备考资料:2020年ACCA考试审计与认证业务知识点(3)

发布时间:2020-10-09

距离ACCA考试还有2个多月的时间,各位小伙伴备考的如何了啊,今日51题库考试学习网为大家分享“备考资料:2020年ACCA考试审计与认证业务知识点(3)”的相关知识点,一起过来复习巩固一下吧。

【知识点】Role and responsibilities of audit

committee 审计委员会的角色和责任

Role and responsibilities of audit

committee

Ø To monitor the integrity of the FS of the

company and any formal announcements relating to the company\'s financial

performance, reviewing significant financial reporting issues and judgements

contained in them.

Ø To review the company\'s internal

financial controls and, unless expressly addressed by a separate board risk

committee composed of independent directors, or by the board itself, the

company\'s control and risk management systems.

Ø To monitor and review the effectiveness

of the company\'s internal audit function.

Ø To make recommendations to the board in

relation to the appointment, reappointment and removal of the external auditor

and to approve the remuneration and terms of engagement of the external

auditors.

Ø Reviewing arrangements for confidential

reporting by employees and investigation of possible improprieties.

Ø To review and monitor the external

auditor‘s independence, objectivity and the effectiveness of the audit process.

Ø To develop and implement policy on the

engagement of the external auditor to supply non-audit services.

Ø To report to the board, identifying any

matters in respect of non-audit services which it considers that action or

improvement is needed and making recommendations as to the steps to be taken.

Ø To report to the board on how AC has

discharged its responsibilities overall.

【知识点】Importance of internal control and

risk management 内部控制和风险管理的重要性

Importance of internal control and risk

management

Ø Safeguarding the company\'s assets.

Ø Helping to prevent and detect fraud.

Ø Safeguarding the shareholders\'

investment.

Ø Helping the business to run efficiently

and reduce identified risks.

Ø Ensuring the reliability of reporting.

Ø Ensuring compliance with relevant law.

以上就是51题库考试学习网带给大家的全部内容,相信小伙伴们都了解清楚。预祝12月份ACCA考试取得满意的成绩,如果想要了解更多关于ACCA考试的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

5 (a) Compare and contrast the responsibilities of management, and of auditors, in relation to the assessment of

going concern. You should include a description of the procedures used in this assessment where relevant.

(7 marks)

5 Dexter Co

(a) Responsibilities of management and auditors

Responsibilities

ISA 570 Going Concern provides a clear framework for the assessment of the going concern status of an entity, and

differentiates between the responsibilities of management and of auditors. Management should assess going concern in order

to decide on the most appropriate basis for the preparation of the financial statements. IAS 1 Presentation of Financial

Statements (revised) requires that where there is significant doubt over an entity’s ability to continue as a going concern, the

uncertainties should be disclosed in a note to the financial statements. Where the directors intend to cease trading, or have

no realistic alternative but to do so, the financial statements should be prepared on a ‘break up’ basis.

Thus the main focus of the management’s assessment of going concern is to ensure that relevant disclosures are made where

necessary, and that the correct basis of preparation is used.

The auditor’s responsibility is to consider the appropriateness of the management’s use of the going concern assumption in

the preparation of the financial statements and to consider whether there are material uncertainties about the entity’s ability

to continue as a going concern that need to be disclosed in a note.

The auditor should also consider the length of the time period that management have looked at in their assessment of going

concern.

The auditor will therefore need to come to an opinion as to the going concern status of an entity but the focus of the auditor’s

evaluation of going concern is to see whether they agree with the assessment made by the management. Therefore whether

they agree with the basis of preparation of the financial statements, or the inclusion in a note to the financial statements, as

required by IAS 1, of any material uncertainty.

Evaluation techniques

In carrying out the going concern assessment, management will evaluate a wide variety of indicators, including operational

and financial. An entity employing good principles of corporate governance should be carrying out such an assessment as

part of the on-going management of the business.

Auditors will use a similar assessment technique in order to come to their own opinion as to the going concern status of an

entity. They will carry out an operational review of the business in order to confirm business understanding, and will conduct

a financial review as part of analytical procedures. Thus both management and auditors will use similar business risk

assessment techniques to discover any threats to the going concern status of the business.

Auditors should not see going concern as a ‘completion issue’, but be alert to issues affecting going concern throughout the

audit. In the same way that management should continually be managing risk (therefore minimising going concern risk),

auditors should be continually be alert to going concern problems throughout the duration of the audit.

However, one difference is that when going concern problems are discovered, the auditor is required by IAS 570 to carry out

additional procedures. Examples of such procedures would include:

– Analysing and discussing cash flow, profit and other relevant forecasts with management

– Analysing and discussing the entity’s latest available interim financial statements

– Reviewing events after the period end to identify those that either mitigate or otherwise affect the entity’s ability to

continue as a going concern, and

– Reading minutes of meetings of shareholders, those charged with governance and relevant committees for reference to

financing difficulties.

Management are not explicitly required to gather specific evidence about going concern, but as part of good governance would

be likely to investigate and react to problems discovered.

(c) Issue of bond

The club proposes to issue a 7% bond with a face value of $50 million on 1 January 2007 at a discount of 5%

that will be secured on income from future ticket sales and corporate hospitality receipts, which are approximately

$20 million per annum. Under the agreement the club cannot use the first $6 million received from corporate

hospitality sales and reserved tickets (season tickets) as this will be used to repay the bond. The money from the

bond will be used to pay for ground improvements and to pay the wages of players.

