ACCA和CPA考试通过率哪个更高,哪个证书更容易,报考ACCA最快多久能考完

发布时间:2020-01-13

ACCA和CPA考试通过率哪个更高呢?哪个证书更容易呢?报考ACCA最快多久能考完?今天51题库考试学习网就来为大家详细解答。

ACCA和CPA同为注册会计师,不过不同的是,一个是国内唯一的注册会计师资格,一个是英国的注册会计师,在我国又被叫做国际注册会计师。两者都是国内比较流行的会计资格,认可度和含金量差异并不算大,但在考试通过率方面,两者的区别较为明显。

ACCA和CPA通过率哪个更高?两大证书的考试哪个更容易?

ACCA,首先作为一个西方的资格考试,它绝不是一个简单的考试,如果简单也就没什么含金量了。那它的难度究竟如何呢?ACCA的课程是使学员由浅入深地全面掌握财务、财务管理、审计、税收及经营战略等方面的专业知识,提升财务英语水平、分析能力并拓宽战略思维。

全球通过率单科基本维持在40-60%左右,低级别科目通过率甚至更高,这是因为ACCA不去刻意控制通过率,当学员的真实水平达到及格标准的时候,往往都会通过考试。

ACCA注重的是实际能力的应用和思维的开发,所以ACCA的考题与实际应用联系的非常紧密,完全没有刁钻的感觉。在专业财务知识部分,ACCA的难度甚至要低于会计中级职称考试。总体来说,只要你有一定的思考能力,并且能够坚持刻苦学习,就一定会通过考试。

而CPA的难是公认的,虽然在中国每年都有十万人参加注册会计师考试,但它的平均通过仅有9-10%左右。这个结果除了学习时间和精力的局限之外,更多是因为为了控制通过率,考官们往往会呈现一些偏题和怪题,所以非常努力却没有通过考试的人大有人在。

从通过率上来看,ACCA要远高于CPA,这就是为什么越来越多的在职人士和大学生都喜欢报考ACCA,来提高自己的竞争力了。不过,需要知道的是,ACCA虽然通过率较高,但是科目较多,费用相对也略高一点,所以一旦开始报考ACCA,就要坚持不懈地学习下去,切勿半途而废。

报考ACCA最快多久能考完?

ACCA有4次考季,每次考季最多可以通过4门,而ACCA考试只需要13门科目,因此财会高手去考最快1年半内就可以通过了。但一般财会学员来说,1年内考出还是有点困难的,因此可以花2年左右考完全科。如果学习能力比较差或者财会基础比较薄弱的话,可能需要3年甚至更久了。

今日分享时间到此结束啦,如果大家觉得意犹未尽,还想了解更多内容的话,敬请关注51题库考试学习网。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Describe the basis for the calculation of the provision for deferred taxation on first time adoption of IFRS

including the provision in the opening IFRS balance sheet. (4 marks)

(ii) A company has to apply IAS12 to the temporary differences between the carrying amount of the assets and liabilities in

its opening IFRS balance sheet (1 November 2003) and their tax bases (IFRS1 ‘First time adoption of IFRS’). The

deferred tax provision will be calculated using tax rates that have been enacted or substantially enacted by the balance

sheet date. The carrying values of the assets and liabilities at the opening balance sheet date will be determined by

reference to IFRS1 and will use the applicable IFRS in the first IFRS financial statements. Any adjustments required to

the deferred tax balance will be recognised directly in retained earnings.

Subsequent balance sheets (at 31 October 2004 and 31 October 2005) will be drawn up using the IFRS used in the

financial statements to 31 October 2005. The deferred tax provision will be adjusted as at 31 October 2004 and thenas at 31 October 2005 to reflect the temporary differences arising at those dates.

