快看!大二才开始报考ACCA会迟吗?

发布时间:2020-05-09

由于ACCA在国内称为"国际注册会计师",是当今知名的国际性会计师组织之一,并且也是许多小伙伴的奋斗目标,但是有一些小伙伴也对ACCA存在一些疑虑,觉得自己大二才报考ACCA会不会有点晚?不了解情况的人或许会觉得大二这不是刚开始奋斗的年纪吗?怎么会晚呢?这是因为ACCA从开始报考到取证通常需要2-3年的时间,很多小伙伴都会担心报考得晚了会影响自己两三年之后毕业或者考研的进程。

其实,大二报考ACCA不算迟,与之相反,大二正是一个报考ACCA的好时机。ACCA的报考条件中教育部认可的高等院校在校生,顺利完成了大一全年的所有课程考试,即可报名成为ACCA的正式学员。这意味着大一期间只能够进行课程的学习并不具备报考ACCA的条件,最早也要等到大二才可以报考,所以说大二是报考的最佳时机。因为大一的时候报不了,如果想报只能走FIA的通道,考过三门之后自动转为ACCA学员,大多数学员多数是大二才开始学习ACCA的。

那么什么时候才能考完ACCA?

以ACCA近年的考试通过率来看,如果在没有免考的情况下,从F1-P阶段完成考试的时间大致是2年-3年的时间。当然,如果有相应的免考机会,比如拥有CPA、MPAcc等证书的话就可以免除一部分科目的考试。这样的话就能大大缩短时间,还能快速通过考试。

现如今,也会有基础知识薄弱,甚至是其他非财会专业的学员报考ACCA,这样的小伙伴一般会更焦虑和不安,但是大家要知道,ACCA的课程的学习是一个循序渐进的过程,重要的是坚持与积累,所以说零基础学习也并不会比拥有一定财会专业知识的人需要更多的学习时间。所以在这里建议基础比较差的小伙伴们可以从大一就开始学习ACCA,如此一来,基本就可以在大学毕业之前完成ACCA全科考试。毕业后再积累一定工作经验的话,就可以马上拿到了ACCA证书了,为你之后的升值加薪或是跳槽提供重要的资本。

好了,今日此篇文章内容分享到这里就结束了,对于大二的考生是不是有想要报考ACCA呢?有想法的话就要赶紧行动起来吧,在这里希望各位考生可以学业有成,考试顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

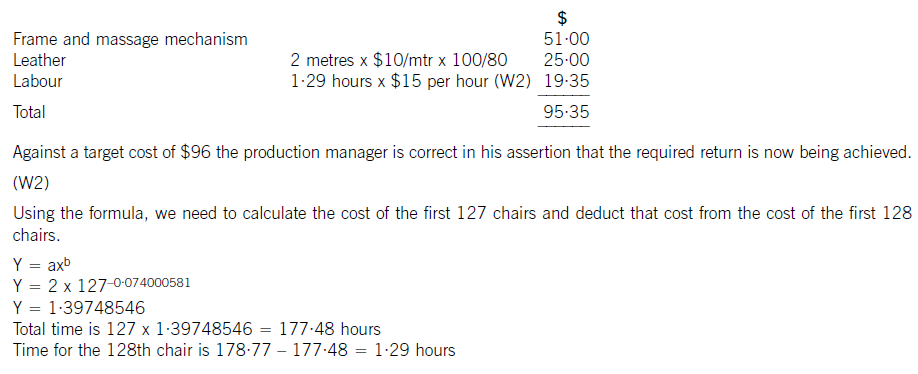

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

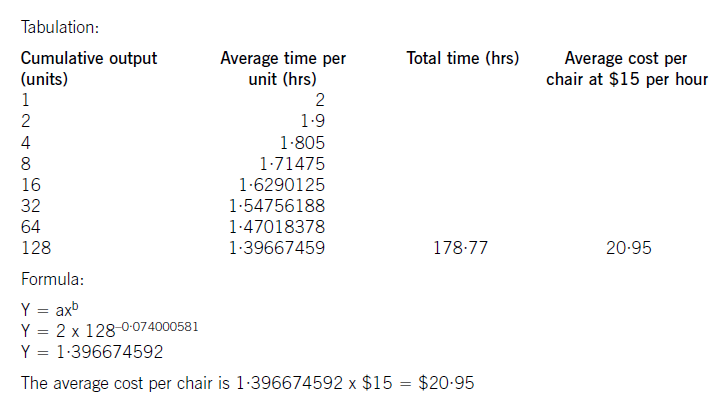

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

6 (a) Explain the term ‘money laundering’. (3 marks)

6 MONEY LAUNDERING

Tutorial note: The answer which follows is indicative of the range of points which might be made. Other relevant material will

be given suitable credit.

(a) Meaning of the term

■ Money laundering is the process by which criminals attempt to conceal the true origin and ownership of the proceeds

of their criminal activity (‘dirty’ money) allowing them to maintain control over the proceeds and, ultimately, providing a

legitimate cover for their sources of income.

■ The term is widely defined to include:

– possessing; or

– in any way dealing with; or

– concealing

the proceeds of any crime (‘criminal property’).

■ It also includes:

– an attempt or conspiracy or incitement to commit such an offence; or

– aiding, abetting, counselling or procuring the commission of such an offence.

■ Further, it includes failure by an individual in a regulated sector to inform. the financial intelligence unit (FIU), as soon

as practicable, of knowledge or suspicion that another person is engaged in money laundering.

Tutorial note: The FIU serves as a national centre for receiving (and, as permitted, requesting), analysing and

disseminating suspicious transaction reports (STRs).

(b) The directors of Carver Ltd are aware that some of the company’s shareholders want to realise the value in their

shares immediately. Accordingly, instead of investing in the office building or the share portfolio they are

considering two alternative strategies whereby, following the sale of the company’s business, a payment will be

made to the company’s shareholders.

(i) Liquidate the company. The payment by the liquidator would be £126 per share.

(ii) The payment of a dividend of £125 per share following which a liquidator will be appointed. The payment

by the liquidator to the shareholders would then be £1 per share.

The company originally issued 20,000 £1 ordinary shares at par value to 19 members of the Cutler family.

Following a number of gifts and inheritances there are now 41 shareholders, all of whom are family members.

The directors have asked you to attend a meeting to set out the tax implications of these two alternative strategies

for each of the two main groups of shareholders: adults with shareholdings of more than 500 shares and children

with shareholdings of 200 shares or less.

Required:

Prepare notes explaining:

– the amount chargeable to tax; and

– the rates of tax that will apply

in respect of each of the two strategies for each of the two groups of shareholders ready for your meeting

with the directors of Carver Ltd. You should assume that none of the shareholders will have any capital

losses either in the tax year 2007/08 or brought forward as at 5 April 2007. (10 marks)

Note:

You should assume that the rates and allowances for the tax year 2006/07 will continue to apply for the

foreseeable future.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-04-15

- 2020-01-09

- 2021-04-23

- 2020-03-01

- 2020-01-10

- 2019-12-27

- 2020-04-19

- 2020-03-20

- 2020-01-08

- 2020-04-18

- 2020-01-09

- 2020-03-26

- 2019-07-21

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-08-01

- 2020-01-10

- 2020-03-05

- 2020-02-10

- 2020-03-11

- 2020-04-19

- 2020-01-03

- 2020-01-09

- 2020-03-10

- 2020-01-10

- 2020-01-10

- 2020-01-09