ACCA考试P3模拟练习:strategic change

发布时间:2019-01-04

特许公认会计师公会(The

Association of Chartered Certified Accountants)简称ACCA,成立于1904年,是目前世界上领先的专业会计师团体,也是国际学员最多、学员规模发展最快的专业会计师组织。今天我们要看的就是ACCA考试中P3科目的模拟练习,希望大家能从做题过程中提升自己。

Question:Sometimes strategy can come about as a largely unintended result of

the everyday activities, decisions and processes that take place at all levels

within an organisation. What is this type of strategy called?

A.

Rational strategy

B.

Emergent strategy

C.

Strategic drift

D.

Unrealised strategy

The correct answer is: Emergent

strategy.

解析:Emergent

strategy 'emerges' from the activities and processes taking place at all levels

of an organisation, in contrast to strategies that come from top-down intended

managerial processes.

The

test of whether a strategy is realised or unrealised is whether what managers

intended has actually been achieved (realised).

备考之路漫长艰辛,需要大家持之以恒,每天要进行复习,切忌三天打鱼两天晒网,51题库考试学习网会一直在您的身边,支持您,陪伴您。祝愿大家早日功成名就!!!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

The group have now decided to convert their business idea into reality.

(b) What elements should a marketing plan contain to achieve a successful launch of their restaurant?

(8 marks)

(b) The launch of any new business is a critical event and a marketing plan a vital ingredient in achieving launch success. Most

companies will associate a marketing plan with the ever-popular 4 Ps. However, the marketing mix can only be decided once

some fundamental marketing decisions have been taken. Firstly, the group need to clearly identify which segments of the

market they are seeking to attract. Segments are made up of groups of customers with similar needs and expectations. If they

are identifying the student market as an important segment they should recognise that there are very different segments within

this group. They are most likely to want to target those students willing and able to pay for a high quality meal and experience.

They are not in the market for low priced/fast food. This requires them to recognise how they are trying to position their

restaurant – high quality and moderate prices looks to be a combination, which will deliver an attractive service and added

value to the customer. The relationship between the customers’ perception of added value and the price charged is, in terms

of Bowman’s strategy clock, likely to be that of a focused differentiator.

For the Casa del Mediterraneo getting the product or service right will involve a complex co-ordination of many different

activities – from buying the right food through to delivering the orders efficiently. As a service, there may be many more things

that potentially can go wrong and it really does come down to the people delivering the service. This involves one of the

additional ‘P’s, involved in delivering services, namely processes, which together with the physical evidence in the shape of

the restaurant, will have a major say in the success or otherwise of the launch. Clearly, the place and the physical evidence

are one and the same thing and the right location will also affect the success of both the launch and the whole venture.

Pricing in a competitive market will be important and many upmarket restaurants price on the basis of what the market will

bear. There needs to be a clear relationship between the price and the value offered. Finally, promotion is perhaps the key

element in the effective launch of the new restaurant. There will need to be a correct choice of media to reach the targetaudience including the use of web-based advertising to get the restaurant known.

Moonstar Co is a property development company which is planning to undertake a $200 million commercial property development. Moonstar Co has had some difficulties over the last few years, with some developments not generating the expected returns and the company has at times struggled to pay its finance costs. As a result Moonstar Co’s credit rating has been lowered, affecting the terms it can obtain for bank finance. Although Moonstar Co is listed on its local stock exchange, 75% of the share capital is held by members of the family who founded the company. The family members who are shareholders do not wish to subscribe for a rights issue and are unwilling to dilute their control over the company by authorising a new issue of equity shares. Moonstar Co’s board is therefore considering other methods of financing the development, which the directors believe will generate higher returns than other recent investments, as the country where Moonstar Co is based appears to be emerging from recession.

Securitisation proposals

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

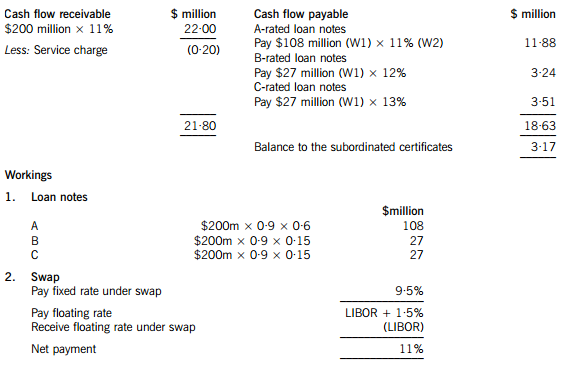

(a) An annual cash flow account compares the estimated cash flows receivable from the property against the liabilities within the securitisation process. The swap introduces leverage into the arrangement.

