分享丨ACCA机考没有经验?没关系,这些干货可以帮助你

发布时间:2019-12-29

2020年已经到来,第一次ACCAer们对考试机考已经了解了多少了呢?一点也不了解也不用担心,51题库考试学习网帮助大家收集到了一些关于机考的注意事项,希望对备考的你有多帮助,现在且随51题库考试学习网,告诉你怎有哪些注意事项吧:

(一)ACCA机考必须带那些东西~

准考证及带有照片的官方有效身份证件、准考证及计算器。(如考生携带个人物品,请将其放至指定区域。)

(二)详细考场规则说明:

考生在到达考场并进行签到后,如因特殊原因需要离场,请主动联系监考人员,不得擅自离开。

可接受的证件类型包括有效期内的护照、驾照和身份证。过期证件、学生证等非国家官方发布的证件不属于有效证件。

(三)请勿携带贵重物品前往考场。

入场前请提前将手机及其他电子产品关闭,包括闹钟及任何提示音,并放在指定区域,请勿随身携带。如考试期间发现随身携带有手机及其他智能电子产品,将被视为违规行为。

食品及饮料不可带入(除去包装的透明瓶装水除外),如果考试中需要服食药物请提前告知监考。

任何书籍、笔记、或者其他与考试相关材料都需存放在指定区域,不可带入考试座位。如在考试期间发现随身携带任何此类相关材料,将被视为违规行为。

考试中可以使用不具备编程功能、无线通讯功能和文字存储功能的科学计算器,有其他额外功能的计算器不允许使用,监考人员有权暂时收走不符合要求的计算器。计算器请提前准备好,现场没有备用计算器提供,考试期间也不能互相借用。

入场后请根据监考指示,按照座位上的号码对号入座,并将身份证件和准考证放在桌角,以便监考进行二次核对。

考生入座后切勿随意触碰键盘鼠标等考试物品,以免影响考试正常开始。

考试开始之后,监考会给每位考生发放一张草稿纸,考试结束后会收回。如果考试期间需要更多的草稿纸,请举手向监考申请。请勿在草稿纸以外的区域书写,比如在准考证或者其他纸张上打草稿等。

(四)迟到及提早交卷规定:

在开考后1小时内(上午10:00前,下午15:00前,晚上19:30前)到达的迟到考生可以入场,但不能补偿考试时间。开考1小时以后到达的考生不能入场。

考试开始后不可以提前结束考试离场。

好啦,这些就是目前51题库考试学习网小编给你们整理的ACCA机考考试需要注意的地方,还有什么疑问欢迎大家加入关注51题库考试学习网,最后祝大家取得好成绩~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

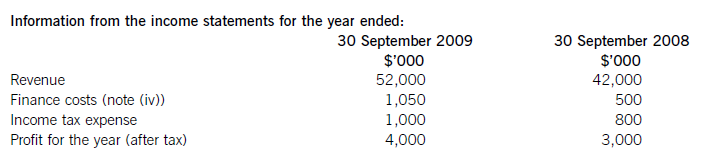

(a) The following information relates to Crosswire a publicly listed company.

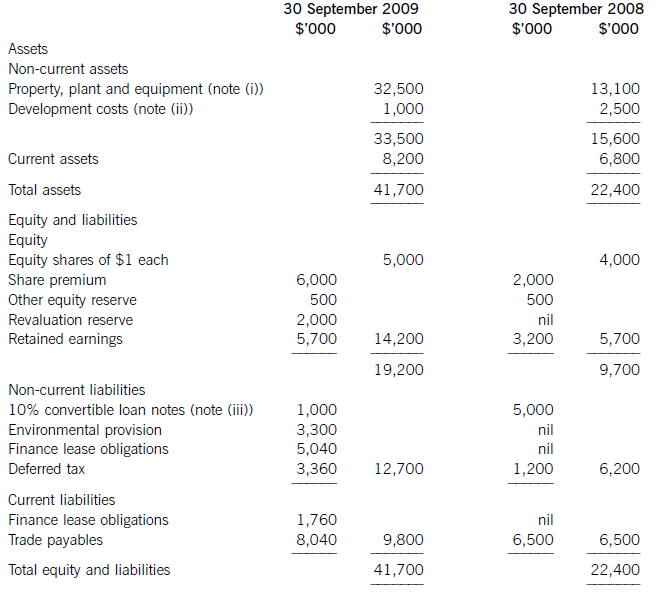

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

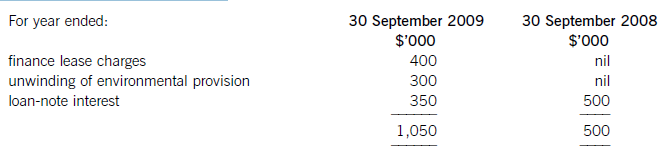

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced.

