2020年ACCA考试会计师与企业财经词汇汇编(2)

发布时间:2020-10-10

今日51题库考试学习网为大家分享2020年ACCA考试会计师与企业财经词汇汇编(2),供大家参考,希望对大家有所帮助,查看更多备考内容请关注51题库考试学习网ACCA考试频道。

ACCA财经词汇汇编:Net Liquid

Assets

【English Terms】

Net Liquid Assets

【中文翻译】

流通资产净值

【详情解释/例子】

公司的流通财务资产减流动负债。

ACCA财经词汇汇编:Net

Investment Income

【English Terms】

Net Investment Income

【中文翻译】

净投资收入

【详情解释/例子】

投资收益减投资直接成本。

ACCA财经词汇汇编:Net Loss

【English Terms】

Net Loss

【中文翻译】

净亏损、净损失

【详情解释/例子】

指一名人士或一家公司的开支超过收入。

ACCA财经词汇汇编:Net

Operating Income

【English Terms】

Net Operating Income(NOI)

【中文翻译】

营运净收入

【详情解释/例子】

公司的营运收入减所得税及少数权益。

ACCA财经词汇汇编:NYSE

【English Terms】

NYSE

【中文翻译】

纽约股票交易所

【详情解释/例子】

纽约股票交易所负责制定政策、监督股票交易所及其会员的行为以及上市证券的公司,也负责管理交易所会员议席的转换,包括评审申请成为专家人士的资格。

ACCA财经词汇汇编:Negative

Carry

【English Terms】

Negative Carry

【中文翻译】

负盈利

【详情解释/例子】

融资成本高于证券或期货投资收益率的交易。

ACCA财经词汇汇编:Negative

Income Tax

【English Terms】

Negative Income Tax

【中文翻译】

负所得税

【详情解释/例子】

向贫穷线以下人士或家庭提供收入资助的税务制度。

ACCA财经词汇汇编:Negative

Goodwill

【English Terms】

Negative Goodwill

【中文翻译】

负商誉

【详情解释/例子】

由于收购价格低于收购资产的公平价值而获得的收益。

ACCA财经词汇汇编:Negative

Covenant

【English Terms】

Negative Covenant

【中文翻译】

负面契约

【详情解释/例子】

禁止借贷方在未获得债券持有人同意下进行某些活动的债券条款。

以上就是51题库考试学习网带给大家的全部内容,相信小伙伴们都了解清楚。预祝12月份ACCA考试取得满意的成绩,如果想要了解更多关于ACCA考试的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

3 The directors of Panel, a public limited company, are reviewing the procedures for the calculation of the deferred tax

provision for their company. They are quite surprised at the impact on the provision caused by changes in accounting

standards such as IFRS1 ‘First time adoption of International Financial Reporting Standards’ and IFRS2 ‘Share-based

Payment’. Panel is adopting International Financial Reporting Standards for the first time as at 31 October 2005 and

the directors are unsure how the deferred tax provision will be calculated in its financial statements ended on that

date including the opening provision at 1 November 2003.

Required:

(a) (i) Explain how changes in accounting standards are likely to have an impact on the provision for deferred

taxation under IAS12 ‘Income Taxes’. (5 marks)

(a) (i) IAS12 ‘Income Taxes’ adopts a balance sheet approach to accounting for deferred taxation. The IAS adopts a full

provision approach to accounting for deferred taxation. It is assumed that the recovery of all assets and the settlement

of all liabilities have tax consequences and that these consequences can be estimated reliably and are unavoidable.

IFRS recognition criteria are generally different from those embodied in tax law, and thus ‘temporary’ differences will

arise which represent the difference between the carrying amount of an asset and liability and its basis for taxation

purposes (tax base). The principle is that a company will settle its liabilities and recover its assets over time and at that

point the tax consequences will crystallise.

Thus a change in an accounting standard will often affect the carrying value of an asset or liability which in turn will

affect the amount of the temporary difference between the carrying value and the tax base. This in turn will affect the

amount of the deferred taxation provision which is the tax rate multiplied by the amount of the temporary differences(assuming a net liability for deferred tax.)

21 Which of the following statements about contingent assets and contingent liabilities are correct?

1 A contingent asset should be disclosed by note if an inflow of economic benefits is probable.

2 A contingent liability should be disclosed by note if it is probable that a transfer of economic benefits to settle it

will be required, with no provision being made.

3 No disclosure is required for a contingent liability if it is not probable that a transfer of economic benefits to settle

it will be required.

4 No disclosure is required for either a contingent liability or a contingent asset if the likelihood of a payment or

receipt is remote.

A 1 and 4 only

B 2 and 3 only

C 2, 3 and 4

D 1, 2 and 4

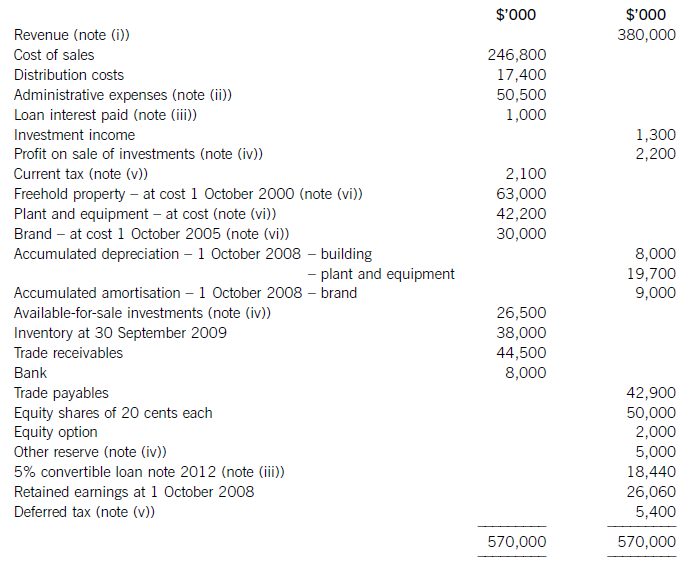

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

(ii) Calculate the corporation tax (CT) payable by Tay Limited for the year ended 31 March 2006, taking

advantage of all available reliefs. (3 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-02-13

- 2019-03-29

- 2021-05-29

- 2021-05-29

- 2020-10-18

- 2020-09-05

- 2020-10-10

- 2019-12-29

- 2020-10-10

- 2020-10-21

- 2021-05-29

- 2020-10-10

- 2020-10-21

- 2020-10-10

- 2021-02-13

- 2020-10-10

- 2020-09-04

- 2021-05-29

- 2019-12-29

- 2021-05-29

- 2020-10-10

- 2019-12-29

- 2020-01-02

- 2020-09-05

- 2020-10-10

- 2021-05-29

- 2020-08-15

- 2020-10-21

- 2021-05-29

- 2020-10-10