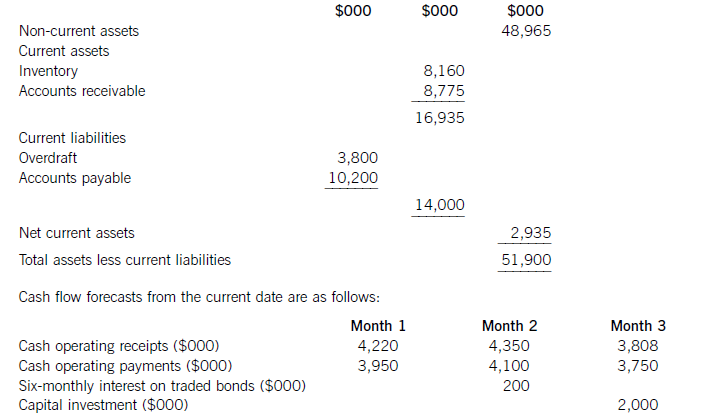

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts.

4 Chris Jones is Managing Director of Supaserve, a medium-sized supermarket chain faced with intense competition

from larger competitors in their core food and drink markets. They are also finding it hard to respond to these

competitors moving into the sale of clothing and household goods. Supaserve has a reputation for friendly customer

care and is looking at the feasibility of introducing an online shopping service, from which customers can order goods

from the comfort of their home and have them delivered, for a small charge, to their home.

Chris recognises that the move to develop an online shopping service will require significant investment in new

technology and support systems. He hopes a significant proportion of existing and most importantly, new customers,

will be attracted to the new service.

Required:

(a) What bases for segmenting this new market would you recommend and what criteria will help determine

whether this segment is sufficiently attractive to commit to the necessary investment? (10 marks)

(a) E-commerce is transforming many of the traditional relationshps between supplier and customer and retailing is no exception.

In broad terms, electronic commerce is defined as ‘the use of electronic networks to facilitate commercial transactions’. In

terms of tangible goods, such as supermarket shopping, it enables online ordering and delivery direct to the customer and

represents a significant move away from the well-established retail formats. Benefits to companies using electronic commerce

have seen companies increase their sales by 10–20% and reduce costs by 20–45%. However, in a significant sized business

like Supaserve the investment costs are high, affecting profit margins and making for more intense competition.

Business-to-consumer electronic commerce is argued to face more barriers to growth than its business-to-business equivalent

and is at an earlier stage in its lifecycle. Issues surrounding the potential for fraud, security of payments, privacy of personal

data and difficulties in accessing electronic retailers, explain this slower start for the retailing side of electronic commerce.

Clearly, for the move to be successful in Supaserve there needs to be a sufficiently large number of customers who can be

persuaded to use the service. This, in turn, will reflect the number of homes with computers and online capabilities. However,

the traditional retailer with a trusted brand and reputation is often in a better position than the specialist online retailer with

no physical stores.

Assessing the size and defining characteristics or attributes of the customer segment likely to use the online shopping service

is an interesting task. There is evidence to suggest that age may be a key factor, with electronic retailing appealing to younger

customers familiar with using information technology. Income may be an important way of segmenting the market, with online

shopping appealing to those families with high disposable income, access to computers and a lifestyle. where leisure time

is valued. Chris’s knowledge of his current customer base will be important in positioning them at various stages of their

lifecycle – does the company appeal to young families with heavy shopping demands? Further insight into buying behaviour

will come from geodemographic segmentation where the combination of where a customer lives and the stage in their

particular shopping lifecycle will give real insights into their buying behaviour and willingness or otherwise to use electronic

shopping.

Essentially, Chris has to come to a decision on whether there is a combination of characteristics that form. a significant

segment willing to use online shopping. This will enable him to decide how it can be measured, whether it is big enough to

make the investment in online shopping worthwhile, can it be accessed and whether it is sufficiently distinct to cater for itsparticular needs.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-04-14

- 2020-04-09

- 2020-05-15

- 2020-05-16

- 2020-01-10

- 2020-01-27

- 2020-01-10

- 2020-04-05

- 2020-05-08

- 2020-01-10

- 2020-04-21

- 2020-03-07

- 2020-01-29

- 2019-06-27

- 2020-03-08

- 2020-01-10

- 2020-02-02

- 2020-01-09

- 2020-03-08

- 2020-05-16

- 2020-08-14

- 2020-01-10

- 2021-07-28

- 2020-01-09

- 2021-06-03

- 2020-05-20

- 2020-04-18

- 2020-04-15

- 2020-05-14