考研和考ACCA哪个对求职帮助更大?

发布时间:2021-10-18

相信很多小伙伴们不论选择考研还是考ACCA证书,都只有一个目的:为了以后的就业、为了个人的求职晋升、为了一份高薪工作。那么考研和考ACCA证书哪个选择对个人求职帮助更大?下面就让51题库考试学习网为你解答一下吧!

一、对于特别注重文凭的同学来说,除了出国还可以选择考研。

一般来说,考研从大三开始着手准备即可。但前提是知道自己想要获得什么,如果能凭借研究生文凭为自己打开更好的局面,考研是不错的选择。如果自己都不知道为什么要考研,建议还是不要浪费时间。身边就有这样的例子:大三的时候室友纷纷考研,问过其中一位室友考研的目标为何,她说不想提早进入社会,还想再享受几年校园生活。如果抱有这样的态度,是万万不可的,校园生活虽然很美好,但安逸的环境极易消磨一个人的斗智,对未来的就业并无好处。

二、对于毕业就想工作的同学来说,考取ACCA证书是最佳选择之一。

对很多同学来讲,考取ACCA是证明自己能力的途径,其高含金量还有助于自己获得更多优质雇主的青睐。因此对毕业即想参加工作的同学来说,考取ACCA认证能为自己打开更好的局面。

如果你是会计、金融之类专业的同学,具备一定的基础,学习ACCA会相对轻松,甚至还可以免试部分科目。如果你是非相关专业的同学,ACCA能够帮你构建起一套全新的知识体系。如果你全科通过了ACCA,还可以获得英国牛津布鲁克斯大学会计学学士学位,这样相当于没考研但取得了双学士学位的学历。

当然,根据个人学习能力不同,全科通过ACCA大约需要2年左右的时间。因此想在毕业前就获得ACCA认证的同学,建议大一、大二期间着手备考。

三、安排好主次

如果只考研或者只考ACCA无法达到你的预期,想要两者兼得就要考验你的学习效率和时间安排把控能力了。

因为大学期间业余时间较充裕,英语基础又比较扎实的同学,十分适合学习ACCA。因此建议同学们可以在本科期间努力学习ACCA,争取考过更多科目。如果到了大三还有未通过的科目,建议不妨先放一放,以最大的精力投入到考研当中。在考研结束后,约有几个月的空闲时期,期间继续抓紧学习ACCA,有利于重新点燃学习热情。

对于考研和考ACCA哪个对个人求职作用帮助更大的问题,一般认为,ACCA认证是专业技能和个人能力的证明,研究生是一份学历认证,关键还是看同学们的个人规划,如果想要进四大,ACCA的优势更大一些,想进体制内工作,研究生文凭更得领导们的认可。

以上就是51题库考试学习网给大家分享的全部内容,希望能够帮到大家!后续请大家持续关注51题库考试学习网,51题库考试学习网将会为大家带来最新的考试资讯!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(iii) Identify and discuss an alternative strategy that may assist in improving the performance of CTC with

effect from 1 May 2009 (where only the products in (a) and (b) above are available for manufacture).

(4 marks)

(iii) If no new products are available then CTC must look to boost revenues obtained from its existing product portolio whilst

seeking to reduce product specific fixed overheads and the company’s other fixed overheads. In order to do this attention

should be focused on the marketing activities currently undertaken.

CTC should consider selling all of its products in ‘multi product’ packages as it might well be the case that the increased

contribution achieved from increased sales volumes would outweigh the diminution in contribution arising from

reductions in the selling price per unit of each product.

CTC could also apply target costing principles in order to reduce costs and thereby increase the margins on each of its

products. Value analysis should be undertaken in order to evaluate the value-added features of each product. For

example, the use of non-combustible materials in manufacture would be a valued added feature of such products

whereas the use of pins and metal fastenings which are potentially harmful to children would obviously not comprise

value added features. CTC should focus on delivering ‘value’ to the customer and in attempting to do so should seek to

identify all non-value activities in order that they may be eliminated and hence margins improved.

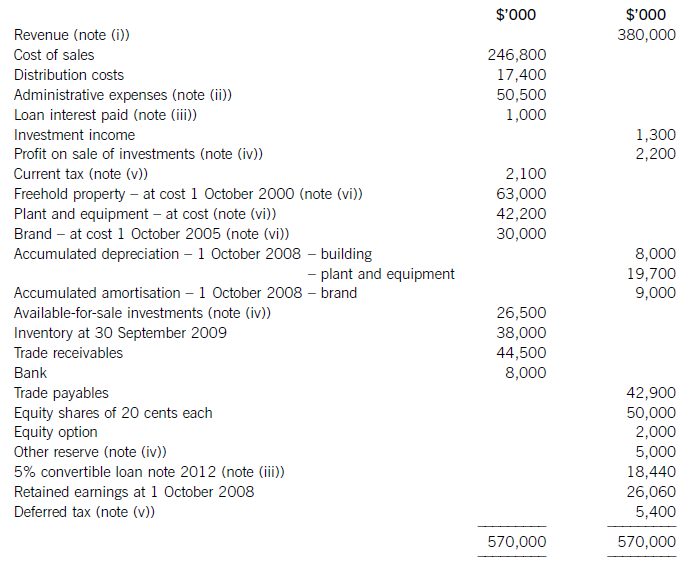

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

(b) Criticise the internal control and internal audit arrangements at Gluck and Goodman as described in the case

scenario. (10 marks)

(b) Criticisms

The audit committee is chaired by an executive director. One of the most important roles of an audit committee is to review

and monitor internal controls. An executive director is not an independent person and so having Mr Chester as chairman

undermines the purpose of the committee as far as its role in governance is concerned.

Mr Chester, the audit committee chairman, considers only financial controls to be important and undermines the purpose of

the committee as far as its role in governance is concerned. There is no recognition of other risks and there is a belief that

management accounting can provide all necessary information. This viewpoint fails to recognise the importance of other

control mechanisms such as technical and operational controls.

Mr Hardanger’s performance was trusted without supporting evidence because of his reputation as a good manager. An audit

committee must be blind to reputation and treat all parts of the business equally. All functions can be subject to monitor and

review without ‘fear or favour’ and the complexity of the production facility makes it an obvious subject of frequent attention.

The audit committee does not enjoy the full support of the non-executive chairman, Mr Allejandra. On the contrary in fact,

he is sceptical about its value. In most situations, the audit committee reports to the chairman and so it is very important

that the chairman protects the audit committee from criticism from executive colleagues, which is unlikely given the situation

at Gluck and Goodman.

There is no internal auditor to report to the committee and hence no flow of information upon which to make control decisions.

Internal auditors are the operational ‘arms’ of an audit committee and without them, the audit committee will have little or no

relevant data upon which to monitor and review control systems in the company.

The ineffectiveness of the internal audit could increase the cost of the external audit. If external auditors view internal controls

as weak they would be likely to require increased attention to audit trails, etc. that would, in turn, increase cost.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-30

- 2020-01-02

- 2019-12-06

- 2020-04-09

- 2020-05-02

- 2020-01-01

- 2020-01-10

- 2020-04-15

- 2020-04-30

- 2020-01-09

- 2020-04-10

- 2019-12-29

- 2019-01-05

- 2020-01-10

- 2020-02-18

- 2020-04-21

- 2021-10-02

- 2020-01-09

- 2020-05-05

- 2020-01-14

- 2020-01-10

- 2020-03-14

- 2020-04-20

- 2020-04-30

- 2021-10-14

- 2020-04-15

- 2021-07-28

- 2020-01-10

- 2020-03-18