ACCA考试报名的具体方法,速度了解一下!

发布时间:2020-04-11

关于ACCA考试报名的具体方法有哪些?不知道的小伙伴快跟着51题库考试学习网一起来了解一下吧!

为了帮助大家准确地报考ACCA,51题库考试学习网特意为大家分享了一套详细的ACCA考试注册报名流程,如果你还不知道怎么报考ACCA,请仔细阅读。

ACCA注册成功后按照以下方法进行考试报名:

1、登录ACCA官网,然后进入MY ACCA

2、在登录界面输入ACCA注册号以及密码

3、登录到MY ACCA之后点击进入左边的EXAM ENTRY

4、点击“EXAM ENTRY”后出现的是考试费情况,点击Enter for Exams

5、选择考试季,点击下拉框选择考试季,显示如下点击“Apply for Exam session”

6、选择ACCA考试科目,在select exam下面的方框打钩,exam type选择“computer based“or”paper based“,没有选项的默认为paper

based,选择考试国家和地点,然后点击next

7、再次确认考试信息和支付金额,如果有欠费,或是年费,在myACCA account balance due后面会显示金额。

8、选择支付方式,支付宝or信用卡(1)选择信用卡,填写Card Number(卡号)、Card Holder Name(持卡人姓名)、Card expiry Date(有效期)、CVC(安全码)、点击“next“acca报名官网是www.accaglobal.com

ACCA考试一直被当作是难度最大的会计资格考试之一,一方面是因为它是全英文的考试,其次还与它的13门考试有关。据了解,在以往报考ACCA的考生当中,能够一次备考的人远不足50%,换句话说,对于大多数ACCA学员来说都要经历挂科重考。

ACCA就业发展前景:

ACCA在全球拥有超过7,500家认可雇主,104个代表处,学员会员遍布179个国家,另外还有海外版的ACCA职位公告板帮助您轻松发现职业发展机会。

ACCA共有超过35,000家企业认可,招聘信息都发在ACCA官网职位公告板上,行业覆盖金融服务业、房地产、快速消费品、管理咨询、政府与公共部门等20多个领域。目前日均在线招聘职位数量维持在6000-8000个,其中60%为财务经理、财务总监及以上职位。

其中在中国共有700多家企业认可雇主,除此之外还有外企、民企、国企等各大企业机构发布的大量职位也列明优先选择ACCA。

无论你是刚准备进入职场的新人,还是寻求职场突破的精英人士,成为ACCA会员后,都可以免费通过ACCA职位公告板,为职业生涯的进阶加速。

以上就是51题库考试学习网带给大家的内容,如果遇到其他不能解决的问题,请及时反馈给51题库考试学习网,我们会尽快帮你解答。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

