ACCA会员还需要进行继续教育吗?新规上线,请速来查看!

发布时间:2020-03-29

众所周知,ACCA和其他财会类证书一样,在通过全部考试,成为ACCA会员后还可以通过相关的继续教育来继续学习。那么,对于ACCA会员来讲,这个继续教育是否是必须的呢?官方是如何规定的?今天就跟随51题库考试学习网的脚步来一探究竟!

通过“继续教育”鼓励终身学习在您的职业生涯中,ACCA鼓励您通过ACCA“继续教育”不断学习,与时俱进。这有助于您提高知识技能水平,增强您的就业能力,为您的客户和雇主实现增值。

作为一名专业人士,积极进取并保持较高的职业水准是脱颖而出的关键。正因为如此,ACCA将参加CPD作为保持会员资格的条件之一。在您取得会员资格之后的第二年,ACCA会正式要求您自1月1日起遵守CPD的相关政策。不过,您可以通过开展新项目、担任新职位、培养新技能,随时参加各类继续教育活动。

详情请参阅:ACCA总部网站CPD介绍继续教育的相关资源与支持,除了可以在工作中不断发展新技能,您或许还希望通过在线学习、面授课程更进一步。

作为ACCA会员,您有机会以合理的价格获取ACCA的CPD资源。ACCA资源中心可按主题、商业领域、学习方式进行分类检索,帮助您迅速锁定最适合自己的课程。您还会收到官方定期推送的电子简报CPD Direct,其中介绍了丰富多彩的课程促销活动、关于完成继续教育的各类技巧等。

作为ACCA会员,您还可以免费使用大量资源。ACCA的继续教育合作伙伴也会为您提供大力支持,帮助您拓展知识面、满足您对继续教育的需求。继续教育申报ACCA会员需按要求在每年1月1日前,就上一个CPD年度提交一份继续教育申报。

同时,请务必认真记录您在近3年以内的学习进度,并保留相关证据以防ACCA抽查。提交继续教育申报手续简便,您可在完成本年度申报要求后,随时在线提交。更多CPD信息,详情请查阅:ACCA中国官网CPD指南。

参与方式:您可通过多种方式参加ACCA的活动,ACCA在线讲座来完成CPD。ACCA全年组织一系列在线讲座,广泛覆盖会员关注的各种话题,包括ACCA战略、理事会工作和重大的行业洞见等。

此外,也会邀请会员参与继续教育在线讲座,以及每年举办的全球“财会前沿”在线论坛等。

好的,今天51题库考试学习网分享了关于ACCA考试的相关问题,相信大家看完以上内容都会觉得豁然开朗了。想了解更多考试相关资讯的小伙伴们请及时关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) Critically discuss the statement (in note 12) of the managing director of GBC and suggest how the company

could calculate the value of the service provision to the population of the Western region. (6 marks)

(c) It would appear that in operating a bus service to the Western region of Geeland that GBC is fulfilling a social objective since

a contribution loss amounting to $38,400 ($230,400 – $268,800) was made as a consequence of operating the route to

the Western region during 2007. As an organisation which is partially funded by the government it is highly probable that

GBC has objectives which differ from those of TTC which is a profit-seeking organisation.

The value of a social service such as the provision of public transport can be quantified, albeit, in non-financial times. It is

possible to apply quantitative measures to the bus service itself, the most obvious ones being the number of passengers

carried and the number of passenger miles travelled.

The cost of the provision of alternative transport to the Western region might also enable a value to be placed on the current

service by GBC.

It might be possible to estimate quantitatively some of the social benefits resulting from the provision of the transport facility

to and from the Western region. For example, GBC could undertake a survey of the population of the Western region in order

to help estimate the extent to which rural depopulation would otherwise have occurred had the transport facility not been

made.

