2020年ACCA新教材什么时候出?

发布时间:2020-03-01

由于ACCA考试每年的考试内容都在不断变化。因此,在新年到来之后,一些准备参加ACCA考试的小伙伴就开始在网上查询ACCA考试教材的相关内容,比如2020年ACCA新教材什么时候出。鉴于此,51题库考试学习网在下面为大家带来2020年ACCA考试教材的相关信息,以供参考。

与其他会计师组织不同,ACCA并不撰写教材与习题,一般是由专业的教材出版机构出版相关学习教材与教辅资料,然后ACCA官方对权威的教材进行认可。而教材的具体发布时间要以ACCA官方认可教材商的消息为准,ACCA学员可在官网上查看教材发布时间。

目前,ACCA官方权威认可的教材商有三家,分别为BPP, Kaplan 及 Becker。这三家的教材各有优势:BPP以详细见称,BPP教材是全球ACCA使用最多的版本,通俗易懂,比较适合新老学员自学,国内的ACCA学员在备考时通常以看BPP课本及精简版讲义为主。并且国内基本上所有的高校ACCA专业也是使用的BPP版教材,主要是因为审计署买下了BPP教材在中国的版权,并且比之FTC版教材价格也有优势,每个点都讲解得很细。ACCA学员备考也更加轻松。

当然了,BBP版本的ACCA教材也有美中不足的地方: BPP版本主要适合于英语水平一般的,理解能力稍微弱的或者是初学者等。但由于ACCA教材BPP版本很多的,部分教材有时候讲得也很啰嗦。

而FTC版是ACCA官方版本教材,在全球的使用率还是比较高的。这套教材的优点是简洁,基本上每门课教材都比BPP版薄,往往是直入重点,但是FTC对F4阶段的ACCA备考并不是那么适用,其难度较之BPP版有所加大,所用单词也要复杂一些。另外,最新版有些地方讲解不是很细致,单凭它参加考试有一定难度。所以参加F阶段的考生,最好选择BPP版本。

以上两个版本是相对而言比较适合国内ACCA学员备考使用的ACCA教材,如何选择要以小伙伴们对教材内容的理解程度。当然了,选择合适的教材固然重要,认真学习教材也是通过考试的必备条件。

以上就是关于ACCA考试教材的相关情况。51题库考试学习网提醒:ACCA考试教材的官方版本都是全英文,因此如果英文水平不够好的小伙伴,最好选择BBP版本哦。最后,51题库考试学习网预祝准备参加2020年ACCA考试的小伙伴都能顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

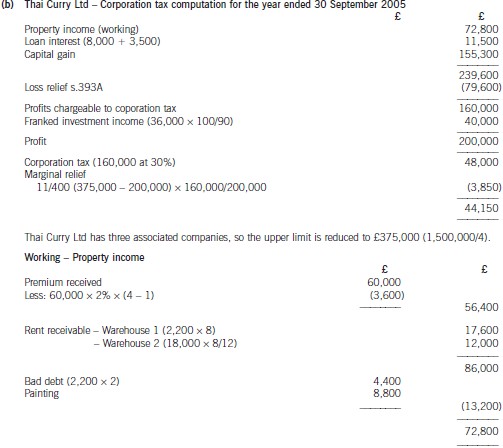

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

(c) Assess the likely criteria which would need to be satisfied for software to be regarded as ‘quality software’.

(4 marks)

(c) The following are important considerations regarding the quality of the business software:

– The software is error-free as this will improve its reliability. Whilst in practice this might not always be achievable the

directors of SSH must recognise the dangers involved in supplying bespoke software which may prove damaging to their

clients’ businesses with the resulting loss of client goodwill.

– The software should meet quality control standards such as those specified by the ISO (International Standards

Organisation).

– The software must be delivered on time. Late delivery of business software will prove problematic since clients may rely

on updated software to meet new customer needs or to fulfil revised business objectives.

– The software must meet the initial specification of the customer. In meeting the specification SSH will be demonstrating

that the software has been produced correctly with an appropriate focus on the requirements of end users.

– The software must be usable i.e. as well as being able to do what it is supposed to do it is important that it is easy to

use.

