吉林省考生进行ACCA报考的具体流程是什么样的

发布时间:2020-01-09

对于即将到来3月份的ACCA考试,ACCAer们是否在备考路上遇到了困难呢?目前,有很多萌新ACCAer们来咨询51题库考试学习网,想问一下ACCA考试报考的具体流程是什么样子的?接下来,就这一问题,51题库考试学习网为大家解答相关的疑惑,建议收藏哦~

首先大家得先知道一点的是:ACCA考试报名成功后不可以缓考。

考试要求:

1、所有课程满分为100分,50分及格。每年6月及12月为全球统考时间,每门考试时间为三小时。

2、单科成绩(除第三阶段核心课程的特殊要求外)有效期为七年,从学员注册成功年度开始算起。

3、课程考试应按顺序进行,一次考试最多可以考四门。若*9阶段有不及格的课程,该课程可与第二阶段的课程一起考,但不得与第三阶段的课程同考。

4、第三阶段3.5,3.6和3.7三门为核心课程,必须在同一次考试中进行,要求这三门课程同时通过。如果有两门课成绩合格,一门课成绩在30-49分之间,允许单独补考该课程两次,若不能通过,三门课需要重新考试。如果有两门不及格,或一门低于30分,三门课均须补考。

想要报名ACCA考试的学生,必须要具备以下条件之一:

1.凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

2.教育部认可的高等院校在校生,顺利完成了大一全年的所有课程考试,即可报名成为ACCA的正式学员;

3.未符合1、2项报名资格的申请者,可以先申请参加FIA资格考试,通过FFA、FMA和FAB三门课程后,可以申请转入ACCA并且豁免F1-F3三门课程的考试,直接进入ACCA技能课程阶段的考试。(注:申请FIA资格考试的学员,可以不满足以上1、2项条件,并且没有相关年龄限制)

ACCA考试报名流程

凡想要报考ACCA的考生请登陆官方网站进行网上注册,并根据个人情况提交下列材料:

①ACCA报考条件中要带学历/学位证明(高校在校生需提交学校出具的在校证明函及第一年所有课程考试合格的成绩单)的原件、复印件和译文。

②身份证的原件、复印件和译文;或提供护照,不需提交翻译件。

③一张两寸照片(黑白彩色均可)

④注册报名费(支付宝、银行汇票或信用卡支付),请确认信用卡可以从国外付款,否则会影响注册返回时间;如果不能确定建议用汇票交纳注册费。

全英文ACCA官网,报名很吃力,不知道怎么弄?ACCA代报名(高顿免费服务)

ACCA报名步骤

1. 登录ACCA全球官网

2. 点击My ACCA登录,输入您的学员号和密码,进入您的个人空间。

3. 选择EXAM ENTER,按照页面相关提示,进入考试报名界面,选择相关报考科目,报名即可。

为什么要报考ACC呢?ACCA是面向国际的“职场黄金文凭”。ACCA就业前景来说目前国内人才缺口大,岗位年薪高,职业发展空间大,是外企招聘财务经理,财务总监等岗位优先录用的条件之一。

俗话说,辛勤耕作十二载,知识田里成果现。考场之上奋笔书,难易题目都做完。ACCAer,为了更好的明天,一起加油吧!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

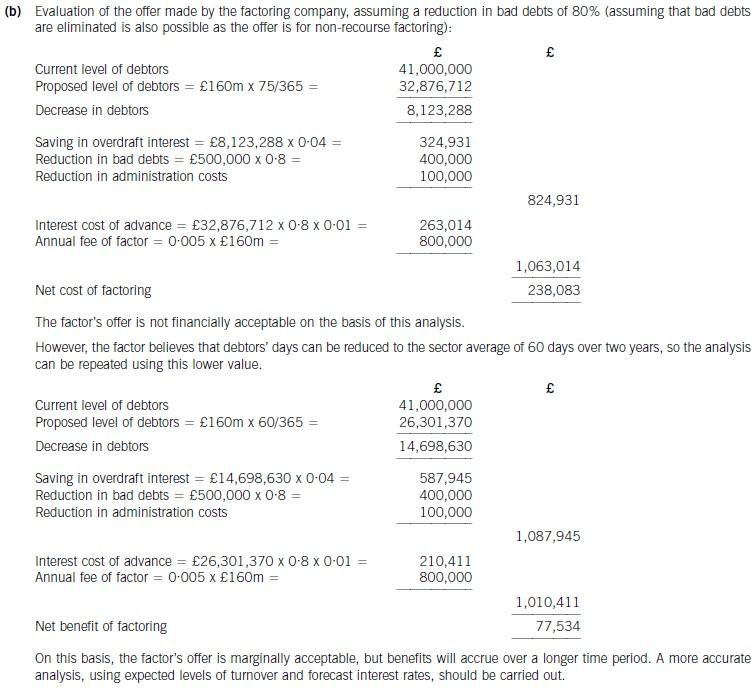

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

(c) On 1 May 2007 Sirus acquired another company, Marne plc. The directors of Marne, who were the only

shareholders, were offered an increased profit share in the enlarged business for a period of two years after the

date of acquisition as an incentive to accept the purchase offer. After this period, normal remuneration levels will

be resumed. Sirus estimated that this would cost them $5 million at 30 April 2008, and a further $6 million at

30 April 2009. These amounts will be paid in cash shortly after the respective year ends. (5 marks)

Required:

Draft a report to the directors of Sirus which discusses the principles and nature of the accounting treatment of

the above elements under International Financial Reporting Standards in the financial statements for the year

ended 30 April 2008.

