新疆考生进行ACCA报考的具体流程是什么样的

发布时间:2020-01-09

对于即将到来3月份的ACCA考试,ACCAer们是否在备考路上遇到了困难呢?目前,有很多萌新ACCAer们来咨询51题库考试学习网,想问一下ACCA考试报考的具体流程是什么样子的?接下来,就这一问题,51题库考试学习网为大家解答相关的疑惑,建议收藏哦~

首先大家得先知道一点的是:ACCA考试报名成功后不可以缓考。

考试要求:

1、所有课程满分为100分,50分及格。每年6月及12月为全球统考时间,每门考试时间为三小时。

2、单科成绩(除第三阶段核心课程的特殊要求外)有效期为七年,从学员注册成功年度开始算起。

3、课程考试应按顺序进行,一次考试最多可以考四门。若*9阶段有不及格的课程,该课程可与第二阶段的课程一起考,但不得与第三阶段的课程同考。

4、第三阶段3.5,3.6和3.7三门为核心课程,必须在同一次考试中进行,要求这三门课程同时通过。如果有两门课成绩合格,一门课成绩在30-49分之间,允许单独补考该课程两次,若不能通过,三门课需要重新考试。如果有两门不及格,或一门低于30分,三门课均须补考。

想要报名ACCA考试的学生,必须要具备以下条件之一:

1.凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

2.教育部认可的高等院校在校生,顺利完成了大一全年的所有课程考试,即可报名成为ACCA的正式学员;

3.未符合1、2项报名资格的申请者,可以先申请参加FIA资格考试,通过FFA、FMA和FAB三门课程后,可以申请转入ACCA并且豁免F1-F3三门课程的考试,直接进入ACCA技能课程阶段的考试。(注:申请FIA资格考试的学员,可以不满足以上1、2项条件,并且没有相关年龄限制)

ACCA考试报名流程

凡想要报考ACCA的考生请登陆官方网站进行网上注册,并根据个人情况提交下列材料:

①ACCA报考条件中要带学历/学位证明(高校在校生需提交学校出具的在校证明函及第一年所有课程考试合格的成绩单)的原件、复印件和译文。

②身份证的原件、复印件和译文;或提供护照,不需提交翻译件。

③一张两寸照片(黑白彩色均可)

④注册报名费(支付宝、银行汇票或信用卡支付),请确认信用卡可以从国外付款,否则会影响注册返回时间;如果不能确定建议用汇票交纳注册费。

全英文ACCA官网,报名很吃力,不知道怎么弄?ACCA代报名(高顿免费服务)

ACCA报名步骤

1. 登录ACCA全球官网

2. 点击My ACCA登录,输入您的学员号和密码,进入您的个人空间。

3. 选择EXAM ENTER,按照页面相关提示,进入考试报名界面,选择相关报考科目,报名即可。

为什么要报考ACC呢?ACCA是面向国际的“职场黄金文凭”。ACCA就业前景来说目前国内人才缺口大,岗位年薪高,职业发展空间大,是外企招聘财务经理,财务总监等岗位优先录用的条件之一。

俗话说,辛勤耕作十二载,知识田里成果现。考场之上奋笔书,难易题目都做完。ACCAer,为了更好的明天,一起加油吧!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

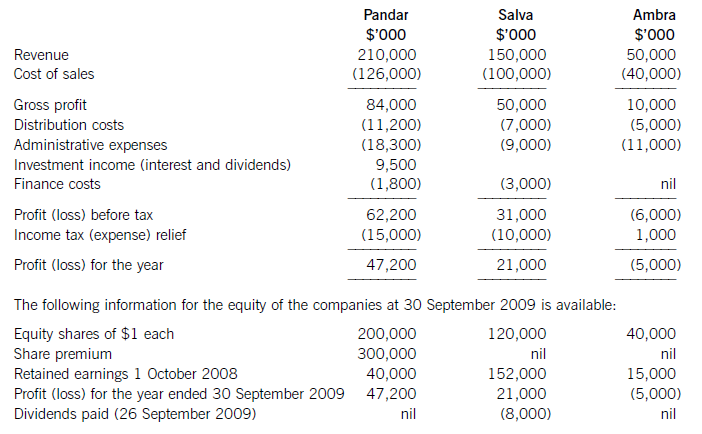

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

(d) Calculate the ex dividend share price predicted by the dividend growth model and discuss the company’s

view that share price growth of at least 8% per year would result from expanding into the retail camera

market. Assume a cost of equity capital of 11% per year. (6 marks)

(d) The dividend growth model calculates the ex div share price from knowledge of the cost of equity capital, the expected growth

rate in dividends and the current dividend per share (or next year’s dividend per share). Using the formula given in the

formulae sheet, the dividend growth rate expected by the company of 8% per year and the decreased dividend of 7·5p per

share:

Share price = (7·5 x 1·08)/(0·11 – 0·08) = 270p or £2·70

This is the same as the share price prior to the announcement (£2·70) and so if dividend growth of 8% per year is achieved,

the dividend growth model forecasts zero share price growth. The share price growth claim made by the company regarding

expansion into the retail camera market cannot therefore be substantiated.

In fact, a lower future share price of £2·49 was predicted by applying the current price-earnings ratio to the earnings per

share resulting from the proposed expansion. If this estimate is correct, a fall in share price of 7% can be expected.

The share price predicted by the dividend growth model of £2·70 would require an after-tax return on the proposed expansion

of 11·66%, which is more than the 9% predicted by the Board. The current return on shareholders’ funds is 7·5% (4·5/60),

but in 2005 it was 12·8% (7·3/57), so 11·66% may be achievable, but looks unlikely.

Since the market price fell from £2·70 to £2·45 following the announcement, it appears that the market does not believe

that the forecast dividend growth can be achieved.

(b) Prepare a consolidated statement of financial position of the Ribby Group at 31 May 2008 in accordance

with International Financial Reporting Standards. (35 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-04-09

- 2020-02-01

- 2021-01-13

- 2019-12-29

- 2020-09-04

- 2020-01-10

- 2020-09-03

- 2021-01-29

- 2021-01-16

- 2020-01-09

- 2020-08-14

- 2021-01-22

- 2020-08-14

- 2020-04-15

- 2019-03-08

- 2020-01-09

- 2020-01-30

- 2020-02-27

- 2021-02-02

- 2020-08-14

- 2020-01-09

- 2020-07-04

- 2020-01-08

- 2020-01-10

- 2021-02-25

- 2020-01-10

- 2020-05-05

- 2021-04-17

- 2021-01-22

- 2020-01-10