速来查阅!有关2020年七月ACCA机考注意事项

发布时间:2020-04-23

2020年7月考季的ACCA考试马上就要来了,想要参加ACCA机考科目的同学们,除了要做好知识的复习之外,还要对ACCA机考中需要注意的事项做一个深入的了解。以下为ACCA机考考生需要注意的几大事项,一起跟随51题库考试学习网来看看吧。

*考生请尽量提前1小时到达考场,以保证充足的时间完成签到。到达后请听从监考的指示尽快前往考场进行签到,不要在候考区域逗留过久。

1.考生入场时请出示:

身份证件、准考证及计算器。(如考生携带个人物品,请将其放至指定区域。)

2.考试规则:

可接受的证件类型包括护照、驾照和身份证。学生证等非国家官方发布的证件不属于有效证件。

入场前请提前将手机及其他电子产品关闭,包括闹钟及任何提示音,并放在指定区域,请勿随身携带。如考试期间发现随身携带有手机及其他智能电子产品,将被视为违规行为。

食品及饮料不可带入(除去包装的透明瓶装水除外),如果考试中需要服食药物请提前告知监考。

任何书籍、笔记、或者其他与考试相关材料都需存放在指定区域,不可带入考试座位。

考试中可以使用不具备编程功能、无线通讯功能和文字存储功能的科学计算器,有其他额外功能的计算器不允许使用,监考人员有权暂时收走不符合要求的计算器。计算器请提前准备好,现场没有备用计算器提供,考试期间也不能互相借用。

入场后请根据监考指示,按照座位上的号码对号入座,并将身份证件和准考证放在桌角,以便监考进行二次核对。

每位考生桌上会备有草稿纸一张,考生入座后切勿触碰键盘鼠标等考试物品。请勿提前在草稿纸上作任何书写。

3.迟到及提早交卷规定:

在开考后1小时内(上午10:00前,下午15:00前,晚上19:30前)到达的迟到考生可以入场,但不能补偿考试时间。开考1小时以后到达的考生不能入场。

考试开始后不可以提前结束考试离场。

愉快的时光总是很短暂,以上就是今天51题库考试学习网为大家分享的全部内容,如有其他疑问请继续关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

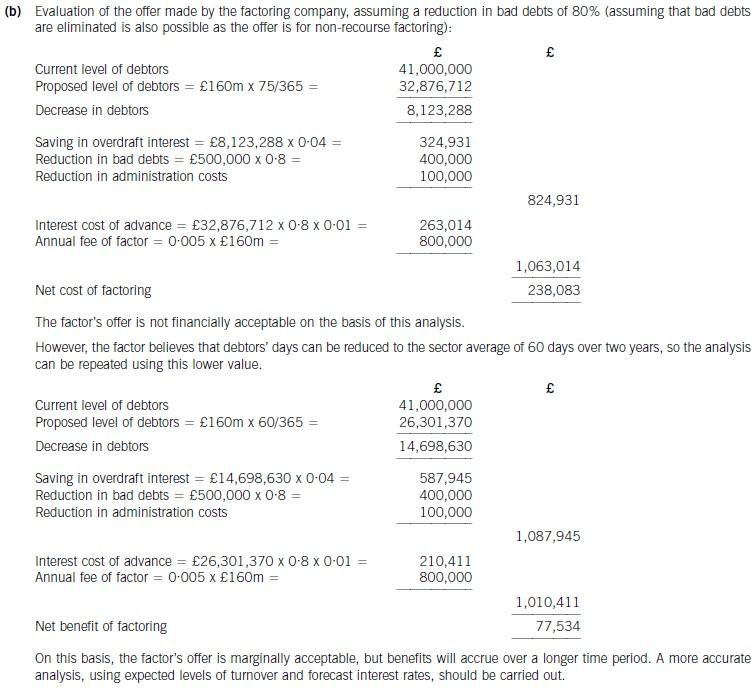

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

(ii) Analyse the effect of delaying the sale of the business of the Stiletto Partnership to Razor Ltd until

30 April 2007 on Clint’s income tax and national insurance position.

You are not required to prepare detailed calculations of his income tax or national insurance liabilities.

(4 marks)

(ii) The implications of delaying the sale of the business

The implications of delaying the sale of the business until 30 April would have been as follows:

– Clint would have received an additional two months of profits amounting to £6,920 (£20,760 x 1/3).

– Clint’s trading income in 2006/07 would have been reduced by £13,015 (£43,723 – £30,708), much of which

would have been subject to income tax at 40%. His additional trading income in 2007/08 of £19,935 would all

have been taxed at 10% and 22%.

– Clint is entitled to the personal age allowance of £7,280 in both years. However, it is abated by £1 for every £2

by which his total income exceeds £20,100. Once Clint’s total income exceeds £24,590 (£20,100 + ((£7,280

– £5,035) x 2)), his personal allowance will be reduced to the standard amount of £5,035. Accordingly, the

increased personal allowance would not be available in 2006/07 regardless of the year in which the business was

sold. It is available in 2007/08 (although part of it is wasted) but would not have been if the sale of the business

had been delayed.

– Clint’s class 4 national insurance contributions in 2006/07 would have been reduced due to the fall in the level

of his trading income. However, much of the saving would be at 1% only. Clint is not liable to class 4 national

insurance contributions in 2007/08 as he is 65 at the start of the year.

– Changing the date on which the business was sold would have had no effect on Clint’s class 2 liability as he is

not required to make class 2 contributions once he is 65 years old.

3 Seejoy is a famous football club but has significant cash flow problems. The directors and shareholders wish to take

steps to improve the club’s financial position. The following proposals had been drafted in an attempt to improve the

cash flow of the club. However, the directors need advice upon their implications.

(a) Sale and leaseback of football stadium (excluding the land element)

The football stadium is currently accounted for using the cost model in IAS16, ‘Property, Plant, and Equipment’.

The carrying value of the stadium will be $12 million at 31 December 2006. The stadium will have a remaining

life of 20 years at 31 December 2006, and the club uses straight line depreciation. It is proposed to sell the

stadium to a third party institution on 1 January 2007 and lease it back under a 20 year finance lease. The sale

price and fair value are $15 million which is the present value of the minimum lease payments. The agreement

transfers the title of the stadium back to the football club at the end of the lease at nil cost. The rental is

$1·2 million per annum in advance commencing on 1 January 2007. The directors do not wish to treat this

transaction as the raising of a secured loan. The implicit interest rate on the finance in the lease is 5·6%.

(9 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

(c) Calculate and explain the amount of income tax relief that Gerard will obtain in respect of the pension

contributions he proposes to make in the tax year 2007/08 and contrast this with how his position could be

improved by delaying some of the contributions that he could have made in 2007/08 until 2008/09. You

should include relevant supporting calculations and quantify the additional tax savings arising as a result of

your advice.

You should ignore the proposed changes to the bonus scheme for this part of this question and assume that

Gerard’s income will not change in 2008/09. (12 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-10

- 2020-04-23

- 2020-04-29

- 2019-10-13

- 2020-03-25

- 2020-01-10

- 2020-03-05

- 2020-01-10

- 2020-05-15

- 2020-03-18

- 2020-01-09

- 2019-07-21

- 2020-01-10

- 2020-01-09

- 2020-03-06

- 2020-01-09

- 2020-01-09

- 2020-01-10

- 2019-07-21

- 2020-04-14

- 2020-05-01

- 2020-04-29

- 2020-04-04

- 2020-01-10

- 2020-03-04

- 2020-02-28

- 2020-03-19

- 2020-02-20

- 2020-03-04