安徽省考生进行ACCA报考的具体流程是什么样的

发布时间:2020-01-09

对于即将到来3月份的ACCA考试,ACCAer们是否在备考路上遇到了困难呢?目前,有很多萌新ACCAer们来咨询51题库考试学习网,想问一下ACCA考试报考的具体流程是什么样子的?接下来,就这一问题,51题库考试学习网为大家解答相关的疑惑,建议收藏哦~

首先大家得先知道一点的是:ACCA考试报名成功后不可以缓考。

考试要求:

1、所有课程满分为100分,50分及格。每年6月及12月为全球统考时间,每门考试时间为三小时。

2、单科成绩(除第三阶段核心课程的特殊要求外)有效期为七年,从学员注册成功年度开始算起。

3、课程考试应按顺序进行,一次考试最多可以考四门。若*9阶段有不及格的课程,该课程可与第二阶段的课程一起考,但不得与第三阶段的课程同考。

4、第三阶段3.5,3.6和3.7三门为核心课程,必须在同一次考试中进行,要求这三门课程同时通过。如果有两门课成绩合格,一门课成绩在30-49分之间,允许单独补考该课程两次,若不能通过,三门课需要重新考试。如果有两门不及格,或一门低于30分,三门课均须补考。

想要报名ACCA考试的学生,必须要具备以下条件之一:

1.凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

2.教育部认可的高等院校在校生,顺利完成了大一全年的所有课程考试,即可报名成为ACCA的正式学员;

3.未符合1、2项报名资格的申请者,可以先申请参加FIA资格考试,通过FFA、FMA和FAB三门课程后,可以申请转入ACCA并且豁免F1-F3三门课程的考试,直接进入ACCA技能课程阶段的考试。(注:申请FIA资格考试的学员,可以不满足以上1、2项条件,并且没有相关年龄限制)

ACCA考试报名流程

凡想要报考ACCA的考生请登陆官方网站进行网上注册,并根据个人情况提交下列材料:

①ACCA报考条件中要带学历/学位证明(高校在校生需提交学校出具的在校证明函及第一年所有课程考试合格的成绩单)的原件、复印件和译文。

②身份证的原件、复印件和译文;或提供护照,不需提交翻译件。

③一张两寸照片(黑白彩色均可)

④注册报名费(支付宝、银行汇票或信用卡支付),请确认信用卡可以从国外付款,否则会影响注册返回时间;如果不能确定建议用汇票交纳注册费。

全英文ACCA官网,报名很吃力,不知道怎么弄?ACCA代报名(高顿免费服务)

ACCA报名步骤

1. 登录ACCA全球官网

2. 点击My ACCA登录,输入您的学员号和密码,进入您的个人空间。

3. 选择EXAM ENTER,按照页面相关提示,进入考试报名界面,选择相关报考科目,报名即可。

为什么要报考ACC呢?ACCA是面向国际的“职场黄金文凭”。ACCA就业前景来说目前国内人才缺口大,岗位年薪高,职业发展空间大,是外企招聘财务经理,财务总监等岗位优先录用的条件之一。

俗话说,辛勤耕作十二载,知识田里成果现。考场之上奋笔书,难易题目都做完。ACCAer,为了更好的明天,一起加油吧!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) You are the audit manager of Petrie Co, a private company, that retails kitchen utensils. The draft financial

statements for the year ended 31 March 2007 show revenue $42·2 million (2006 – $41·8 million), profit before

taxation of $1·8 million (2006 – $2·2 million) and total assets of $30·7 million (2006 – $23·4 million).

You are currently reviewing two matters that have been left for your attention on Petrie’s audit working paper file

for the year ended 31 March 2007:

(i) Petrie’s management board decided to revalue properties for the year ended 31 March 2007 that had

previously all been measured at depreciated cost. At the balance sheet date three properties had been

revalued by a total of $1·7 million. Another nine properties have since been revalued by $5·4 million. The

remaining three properties are expected to be revalued later in 2007. (5 marks)

Required:

Identify and comment on the implications of these two matters for your auditor’s report on the financial

statements of Petrie Co for the year ended 31 March 2007.

