什么?湖北省考生2020年ACCA考试不知道看什么书?那么下面的教材宝典你必须收藏

发布时间:2020-01-09

新年伊始,步入2020年,离3月份的ACCA考试越来越近了,相信感兴趣的小伙伴都已经报了名,但51题库考试学习网听说有很多小伙伴们不知道复习应该看什么书,手足无措,不知道该怎么复习。不用担心这个问题,51题库考试学习网会逐一为大家解答困惑:

大家都知道教材是考试复习的基础,跟其他考试一样,考ACCA也是如此,几乎每个ACCA的小伙伴都会买教材,但是并不是每一个小伙伴都会把教材读懂读透。习题固然要练,但是教材才是考试的出题来源,因此小伙伴有必要在练题之前先确保自己已经熟练掌握教材的内容了。希望对大家有所帮助!

在这里51题库考试学习网建议大家可以利用的教材有BPP教材和FTC教材,两者的差别在于BPP教材是全球ACCA使用最多的版本,而FTC版是ACCA官方版本教材,在全球使用也比较多。相对于BPP教材,FTC这套教材的优点是简洁,基本上每门课教材都比BPP版薄,但是FTC对F4阶段的ACCA备考并不是那么适用,其难度较之BPP版有所加大,所用单词也要复杂一些。因此BPP教材的优点也就是相当于FTC来说英语单词较为基础,容易被初学者吸收。同时对于最新FTC版有些地方讲解不是很细致,单凭它参加考试有一定难度

目前这两种都较适合中国ACCA考生,如何选择的关键就在于考生自己,英语基础强一点的,学习效率高的考生就可以选择FTC可能效果好一些;反之,如果是英语相对薄弱一点的,学习能力一般的考生,就可以选择基础的BPP教材。其实,没有万能的学习方法,适合自己的学习方法那才是最好的复习方法,可以借鉴但不提倡照搬。

需要注意的是,每一年ACCA的14门课都会更新他们的TEXT BOOK和练习册。而这两本书,练习册往往被很多小伙伴重视,却偏偏忽视TEXT BOOK。很多的同学复习的时候喜欢记要点,而不愿意花时间读原汁原味的原版书籍。其实这是一个很不好的习惯,既不利于我们准确地把握知识点,也影响了我们专业英语能力的提高。

51题库考试学习网建议各位小伙伴在考试的三个月前,一定要用心看TEXT BOOK。先用一到两个月把书认真地读一遍,再上课、做题直到考前冲刺。考完试后不要着急把书丢在一边拿,大家可以把自己喜欢的章节保留下来,便于以后进一步学习或闲暇时看看读读。当然,千万不要忘记关注ACCA官网的更新,及时下载学习资料。

以上就是报考ACCA的具体规则和流程,想要了解更多2020年ACCA的相关资讯,欢迎加入关注51题库考试学习网,51题库考试学习网将不定时更新你想了解的咨询~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

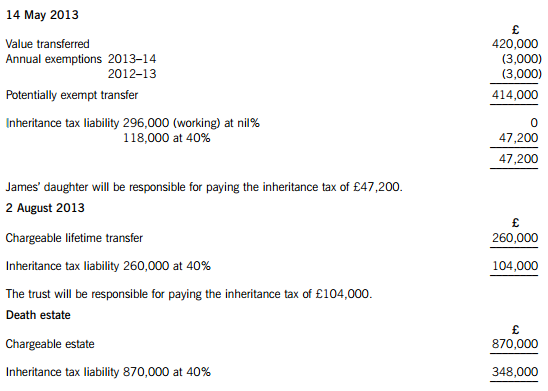

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

(b) Comment (with relevant calculations) on the performance of the business of Quicklink Ltd and Celer

Transport during the year ended 31 May 2005 and, insofar as the information permits, its projected

performance for the year ending 31 May 2006. Your answer should specifically consider:

(i) Revenue generation per vehicle

(ii) Vehicle utilisation and delivery mix

(iii) Service quality. (14 marks)

difference will reduce in the year ending 31 May 2006 due to the projected growth in sales volumes of the Celer Transport

business. The average mail/parcels delivery of mail/parcels per vehicle of the Quicklink Ltd part of the business is budgeted

at 12,764 which is still 30·91% higher than that of the Celer Transport business.