The application of the technique of cost-benefit analysis makes it possible to estimate money values for non-monetary

benefits. Social benefits can therefore be expressed in financial terms. It is highly probable that the fact that the Western region

is served by GBC will increase the attractiveness of living in a rural area, which may in turn precipitate an increase in property

values in the Western region and the financial benefit could be expressed in terms of the aggregate increase in property values

in the region as a whole.

(b) Explain the principal audit procedures to be performed during the final audit in respect of the estimated

warranty provision in the balance sheet of Island Co as at 30 November 2007. (5 marks)

(b) ISA 540 Audit of Accounting Estimates requires that auditors should obtain sufficient audit evidence as to whether an

accounting estimate, such as a warranty provision, is reasonable given the entity’s circumstances, and that disclosure is

appropriate. One, or a combination of the following approaches should be used:

Review and test the process used by management to develop the estimate

– Review contracts or orders for the terms of the warranty to gain an understanding of the obligation of Island Co

– Review correspondence with customers during the year to gain an understanding of claims already in progress at the

year end

– Perform. analytical procedures to compare the level of warranty provision year on year, and compare actual to budgeted

provisions. If possible disaggregate the data, for example, compare provision for specific types of machinery or customer

by customer

– Re-calculate the warranty provision

– Agree the percentage applied in the calculation to the stated accounting policy of Island Co

– Review board minutes for discussion of on-going warranty claims, and for approval of the amount provided

– Use management accounts to ascertain normal level of warranty rectification costs during the year

– Discuss with Kate Shannon the assumptions she used to determine the percentage used in her calculations

– Consider whether assumptions used are consistent with the auditors’ understanding of the business

– Compare prior year provision with actual expenditure on warranty claims in the accounting period

– Compare the current year provision with prior year and discuss any fluctuation with Kate Shannon.

Review subsequent events which confirm the estimate made

– Review any work carried out post year end on specific faults that have been provided for. Agree that all costs are included

in the year end provision.

– Agree cash expended on rectification work in the post balance sheet period to the cash book

– Agree cash expended on rectification work post year end to suppliers’ invoices, or to internal cost ledgers if work carried

out by employees of Island Co

– Read customer correspondence received post year end for any claims received since the year end.

2 Graeme, aged 57, is married to Catherine, aged 58. They work as medical consultants, and both are higher rate

taxpayers. Barry, their son, is aged 32. Graeme, Catherine and Barry are all UK resident, ordinarily resident and

domiciled. Graeme has come to you for some tax advice.

Graeme has invested in shares for some time, in particular shares in Thistle Dubh Limited. He informs you of the

following transactions in Thistle Dubh Limited shares:

(i) In December 1986, on the death of his grandmother, he inherited 10,000 £1 ordinary shares in Thistle Dubh

Limited, an unquoted UK trading company providing food supplies for sporting events. The probate value of the

shares was 360p per share.

(ii) In March 1992, he took up a rights issue, buying one share for every two held. The price paid for the rights

shares was £10 per share.

(iii) In October 1999, the company underwent a reorganisation, and the ordinary shares were split into two new

classes of ordinary share – ‘T’ shares and ‘D’ shares, each with differing rights. Graeme received two ‘T’ and three

‘D’ shares for each original Thistle Dubh Limited share held. The market values for the ‘T’ shares and the ‘D’

shares on the date of reorganisation were 135p and 405p per share respectively.

(iv) On 1 May 2005, Graeme sold 12,000 ‘T’ shares. The market values for the ‘T’ shares and the ‘D’ shares on that

day were 300p and 600p per share respectively.

(v) In October 2005, Graeme sold all of his ‘D’ shares for £85,000.

(vi) The current market value of ‘T’ shares is 384p per share. The shares remain unquoted.

Graeme and Catherine have owned a holiday cottage in a remote part of the UK for many years. In recent years, they

have used the property infrequently, as they have taken their holidays abroad and the cottage has been let out as

furnished holiday accommodation.

Graeme and Catherine are now considering selling the UK country cottage and purchasing a holiday villa abroad.