NOTE: The mark allocation is shown against each of the matters above.

(b) Implications for auditor’s report

(i) Selective revaluation of premises

The revaluations are clearly material to the balance sheet as $1·7 million and $5·4 million represent 5·5% and 17·6%

of total assets, respectively (and 23·1% in total). As the effects of the revaluation on line items in the financial statements

are clearly identified (e.g. revalued amount, depreciation, surplus in statement of changes in equity) the matter is not

pervasive.

The valuations of the nine properties after the year end provide additional evidence of conditions existing at the year end

and are therefore adjusting events per IAS 10 Events After the Balance Sheet Date.

Tutorial note: It is ‘now’ still less than three months after the year end so these valuations can reasonably be expected

to reflect year end values.

However, IAS 16 Property, Plant and Equipment does not permit the selective revaluation of assets thus the whole class

of premises would need to have been revalued for the year to 31 March 2007 to change the measurement basis for this

reporting period.

The revaluation exercise is incomplete. Unless the remaining three properties are revalued before the auditor’s report on

the financial statements for the year ended 31 March 2007 is signed off:

(1) the $7·1 revaluation made so far must be reversed to show all premises at depreciated cost as in previous years;

OR

(2) the auditor’s report would be qualified ‘except for’ disagreement regarding non-compliance with IAS 16.

When it is appropriate to adopt the revaluation model (e.g. next year) the change in accounting policy (from a cost model

to a revaluation model) should be accounted for in accordance with IAS 16 (i.e. as a revaluation).

Tutorial note: IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors does not apply to the initial

application of a policy to revalue assets in accordance with IAS 16.

Assuming the revaluation is written back, before giving an unmodified opinion, the auditor should consider why the three

properties were not revalued. In particular if there are any indicators of impairment (e.g. physical dilapidation) there

should be sufficient evidence on the working paper file to show that the carrying amount of these properties is not

materially greater than their recoverable amount (i.e. the higher of value in use and fair value less costs to sell).

If there is insufficient evidence to confirm that the three properties are not impaired (e.g. if the auditor was prevented

from inspecting the properties) the auditor’s report would be qualified ‘except for’ on grounds of limitation on scope.

If there is evidence of material impairment but management fail to write down the carrying amount to recoverable

amount the auditor’s report would be qualified ‘except for’ disagreement regarding non-compliance with IAS 36

Impairment of Assets.

1 Your client, Island Co, is a manufacturer of machinery used in the coal extraction industry. You are currently planning

the audit of the financial statements for the year ended 30 November 2007. The draft financial statements show

revenue of $125 million (2006 – $103 million), profit before tax of $5·6 million (2006 – $5·1 million) and total

assets of $95 million (2006 – $90 million). Your firm was appointed as auditor to Island Co for the first time in June

2007.

Island Co designs, constructs and installs machinery for five key customers. Payment is due in three instalments: 50%

is due when the order is confirmed (stage one), 25% on delivery of the machinery (stage two), and 25% on successful

installation in the customer’s coal mine (stage three). Generally it takes six months from the order being finalised until

the final installation.

At 30 November, there is an amount outstanding of $2·85 million from Jacks Mine Co. The amount is a disputed

stage three payment. Jacks Mine Co is refusing to pay until the machinery, which was installed in August 2007, is

running at 100% efficiency.

One customer, Sawyer Co, communicated in November 2007, via its lawyers with Island Co, claiming damages for

injuries suffered by a drilling machine operator whose arm was severely injured when a machine malfunctioned. Kate

Shannon, the chief executive officer of Island Co, has told you that the claim is being ignored as it is generally known

that Sawyer Co has a poor health and safety record, and thus the accident was their fault. Two orders which were

placed by Sawyer Co in October 2007 have been cancelled.