As far as specialist activities are concerned, Quicklink Ltd is budgeted to generate average revenues per vehicle amounting to

£374,850 whilst Celer Transport is budgeted to earn an average of £122,727 from each of the vehicles engaged in delivery

of processed food. It is noticeable that all contracts with major food producers were renewed on 1 June 2005 and it would

appear that there were no increases in the annual value of the contracts with major food producers. This might have been

the result of a strategic decision by the management of the combined entity in order to secure the future of this part of the

business which had been built up previously by the management of Celer Transport.

Each vehicle owned by Quicklink Ltd and Celer Transport is in use for 340 days during each year, which based on a

365 day year would give an in use % of 93%. This appears acceptable given the need for routine maintenance and repairs

due to wear and tear.

During the year ended 31 May 2005 the number of on-time deliveries of mail and parcel and industrial machinery deliveries

were 99·5% and 100% respectively. This compares with ratios of 82% and 97% in respect of mail and parcel and processed

food deliveries made by Celer Transport. In this critical area it is worth noting that Quicklink Ltd achieved their higher on-time

delivery target of 99% in respect of each activity whereas Celer Transport were unable to do so. Moreover, it is worth noting

that Celer Transport missed their target time for delivery of food products on 975 occasions throughout the year 31 May 2005

and this might well cause a high level of customer dissatisfaction and even result in lost business.

It is interesting to note that whilst the businesses operate in the same industry they have a rather different delivery mix in

terms of same day/next day demands by clients. Same day deliveries only comprise 20% of the business of Quicklink Ltd

whereas they comprise 75% of the business of Celer Transport. This may explain why the delivery performance of Celer

Transport with regard to mail and parcel deliveries was not as good as that of Quicklink Ltd.

The fact that 120 items of mail and 25 parcels were lost by the Celer Transport business is most disturbing and could prove

damaging as the safe delivery of such items is the very substance of the business and would almost certainly have resulted

in a loss of customer goodwill. This is an issue which must be addressed as a matter of urgency.

The introduction of the call management system by Quicklink Ltd on 1 June 2004 is now proving its worth with 99% of calls

answered within the target time of 20 seconds. This compares favourably with the Celer Transport business in which only

90% of a much smaller volume of calls were answered within a longer target time of 30 seconds. Future performance in this

area will improve if the call management system is applied to the Celer Transport business. In particular, it is likely that the

number of abandoned calls will be reduced and enhance the ‘image’ of the Celer Transport business.

1 Your client, Island Co, is a manufacturer of machinery used in the coal extraction industry. You are currently planning

the audit of the financial statements for the year ended 30 November 2007. The draft financial statements show

revenue of $125 million (2006 – $103 million), profit before tax of $5·6 million (2006 – $5·1 million) and total

assets of $95 million (2006 – $90 million). Your firm was appointed as auditor to Island Co for the first time in June

2007.

Island Co designs, constructs and installs machinery for five key customers. Payment is due in three instalments: 50%

is due when the order is confirmed (stage one), 25% on delivery of the machinery (stage two), and 25% on successful

installation in the customer’s coal mine (stage three). Generally it takes six months from the order being finalised until

the final installation.

At 30 November, there is an amount outstanding of $2·85 million from Jacks Mine Co. The amount is a disputed

stage three payment. Jacks Mine Co is refusing to pay until the machinery, which was installed in August 2007, is

running at 100% efficiency.

One customer, Sawyer Co, communicated in November 2007, via its lawyers with Island Co, claiming damages for

injuries suffered by a drilling machine operator whose arm was severely injured when a machine malfunctioned. Kate

Shannon, the chief executive officer of Island Co, has told you that the claim is being ignored as it is generally known

that Sawyer Co has a poor health and safety record, and thus the accident was their fault. Two orders which were

placed by Sawyer Co in October 2007 have been cancelled.

Work in progress is valued at $8·5 million at 30 November 2007. A physical inventory count was held on

17 November 2007. The chief engineer estimated the stage of completion of each machine at that date. One of the

major components included in the coal extracting machinery is now being sourced from overseas. The new supplier,

Locke Co, is located in Spain and invoices Island Co in euros. There is a trade payable of $1·5 million owing to Locke

Co recorded within current liabilities.

All machines are supplied carrying a one year warranty. A warranty provision is recognised on the balance sheet at

$2·5 million (2006 – $2·4 million). Kate Shannon estimates the cost of repairing defective machinery reported by

customers, and this estimate forms the basis of the provision.

