有考友知道ACCA考试科目有哪些吗?

发布时间:2021-06-11

有考友知道ACCA考试科目有哪些吗?

最佳答案

ACCA考试科目一共有14门课程,分3个部分,每年完成一个阶段。具体科目如下:

第一部分主要涉及基本会计原理,财会信息作用和管理领域的主要问题等,即《财务报表编制》、《财务信息与管理》、《人力资源管理》。

第二部分涵盖专业财会人员应具备的核心专业技能,介绍商务运作的法律环境,并强化财会方面关键技能,即《信息系统》、《公司法与法》、《企业税务》、《财务管理与控制》、《财务报告》、《审计与内部控制》。

第三部分着重于企业战略管理中财务人员作用,培养学员以专业知识对信息进行评估,并在专业伦理框架内提出合理的经营建议。具体为《审计与认证业务》、《高级税务》、《业绩管理》、《企业信息管理》等4门中选择2门;以及核心课程《战略经营计划与开发》、《高级公司报告》、《战略财务管理》等3门。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(iii) How items not dealt with by an IFRS for SMEs should be treated. (5 marks)

(iii) The treatment of items not dealt with by an IFRS for SMEs

IFRSs for SMEs would not necessarily deal with all the recognition and measurement issues facing an entity but the key

issues should revolve around the nature of the recognition, measurement and disclosure of the transactions of SMEs. In

the case where the item is not dealt with by the standards there are three alternatives:

(a) the entity can look to the full IFRS to resolve the issue

(b) management’s judgement can be used with reference to the Framework and consistency with other IFRSs for SMEs

(c) existing practice could be used.

The first approach is more likely to result in greater consistency and comparability. However, this approach may also

increase the burden on SMEs as it can be argued that they are subject to two sets of standards.

An SME may wish to make a disclosure required by a full IFRS which is not required by the SME standard, or a

measurement principle is simplified or exempted in the SME standard, or the IFRS may give a choice between two

measurement options and the SME standard does not allow choice. Thus the issue arises as to whether SMEs should

be able to choose to comply with a full IFRS for some items and SME standards for other items, allowing an SME to

revert to IFRS on a principle by principle basis. The problem which will arise will be a lack of consistency and

comparability of SME financial statements.

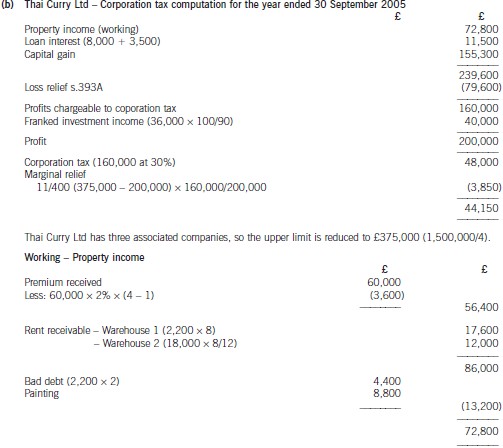

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

(b) Donald actually decided to operate as a sole trader. The first year’s results of his business were not as he had

hoped, and he made a trading loss of £8,000 in the year to 31 March 2007. However, trading is now improving,

and Donald has sufficient orders to ensure that the business will make profits of at least £30,000 in the year to

31 March 2008.

In order to raise funds to support his business over the last 15 months, Donald has sold a painting which was

given to him on the death of his grandmother in January 1998. The probate value of the painting was £3,200,

and Donald sold it for £8,084 (after deduction of 6% commission costs) in November 2006.

He also sold other assets in the year of assessment 2006/07, realising further chargeable gains of £8,775 (after

indexation of £249 and taper relief of £975).

Required:

(i) Calculate the chargeable gain on the disposal of the painting in November 2006. (4 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-03-11

- 2021-01-04

- 2021-04-15

- 2021-05-06

- 2021-12-27

- 2021-05-11

- 2021-03-10

- 2021-01-01

- 2021-02-16

- 2021-12-31

- 2021-04-16

- 2021-03-11

- 2021-04-16

- 2021-03-11

- 2021-03-12

- 2021-06-15

- 2021-11-13

- 2021-03-12

- 2021-03-11

- 2021-03-12

- 2021-04-15

- 2021-06-05

- 2021-03-10

- 2021-03-10

- 2021-03-11

- 2021-03-13

- 2021-05-24

- 2021-03-12

- 2021-03-11

- 2021-03-10