Work in progress is valued at $8·5 million at 30 November 2007. A physical inventory count was held on

17 November 2007. The chief engineer estimated the stage of completion of each machine at that date. One of the

major components included in the coal extracting machinery is now being sourced from overseas. The new supplier,

Locke Co, is located in Spain and invoices Island Co in euros. There is a trade payable of $1·5 million owing to Locke

Co recorded within current liabilities.

All machines are supplied carrying a one year warranty. A warranty provision is recognised on the balance sheet at

$2·5 million (2006 – $2·4 million). Kate Shannon estimates the cost of repairing defective machinery reported by

customers, and this estimate forms the basis of the provision.

Kate Shannon owns 60% of the shares in Island Co. She also owns 55% of Pacific Co, which leases a head office to

Island Co. Kate is considering selling some of her shares in Island Co in late January 2008, and would like the audit

to be finished by that time.

Required:

(a) Using the information provided, identify and explain the principal audit risks, and any other matters to be

considered when planning the final audit for Island Co for the year ended 30 November 2007.

Note: your answer should be presented in the format of briefing notes to be used at a planning meeting.

Requirement (a) includes 2 professional marks. (13 marks)

1 ISLAND CO

(a) Briefing Notes

Subject: Principal Audit Risks – Island Co

Revenue Recognition – timing

Island Co raises sales invoices in three stages. There is potential for breach of IAS 18 Revenue, which states that revenue

should only be recognised once the seller has the right to receive it, in other words the seller has performed its contractual

obligations. This right does not necessarily correspond to amounts falling due for payment in accordance with an invoice

schedule agreed with a customer as part of a contract. Island Co appears to receive payment from its customers in advance

of performing any obligation, as the stage one invoice is raised when an order is confirmed i.e. before any work has actually

taken place. This creates the potential for revenue to be recognised too early, in advance of any performance of contractual

obligation. When a payment is received in advance of performance, a liability should be recognised equal to the amount

received, representing the obligation under the contract. Therefore a significant risk is that revenue is overstated and liabilities

understated.

Tutorial note: Equivalent guidance is also provided in IAS 11 Construction Contracts and credit will be awarded where

candidates discuss revenue recognition under IAS 11 as Island Co is providing a single substantial asset for a customer

under the terms of a contract.

Disputed receivable

The amount owed from Jacks Mine Co is highly material as it represents 50·9% of profit before tax, 2·3% of revenue, and

3% of total assets. The risk is that the receivable is overstated if no impairment of the disputed receivable is recognised.

Legal claim

The claim should be investigated seriously by Island Co. The chief executive officer’s (CEO) opinion that the claim will not

result in any financial consequence for Island Co is na?ve and flippant. Damages could be awarded against Island Co if it is

found that the machinery is faulty. The recurring high level of warranty provision implies that machinery faults are fairly

common and therefore the accident could be the result of a defective machine being supplied to Sawyer Co. The risk is that

no provision is created for the potential damages under IAS 37 Provisions, Contingent Liabilities and Contingent Assets, if the

likelihood of paying damages is considered probable. Alternatively, if the likelihood of damages being paid to Sawyer Co is

considered a possibility then a disclosure note should be made in the financial statements describing the nature and possible

financial effect of the contingent liability. As discussed below, the CEO, Kate Shannon, has an incentive not to make a

provision or disclose a contingent liability due to the planned share sale post year end.

A further risk is that any legal fees associated with the claim have not been accrued within the financial statements. As the

claim has arisen during the year, the expense must be included in this year’s income statement, even if the claim is still ongoing

at the year end.

The fact that the legal claim is effectively being ignored may cast doubts on the overall integrity of senior management, and

on the integrity of the financial statements. Management representations should be approached with a degree of professional

scepticism during the audit.