(c) Acquisition of Marne

All business combinations within the scope of IFRS 3 ‘Business Combinations’ must be accounted for using the purchase

method. (IFRS 3.14) The pooling of interests method is prohibited. Under IFRS 3, an acquirer must be identified for all

business combinations. (IFRS 3.17) Sirus will be identified as the acquirer of Marne and must measure the cost of a business

combination at the sum of the fair values, at the date of exchange, of assets given, liabilities incurred or assumed, in exchange

for control of Marne; plus any costs directly attributable to the combination. (IFRS 3.24) If the cost is subject to adjustment

contingent on future events, the acquirer includes the amount of that adjustment in the cost of the combination at the

acquisition date if the adjustment is probable and can be measured reliably. (IFRS 3.32) However, if the contingent payment

either is not probable or cannot be measured reliably, it is not measured as part of the initial cost of the business combination.

If that adjustment subsequently becomes probable and can be measured reliably, the additional consideration is treated as

an adjustment to the cost of the combination. (IAS 3.34) The issue with the increased profit share payable to the directors

of Marne is whether the payment constitutes remuneration or consideration for the business acquired. Because the directors

of Marne fall back to normal remuneration levels after the two year period, it appears that this additional payment will

constitute part of the purchase consideration with the resultant increase in goodwill. It seems as though these payments can

be measured reliably and therefore the cost of the acquisition should be increased by the net present value of $11 million at

1 May 2007 being $5 million discounted for 1 year and $6 million for 2 years.

(b) Discuss the limitations of the above estimates. (6 marks)

(b) The estimates are based upon unrealistic assumptions and are subject to a considerable margin of error. Possible limitations

include:

(i) Sales, operating costs, replacement investments, and dividends are unlikely to increase by the same amount.

(ii) Forecasts of future growth rates may not be accurate. Paxis is unlikely to have access to enough internal information

about the activities of Wragger to make accurate projections.

(iii) The expected reduction in operating costs might not be achieved.

(iv) The estimates are based upon present values to infinity of expected free cash flows. A shorter time horizon might be

more realistic.

(v) The cost of capital for the combined company could differ from that estimated, depending how the market evaluates the

risk of the combined entity.

(vi) The analysis is based upon the assumption that the initial offer price is accepted.

(vii) There is no information about the fees and other costs associated with the proposed acquisition. In many cases these

are substantial, and must be included in the analysis.

(viii) The post acquisition integration of organisations often involves unforeseen costs which would reduce the benefit of any

potential synergy.

(b) The tax relief available in respect of the anticipated trading losses, together with supporting calculations and

a recommended structure for the business. (16 marks)

Aral Ltd owned by Banda

The losses would have to be carried forward and deducted from the trading profits of the year ending 30 June 2010.

Aral Ltd cannot offset the loss in the current period or carry it back as it has no other income or gains.

Aral Ltd owned by Flores Ltd

The two companies will form. a group relief group if Flores Ltd owns at least 75% of the ordinary share capital of Aral

Ltd. The trading losses could be surrendered to Flores Ltd in the year ending 30 June 2008 and the year ending

30 June 2009. The total tax saved would be £11,079 ((£38,696 + £19,616) x 19%)

Recommended structure

The Aral business should be established in a company owned by Flores Ltd.

This will maximise the relief available in respect of the trading losses and enable relief to be obtained in the period in

which the losses are incurred.

Tutorial note

The whole of the loss for the period ending 30 June 2008 can be surrendered to Flores Ltd as it is less than that

company’s profit for the corresponding period, i.e. £60,000 (£120,000 x 6/12).

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-09

- 2020-09-04

- 2021-10-03

- 2020-07-04

- 2020-02-27

- 2020-01-10

- 2020-09-03

- 2020-01-01

- 2020-09-03

- 2020-01-09

- 2020-09-03

- 2020-08-13

- 2020-01-10

- 2020-01-03

- 2021-01-16

- 2020-07-04

- 2020-01-09

- 2019-03-16

- 2020-05-20

- 2020-01-10

- 2021-04-25

- 2020-01-10

- 2020-01-09

- 2020-01-09

- 2021-04-04

- 2020-09-03

- 2020-09-03

- 2020-08-12

- 2020-01-28