1 Oliver Hoppe has been working at Hoopers and Henderson accountancy practice for eighteen months. He feels that

he fits in well, especially with his colleagues and has learnt a lot from them. However, he feels that the rules and

regulations governing everyday activities and time keeping are not clear.

Oliver does not get on well with his line manager, David Morgan. There appears to be a clash of personalities and

reluctance on David Morgan’s part to deal with the icy atmosphere between them after David was asked by one of

the accounting partners to give Oliver a job. For the past three months Oliver has gone to lunch with his fellow workers

and always returned to work with them or before them. In fact they all have returned to work about ten minutes late

on several previous occasions. After the third time, Oliver was called into David Morgan’s office and given an oral

warning about his time keeping.

Oliver was not permitted to argue his case and none of the other staff who returned late were disciplined in this way.

On the next occasion the group was late returning from lunch, David Morgan presented Oliver with a written warning

about his time keeping.

Yesterday, Oliver was five minutes late returning to work. His colleagues returned after him. David Morgan gave Oliver

notice and told him to work until the end of the week and then collect his salary, the necessary paperwork and to

leave the practice.

There is a partner responsible for human resources. Oliver has come to see the partner to discuss the grievance

procedures against David Morgan for his treatment and about what Oliver regards as unfair dismissal.

Required:

(a) Describe the six stages of a formal disciplinary procedure that an organisation such as Hoopers and

Henderson should have in place. (12 marks)

1 Overview

A grievance occurs when an individual thinks that he or she has been wrongly treated by colleagues or management, especially

in disciplinary matters. An unresolved feeling of grievance can often lead to further problems for the organisation. The purpose of

procedures is to resolve disciplinary and grievance issues to the satisfaction of all concerned and as early as possible.

If a grievance perceived by an employee is not resolved, then conflict and discontent can arise that will affect the work of the

individual and the organisation. Accountants as managers need to be aware of the need to resolve grievances satisfactorily and

professionally.

The fundamental basis of organisational disciplinary and grievance procedures is that they must be explicitly clear and accessible

to all.

Part (a):

An official and correctly applied disciplinary procedure has six steps which should be followed in the correct order and applied

equitably.

The Informal Talk.

This is the first step. If the disciplinary matter is of a minor nature and the individual has had until this occasion a good record,

then an informal meeting can often resolve the issue.

Reprimand or Oral Warning.

Here the manager draws the attention of the employee to unsatisfactory behaviour, a repeat of which could lead to formal

disciplinary proceedings.

Official or Written Warning.

A written warning is a serious matter. It draws the attention of the offending employee to a serious breach of conduct and remains

a recorded document on the employee’s employment history.

Such written documents can be used as evidence if further action is taken, especially dismissal.

Suspension or Lay-off.

If an offence is of a serious nature, if the employee has repeated an earlier offence or if there have been repeated problems then

an employee may be suspended from work for a period of time without pay.

Demotion.

This is a situation where an employee is demoted to a lower salary or position within an organisation. This is a very serious step

to take and can be regarded as a form. of internal dismissal. This course of action can have negative repercussions because the

employee concerned will feel dissatisfied and such feelings can affect their own work and that of others.

Dismissal.

This is the ultimate disciplinary measure and should be used only in the most extreme cases. As with demotion, the dismissal of

a staff member can lead to wider dissatisfaction amongst the employees.

The employee may nominate a representative at any stage of the procedure, especially at the more serious stages.

5 The directors of Quapaw, a limited liability company, are reviewing the company’s draft financial statements for the

year ended 31 December 2004.

The following material matters are under discussion:

(a) During the year the company has begun selling a product with a one-year warranty under which manufacturing

defects are remedied without charge. Some claims have already arisen under the warranty. (2 marks)

Required:

Advise the directors on the correct treatment of these matters, stating the relevant accounting standard which

justifies your answer in each case.

NOTE: The mark allocation is shown against each of the three matters

(a) The correct treatment is to provide for the best estimate of the costs likely to be incurred under the warranty, as required by

IAS37 Provisions, contingent liabilities and contingent assets.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-05-29

- 2020-10-21

- 2021-02-13

- 2020-10-10

- 2021-05-29

- 2021-05-29

- 2021-02-21

- 2020-10-18

- 2020-08-15

- 2021-05-29

- 2020-10-10

- 2021-02-13

- 2020-10-18

- 2020-10-21

- 2020-10-10

- 2019-03-24

- 2020-10-21

- 2021-02-13

- 2020-10-10

- 2021-05-29

- 2020-09-05

- 2020-10-10

- 2021-02-13

- 2019-06-22

- 2020-08-15

- 2020-01-02

- 2021-05-29

- 2020-09-05

- 2021-02-13

- 2019-12-29