2020年ACCA考试财务会计(基础阶段)财经词汇汇总10

发布时间:2020-10-11

各位小伙伴注意了,今天51题库考试学习网为大家分享2020年ACCA考试财务会计(基础阶段)财经词汇汇总10,供大家参考,希望对大家有所帮助。

ACCA财经词汇汇编:先投资,后调查

【English Terms】

"Invest, Then Investigate"

【中文翻译】

先投资,后调查

【详情解释/例子】

投资者即时买入股票,然后才进行研究和尽职调查的投资策略。

ACCA财经词汇汇编:Infrastructure

【English Terms】

Infrastructure

【中文翻译】

基础设施

【详情解释/例子】

一个国家的基本实质系统。

ACCA财经词汇汇编:Inflection

Point

【English Terms】

Inflection Point

【中文翻译】

转捩点

【详情解释/例子】

改变我们想法或行为的事件Andy Grove, 英特尔的创办人。

ACCA财经词汇汇编:Initial

Public Offering(IPO)

【English Terms】

Initial Public Offering(IPO)

【中文翻译】

首次公开上市

【详情解释/例子】

私人公司首次向公众发售股票。首次公开上市一般是较小型、较新的公司筹集资金扩展业务的途径。

ACCA财经词汇汇编:Insider

【English Terms】

Insider

【中文翻译】

内幕人士

【详情解释/例子】

拥有或可接触公司有价值的非公开信息的任何人士。

ACCA财经词汇汇编:Insider

Information

【English Terms】

Insider Information

【中文翻译】

内幕消息

【详情解释/例子】

未向公众披露,有关公司活动的重要信息。

ACCA财经词汇汇编:Institutional

Brokers'Estimate System(IBES)

【English Terms】

Institutional Brokers\'Estimate System(IBES)

【中文翻译】

机构经纪人预测系统

【详情解释/例子】

搜集股票研究分析员对主要上市公司未来盈利的预测,并编制报告的系统。

ACCA财经词汇汇编:Installment

Debt

【English Terms】

Installment Debt

【中文翻译】

分期偿还债务

【详情解释/例子】

债务人必须定期偿还,直至全数清偿本金与利息的债务。

ACCA财经词汇汇编:Insider

Trading

【English Terms】

Insider Trading

【中文翻译】

内幕交易

【详情解释/例子】

拥有有关一种证券的非公开重要信息的人士买卖该种证券。这个行为使该内幕人士违反信托责任或其他基于信任及诚信的关系。

ACCA财经词汇汇编:International

Accounting Standards

【English Terms】

International Accounting Standards

【中文翻译】

国际会计标准

【详情解释/例子】

一套会计标准,列明将不同种类交易或其他事件纪录在财务报表的正确方法,国际会计标准由国际会计标准委员会发布。

以上就是51题库考试学习网带给大家的全部内容,相信小伙伴们都了解清楚。预祝12月份ACCA考试取得满意的成绩,如果想要了解更多关于ACCA考试的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

8 P and Q are in partnership, sharing profits in the ratio 2:1. On 1 July 2004 they admitted P’s son R as a partner. P

guaranteed that R’s profit share would not be less than $25,000 for the six months to 31 December 2004. The profitsharing

arrangements after R’s admission were P 50%, Q 30%, R 20%. The profit for the year ended 31 December

2004 is $240,000, accruing evenly over the year.

What should P’s final profit share be for the year ended 31 December 2004?

A $140,000

B $139,000

C $114,000

D $139,375

80,000 + 60,000 – 1,000 = 139,000

(ii) analytical procedures, (6 marks)

might appropriately be used in the due diligence review of MCM.

(ii) Analytical procedures

Tutorial note: The range of valid answer points is very broad for this part.

■ Review the trend of MCM’s profit (gross and net) for the last five years (say). Similarly earnings per share and

gearing.

■ For both the National and International businesses compare:

– gross profit, net profit, and return on assets for the last five years (say);

– actual monthly revenue against budget for the last 18 months (say). Similarly, for major items of expenditure

such as:

– full-time salaries;

– freelance consultancy fees;

– premises costs (e.g. depreciation, lease rentals, maintenance, etc);

– monthly revenue (also costs and profit) by centre.

■ Review projections of future profitability of MCM against net profit percentage at 31 December 2004 for:

– the National business (10·4%);

– the International business (38·1%); and

– overall (19·9%).

■ Review of disposal value of owned premises against book values.

■ Compare actual cash balances with budget on a monthly basis and compare borrowings against loan and overdraft

facilities.

■ Compare the average collection period for International’s trade receivables month on month since 31 December

2004 (when it was nearly seven months, i.e.

$3·7

–––– × 365 days) and compare with the National business.

$6·3

■ Compare financial ratios for each of the national centres against the National business overall (and similarly for the

International Business). For example:

– gross and net profit margins;

– return on centre assets;

– average collection period;

– average payment period;

– liquidity ratio.

■ Compare key performance indicators across the centres for the year to 31 December 2004 and 2005 to date. For

example:

– number of corporate clients;

– number of delegates;

– number of training days;

– average revenue per delegate per day;

– average cost per consultancy day.

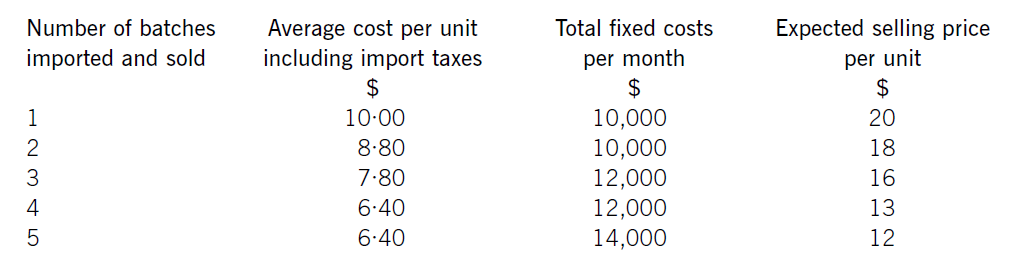

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-09-05

- 2020-10-11

- 2021-02-14

- 2020-10-11

- 2021-02-14

- 2020-10-11

- 2020-10-18

- 2020-10-15

- 2020-10-15

- 2020-10-11

- 2021-02-14

- 2021-02-14

- 2020-10-18

- 2021-02-14

- 2021-04-08

- 2020-09-05

- 2020-09-05

- 2020-10-11

- 2021-02-14

- 2021-04-04

- 2020-10-11

- 2020-10-11

- 2020-10-11

- 2020-10-15

- 2019-03-17

- 2019-06-29

- 2020-10-15

- 2021-02-14

- 2020-10-15

- 2020-10-15