大学生如何在CPA和ACCA中选择?

发布时间:2021-05-08

最近有很多大学生都在问在校期间CPA和ACCA到底应该考哪一个?这两个证书的难度如何?应该怎么选择?下面51题库考试学习网就带大家一起来了解一下!

ACCA和CPA作为财会领域的顶尖证书,是非常具有含金量和说服力的,以后想从事财会金融方面工作的学生,这两个证书是最佳的选择。对于刚上大学的学生,有很多的空闲时间学习新知识,为之后找工作和职场打拼提前做准备。

但是问题来了,CPA和ACCA怎么选择呢?在大学有限的时间里应该选择哪个呢?这是很大的一个问题。那么就让我们来看看大学期间到底怎么安排吧。

从时间上看:CPA只有拿到毕业证之后才可以考,但是ACCA大学在读期间就可以考,在这期间可以合理的利用好时间差:从大一开始先考ACCA,差不多两年半的时间就可以考完。然后在大四的时候准备CPA考试。利用好大学四年,一举拿下财会界的两大证书!

从内容上看:ACCA的课程知识更倾向商业综合思维性,考试中有很多需要分析与大段论述的内容,对思维能力,逻辑能力,分析能力都有一定的要求。这也证明了这是一门更全面,更综合的考试,不在于培养传统会计从业人员,而在于培养具有较强综合素质的管理人才。大学期间,许多报考ACCA的同学都能在商赛中脱颖而出,同时也收获了许多知名企业的offer,也从侧面体现了ACCA的学习对综合素质与职业素养有很高要求。

如果想要顺利考过CPA,主要靠背诵,CPA是能力检测的考试,而且不光是会计,还会涉及很多其他学科的知识。先把ACCA考完,有一定的理论基础后,再学习CPA会有很大的帮助。

只要踏进了财会行业,考证就是必经之路,各位小伙伴可以趁着年轻,趁着有时间和激情,把该考证书的都考完了,以后就能轻松一些。大学的时间很宝贵,大家根据自己的实际情况,合理安排好时间,争取大学在校期间先把ACCA考完,毕业后把CPA考过。

以上就是整篇文章的全部内容了,希望这篇文章对大家有所帮助。祝愿大家早日拿到证书,积极备考,取得满意的成绩。更多考试资讯可以持续关注51题库考试学习网。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Briefly explain the two types of informal communication known as the grapevine and rumour. (6 marks)

(b) The grapevine and rumour are the two main types of informal communication.

The grapevine is probably the best known type of informal communication. All organisations have a grapevine and it will thrive if there is lack of information and consequently employees will make assumptions about events. In addition, insecurity,gossip about issues and fellow employees, personal animosity between employees or managers or new information that has not yet reached the formal communication system, will all drive the grapevine.

Rumours are the other main informal means of communication and are often active if there is a lack of formal communication.A rumour is inevitably a communication not based on verified facts and may therefore be true or false. Rumours travel quickly(often quicker than both the formal system and the grapevine) and can influence those who hear them and cause confusion,especially if bad news is the basis of the rumour. Managers must ensure that the formal communication system is such that rumours can be stopped, especially since they can have a serious negative effect on employees.

(b) Assess the benefits of the separation of the roles of chief executive and chairman that Alliya Yongvanich

argued for and explain her belief that ‘accountability to shareholders’ is increased by the separation of these

roles. (12 marks)

(b) Separation of the roles of CEO and chairman

Benefits of separation of roles

The separation of the roles of chief executive and chairman was first provided for in the UK by the 1992 Cadbury provisions

although it has been included in all codes since. Most relevant to the case is the terms of the ICGN clause s.11 and OECD

VI (E) both of which provide for the separation of these roles. In the UK it is covered in the combined code section A2.

The separation of roles offers the benefit that it frees up the chief executive to fully concentrate on the management of the

organisation without the necessity to report to shareholders or otherwise become distracted from his or her executive

responsibilities. The arrangement provides a position (that of chairman) that is expected to represent shareholders’ interests

and that is the point of contact into the company for shareholders. Some codes also require the chairman to represent the

interests of other stakeholders such as employees.

Having two people rather than one at the head of a large organisation removes the risks of ‘unfettered powers’ being

concentrated in a single individual and this is an important safeguard for investors concerned with excessive secrecy or

lack of transparency and accountability. The case of Robert Maxwell is a good illustration of a single dominating

executive chairman operating unchallenged and, in so doing, acting illegally. Having the two roles separated reduces

the risk of a conflict of interest in a single person being responsible for company performance whilst also reporting on

that performance to markets. Finally, the chairman provides a conduit for the concerns of non-executive directors who,

in turn, provide an important external representation of external concerns on boards of directors.