Sawyer Co has cancelled two orders. If the amounts are still outstanding at the year end then it is highly likely that Sawyer

Co will not pay the invoiced amounts, and thus receivables are overstated. If the stage one payments have already been made,

then Sawyer Co may claim a refund, in which case a provision should be made to repay the amount, or a contingent liability

disclosed in a note to the financial statements.

Sawyer Co is one of only five major customers, and losing this customer could have future going concern implications for

Island Co if a new source of revenue cannot be found to replace the lost income stream from Sawyer Co. If the legal claim

becomes public knowledge, and if Island Co is found to have supplied faulty machinery, then it will be difficult to attract new

customers.

A case of this nature could bring bad publicity to Island Co, a potential going concern issue if it results in any of the five key

customers terminating orders with Island Co. The auditors should plan to extend the going concern work programme to

incorporate the issues noted above.

Inventories

Work in progress is material to the financial statements, representing 8·9% of total assets. The inventory count was held two

weeks prior to the year end. There is an inherent risk that the valuation has not been correctly rolled forward to a year end

position.

The key risk is the estimation of the stage of completion of work in progress. This is subjective, and knowledge appears to

be confined to the chief engineer. Inventory could be overvalued if the machines are assessed to be more complete than they

actually are at the year end. Absorption of labour costs and overheads into each machine is a complex calculation and must

be done consistently with previous years.

It will also be important that consumable inventories not yet utilised on a machine, e.g. screws, nuts and bolts, are correctly

valued and included as inventories of raw materials within current assets.

Overseas supplier

As the supplier is new, controls may not yet have been established over the recording of foreign currency transactions.

Inherent risk is high as the trade payable should be retranslated using the year end exchange rate per IAS 21 The Effects of

Changes in Foreign Exchange Rates. If the retranslation is not performed at the year end, the trade payable could be

significantly over or under valued, depending on the movement of the dollar to euro exchange rate between the purchase date

and the year end. The components should remain at historic cost within inventory valuation and should not be retranslated

at the year end.

Warranty provision

The warranty provision is material at 2·6% of total assets (2006 – 2·7%). The provision has increased by only $100,000,

an increase of 4·2%, compared to a revenue increase of 21·4%. This could indicate an underprovision as the percentage

change in revenue would be expected to be in line with the percentage change in the warranty provision, unless significant

improvements had been made to the quality of machines installed for customers during the year. This appears unlikely given

the legal claim by Sawyer Co, and the machines installed at Jacks Mine Co operating inefficiently. The basis of the estimate

could be understated to avoid charging the increase in the provision as an expense through the income statement. This is of

special concern given that it is the CEO and majority shareholder who estimates the warranty provision.

Majority shareholder

Kate Shannon exerts control over Island Co via a majority shareholding, and by holding the position of CEO. This greatly

increases the inherent risk that the financial statements could be deliberately misstated, i.e. overvaluation of assets,

undervaluation of liabilities, and thus overstatement of profits. The risk is severe at this year end as Kate Shannon is hoping

to sell some Island Co shares post year end. As the price that she receives for these shares will be to a large extent influenced

by the balance sheet position of the company at 30 November 2007, she has a definite interest in manipulating the financial

statements for her own personal benefit. For example:

– Not recognising a provision or contingent liability for the legal claim from Sawyer Co

– Not providing for the potentially irrecoverable receivable from Jacks Mines Co

– Not increasing the warranty provision

– Recognising revenue earlier than permitted by IAS 18 Revenue.

Related party transactions

Kate Shannon controls Island Co and also controls Pacific Co. Transactions between the two companies should be disclosed

per IAS 24 Related Party Disclosures. There is risk that not all transactions have been disclosed, or that a transaction has

been disclosed at an inappropriate value. Details of the lease contract between the two companies should be disclosed within

a note to the financial statements, in particular, any amounts owed from Island Co to Pacific Co at 30 November 2007 should

be disclosed.