Kate Shannon owns 60% of the shares in Island Co. She also owns 55% of Pacific Co, which leases a head office to

Island Co. Kate is considering selling some of her shares in Island Co in late January 2008, and would like the audit

to be finished by that time.

Required:

(a) Using the information provided, identify and explain the principal audit risks, and any other matters to be

considered when planning the final audit for Island Co for the year ended 30 November 2007.

Note: your answer should be presented in the format of briefing notes to be used at a planning meeting.

Requirement (a) includes 2 professional marks. (13 marks)

1 ISLAND CO

(a) Briefing Notes

Subject: Principal Audit Risks – Island Co

Revenue Recognition – timing

Island Co raises sales invoices in three stages. There is potential for breach of IAS 18 Revenue, which states that revenue

should only be recognised once the seller has the right to receive it, in other words the seller has performed its contractual

obligations. This right does not necessarily correspond to amounts falling due for payment in accordance with an invoice

schedule agreed with a customer as part of a contract. Island Co appears to receive payment from its customers in advance

of performing any obligation, as the stage one invoice is raised when an order is confirmed i.e. before any work has actually

taken place. This creates the potential for revenue to be recognised too early, in advance of any performance of contractual

obligation. When a payment is received in advance of performance, a liability should be recognised equal to the amount

received, representing the obligation under the contract. Therefore a significant risk is that revenue is overstated and liabilities

understated.

Tutorial note: Equivalent guidance is also provided in IAS 11 Construction Contracts and credit will be awarded where

candidates discuss revenue recognition under IAS 11 as Island Co is providing a single substantial asset for a customer

under the terms of a contract.

Disputed receivable

The amount owed from Jacks Mine Co is highly material as it represents 50·9% of profit before tax, 2·3% of revenue, and

3% of total assets. The risk is that the receivable is overstated if no impairment of the disputed receivable is recognised.

Legal claim

The claim should be investigated seriously by Island Co. The chief executive officer’s (CEO) opinion that the claim will not

result in any financial consequence for Island Co is na?ve and flippant. Damages could be awarded against Island Co if it is

found that the machinery is faulty. The recurring high level of warranty provision implies that machinery faults are fairly

common and therefore the accident could be the result of a defective machine being supplied to Sawyer Co. The risk is that

no provision is created for the potential damages under IAS 37 Provisions, Contingent Liabilities and Contingent Assets, if the

likelihood of paying damages is considered probable. Alternatively, if the likelihood of damages being paid to Sawyer Co is

considered a possibility then a disclosure note should be made in the financial statements describing the nature and possible

financial effect of the contingent liability. As discussed below, the CEO, Kate Shannon, has an incentive not to make a

provision or disclose a contingent liability due to the planned share sale post year end.

A further risk is that any legal fees associated with the claim have not been accrued within the financial statements. As the

claim has arisen during the year, the expense must be included in this year’s income statement, even if the claim is still ongoing

at the year end.

The fact that the legal claim is effectively being ignored may cast doubts on the overall integrity of senior management, and

on the integrity of the financial statements. Management representations should be approached with a degree of professional

scepticism during the audit.

Sawyer Co has cancelled two orders. If the amounts are still outstanding at the year end then it is highly likely that Sawyer

Co will not pay the invoiced amounts, and thus receivables are overstated. If the stage one payments have already been made,

then Sawyer Co may claim a refund, in which case a provision should be made to repay the amount, or a contingent liability

disclosed in a note to the financial statements.

Sawyer Co is one of only five major customers, and losing this customer could have future going concern implications for

Island Co if a new source of revenue cannot be found to replace the lost income stream from Sawyer Co. If the legal claim

becomes public knowledge, and if Island Co is found to have supplied faulty machinery, then it will be difficult to attract new

customers.

A case of this nature could bring bad publicity to Island Co, a potential going concern issue if it results in any of the five key

customers terminating orders with Island Co. The auditors should plan to extend the going concern work programme to

incorporate the issues noted above.

Inventories

Work in progress is material to the financial statements, representing 8·9% of total assets. The inventory count was held two

weeks prior to the year end. There is an inherent risk that the valuation has not been correctly rolled forward to a year end

position.

The key risk is the estimation of the stage of completion of work in progress. This is subjective, and knowledge appears to

be confined to the chief engineer. Inventory could be overvalued if the machines are assessed to be more complete than they

actually are at the year end. Absorption of labour costs and overheads into each machine is a complex calculation and must

be done consistently with previous years.