The bond will be repayable, both capital and interest, over 15 years with the first payment of $6 million due on

31 December 2007. It has an effective interest rate of 7·7%. There will be no active market for the bond and

the company does not wish to use valuation models to value the bond. (6 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

(c) Issue of bond

This form. of financing a football club’s operations is known as ‘securitisation’. Often in these cases a special purpose vehicle

is set up to administer the income stream or assets involved. In this case, a special purpose vehicle has not been set up. The

benefit of securitisation of the future corporate hospitality sales and season ticket receipts is that there will be a capital

injection into the club and it is likely that the effective interest rate is lower because of the security provided by the income

from the receipts. The main problem with the planned raising of capital is the way in which the money is to be used. The

use of the bond for ground improvements can be commended as long term cash should be used for long term investment but

using the bond for players’ wages will cause liquidity problems for the club.

This type of securitisation is often called a ‘future flow’ securitisation. There is no existing asset transferred to a special purpose

vehicle in this type of transaction and, therefore, there is no off balance sheet effect. The bond is shown as a long term liability

and is accounted for under IAS39 ‘Financial Instruments: Recognition and Measurement’. There are no issues of

derecognition of assets as there can be in other securitisation transactions. In some jurisdictions there are legal issues in

assigning future receivables as they constitute an unidentifiable debt which does not exist at present and because of this

uncertainty often the bond holders will require additional security such as a charge on the football stadium.

The bond will be a financial liability and it will be classified in one of two ways:

(i) Financial liabilities at fair value through profit or loss include financial liabilities that the entity either has incurred for

trading purposes and, where permitted, has designated to the category at inception. Derivative liabilities are always

treated as held for trading unless they are designated and effective as hedging instruments. An example of a liability held

for trading is an issued debt instrument that the entity intends to repurchase in the near term to make a gain from shortterm

movements in interest rates. It is unlikely that the bond will be classified in this category.

(ii) The second category is financial liabilities measured at amortised cost. It is the default category for financial liabilities

that do not meet the criteria for financial liabilities at fair value through profit or loss. In most entities, most financial

liabilities will fall into this category. Examples of financial liabilities that generally would be classified in this category are

account payables, note payables, issued debt instruments, and deposits from customers. Thus the bond is likely to be

classified under this heading. When a financial liability is recognised initially in the balance sheet, the liability is

measured at fair value. Fair value is the amount for which a liability can be settled between knowledgeable, willing

parties in an arm’s length transaction. Since fair value is a market transaction price, on initial recognition fair value will

usually equal the amount of consideration received for the financial liability. Subsequent to initial recognition financial

liabilities are measured using amortised cost or fair value. In this case the company does not wish to use valuation

models nor is there an active market for the bond and, therefore, amortised cost will be used to measure the bond.

The bond will be shown initially at $50 million × 95%, i.e. $47·5 million as this is the consideration received. Subsequentlyat 31 December 2007, the bond will be shown as follows:

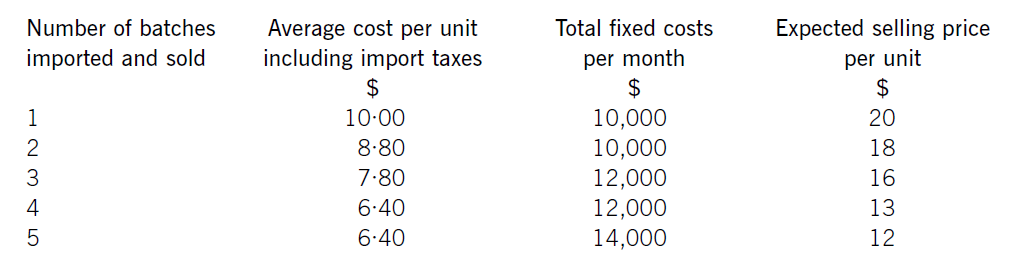

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

Required:

(iii) A firm of consultants has offered to undertake a study on behalf of Envico Ltd which will provide perfect

information regarding seminar attendance during the forthcoming year.

Advise the management of Envico Ltd with regard to the maximum amount that they should pay to

consultants for perfect information regarding seminar attendance and comment briefly on the use of

perfect information in such decisions. (5 marks)

(iii) If attendance = 100 then management would opt for room size A which would produce a contribution of £832,000 x

0·2 = £166,400.

If attendance = 200 then management would opt for room size B which would produce a contribution of £2,163,200

x 0·5 = £1,081,600.

If attendance = 400 then management would opt for room size D which would produce a contribution of £6,656,000

x 0·3 = £1,996,800.

Therefore the expected value of perfect information would be the sum of the expected values of the three possible

outcomes which amounts to £3,244,800. Thus, if the information is correct then management should be willing to pay

up to £3,244,800 – £1,497,600 = £1,747,200 for the information. In practice, it is unlikely that perfect information

is obtainable. The management of Envico Ltd are really buying an information system that will provide them with a signal

which may prove to be correct or incorrect! For example, the consultants may predict that demand will be for 300

seminar places, however there still remains the fact that there is a likelihood of actual demand being for either 100,

200 or 400 seminar places. One should be mindful that imperfect information which may be, say only 75% reliable,

might still be worth obtaining. Other than when the value of imperfect and perfect information are equal to zero, the

value of perfect information will always be greater than the value of imperfect information.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-18

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-09

- 2020-10-18

- 2020-10-09

- 2020-10-18

- 2020-10-09

- 2019-01-04

- 2020-10-18

- 2020-10-09

- 2020-10-18

- 2020-10-09

- 2020-10-18

- 2020-10-09

- 2020-10-09

- 2019-01-04

- 2020-10-18

- 2020-10-09

- 2020-10-18

- 2020-10-09