Initially they plan to let this villa out on a furnished basis, but following their anticipated retirement, would expect to

occupy the property for a significant part of the year themselves, possibly moving to live in the villa permanently.

Required:

(a) Calculate the total chargeable gains arising on Graeme’s disposals of ‘T’ and ‘D’ ordinary shares in May and

October 2005 respectively. (7 marks)

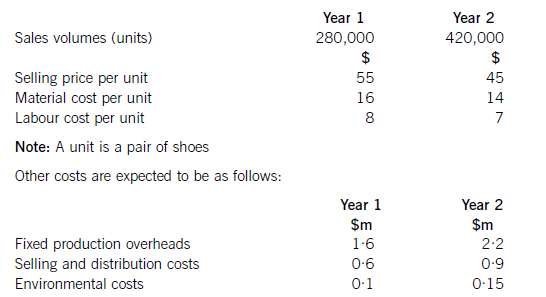

Shoe Co, a shoe manufacturer, has developed a new product called the ‘Smart Shoe’ for children, which has a built-in tracking device. The shoes are expected to have a life cycle of two years, at which point Shoe Co hopes to introduce a new type of Smart Shoe with even more advanced technology. Shoe Co plans to use life cycle costing to work out the total production cost of the Smart Shoe and the total estimated profit for the two-year period.

Shoe Co has spent $5·6m developing the Smart Shoe. The time spent on this development meant that the company missed out on the opportunity of earning an estimated $800,000 contribution from the sale of another product.

The company has applied for and been granted a ten-year patent for the technology, although it must be renewed each year at a cost of $200,000. The costs of the patent application were $500,000, which included $20,000 for the salary costs of Shoe Co’s lawyer, who is a permanent employee of the company and was responsible for preparing the application.

The following information is also available for the next two years:

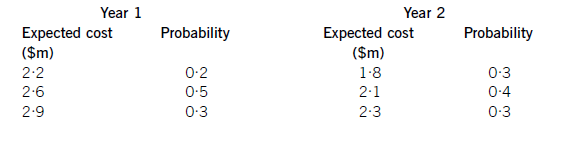

Shoe Co is still negotiating with marketing companies with regard to its advertising campaign, so is uncertain as to what the total marketing costs will be each year. However, the following information is available as regards the probabilities of the range of costs which are likely to be incurred:

Required:

Applying the principles of life cycle costing, calculate the total expected profit for Shoe Co for the two-year period.

(10 marks)

Totalsalesrevenue=(280,000x$55)+(420,000x$45)=$15·4m+18·9m=$34·3m.NoteTheexpectedprofithasbeencalculatedusinglifecyclecostingnotrelevantcosting.Hence,the$20,000salarycostincludedinpatentcostsshouldbeincludedinthelifecyclecost.Similarly,theopportunitycostof$800,000isnotincludedusinglifecyclecostingwhereasifrelevantcostingwasbeingusedtodecideonaparticularcourseofaction,theopportunitycostwouldbeincluded.Working1Expectedmarketingcostinyear1:(0·2x$2·2m)+(0·5x$2·6m)+(0·3x$2·9m)=$2·61mExpectedmarketingcostyear2:(0·3x$1·8m)+(0·4x$2·1m)+(0·3x$2·3m)=$2·07mTotalexpectedmarketingcost=$4·68m

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-02-04

- 2020-01-09

- 2020-05-09

- 2020-04-05

- 2020-04-22

- 2020-01-11

- 2020-05-17

- 2020-01-09

- 2020-04-20

- 2020-05-20

- 2020-04-08

- 2020-04-01

- 2019-07-19

- 2020-03-12

- 2020-02-12

- 2020-01-09

- 2020-05-20

- 2020-01-09

- 2020-05-06

- 2020-05-09

- 2020-01-09

- 2020-03-21

- 2020-04-21

- 2020-03-02

- 2019-07-19

- 2020-02-06

- 2020-01-09

- 2020-05-20

- 2020-01-31