ACCA考试相关信息

发布时间:2021-08-12

还有同学不了解ACCA考试吗?没关系,51题库考试学习网今天就为大家详细介绍一下ACCA考试的相关信息,一起来看看吧!

关于ACCA,51题库考试学习网整理了以下这几个问题来介绍:

1.ACCA是什么?

ACCA是特许公认会计师公会,俗称国际注册会计师,在全球180多个国家获得认可。

2.ACCA考试科目有哪些?

ACCA考试由F1-F9、P1-P7共计16门课程组成,其中P4-P7这4门为选修课程,学员可以从其中选择2门参加考试,也就是考过14门课程即为考试通过。

3.ACCA 16门课程中英文名称

第一部分:知识课程

(1)F1:会计师与企业Accountant in Business(AB)

(2)F2:管理会计Management Accounting(MA)

(3)F3:财务会计Financial Accounting(FA)

第二部分:技能课程

(4)F4:公司法与商法Corporate and Business Law(CL)

(5)F5:业绩管理Performance Management(PM)

(6)F6:税务Taxation(TX)

(7)F7:财务报告Financial Reporting(FR)

(8)F8:审计与认证业务Audit and Assurance(AA)

(9)F9:财务管理Financial Management(FM)

第三部分:核心课程

(10)P1:公司治理、风险管理与职业操守Governance、Risk and Ethics(GRE)

(11)P2:公司报告Corporate Reporting(CR)

(12)P3:商务分析Business Analysis(BA)

第四部分:选修课程

(13)P4:高级财务管理Advanced Financial Management(AFM)

(14)P5:高级业绩管理Advanced Performance Management(APM)

(15)P6:高级税务Advanced Taxation(AT)

(16)P7:高级审计与认证业务Advanced Audit and Assurance(AAA)

4.ACCA报考须知:

准备报考ACCA考试的考生都必须在ACCA官网www.accaglobal.com注册为学员,才能报名参加考试。

5.ACCA报名条件:

(1)年满16周岁以上者,可先学习FIA三门课程(即FAB、FMA、FFA),这三门课程相当于ACCA知识阶段的F1、F2、F3,这三门课程考试通过后即可转为ACCA学员;

(2)教育部承认的大专学历者,可以直接在ACCA官网注册成为ACCA学员,即可参加ACCA的考试;

(3)教育部承认的在校大学生,完成大一阶段全部考试即可在ACCA官网注册成为ACCA学员,参加ACCA的全部课程考试。

6.ACCA目前在全球有近18万名会员,45万多名学员,在中国有2.4万名会员,6.1万名学员。中国大陆市场目前急需ACCA人才30万名,但现在仅有不到5000名,人才缺口较大。

7.ACCA免试政策(教育部认可学历):

(1)教育部认可的会计学、金融学专业获得学士学位者免试F1-F5;

(2)会计学辅修专业免试F1-F3;

(3)法律专业免试F4;

(4)商务及管理专业免试F1;

(5)会计硕士免试F1-F9;

(6)工商管理硕士免试F1-F3;

(7)中国的注册会计师免试F1-F9;

(8)在校会计学专业大学生完成第二学年或第三学年全部课程免试F1-F3。

8.对英语基础的要求:

虽然ACCA采取纯英文考试形式,但ACCA考试对学员的英语基础没有设置门槛,如果觉得自己英语基础比较差,通过F1-F3的学习可以迅速提高自己的阅读能力以及专业词汇量,为后面的学习打下良好的基础,相信任何事情的学习都是一个熟能生巧的过程。

9.考试次数:

ACCA自2016年起每年的3、6、9、12月份共举行4次考试,都为全球统考,大大缩短了考试通过的时间,大部分学员在不到2年的时间里便可完成所有的考试。

10.ACCA考试形式:

ACCA考试采取笔试和机考相结合,考试形式灵活。自2016年7月1日起,FIA、FI、F2、F3只能参加机考考试;,自2016年9月份起,F4-F9采取机考和笔试相结合;机考可以随时参加,但是需提前与机考中心预约,P段考试仍为笔试。