– The software should be capable of being updated in the light of future changes that occur in the clients’ requirements.

A manufacturing company, Man Co, has two divisions: Division L and Division M. Both divisions make a single standardised product. Division L makes component L, which is supplied to both Division M and external customers.

Division M makes product M using one unit of component L and other materials. It then sells the completed

product M to external customers. To date, Division M has always bought component L from Division L.

The following information is available:

Division L charges the same price for component L to both Division M and external customers. However, it does not incur the selling and distribution costs when transferring internally.

Division M has just been approached by a new supplier who has offered to supply it with component L for $37 per unit. Prior to this offer, the cheapest price which Division M could have bought component L for from outside the group was $42 per unit.

It is head office policy to let the divisions operate autonomously without interference at all.

Required:

(a) Calculate the incremental profit/(loss) per component for the group if Division M accepts the new supplier’s

offer and recommend how many components Division L should sell to Division M if group profits are to be

maximised. (3 marks)

(b) Using the quantities calculated in (a) and the current transfer price, calculate the total annual profits of each division and the group as a whole. (6 marks)

(c) Discuss the problems which will arise if the transfer price remains unchanged and advise the divisions on a suitable alternative transfer price for component L. (6 marks)

(a)MaximisinggroupprofitDivisionLhasenoughcapacitytosupplybothDivisionManditsexternalcustomerswithcomponentL.Therefore,incrementalcostofDivisionMbuyingexternallyisasfollows:CostperunitofcomponentLwhenboughtfromexternalsupplier:$37CostperunitforDivisionLofmakingcomponentL:$20.ThereforeincrementalcosttogroupofeachunitofcomponentLbeingboughtinbyDivisionMratherthantransferredinternally:$17($37–20).Fromthegroup’spointofview,themostprofitablecourseofactionisthereforethatall120,000unitsofcomponentLshouldbetransferredinternally.(b)CalculatingtotalgroupprofitTotalgroupprofitswillbeasfollows:DivisionL:Contributionearnedpertransferredcomponent=$40–$20=$20Profitearnedpercomponentsoldexternally=$40–$24=$16(c)ProblemswithcurrenttransferpriceandsuggestedalternativeTheproblemisthatthecurrenttransferpriceof$40perunitisnowtoohigh.Whilstthishasnotbeenaproblembeforesinceexternalsupplierswerecharging$42perunit,itisaproblemnowthatDivisionMhasbeenofferedcomponentLfor$37perunit.IfDivisionMnowactsinitsowninterestsratherthantheinterestsofthegroupasawhole,itwillbuycomponentLfromtheexternalsupplierratherthanfromDivisionL.ThiswillmeanthattheprofitsofthegroupwillfallsubstantiallyandDivisionLwillhavesignificantunusedcapacity.Consequently,DivisionLneedstoreduceitsprice.Thecurrentpricedoesnotreflectthefactthattherearenosellinganddistributioncostsassociatedwithtransferringinternally,i.e.thecostofsellinginternallyis$4lessforDivisionLthansellingexternally.So,itcouldreducethepriceto$36andstillmakethesameprofitonthesesalesasonitsexternalsales.ThiswouldthereforebethesuggestedtransferpricesothatDivisionMisstillsaving$1perunitcomparedtotheexternalprice.Atransferpriceof$37wouldalsopresumablybeacceptabletoDivisionMsincethisisthesameastheexternalsupplierisoffering.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-07-20

- 2020-03-12

- 2019-07-20

- 2019-07-20

- 2020-03-01

- 2020-03-11

- 2020-09-04

- 2019-07-20

- 2019-07-20

- 2020-04-14

- 2020-01-09

- 2020-03-11

- 2019-07-20

- 2019-07-20

- 2020-03-12

- 2019-07-20

- 2019-07-20

- 2020-01-09

- 2020-03-12

- 2019-07-20

- 2020-03-01

- 2020-01-09

- 2020-09-04

- 2020-01-09

- 2020-01-09

- 2020-09-04

- 2020-01-09

- 2019-07-20

- 2020-01-09

- 2020-01-09