ACCA考试怎样才算成功正确打印了准考证?

发布时间:2022-01-22

ACCA资格考试是门槛相对较低的一个证书考试,比起只能毕业后报考的CPA证书来讲,报考条件要低很多。最近有不少报考ACCA考试的同学出现了疑问:“这种国际性质的考试,准考证该怎么打印呢?”下面是51题库考试学习网为大家带来的一些ACCA考试相关的信息,感兴趣的同学快来围观吧!

通常来说,在考前两周,可以登陆MYACCA里打印准考证。

一、打印准考证步骤:

(1) ACCA考试学员需登陆ACCA官网;

(2) 点击MYACCA后登入您的学员号和密码进入;

(3) 点击左侧栏里EXAM ENTRY & RESULTS进入;

(4) 点击EXAM ATTENDANCE DOCKET生成页面打印即可。

二、注意事项:

1、请仔细阅读准考证上EXAMINATION REGULATIONS和EXAMINATION GUIDELINES,务必严格遵守。ACCA考试学员请仔细核对的考试地点,仔细看准考证上的地址,以免大家走错考场。

2、ACCA准考证需双面打印,无需彩印,黑白打印即可。

3、准考证是学员考试必带的证明,请重视;打印准考证数量须和考试科数相同;

4、2017年3月考季起,ACCA全球统考准考证将不会再有个人照片。

5、因邮寄的准考证收到时间较晚,建议提前打印好准考证,仔细核对报考科目和考试地点有无错误。

6、准考证一定要提前打印,因为越往后官网可能出现各种崩溃状态,尽早打印。 ACCA何时打印准考证都是有ACCA官方统一安排公布时间,2016年实施每年4次考试之后,一般准考证会提前一个月左右就开放打印入口了,考生可自行打印。

ACCA准考证分为两种形式发放,一种是正式纸质版由ACCA英国方约在考前2-3周寄出,另一种是MY ACCA账户中的准考证。未收到ACCA官方邮寄准考证的考生可以在MY ACCA的账户中下载打印准考证,下载打印的准考证与英国邮寄的准考证作用相同。注:准考证必须有照片,准考证上面没有照片的学员请尽快与ACCA 英国方联系。

大家不要认为ACCA门槛较低,它的考试水准和难度就很容易。相反,考试难度也是很大的,毫不夸张地说ACCA是一个宽进严出的考试模式。因此,拿到证书的人是少之又少。

以上就是51题库考试学习网给大家带来的ACCA考试相关的内容,希望能够帮到大家!想要了解更多ACCA考试相关的信息,请持续关注51题库考试学习网。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) (i) Explain how the use of Ansoff’s product-market matrix might assist the management of Vision plc to

reduce the profit-gap that is forecast to exist at 30 November 2009. (3 marks)