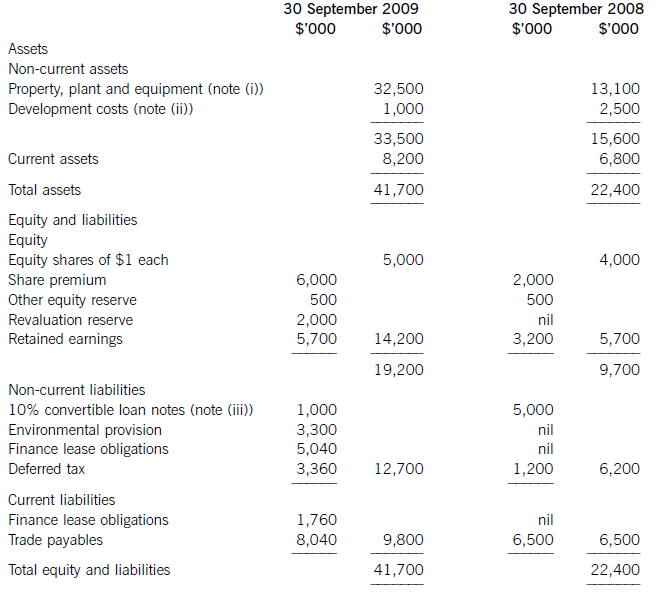

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

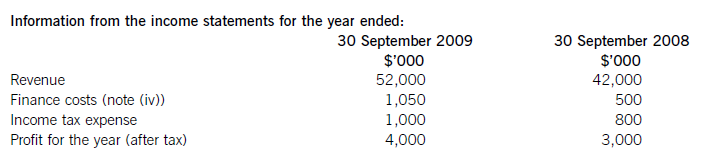

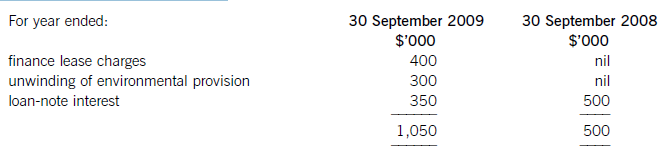

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced.

(c) Briefly discuss why the directors of HFL might choose contract D irrespective of whether or not contract D

would have been selected using expected values as per part (a). (2 marks)

(c) The directors might select Contract D under which 360,000 kilograms of organic mushrooms would be supplied to HFL for

each outlet. This is the entire capacity of HFL which would ensure that competitors would not be able to supply the same

product and hence the competitive advantage held by HFL might be preserved.

(b) Explain the advantages and the disadvantages of:

(i) the face to face interview between two people; (6 marks)

(b) (i) The face to face interview is the most common form. of interview. In this situation the candidate is interviewed by a single representative of the employing organisation.

The advantages of such interviews are that they establish an understanding between the participants, are cost effective for the organisation (only one member of the organisation’s staff is involved) and, because of the more personal nature, ensure that candidates feel comfortable.

The disadvantages are that the selection interview relies on the views and impression of a single interviewer that can be both subjective and biased. In addition, the interviewer may be selective in questioning and it is easier for the candidate to hide weaknesses or lack of ability.

(b) Criticise the internal control and internal audit arrangements at Gluck and Goodman as described in the case

scenario. (10 marks)

(b) Criticisms

The audit committee is chaired by an executive director. One of the most important roles of an audit committee is to review

and monitor internal controls. An executive director is not an independent person and so having Mr Chester as chairman

undermines the purpose of the committee as far as its role in governance is concerned.

Mr Chester, the audit committee chairman, considers only financial controls to be important and undermines the purpose of

the committee as far as its role in governance is concerned. There is no recognition of other risks and there is a belief that

management accounting can provide all necessary information. This viewpoint fails to recognise the importance of other

control mechanisms such as technical and operational controls.

Mr Hardanger’s performance was trusted without supporting evidence because of his reputation as a good manager. An audit

committee must be blind to reputation and treat all parts of the business equally. All functions can be subject to monitor and

review without ‘fear or favour’ and the complexity of the production facility makes it an obvious subject of frequent attention.

The audit committee does not enjoy the full support of the non-executive chairman, Mr Allejandra. On the contrary in fact,

he is sceptical about its value. In most situations, the audit committee reports to the chairman and so it is very important

that the chairman protects the audit committee from criticism from executive colleagues, which is unlikely given the situation

at Gluck and Goodman.

There is no internal auditor to report to the committee and hence no flow of information upon which to make control decisions.

Internal auditors are the operational ‘arms’ of an audit committee and without them, the audit committee will have little or no

relevant data upon which to monitor and review control systems in the company.

The ineffectiveness of the internal audit could increase the cost of the external audit. If external auditors view internal controls

as weak they would be likely to require increased attention to audit trails, etc. that would, in turn, increase cost.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-08

- 2020-03-26

- 2020-03-05

- 2020-03-12

- 2020-01-10

- 2020-03-11

- 2020-04-03

- 2020-03-11

- 2020-01-09

- 2020-04-18

- 2020-03-14

- 2020-03-07

- 2020-04-21

- 2020-01-10

- 2019-07-21

- 2020-01-09

- 2020-03-05

- 2019-12-29

- 2020-02-29

- 2021-06-25

- 2020-01-09

- 2020-01-09

- 2020-03-05

- 2020-04-08

- 2020-01-10

- 2020-01-14

- 2020-01-10

- 2020-03-13

- 2019-03-30

- 2020-03-12