ACCA考试 2021_10_23 每日一练

5 (a) IFAC’s ‘Code of Ethics for Professional Accountants’ is divided into three parts:

Part A – Applicable to All Professional Accountants

Part B – Applicable to Professional Accountants in Public Practice

Part C – Applicable to Employed Professional Accountants

Required:

Distinguish between ‘Professional Accountants’, ‘Professional Accountants in Public Practice’ and ‘Employed

Professional Accountants’. (3 marks)

(c) In October 2004, Volcan commenced the development of a site in a valley of ‘outstanding natural beauty’ on

which to build a retail ‘megastore’ and warehouse in late 2005. Local government planning permission for the

development, which was received in April 2005, requires that three 100-year-old trees within the valley be

preserved and the surrounding valley be restored in 2006. Additions to property, plant and equipment during

the year include $4·4 million for the estimated cost of site restoration. This estimate includes a provision of

$0·4 million for the relocation of the 100-year-old trees.

In March 2005 the trees were chopped down to make way for a car park. A fine of $20,000 per tree was paid

to the local government in May 2005. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Volcan for the year ended

31 March 2005.

NOTE: The mark allocation is shown against each of the three issues.

(ii) Explain, with reasons, the relief available in respect of the fall in value of the shares in All Over plc,

identify the years in which it can be claimed and state the time limit for submitting the claim.

(3 marks)

(ii) On 1 July 2006 Petrie introduced a 10-year warranty on all sales of its entire range of stainless steel

cookware. Sales of stainless steel cookware for the year ended 31 March 2007 totalled $18·2 million. The

notes to the financial statements disclose the following:

‘Since 1 July 2006, the company’s stainless steel cookware is guaranteed to be free from defects in

materials and workmanship under normal household use within a 10-year guarantee period. No provision

has been recognised as the amount of the obligation cannot be measured with sufficient reliability.’

(4 marks)

Your auditor’s report on the financial statements for the year ended 31 March 2006 was unmodified.

Required:

Identify and comment on the implications of these two matters for your auditor’s report on the financial

statements of Petrie Co for the year ended 31 March 2007.

NOTE: The mark allocation is shown against each of the matters above.

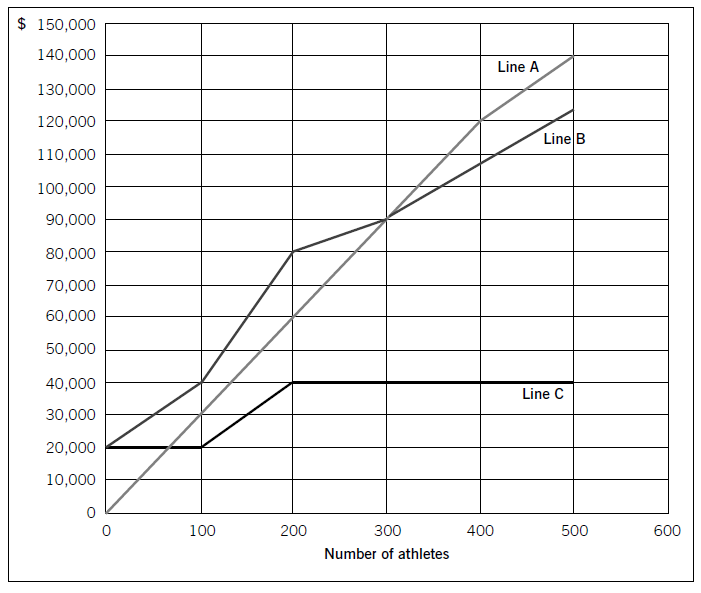

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

3 Joe Lawson is founder and Managing Director of Lawson Engineering, a medium sized, privately owned family

business specialising in the design and manufacture of precision engineering products. Its customers are major

industrial customers in the aerospace, automotive and chemical industries, many of which are globally recognised

companies. Lawson prides itself on the long-term relationships it has built up with these high profile customers. The

strength of these relationships is built on Lawson’s worldwide reputation for engineering excellence, which has

tangible recognition in its gaining prestigious international awards for product and process innovation and quality

performance. Lawson Engineering is a company name well known in its chosen international markets. Its reputation

has been enhanced by the awarding of a significant number of worldwide patents for the highly innovative products

it has designed. This in turn reflects the commitment to recruiting highly skilled engineers, facilitating positive staff

development and investing in significant research and development.

Its products command premium prices and are key to the superior performance of its customers’ products. Lawson

Engineering has also established long-term relationships with its main suppliers, particularly those making the exotic

materials built into their advanced products. Such relationships are crucial in research and development projects,

some of which take a number of years to come to fruition. Joe Lawson epitomises the ‘can do’ philosophy of the

company, always willing to take on the complex engineering challenges presented by his demanding customers.

Lawson Engineering now faces problems caused by its own success. Its current location, premises and facilities are

inadequate to allow the continued growth of the company. Joe is faced with the need to fund a new, expensive,

purpose-built facility on a new industrial estate. Although successful against a number of performance criteria, Lawson

Engineering’s performance against traditional financial measures has been relatively modest and unlikely to impress

the financial backers Joe wants to provide the necessary long-term capital.

Joe has become aware of the increasing attention paid to the intangible resources of a firm in a business. He

understands that you, as a strategy consultant, can advise him on the best way to show that his business should be

judged on the complete range of assets it possesses.

Required:

(a) Using models where appropriate, provide Joe with a resource analysis showing why the company’s intangible

resources and related capabilities should be taken into account when assessing Lawson Engineering’s case

for financial support. (12 marks)