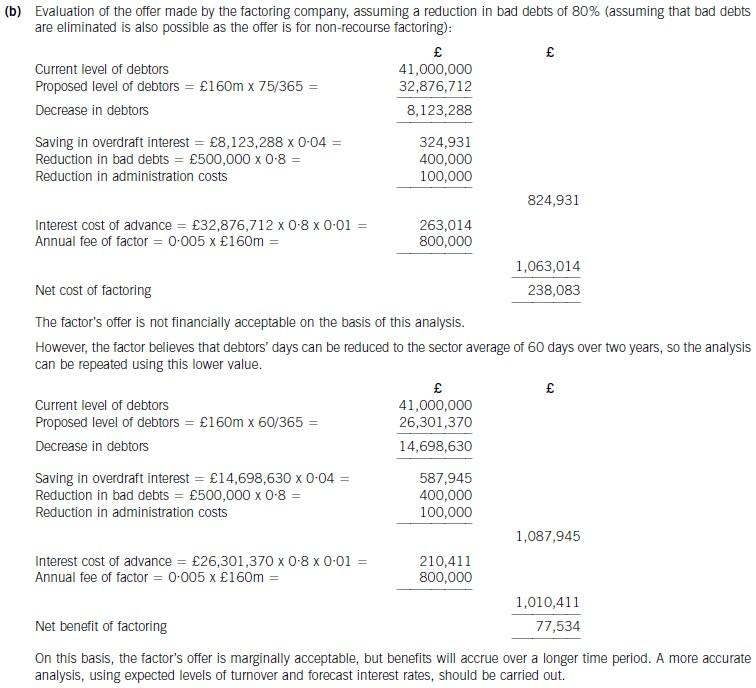

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

(c) Software Supply Co. (4 marks)

(c) Software Supply Co

Here it seems that Smith & Co has referred the provision of bespoke accounting software to an external provider – Software

Supply Co, and that a commission is being paid to Smith & Co for these referrals. It is common for audit firms to recommend

other providers to their audit clients.

This could be perceived as an objectivity and self-interest threat, as the audit firm is benefiting financially through

recommending clients to a particular provider of goods and services. However, if appropriate safeguards are in place, the

referrals and receipt of commissions can continue.

Action to be taken:

– Verification from all personnel involved with the audit of clients to whom Software Supply Co has provided a service that

they have no financial or personal interest in Software Supply Co.

– Smith & Co must ensure that:

For each client where a referral is made, full disclosure has been made to the client regarding the arrangement

Written acknowledgement that Smith & Co is to receive a referral fee should be obtained from the client.

– Procedures must be put into place to monitor the quality of goods and services provided by Software Supply Co to audit

clients.

(b) (i) Discuss the relationship between the concepts of ‘business risk’ and ‘financial statement risk’; and

(4 marks)

(b) (i) Business risk is defined as a threat which could mean that a business fails to meet an ongoing business objective.

Business risks represent problems which are faced by the management of a business, and these problems should be

identified and assessed for their possible impact on the business.

Financial statement risk is the risk that components of the financial statements could be misstated, through inaccurate

or incomplete recording of transactions or disclosure. Financial statement risks therefore represent potential errors or

deliberate misstatements in the published accounts of a business.

There is usually a direct relationship between business risk and financial statement risk. Generally a business risk, if not

addressed by management, will have an impact on specific components of the financial statements. For example, for

Medix Co, declining demand for metal surgical equipment has been identified as a business risk. An associated financial

statement risk is the potential over-valuation of obsolete inventory.

Sometimes business risks have a more general effect on the financial statements. Weak internal systems and controls

are often identified as a business risk. Inadequacies in systems and controls could lead to errors or misstatements in

any area of the financial statements so auditors would perceive this as a general audit risk factor.

Business risks are often linked to going concern issues, because if a business is failing to meet objectives such as cash

generation, or revenue maximisation, then it may struggle to continue in operational existence. In terms of financial

statement risk, going concern is a very specific issue, and the risk is normally the inadequate disclosure of going concern

problems. In the extreme situation where a business is definitely not a going concern, then the risk is that the financial

statements have been prepared on the wrong basis, as in this case the ‘break up basis’ should be used.

Business risk and financial statement risk concepts can both be used by auditors in order to identify areas of the financial

statements likely to be misstated at the year end. The business risk approach places the auditor ‘in the shoes’ of

management, and therefore provides deeper insight into the operations of the business and generates extensive business

understanding.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-01-03

- 2020-01-10

- 2020-09-04

- 2020-01-09

- 2020-09-04

- 2020-01-08

- 2020-01-10

- 2020-01-10

- 2020-12-24

- 2022-02-24

- 2020-01-09

- 2022-01-20

- 2020-08-15

- 2020-09-03

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-08-14

- 2020-01-10

- 2021-09-13

- 2022-02-25

- 2020-08-15

- 2022-01-22

- 2020-01-08

- 2022-01-22

- 2020-01-08

- 2020-01-08

- 2020-08-19

- 2020-08-14

- 2020-01-09