, the reluctance of the company to re-visit the business case means that the budget (or cost) of the solution is fixed. The implementation date might be desirable, but it does not seem to be business critical. It is an internal system and so any delays in implementation will not affect customers. It will also be a relatively seamless transition for most employees in the company. They already record the time record details which the new system will collect and so all they will see is a changed user interface. Only the direct users of the output (account managers and the project office) will be affected by any delay. The scope of the software package is also pre-defined. If it fails to meet requirements, then the users will have to adjust their expectations or business methods. There is no money to finance customisation or add-on systems, so in this sense the scope of the solution is also fixed. The quality of the software, in terms of its reliability and robustness, should also be good, as it is a popular software solution used in many large companies.

In project 2, the launch date is fixed. It has been heavily publicised, the venue is booked and over 400 attendees are expected, including newspaper journalists. Thus the time of the project is fixed. However, although orders will be taken at the launch, the product is not expected to ship until a month after launch. Thus the scope of the product shown at the launch date might be restricted and inherent quality problems might not yet be solved. Any defects can be explained away (this is a pre-production model) or, more effectively, they may be avoided by ensuring that the product is demonstrated to attendees, not used by them. The project manager must ensure that key functionality of the product is available on launch date (such as producing an image of a certain quality), but other functionality, not central to the presentation (for example, promised support for all image file formats) could be delayed until after the presentation. The company should make extra funds available to ensure that the launch date is successful.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-02

- 2020-09-04

- 2019-03-20

- 2019-07-20

- 2020-01-09

- 2020-02-29

- 2020-01-09

- 2019-07-20

- 2020-01-09

- 2019-07-20

- 2019-07-20

- 2019-07-20

- 2020-01-09

- 2020-02-29

- 2020-01-09

- 2019-07-20

- 2019-03-20

- 2020-02-29

- 2020-01-09

- 2019-07-20

- 2020-01-09

- 2019-07-20

- 2019-07-20

- 2020-01-09

- 2020-04-22

- 2020-01-09

- 2020-01-09

- 2019-07-20

- 2019-03-20