11.ACCA考试时长:

由于考虑到时差,中国考区考试开始时间一般为下午3点。

12.及格分数:

ACCA每科考试满分均为100分,50分及格。

13.ACCA会员资格:

ACCA考生通过14门课程的考试后成为准会员,准会员需完成在线职业能力与道德模块的测试并具有3年相关工作经验,便可申请成为ACCA会员。

以上就是51题库考试学习网为大家分享的关于ACCA考试的相关内容了,关于ACCA今天就说到这里吧,更多资讯敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Describe with suitable calculations how the goodwill arising on the acquisition of Briars will be dealt with in

the group financial statements and how the loan to Briars should be treated in the financial statements of

Briars for the year ended 31 May 2006. (9 marks)

(b) IAS21 ‘The Effects of Changes in Foreign Exchange Rates’ requires goodwill arising on the acquisition of a foreign operation

and fair value adjustments to acquired assets and liabilities to be treated as belonging to the foreign operation. They should

be expressed in the functional currency of the foreign operation and translated at the closing rate at each balance sheet date.

Effectively goodwill is treated as a foreign currency asset which is retranslated at the closing rate. In this case the goodwillarising on the acquisition of Briars would be treated as follows:

At 31 May 2006, the goodwill will be retranslated at 2·5 euros to the dollar to give a figure of $4·4 million. Therefore this

will be the figure for goodwill in the balance sheet and an exchange loss of $1·4 million recorded in equity (translation

reserve). The impairment of goodwill will be expensed in profit or loss to the value of $1·2 million. (The closing rate has been

used to translate the impairment; however, there may be an argument for using the average rate.)

The loan to Briars will effectively be classed as a financial liability measured at amortised cost. It is the default category for

financial liabilities that do not meet the definition of financial liabilities at fair value through profit or loss. For most entities,

most financial liabilities will fall into this category. When a financial liability is recognised initially in the balance sheet, the

liability is measured at fair value. Fair value is the amount for which a liability can be settled, between knowledgeable, willing

parties in an arm’s length transaction. In other words, fair value is an actual or estimated transaction price on the reporting

date for a transaction taking place between unrelated parties that have adequate information about the asset or liability being

measured.

Since fair value is a market transaction price, on initial recognition fair value generally is assumed to equal the amount of

consideration paid or received for the financial asset or financial liability. Accordingly, IAS39 specifies that the best evidence

of the fair value of a financial instrument at initial recognition generally is the transaction price. However for longer-term

receivables or payables that do not pay interest or pay a below-market interest, IAS39 does require measurement initially at

the present value of the cash flows to be received or paid.

Thus in Briars financial statements the following entries will be made:

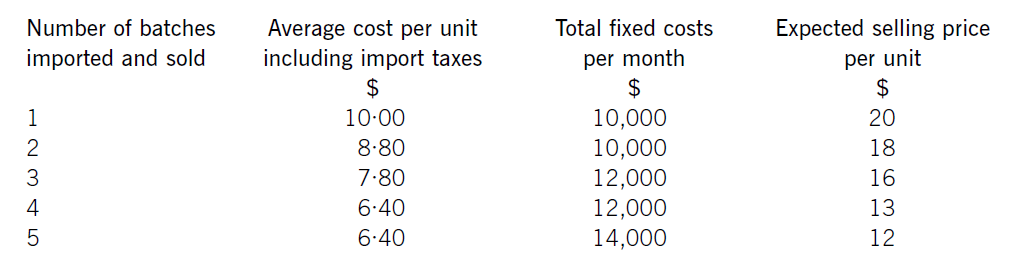

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

(ii) Briefly discuss TWO factors which could reduce the rate of return earned by the investment as per the

results in part (a). (4 marks)

(ii) Two factors which might reduce the return earned by the investment are as follows:

(i) Poor product quality

The very nature of the product requires that it is of the highest quality i.e. the cakes are made for human

consumption. Bad publicity via a ‘product recall’ could potentially have a catastrophic effect on the total sales to

Superstores plc over the eighteen month period.

