黑龙江省2020年9月ACCA考试报名在什么时候结束?

发布时间:2020-07-04

黑龙江省2020年9月ACCA考试报名正在火热进行中,本次考试常规报名的截止日期是:7月27日。小伙伴们要注意安排好自己的考试计划。各位有志于考取ACCA证书的小伙伴们珍惜今年的每一次报名机会,认真备考,尽早拿下ACCA证书。现在就一起来看看具体内容吧。

以下是黑龙江省9月份ACCA考试报名的具体费用详情。

ACCA报名注册常见问题

1、考试报名。ACCA总部推荐学员使用双币信用卡在线考试报名。这样您将可以及时确认报名成功并且可

以享受提前考试报名时段的优惠价格。如果使用汇票方式交纳考试费用,您需等待收到总部的纸质考试报名表,填写完整的考试报名表及办理汇票后一起邮寄到英国

进行考试报名。使用汇票进行考试报名只能申请常规时段的考试报名。

2、准考证。考试报名成功后不能立刻下载准考证,考生一般在5月中旬和11月中旬收到总部邮寄的准考证,收到准考证后,请学员检查考试科目和地点是否与您的选择有出入,有问题请及时通知各代表处或联系英国总部。未收到准考证的学员也可以登陆www.accaglobal.com中的MYACCA下载并打印。下载和邮寄得到的准考证有同等效力。

3、提醒您注意:无论您在几月份注册ACCA或者是否参加ACCA考试,都将从注册后第二个自然年度的一月份开始缴纳年费,以保持学员身份、继续考试。例如,您在2011年12月注册成为ACCA学员,2012年1月1日您就需缴纳2012年的年费了。您如果没有在规定时间内及时付清所欠的任何费用(年费、免试费等)都将被除名。请您登录英文官网在MY ACCA中查看自己是否有任何欠费并及时支付。

4、如果注册后您的通讯地址、EMAIL地址及手机号码有任何变更,请您登录ACCA英文官方网站和中文官方网站MY ACCA,及时在线更新。特别提醒您,为了方便联系,电话一项请您尽量提供有效的手机号码。

今天分享的内容到此结束,各位小伙伴们记得在规定时间内完成报名,然后专心备考,如需了解更多ACCA考试相关的内容,记得关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

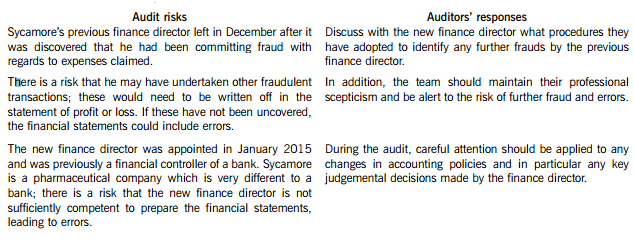

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

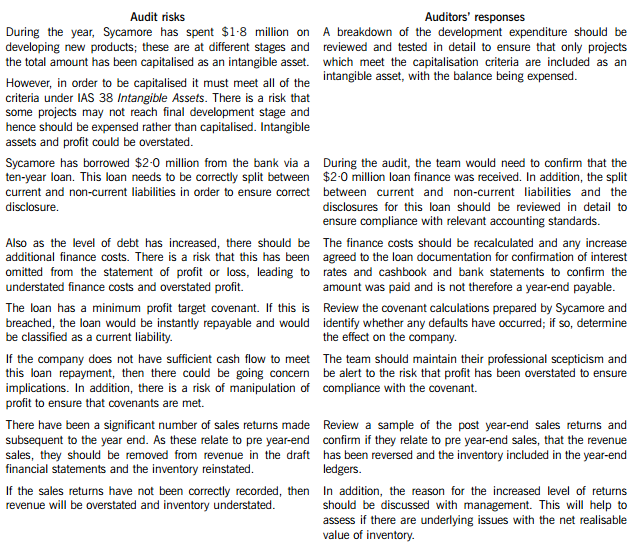

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

(c) In October 2004, Volcan commenced the development of a site in a valley of ‘outstanding natural beauty’ on

which to build a retail ‘megastore’ and warehouse in late 2005. Local government planning permission for the

development, which was received in April 2005, requires that three 100-year-old trees within the valley be

preserved and the surrounding valley be restored in 2006. Additions to property, plant and equipment during

the year include $4·4 million for the estimated cost of site restoration. This estimate includes a provision of

$0·4 million for the relocation of the 100-year-old trees.

In March 2005 the trees were chopped down to make way for a car park. A fine of $20,000 per tree was paid

to the local government in May 2005. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Volcan for the year ended

31 March 2005.

NOTE: The mark allocation is shown against each of the three issues.