It will also be important that consumable inventories not yet utilised on a machine, e.g. screws, nuts and bolts, are correctly

valued and included as inventories of raw materials within current assets.

Overseas supplier

As the supplier is new, controls may not yet have been established over the recording of foreign currency transactions.

Inherent risk is high as the trade payable should be retranslated using the year end exchange rate per IAS 21 The Effects of

Changes in Foreign Exchange Rates. If the retranslation is not performed at the year end, the trade payable could be

significantly over or under valued, depending on the movement of the dollar to euro exchange rate between the purchase date

and the year end. The components should remain at historic cost within inventory valuation and should not be retranslated

at the year end.

Warranty provision

The warranty provision is material at 2·6% of total assets (2006 – 2·7%). The provision has increased by only $100,000,

an increase of 4·2%, compared to a revenue increase of 21·4%. This could indicate an underprovision as the percentage

change in revenue would be expected to be in line with the percentage change in the warranty provision, unless significant

improvements had been made to the quality of machines installed for customers during the year. This appears unlikely given

the legal claim by Sawyer Co, and the machines installed at Jacks Mine Co operating inefficiently. The basis of the estimate

could be understated to avoid charging the increase in the provision as an expense through the income statement. This is of

special concern given that it is the CEO and majority shareholder who estimates the warranty provision.

Majority shareholder

Kate Shannon exerts control over Island Co via a majority shareholding, and by holding the position of CEO. This greatly

increases the inherent risk that the financial statements could be deliberately misstated, i.e. overvaluation of assets,

undervaluation of liabilities, and thus overstatement of profits. The risk is severe at this year end as Kate Shannon is hoping

to sell some Island Co shares post year end. As the price that she receives for these shares will be to a large extent influenced

by the balance sheet position of the company at 30 November 2007, she has a definite interest in manipulating the financial

statements for her own personal benefit. For example:

– Not recognising a provision or contingent liability for the legal claim from Sawyer Co

– Not providing for the potentially irrecoverable receivable from Jacks Mines Co

– Not increasing the warranty provision

– Recognising revenue earlier than permitted by IAS 18 Revenue.

Related party transactions

Kate Shannon controls Island Co and also controls Pacific Co. Transactions between the two companies should be disclosed

per IAS 24 Related Party Disclosures. There is risk that not all transactions have been disclosed, or that a transaction has

been disclosed at an inappropriate value. Details of the lease contract between the two companies should be disclosed within

a note to the financial statements, in particular, any amounts owed from Island Co to Pacific Co at 30 November 2007 should

be disclosed.

Other issues

– Kate Shannon wants the audit to be completed as soon as possible, which brings forward the deadline for completion

of the audit. The audit team may not have time to complete all necessary procedures, or there may not be time for

adequate reviews to be carried out on the work performed. Detection risk, and thus audit risk is increased, and the

overall quality of the audit could be jeopardised.

– This is especially important given that this is the first year audit and therefore the audit team will be working with a

steep learning curve. Audit procedures may take longer than originally planned, yet there is little time to extend

procedures where necessary.

– Kate Shannon may also exert considerable influence on the members of the audit team to ensure that the financial

statements show the best possible position of Island Co in view of her share sale. It is crucial that the audit team

members adhere strictly to ethical guidelines and that independence is beyond question.

– Due to the seriousness of the matters noted above, a final matter to be considered at the planning stage is that a second

partner review (Engagement Quality Control Review) should be considered for the audit this year end. A suitable

independent reviewer should be indentified, and time planned and budgeted for at the end of the assignment.

Conclusion

From the range of issues discussed in these briefing notes, it can be seen that the audit of Island Co will be a relatively high

risk engagement.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2019-07-20

- 2020-01-09

- 2020-03-12

- 2019-07-20

- 2020-01-09

- 2020-03-01

- 2019-07-20

- 2020-03-12

- 2020-03-01

- 2019-07-20

- 2019-03-08

- 2019-07-20

- 2020-03-01

- 2019-07-20

- 2020-03-11

- 2020-01-09

- 2019-07-20

- 2020-01-09

- 2020-01-09

- 2020-03-11

- 2020-03-01

- 2020-03-01

- 2019-07-20

- 2019-12-06

- 2020-03-11

- 2019-07-20

- 2020-01-09

- 2019-07-20

- 2020-03-12