2019年ACCA考试《高级审计与认证业务(专业阶段)》章节练习(2019-03-15)

发布时间:2019-03-15

Required:

A.

Explain why ‘auditor independence’ is necessary in

auditor-client relationships and describe THREE threats to auditor independence

in the case. (9 marks)

B.Anne is experiencing some tension due to the conflict between her duties and responsibilities as an employee of Fillmore Pierce and as a qualified professional accountant.

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

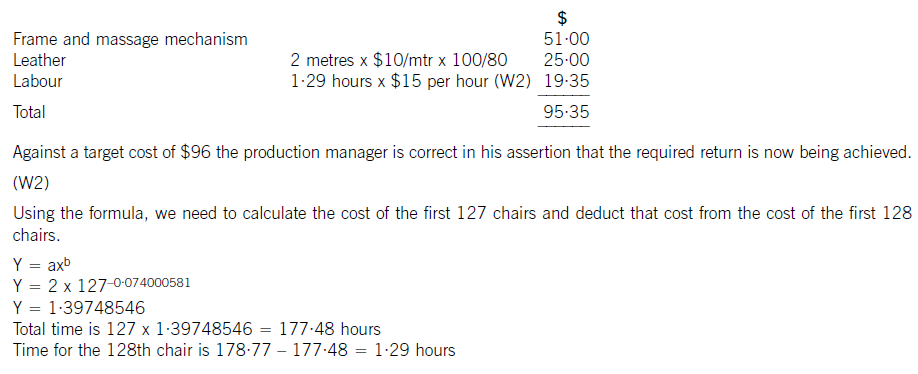

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

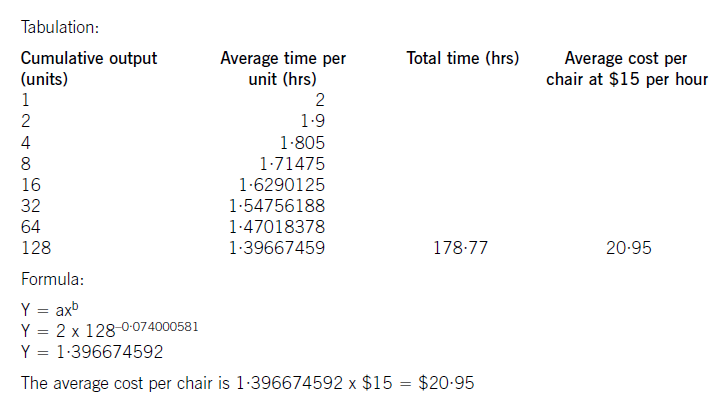

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

(b) (i) Calculate the inheritance tax (IHT) that will be payable if Debbie were to die today (8 June 2005).

Assume that no tax planning measures are taken and that there has been no change in the value of any

of the assets since David’s death. (4 marks)

(ii) The recoverability of the deferred tax asset. (4 marks)

(ii) Principal audit procedures – recoverability of deferred tax asset

– Obtain a copy of Bluebell Co’s current tax computation and deferred tax calculations and agree figures to any

relevant tax correspondence and/or underlying accounting records.

– Develop an independent expectation of the estimate to corroborate the reasonableness of management’s estimate.

– Obtain forecasts of profitability and agree that there is sufficient forecast taxable profit available for the losses to be

offset against. Evaluate the assumptions used in the forecast against business understanding. In particular consider

assumptions regarding the growth rate of taxable profit in light of the underlying detrimental trend in profit before

tax.

– Assess the time period it will take to generate sufficient profits to utilise the tax losses. If it is going to take a number

of years to generate such profits, it may be that the recognition of the asset should be restricted.

– Using tax correspondence, verify that there is no restriction on the ability of Bluebell Co to carry the losses forward

and to use the losses against future taxable profits.

Tutorial note: in many tax jurisdictions losses can only be carried forward to be utilised against profits generated

from the same trade. Although in the scenario there is no evidence of such a change in trade, or indeed any kind

of restriction on the use of losses, it is still a valid audit procedure to verify that this is the case

(ii) evaluates the relative performance of the four depots as indicated by the analysis in the summary table

prepared in (i); (5 marks)

(ii) The summary analysis in (a)(i) shows that using overall points gained, Michaelangelotown has achieved the best

performance with 12 points. Donatellotown and Leonardotown have achieved a reasonable level of performance with

eight points each. Raphaeltown has under performed, however, gaining only four out of the available 12 points.

Michaelangelotown is the only depot to have achieved both an increase in revenue over budget and an increased

profit:revenue percentage.

In the customer care and service delivery statistics, Michaelangelotown has achieved all six of the target standards,

Donatellotown four; Leonardotown three. The Raphaeltown statistic of achieving only one out of six targets indicates the

need for investigation.

With regard to the credit control and administrative efficiency statistics, Leonardotown and Michaelangelotown achieved

all four standards and Donatellotown achieved three of the four standards. Once again, Raphaeltown is the ‘poor

performer’ achieving only two of the four standards.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。