Other issues

– Kate Shannon wants the audit to be completed as soon as possible, which brings forward the deadline for completion

of the audit. The audit team may not have time to complete all necessary procedures, or there may not be time for

adequate reviews to be carried out on the work performed. Detection risk, and thus audit risk is increased, and the

overall quality of the audit could be jeopardised.

– This is especially important given that this is the first year audit and therefore the audit team will be working with a

steep learning curve. Audit procedures may take longer than originally planned, yet there is little time to extend

procedures where necessary.

– Kate Shannon may also exert considerable influence on the members of the audit team to ensure that the financial

statements show the best possible position of Island Co in view of her share sale. It is crucial that the audit team

members adhere strictly to ethical guidelines and that independence is beyond question.

– Due to the seriousness of the matters noted above, a final matter to be considered at the planning stage is that a second

partner review (Engagement Quality Control Review) should be considered for the audit this year end. A suitable

independent reviewer should be indentified, and time planned and budgeted for at the end of the assignment.

Conclusion

From the range of issues discussed in these briefing notes, it can be seen that the audit of Island Co will be a relatively high

risk engagement.

Moonstar Co is a property development company which is planning to undertake a $200 million commercial property development. Moonstar Co has had some difficulties over the last few years, with some developments not generating the expected returns and the company has at times struggled to pay its finance costs. As a result Moonstar Co’s credit rating has been lowered, affecting the terms it can obtain for bank finance. Although Moonstar Co is listed on its local stock exchange, 75% of the share capital is held by members of the family who founded the company. The family members who are shareholders do not wish to subscribe for a rights issue and are unwilling to dilute their control over the company by authorising a new issue of equity shares. Moonstar Co’s board is therefore considering other methods of financing the development, which the directors believe will generate higher returns than other recent investments, as the country where Moonstar Co is based appears to be emerging from recession.

Securitisation proposals

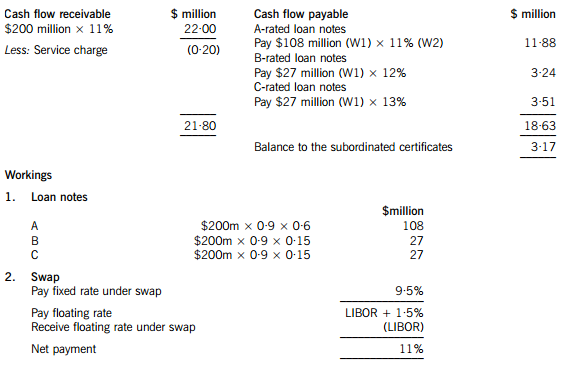

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

(a) An annual cash flow account compares the estimated cash flows receivable from the property against the liabilities within the securitisation process. The swap introduces leverage into the arrangement.

The holders of the certificates are expected to receive $3·17million on $18 million, giving them a return of 17·6%. If the cash flows are 5% lower than the non-executive director has predicted, annual revenue received will fall to $20·90 million, reducing the balance available for the subordinated certificates to $2·07 million, giving a return of 11·5% on the subordinated certificates, which is below the returns offered on the B and C-rated loan notes. The point at which the holders of the certificates will receive nothing and below which the holders of the C-rated loan notes will not receive their full income will be an annual income of $18·83 million (a return of 9·4%), which is 14·4% less than the income that the non-executive director has forecast.

(b) Benefits

The finance costs of the securitisation may be lower than the finance costs of ordinary loan capital. The cash flows from the commercial property development may be regarded as lower risk than Moonstar Co’s other revenue streams. This will impact upon the rates that Moonstar Co is able to offer borrowers.

The securitisation matches the assets of the future cash flows to the liabilities to loan note holders. The non-executive director is assuming a steady stream of lease income over the next 10 years, with the development probably being close to being fully occupied over that period.