Tutorial note: Reference to codes other than the UK is also acceptable. In all cases, detailed (clause number) knowledge

of code provisions is not required.

Accountability and separation of roles

In terms of the separation of roles assisting in the accountability to shareholders, four points can be made.

The chairman scrutinises the chief executive’s management performance on behalf of the shareholders and will be

involved in approving the design of the chief executive’s reward package. It is the responsibility of the chairman to hold

the chief executive to account on shareholders’ behalfs.

Shareholders have an identified person (chairman) to hold accountable for the performance of their investment. Whilst

day-to-day contact will normally be with the investor relations department (or its equivalent) they can ultimately hold

the chairman to account.

The presence of a separate chairman ensures that a system is in place to ensure NEDs have a person to report to outside the

executive structure. This encourages the freedom of expression of NEDs to the chairman and this, in turn, enables issues to

be raised and acted upon when necessary.

The chairman is legally accountable and, in most cases, an experienced person. He/she can be independent and more

dispassionate because he or she is not intimately involved with day-to-day management issues.

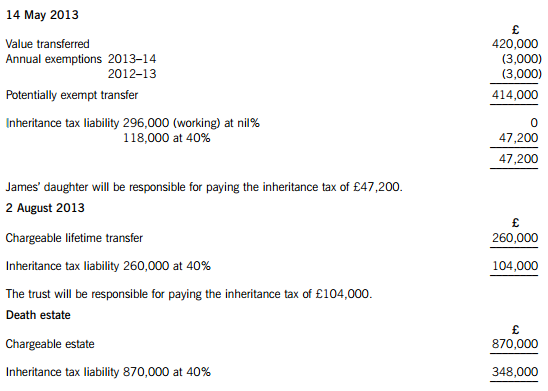

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

(b) GHG has always used local labour to build and subsequently operate hotels. The directors of GHG are again

considering employing a local workforce not only to build the hotel but also to operate it on a daily basis.

Required:

Explain TWO ways in which the possibility of cultural differences might impact on the performance of a local

workforce in building and operating a hotel in Tomorrowland. (6 marks)

(b) The directors of GHG should be mindful that the effectiveness of a locally employed workforce within Tomorrowland will be

influenced by a number of factors including the following:

The availability of local skills

If Tomorrowland is a lower wage economy it is quite conceivable that a sufficient number of employees possessing the

requisite skills to undertake the construction of a large hotel cannot be found. If there are insufficient local resources then this

would necessitate the training of employees in all aspects of building construction. This will incur significant costs and time

and needs to be reflected in any proposed timetable for construction of the hotel. As far as the operation of the hotel is

concerned then staff will have to be recruited and trained which will again give rise to significant start-up costs. However, this

should not present the directors of GHG with such a major problem as that of training construction staff. Indeed, it is highly

probable that GHG would use its own staff in order to train new recruits.

Attitudes to work

The prevailing culture within Tomorrowland will have a profound impact on attitudes to work of its population. Attitudes to

hours of work, timekeeping and absenteeism vary from culture to culture. For example, as regards hours of work in the

construction industry in countries which experience very hot climates, work is often suspended during the hottest part of each

day and recommenced several hours later when temperatures are much cooler. The directors of GHG need to recognise that

climatic conditions not only affect the design of a building but also its construction.

A potentially sensitive issue within regarding the use of local labour in the construction of the hotel lies in the fact that national

holidays and especially religious holidays need to be observed and taken into consideration in any proposed timetable for

construction of the hotel. As regards the operation of a hotel then consideration needs to be given to the different cultures

from which the guests come. For example, this will require a detailed consideration of menus to be offered. However, it might

well be the case that the local population might be unwilling to prepare dishes comprising ingredients which are unacceptable

to their culture due to, for example, religious beliefs.

(Note: other relevant factors would be acceptable.)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-02-08

- 2020-03-07

- 2019-01-11

- 2020-01-15

- 2020-02-21

- 2020-01-10

- 2020-03-25

- 2020-02-19

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-01-09

- 2019-03-27

- 2020-01-10

- 2020-04-11

- 2019-11-27

- 2020-01-01

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-05-15

- 2020-04-29

- 2021-06-27

- 2020-01-10

- 2020-04-22

- 2020-01-10