(ii) The popularity of the Mighty Ben character

There is always the risk that the popularity of the character upon which the product is based will diminish with a

resultant impact on sales volumes achieved. In this regard it would be advisable to attempt to negotiate with

Superstores plc in order to minimise potential future losses.

5 Ambush, a public limited company, is assessing the impact of implementing the revised IAS39 ‘Financial Instruments:

Recognition and Measurement’. The directors realise that significant changes may occur in their accounting treatment

of financial instruments and they understand that on initial recognition any financial asset or liability can be

designated as one to be measured at fair value through profit or loss (the fair value option). However, there are certain

issues that they wish to have explained and these are set out below.

Required:

(a) Outline in a report to the directors of Ambush the following information:

(i) how financial assets and liabilities are measured and classified, briefly setting out the accounting

method used for each category. (Hedging relationships can be ignored.) (10 marks)

5 Report to the Directors of Ambush, a public limited company

(a) The following report sets out the principal aspects of IAS 39 in the designated areas.

(i) Classification of financial instruments and their measurement

Financial assets and liabilities are initially measured at fair value which will normally be the fair value of the

consideration given or received. Transaction costs are included in the initial carrying value of the instrument unless it

is carried at ‘fair value through profit or loss’ when these costs are recognised in the income statement.

Financial assets should be classified into four categories:

(i) financial assets at fair value through profit or loss

(ii) loans and receivables

(iii) held-to-maturity investments (HTM)

(iv) available-for-sale financial assets (AFS).

The first category above has two sub categories which are ‘held for trading’ and those designated to this category at

inception/initial recognition. This latter designation is irrevocable.

Financial liabilities have two categories: those at fair value through profit or loss, and ‘other’ liabilities. As with financial

assets those liabilities designated as at fair value through profit or loss have two sub categories which are the same as

those for financial assets.

Reclassifications between categories are uncommon and restricted under IAS 39 and are prohibited into and out of the

fair value through profit or loss category. Reclassifications between AFS and HTM are possible but it is not possible from

loans and receivables to AFS. The held to maturity category is limited in its application as if the company sells or

reclassifies more than an immaterial amount of the portfolio, it is barred from using the category for at least two years.

Also all remaining HTM investments would be reclassified to AFS.

Subsequent measurement of financial assets and liabilities depends on the classification. The following tablesummarises the position:

Amortised cost is the cost of an asset or liability adjusted to achieve a constant effective interest rate over the life of the

asset or liability.

It is not possible to compute amortised cost for instruments that do not have fixed or determinable payments, such as

for equity instruments, and such instruments therefore cannot be classified into these categories.

A company must apply the effective interest rate method in the measurement of amortised cost. The effective interest

rate method determines how much interest income or interest expense should be reported in profit and loss.

For financial assets at fair value through profit or loss and financial liabilities at fair value through profit or loss, all

changes in fair value are recognised in profit or loss when they occur. This includes unrealised holding gains and losses.

For available-for-sale financial assets, unrealised holding gains and losses are deferred in reserves until they are realised

or impairment occurs. Only interest income and dividend income, impairment losses, and certain foreign currency gains

and losses are recognised in profit or loss.

Investments in unquoted equity instruments that cannot be reliably measured at fair value are subsequently measureat cost. Unrealised holding gains/losses are not normally recognised in profit/loss.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-25

- 2020-01-10

- 2020-01-10

- 2020-04-16

- 2020-08-05

- 2020-01-10

- 2020-05-13

- 2020-01-10

- 2020-01-07

- 2020-05-06

- 2020-01-10

- 2020-03-25

- 2020-01-10

- 2020-03-07

- 2020-01-10

- 2020-03-11

- 2020-01-10

- 2020-01-13

- 2020-03-07

- 2020-05-12

- 2021-07-28

- 2019-12-27

- 2020-01-10

- 2020-05-20

- 2020-01-04

- 2020-01-09

- 2020-03-07

- 2020-02-01

- 2019-07-20

- 2020-02-20