The securitisation means that Moonstar Co is no longer concerned with the risk that the level of earnings from the properties will be insufficient to pay the finance costs. Risks have effectively been transferred to the loan note holders.

Risks

Not all of the tranches may appeal to investors. The risk-return relationship on the subordinated certificates does not look very appealing, with the return quite likely to be below what is received on the C-rated loan notes. Even the C-rated loan note holders may question the relationship between the risk and return if there is continued uncertainty in the property sector.

If Moonstar Co seeks funding from other sources for other developments, transferring out a lower risk income stream means that the residual risks associated with the rest of Moonstar Co’s portfolio will be higher. This may affect the availability and terms of other borrowing.

It appears that the size of the securitisation should be large enough for the costs to be bearable. However Moonstar Co may face unforeseen costs, possibly unexpected management or legal expenses.

(c) (i) Sukuk finance could be appropriate for the securitisation of the leasing portfolio. An asset-backed Sukuk would be the same kind of arrangement as the securitisation, where assets are transferred to a special purpose vehicle and the returns and repayments are directly financed by the income from the assets. The Sukuk holders would bear the risks and returns of the relationship.

The other type of Sukuk would be more like a sale and leaseback of the development. Here the Sukuk holders would be guaranteed a rental, so it would seem less appropriate for Moonstar Co if there is significant uncertainty about the returns from the development.

The main issue with the asset-backed Sukuk finance is whether it would be as appealing as certainly the A-tranche of the securitisation arrangement which the non-executive director has proposed. The safer income that the securitisation offers A-tranche investors may be more appealing to investors than a marginally better return from the Sukuk. There will also be costs involved in establishing and gaining approval for the Sukuk, although these costs may be less than for the securitisation arrangement described above.

(ii) A Mudaraba contract would involve the bank providing capital for Moonstar Co to invest in the development. Moonstar Co would manage the investment which the capital funded. Profits from the investment would be shared with the bank, but losses would be solely borne by the bank. A Mudaraba contract is essentially an equity partnership, so Moonstar Co might not face the threat to its credit rating which it would if it obtained ordinary loan finance for the development. A Mudaraba contract would also represent a diversification of sources of finance. It would not require the commitment to pay interest that loan finance would involve.

Moonstar Co would maintain control over the running of the project. A Mudaraba contract would offer a method of obtaining equity funding without the dilution of control which an issue of shares to external shareholders would bring. This is likely to make it appealing to Moonstar Co’s directors, given their desire to maintain a dominant influence over the business.

The bank would be concerned about the uncertainties regarding the rental income from the development. Although the lack of involvement by the bank might appeal to Moonstar Co's directors, the bank might not find it so attractive. The bank might be concerned about information asymmetry – that Moonstar Co’s management might be reluctant to supply the bank with the information it needs to judge how well its investment is performing.

(ii) authority; (3 marks)

(ii) AUTHORITY is the scope and amount of discretion given to a person to make decisions by virtue of the position held within the organisation. The authority and power structure of an organisation defines the part each member of the organisation is expected to perform. and the relationship between the organisation’s members so that its efforts are effective. The source of authority may be top down (as in formal organisations) or bottom up (as in social organizations and politics). In the scenario, authority is from the top and should be delegated downwards.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-02-01

- 2020-01-30

- 2020-02-27

- 2021-05-22

- 2020-09-03

- 2020-01-09

- 2021-02-03

- 2020-02-27

- 2020-01-09

- 2020-01-09

- 2021-04-08

- 2020-02-23

- 2020-02-27

- 2021-10-22

- 2020-01-09

- 2020-03-04

- 2021-01-21

- 2021-01-22

- 2020-01-08

- 2020-01-09

- 2020-01-09

- 2020-12-31

- 2020-01-09

- 2020-01-08

- 2020-01-10

- 2021-04-09

- 2020-01-09

- 2020-01-10

- 2021-01-13

- 2020-02-02