(c) Site restoration

(i) Matters

■ The provision for site restoration represents nearly 2·5% of total assets and is therefore material if it is not

warranted.

■ The estimated cost of restoring the site is a cost directly attributable to the initial measurement of the tangible fixed

asset to the extent that it is recognised as a provision under IAS 37 ‘Provisions, Contingent Liabilities and

Contingent Assets’ (IAS 16 ‘Property, Plant and Equipment’).

■ A provision should not be recognised for site restoration unless it meets the definition of a liability, i.e:

– a present obligation;

– arising from past events;

– the settlement of which is expected to result in an outflow of resources embodying economic benefits.

■ The provision is overstated by nearly $0·34m since Volcan is not obliged to relocate the trees and de facto has

only an obligation of $60,000 as at 31 March 2005 (being the penalty for having felled them). When considered

in isolation, this overstatement is immaterial (representing only 0·2% of total assets and 3·6% of PBT).

■ It seems that even if there are local government regulations calling for site restoration there is no obligation unless

the penalties for non-compliance are prohibitive (unlike the fines for the trees).

■ It is unlikely that commencement of site development has given rise to a constructive obligation, since past actions

(disregarding the preservation of the trees) must dispel any expectation that Volcan will honour any pledge to

restore the valley.

■ Whether commencing development of the site, and destroying the trees, conflicts with any statement of socioenvironmental

responsibility in the annual report.

(ii) Audit evidence

■ A copy of the planning application and permission granted setting out the penalties for non-compliance.

■ Payment of $60,000 to local government in May 2005 agreed to the bank statement.

■ The present value calculation of the future cash expenditure making up the $4·0m provision.

Tutorial note: Evidence supporting the calculation of $0·4m is irrelevant as there is no liability to be provided for.

■ Agreement that the pre-tax discount rate used reflects current market assessments of the time value of money (as

for (a)).

■ Asset inspection at the site as at 31 March 2005.

■ Any contracts entered into which might confirm or dispute management’s intentions to restore the site. For

example, whether plant hire (bulldozers, etc) covers only the period over which the warehouse will be constructed

– or whether it extends to the period in which the valley would be ‘made good’.

(c) Discuss the ethical and social responsibilities of the Beth Group and whether a change in the ethical and

social attitudes of the management could improve business performance. (7 marks)

Note: requirement (c) includes 2 professional marks for development of the discussion of the ethical and social

responsibilities of the Beth Group.

(c) Corporate social responsibility (CSR) is concerned with business ethics and the company’s accountability to its stakeholders,

and about the way it meets its wider obligations. CSR emphasises the need for companies to adopt a coherent approach to

a range of stakeholders including investors, employees, suppliers, and customers. Beth has paid little regard to the promotion

of socially and ethically responsible policies. For example, the decision to not pay the SME creditors on the grounds that they

could not afford to sue the company is ethically unacceptable. Additionally, Beth pays little regard to local customs and

cultures in its business dealings.

The stagnation being suffered by Beth could perhaps be reversed if it adopted more environmentally friendly policies. The

corporate image is suffering because of its attitude to the environment. Environmentally friendly policies could be cost effective

if they help to increase market share and reduce the amount of litigation costs it has to suffer. The communication of these

policies would be through the environmental report, and it is critical that stakeholders feel that the company is being

transparent in its disclosures.

Evidence of corporate misbehaviour (Enron, World.com) has stimulated interest in the behaviour of companies. There has

been pressure for companies to show more awareness and concern, not only for the environment but for the rights and

interests of the people they do business with. Governments have made it clear that directors must consider the short-term

and long-term consequences of their actions, and take into account their relationships with employees and the impact of the

business on the community and the environment. The behaviour of Beth will have had an adverse effect on their corporate

image.

CSR requires the directors to address strategic issues about the aims, purposes, and operational methods of the organisation,

and some redefinition of the business model that assumes that profit motive and shareholder interests define the core purpose

of the company. The profits of Beth will suffer if employees are not valued and there is poor customer support.

Arrangements should be put in place to ensure that the business is conducted in a responsible manner. The board should

look at broad social and environmental issues affecting the company and set policy and targets, monitoring performance and

improvements.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-02-27

- 2021-01-13

- 2020-01-09

- 2020-08-14

- 2020-01-08

- 2019-12-29

- 2020-01-04

- 2020-01-10

- 2020-01-09

- 2021-01-13

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-01-10

- 2020-04-18

- 2020-01-10

- 2021-10-09

- 2020-03-26

- 2019-12-28

- 2021-01-13

- 2020-02-28

- 2020-02-22

- 2020-02-27

- 2020-01-09

- 2020-01-14

- 2020-01-10

- 2020-05-20

- 2021-04-17

- 2020-03-20

- 2021-01-13