ACCAF1考试-会计师与企业(基础阶段)章节练习(2020-10-09)

发布时间:2020-10-09

各位参加2020年ACCA考试的小伙伴们注意啦!今天51题库考试学习网给各位小伙伴分享ACCAF1考试-会计师与企业(基础阶段)章节练习题(2),感兴趣的小伙伴赶快来围观哦!

1. Which of the following is likely to lead

to a fall in the price of good Q which is a normal good?

A A rise in the price of good P, a

substitute for good Q

B A fall in the level of household incomes

generally

C A fall in the price of good T, a

complement to good Q

D A belief that the price of good Q is

likely to double in the next 3 months

答案:B

2. According to the theory of the firm,

which of the following statements describes an oligopoly?

A There are no barriers to entry into or

exit from the market

B There is only one producer in the market

C There are four producers exerting

considerable influence in the market

D There are many producers but they each

use product differentiation to distinguish themselves from each other

答案:C

3 Which of the following is not a substitute

for carpets?

A Ceramic floor tiles

B Wooden floorboard

C Carpet underlay

答案:C

4. Which of the following is not a

complement to cars?

A Petrol

B Tyres

C Holidays

答案:C

5. The demand for fashion goods is not

influenced by:

A Price

B Allocative inefficiency among producers

C The distribution of income among

households

D Expectation of future price changes

答案:B

6. If the price of coffee falls, which one

of the following outcomes would be expected to occur?

A A fall in the quantity of coffee demanded

B A rise in the price of tea

C A fall in the demand for drinking cups

D A fall in the demand for tea

答案:D

今天的试题分享到此结束,预祝各位小伙伴顺利通过接下来的ACCA考试,如需查看更多ACCA考试试题,记得关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

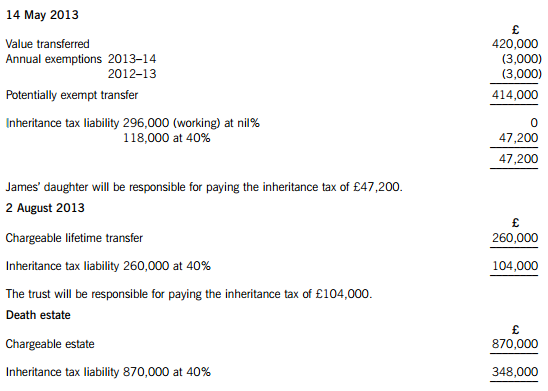

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

4 Chris Jones is Managing Director of Supaserve, a medium-sized supermarket chain faced with intense competition

from larger competitors in their core food and drink markets. They are also finding it hard to respond to these

competitors moving into the sale of clothing and household goods. Supaserve has a reputation for friendly customer

care and is looking at the feasibility of introducing an online shopping service, from which customers can order goods

from the comfort of their home and have them delivered, for a small charge, to their home.

Chris recognises that the move to develop an online shopping service will require significant investment in new

technology and support systems. He hopes a significant proportion of existing and most importantly, new customers,

will be attracted to the new service.

Required:

(a) What bases for segmenting this new market would you recommend and what criteria will help determine

whether this segment is sufficiently attractive to commit to the necessary investment? (10 marks)

(a) E-commerce is transforming many of the traditional relationshps between supplier and customer and retailing is no exception.

In broad terms, electronic commerce is defined as ‘the use of electronic networks to facilitate commercial transactions’. In

terms of tangible goods, such as supermarket shopping, it enables online ordering and delivery direct to the customer and

represents a significant move away from the well-established retail formats. Benefits to companies using electronic commerce

have seen companies increase their sales by 10–20% and reduce costs by 20–45%. However, in a significant sized business

like Supaserve the investment costs are high, affecting profit margins and making for more intense competition.

Business-to-consumer electronic commerce is argued to face more barriers to growth than its business-to-business equivalent

and is at an earlier stage in its lifecycle. Issues surrounding the potential for fraud, security of payments, privacy of personal

data and difficulties in accessing electronic retailers, explain this slower start for the retailing side of electronic commerce.

Clearly, for the move to be successful in Supaserve there needs to be a sufficiently large number of customers who can be

persuaded to use the service. This, in turn, will reflect the number of homes with computers and online capabilities. However,

the traditional retailer with a trusted brand and reputation is often in a better position than the specialist online retailer with

no physical stores.

Assessing the size and defining characteristics or attributes of the customer segment likely to use the online shopping service

is an interesting task. There is evidence to suggest that age may be a key factor, with electronic retailing appealing to younger

customers familiar with using information technology. Income may be an important way of segmenting the market, with online

shopping appealing to those families with high disposable income, access to computers and a lifestyle. where leisure time

is valued. Chris’s knowledge of his current customer base will be important in positioning them at various stages of their

lifecycle – does the company appeal to young families with heavy shopping demands? Further insight into buying behaviour

will come from geodemographic segmentation where the combination of where a customer lives and the stage in their

particular shopping lifecycle will give real insights into their buying behaviour and willingness or otherwise to use electronic

shopping.

Essentially, Chris has to come to a decision on whether there is a combination of characteristics that form. a significant

segment willing to use online shopping. This will enable him to decide how it can be measured, whether it is big enough to

make the investment in online shopping worthwhile, can it be accessed and whether it is sufficiently distinct to cater for itsparticular needs.

(c) Pinzon, a limited liability company and audit client, is threatening to sue your firm in respect of audit fees charged

for the year ended 31 December 2004. Pinzon is alleging that Bartolome billed the full rate on air fares for audit

staff when substantial discounts had been obtained by Bartolome. (4 marks)

Required:

Comment on the ethical and other professional issues raised by each of the above matters and their implications,

if any, for the continuation of each assignment.

NOTE: The mark allocation is shown against each of the three issues.

(c) Threatened legal action

Ethical and professional issues

■ An advocacy threat has arisen as Bartolome and Pinzon are in opposition concerning the fee note for the 2004 audit.

■ If Pinzon’s allegations are true this may cast serious doubt on the integrity of Bartolome. Pinzon should be advised to

take their claims first to ACCA’s Disciplinary Committee.

■ If Bartolome has indeed charged full air fares when substantial discounts had been obtained this could be due to:

– Bartolome incorrectly believing this to be an acceptable industry practice; or

– a billing error/oversight.

In either case Bartolome should issue a credit note, although this may be insufficient to make amends and salvage the

auditor-client relationship.

■ Bartolome may have legitimately claimed for full airfares if this was agreed in its contract (i.e. the terms of engagement)

with Pinzon.

Implications for continuation with assignment

Unless the threat of legal action is amicably resolved very quickly (which is perhaps unlikely) Pinzon and Bartolome are in

conflict. Bartolome cannot therefore be seen to be independent and so should tender their resignation as auditor for the year

ending 31 December 2005 (assuming they were re-appointed and have not already been removed from office).

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-10

- 2020-10-10

- 2020-08-15

- 2020-10-10

- 2020-10-10

- 2020-08-15

- 2020-10-10

- 2020-08-15

- 2020-08-15

- 2020-10-09

- 2020-10-10

- 2020-08-15

- 2020-10-09

- 2020-10-10

- 2020-08-15

- 2020-10-09

- 2020-10-10

- 2020-10-10

- 2020-10-10

- 2020-10-10

- 2020-08-15

- 2020-10-10

- 2020-08-15

- 2020-10-10

- 2020-10-10

- 2020-10-09

- 2020-10-10

- 2020-10-10

- 2020-08-15

- 2020-10-10