2020年ACCA考试会计师与企业财经词汇汇编(9)

发布时间:2020-10-10

各位小伙伴注意了,备考已经进入了关键期,现在状态如何啊,今天51题库考试学习网为大家分享2020年ACCA考试会计师与企业财经词汇汇编(9),一起来看看吧。

ACCA财经词汇汇编:Market

Value

【English Terms】

Market Value

【中文翻译】

市场价值

【详情解释/例子】

1.投资者在特定时间买入或卖出普通股或债券的当时报价。

2.某些情况指市场总价值,即总市值加债务的市场价值。

ACCA财经词汇汇编:Market

Sentiment

【English Terms】

Market Sentiment

【中文翻译】

市场情绪

【详情解释/例子】

市场的气氛与基调。主要体现在证券的买卖活动及价格上。

ACCA财经词汇汇编:Mean

【English Terms】

Mean

【中文翻译】

平均值

【详情解释/例子】

两个或以上数字的简单数学平均。

ACCA财经词汇汇编:Maturity

Date

【English Terms】

Maturity Date

【中文翻译】

到期日期

【详情解释/例子】

借贷方向投资者偿付债券本金或其他债务的日期,也是停止支付利息的日子。

ACCA财经词汇汇编:Maturity

【English Terms】

Maturity

【中文翻译】

期限

【详情解释/例子】

1.债券必须偿还本金前的时期。

2.证券有效期届满。

ACCA财经词汇汇编:Marketable

Securities

【English Terms】

Marketable Securities

【中文翻译】

有价证券

【详情解释/例子】

流通性非常高,可迅速以合理价格转换成为现金的证券。

ACCA财经词汇汇编:Marketable

Securities

【English Terms】

Marketable Securities

【中文翻译】

有价证券

【详情解释/例子】

流通性非常高,可迅速以合理价格转换成为现金的证券。

ACCA财经词汇汇编:Mega Cap

【English Terms】

Mega Cap

【中文翻译】

超高市值股票

【详情解释/例子】

总市值超过 2000 亿美元的公司。

ACCA财经词汇汇编:Medium Term

Note(MTN)

【English Terms】

Medium Term Note(MTN)

【中文翻译】

中期票据

【详情解释/例子】

一般指年期 5-10 年的票据。

ACCA财经词汇汇编:Medium Term

【English Terms】

Medium Term

【中文翻译】

中期

【详情解释/例子】

在中等年期内持有资产。

ACCA财经词汇汇编:Mechanical

Investing

【English Terms】

Mechanical Investing

【中文翻译】

机械化投资

【详情解释/例子】

根据预定机械性投资选择标准买卖股票。这个选择标准利用重点相对实力或势头(有时也采用其他指标),评定多种股票的优先秩序,然后投资者投资于这类投资选择制度中排名最高的5-10 种股票。

以上就是51题库考试学习网带给大家的全部内容,相信小伙伴们都了解清楚。预祝12月份ACCA考试取得满意的成绩,如果想要了解更多关于ACCA考试的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

4 A properly conducted appraisal interview is fundamental in ensuring the success of an organisation’s performance

appraisal system.

Required:

(a) Describe three approaches to conducting the appraisal interview. (5 marks)

4 Appraisal systems are central to human resource management and understanding the difficulties of such schemes and the correct

approach to them is necessary if the appraisal process is to be successful and worthwhile.

(a) The manager conducting the interview might base it on one of three approaches.

The Tell and Sell Method. The manager explains to the employee being appraised how the appraisal assessment is to be undertaken and gains acceptance of the evaluation and improvement plan from the employee. Human resource skills are important with this approach in order for the manager to be able to provide constructive criticism and to motivate the employee.

The Tell and Listen Method. The manager invites the employee to respond to the way that the interview is to be conducted.This approach requires counselling skills and encouragement to allow the employee to participate fully in the interview. A particular feature of this approach is the encouragment of feedback from the employee.

The Problem Solving Method. With this method the manager takes a more helpful approach and concentrates on the work problems of the employee, who is encouraged to think through his or her problems and to provide their own intrinsic motivation.

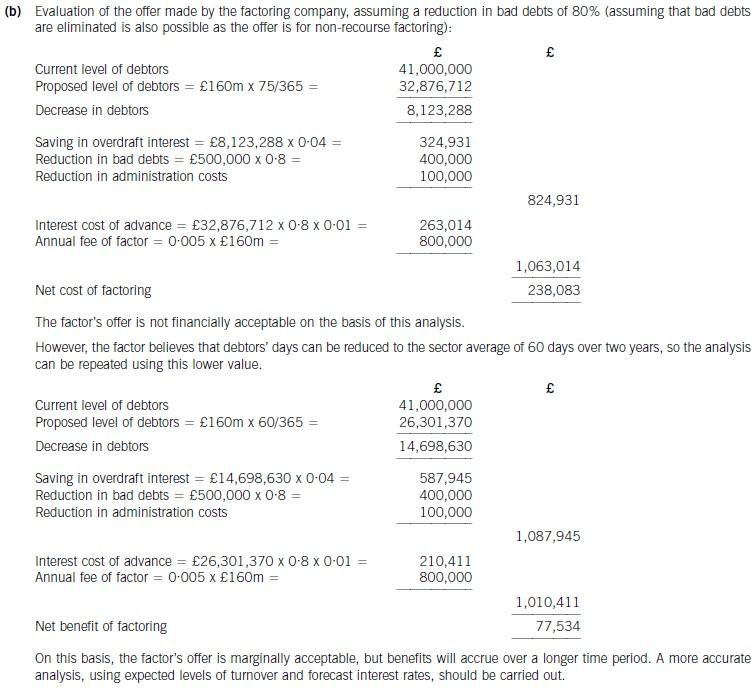

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

(b) Calculate the taxable benefit in 2005/06 if Jan were to use the accommodation offered by his employer. You

may assume that the rules for calculating benefits are the same as in 2004/05. (3 marks)

(b) Benefit – accommodation

If Jan accepts the offer, he will occupy the building for a period of eight months in the tax year 2005/06 (from 6 August 2005

– 5 April 2006). The benefit will last for six months.

The taxable benefit is the higher of:

(i) The rent borne by the company = 600 x 6 = 3,600

(ii) The annual (rateable) value = 6,000 x 6/12 = 3,000

i.e. £3,600.

In addition, as the property costs in excess of £75,000, an additional benefit arises. The excess is subject to the official rate

of interest, and is calculated as follows:

(155,000 – 75,000) x 5% = 4,000 x 6/12 = 2,000

Total taxable benefit is £3,600 + £2,000 = £5,600.

Tutorial note: strictly speaking the additional charge does not apply if the expensive property is rented rather than owned –

therefore the above answer, whilst the most commonly given is not technically correct. One mark was awarded if the

additional benefit calculation was performed as shown above and an alternative one mark was awarded if the additional

benefit was not calculated for the correct technical reason.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-12-29

- 2020-10-18

- 2020-08-15

- 2021-02-13

- 2021-02-13

- 2020-10-10

- 2019-03-17

- 2020-10-21

- 2020-10-21

- 2020-01-01

- 2020-10-10

- 2019-12-29

- 2021-02-13

- 2020-10-10

- 2020-09-05

- 2021-05-29

- 2019-01-04

- 2019-03-17

- 2020-10-10

- 2020-09-05

- 2020-09-05

- 2019-12-29

- 2020-08-14

- 2020-10-21

- 2019-03-09

- 2020-10-21

- 2020-09-04

- 2020-10-10

- 2020-10-10

- 2020-10-10