2021年ACCA考试:会计师与企业财经词汇汇编(5)

发布时间:2021-05-29

各位小伙伴注意了,备考已经进入了关键期,现在状态如何啊,今天51题库考试学习网为大家分享ACCA考试会计师与企业财经词汇汇编(5),供大家参考,希望对大家有所帮助!

ACCA财经词汇汇编:Leveraged Recapitalization

【English Terms】

Leveraged Recapitalization

【中文翻译】

融资资本充实

【详情解释/例子】

指公司借入大额新债务,以支付大额股息或重新买入股票,导致公司的负债率大增。

ACCA财经词汇汇编:Letter of Credit

【English Terms】

Letter of Credit

【中文翻译】

信用证

【详情解释/例子】

银行发出的函件,证明一宗交易的买方会准时向卖方支付预定的金额。

ACCA财经词汇汇编:Lock-up Agreement

【English Terms】

Lock-up Agreement

【中文翻译】

锁定协议

【详情解释/例子】

承销商与公司的内部人士之间具有法律约束力的合约,规定在特定时期内,这些人士不可出售任何该公司的股票。

ACCA财经词汇汇编:Loan Loss Provision

【English Terms】

Loan Loss Provision

【中文翻译】

贷款损失准备金

【详情解释/例子】

预留应付坏账的款项(客户违约、需要重新磋商贷款条款等)。

ACCA财经词汇汇编:Loan Sharking

【English Terms】

Loan Sharking

【中文翻译】

高利贷

【详情解释/例子】

借方支付的利息高于法定利率。贷方一般不能收取高于每年60%的利息,但实际规定视乎国家而定。

ACCA财经词汇汇编:Loan Syndication

【English Terms】

Loan Syndication

【中文翻译】

贷款银团

【详情解释/例子】

多个贷方共同出资的贷款,各贷方的出资比例可能不同。

ACCA财经词汇汇编:Loan to Value Ratio

【English Terms】

Loan to Value Ratio

【中文翻译】

贷款与价值比率

【详情解释/例子】

放贷风险比率,计算方法为抵押或贷款总额除以物业的估值。

ACCA财经词汇汇编:Listed Security

【English Terms】

Listed Security

【中文翻译】

上市证券

【详情解释/例子】

获认可、受管制交易所接受进行买卖的证券。

ACCA财经词汇汇编:Liquidity Risk

【English Terms】

Liquidity Risk

【中文翻译】

流通风险

【详情解释/例子】

指一项投资缺乏市场买卖能力,即不能迅速买入或卖出,以避免或减少损失的风险。

ACCA财经词汇汇编:Liquid Market

【English Terms】

Liquid Market

【中文翻译】

高流通性市场

【详情解释/例子】

存在大量叫价及出价的市场,高流通性、价差低及波动性低是高流通性市场的指标。

以上就是51题库考试学习网带给大家的全部内容,希望能够帮到大家!预祝大家在ACCA考试中取得满意的成绩,如果想要了解更多关于ACCA考试的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(a) The following information relates to Crosswire a publicly listed company.

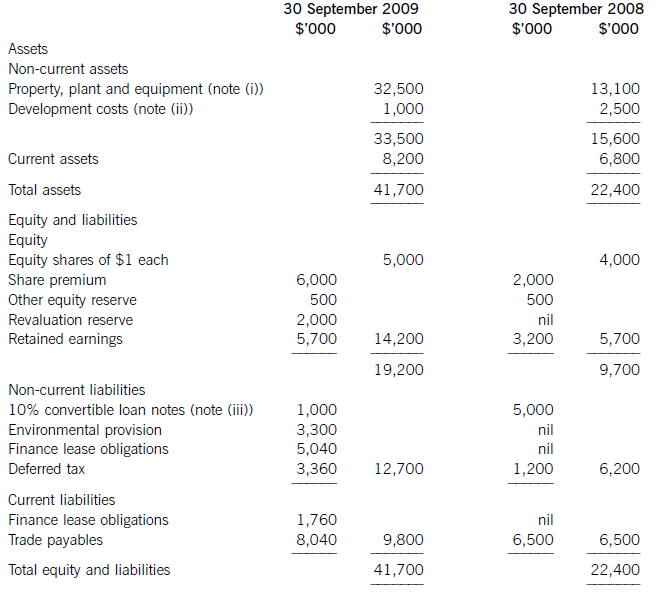

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

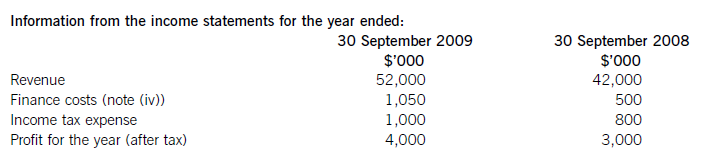

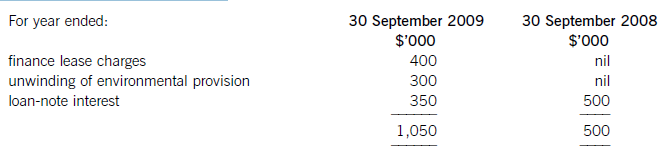

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced.

(ii) How existing standards could be modified to meet the needs of SMEs. (6 marks

(ii) The development of IFRSs for SMEs as a modification of existing IFRSs

Most SMEs have a narrower range of users than listed entities. The main groups of users are likely to be the owners,

suppliers and lenders. In deciding upon the modifications to make to IFRS, the needs of the users will need to be taken

into account as well as the costs and other burdens imposed upon SMEs by the IFRS. There will have to be a relaxation

of some of the measurement and recognition criteria in IFRS in order to achieve the reduction in the costs and the

burdens. Some disclosure requirements, such as segmental reports and earnings per share, are intended to meet the

needs of listed entities, or to assist users in making forecasts of the future. Users of financial statements of SMEs often

do not make such kinds of forecasts. Thus these disclosures may not be relevant to SMEs, and a review of all of the

disclosure requirements in IFRS will be required to assess their appropriateness for SMEs.

The difficulty is determining which information is relevant to SMEs without making the information disclosed

meaningless or too narrow/restricted. It may mean that measurement requirements of a complex nature may have to be

omitted.

There are, however, rational grounds for justifying different treatments because of the different nature of the entities and

the existence of established practices at the time of the issue of an IFRS.

3 The directors of The Healthy Eating Group (HEG), a successful restaurant chain, which commenced trading in 1998,

have decided to enter the sandwich market in Homeland, its country of operation. It has set up a separate operation

under the name of Healthy Sandwiches Co (HSC). A management team for HSC has been recruited via a recruitment

consultancy which specialises in food sector appointments. Homeland has very high unemployment and the vast

majority of its workforce has no experience in a food manufacturing environment. HSC will commence trading on

1 January 2008.

The following information is available:

(1) HSC has agreed to make and supply sandwiches to agreed recipes for the Superior Food Group (SFG) which

owns a chain of supermarkets in all towns and cities within Homeland. SFG insists that it selects the suppliers

of the ingredients that are used in making the sandwiches it sells and therefore HSC would be unable to reduce

the costs of the ingredients used in the sandwiches. HSC will be the sole supplier for SFG.

(2) The number of sandwiches sold per year in Homeland is 625 million. SFG has a market share of 4%.

(3) The average selling price of all sandwiches sold by SFG is $2·40. SFG wishes to make a mark-up of 331/3% on

all sandwiches sold. 90% of all sandwiches sold by SFG are sold before 2 pm each day. The majority of the

remaining 10% are sold after 8 pm. It is the intention that all sandwiches are sold on the day that they are

delivered into SFG’s supermarkets.

(4) The finance director of HSC has estimated that the average cost of ingredients per sandwich is $0·70. All

sandwiches are made by hand.

(5) Packaging and labelling costs amount to $0·15 per sandwich.

(6) Fixed overheads have been estimated to amount to $5,401,000 per annum. Note that fixed overheads include

all wages and salaries costs as all employees are subject to fixed term employment contracts.

(7) Distribution costs are expected to amount to 8% of HSC’s revenue.

(8) The finance director of HSC has stated that he believes the target sales margin of 32% can be achieved, although

he is concerned about the effect that an increase in the cost of all ingredients would have on the forecast profits

(assuming that all other revenue/cost data remains unchanged).

(9) The existing management information system of HEG was purchased at the time that HEG commenced trading.

The directors are now considering investing in an enterprise resource planning system (ERPS).

Required:

(a) Using only the above information, show how the finance director of HSC reached his conclusion regarding

the expected sales margin and also state whether he was correct to be concerned about an increase in the

price of ingredients. (5 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-02-13

- 2020-10-10

- 2020-10-21

- 2019-11-14

- 2019-06-22

- 2020-01-01

- 2020-08-14

- 2020-10-21

- 2021-02-13

- 2021-05-29

- 2020-09-04

- 2020-10-18

- 2019-06-22

- 2020-10-21

- 2020-09-05

- 2020-08-14

- 2020-10-21

- 2020-10-10

- 2021-02-13

- 2020-10-10

- 2020-01-02

- 2019-06-22

- 2021-02-13

- 2021-05-29

- 2021-02-13

- 2019-03-09

- 2020-10-18

- 2020-10-18

- 2021-02-13

- 2019-12-29