The holders of the certificates are expected to receive $3·17million on $18 million, giving them a return of 17·6%. If the cash flows are 5% lower than the non-executive director has predicted, annual revenue received will fall to $20·90 million, reducing the balance available for the subordinated certificates to $2·07 million, giving a return of 11·5% on the subordinated certificates, which is below the returns offered on the B and C-rated loan notes. The point at which the holders of the certificates will receive nothing and below which the holders of the C-rated loan notes will not receive their full income will be an annual income of $18·83 million (a return of 9·4%), which is 14·4% less than the income that the non-executive director has forecast.

(b) Benefits

The finance costs of the securitisation may be lower than the finance costs of ordinary loan capital. The cash flows from the commercial property development may be regarded as lower risk than Moonstar Co’s other revenue streams. This will impact upon the rates that Moonstar Co is able to offer borrowers.

The securitisation matches the assets of the future cash flows to the liabilities to loan note holders. The non-executive director is assuming a steady stream of lease income over the next 10 years, with the development probably being close to being fully occupied over that period.

The securitisation means that Moonstar Co is no longer concerned with the risk that the level of earnings from the properties will be insufficient to pay the finance costs. Risks have effectively been transferred to the loan note holders.

Risks

Not all of the tranches may appeal to investors. The risk-return relationship on the subordinated certificates does not look very appealing, with the return quite likely to be below what is received on the C-rated loan notes. Even the C-rated loan note holders may question the relationship between the risk and return if there is continued uncertainty in the property sector.

If Moonstar Co seeks funding from other sources for other developments, transferring out a lower risk income stream means that the residual risks associated with the rest of Moonstar Co’s portfolio will be higher. This may affect the availability and terms of other borrowing.

It appears that the size of the securitisation should be large enough for the costs to be bearable. However Moonstar Co may face unforeseen costs, possibly unexpected management or legal expenses.

(c) (i) Sukuk finance could be appropriate for the securitisation of the leasing portfolio. An asset-backed Sukuk would be the same kind of arrangement as the securitisation, where assets are transferred to a special purpose vehicle and the returns and repayments are directly financed by the income from the assets. The Sukuk holders would bear the risks and returns of the relationship.

The other type of Sukuk would be more like a sale and leaseback of the development. Here the Sukuk holders would be guaranteed a rental, so it would seem less appropriate for Moonstar Co if there is significant uncertainty about the returns from the development.

The main issue with the asset-backed Sukuk finance is whether it would be as appealing as certainly the A-tranche of the securitisation arrangement which the non-executive director has proposed. The safer income that the securitisation offers A-tranche investors may be more appealing to investors than a marginally better return from the Sukuk. There will also be costs involved in establishing and gaining approval for the Sukuk, although these costs may be less than for the securitisation arrangement described above.

(ii) A Mudaraba contract would involve the bank providing capital for Moonstar Co to invest in the development. Moonstar Co would manage the investment which the capital funded. Profits from the investment would be shared with the bank, but losses would be solely borne by the bank. A Mudaraba contract is essentially an equity partnership, so Moonstar Co might not face the threat to its credit rating which it would if it obtained ordinary loan finance for the development. A Mudaraba contract would also represent a diversification of sources of finance. It would not require the commitment to pay interest that loan finance would involve.

Moonstar Co would maintain control over the running of the project. A Mudaraba contract would offer a method of obtaining equity funding without the dilution of control which an issue of shares to external shareholders would bring. This is likely to make it appealing to Moonstar Co’s directors, given their desire to maintain a dominant influence over the business.

The bank would be concerned about the uncertainties regarding the rental income from the development. Although the lack of involvement by the bank might appeal to Moonstar Co's directors, the bank might not find it so attractive. The bank might be concerned about information asymmetry – that Moonstar Co’s management might be reluctant to supply the bank with the information it needs to judge how well its investment is performing.

5 You are an audit manager in Fox & Steeple, a firm of Chartered Certified Accountants, responsible for allocating staff

to the following three audits of financial statements for the year ending 31 December 2006:

(a) Blythe Co is a new audit client. This private company is a local manufacturer and distributor of sportswear. The

company’s finance director, Peter, sees little value in the audit and put it out to tender last year as a cost-cutting

exercise. In accordance with the requirements of the invitation to tender your firm indicated that there would not

be an interim audit.

(b) Huggins Co, a long-standing client, operates a national supermarket chain. Your firm provided Huggins Co with

corporate financial advice on obtaining a listing on a recognised stock exchange in 2005. Senior management

expects a thorough examination of the company’s computerised systems, and are also seeking assurance that

the annual report will not attract adverse criticism.

(c) Gray Co has been an audit client since 1999 after your firm advised management on a successful buyout. Gray

provides communication services and software solutions. Your firm provides Gray with technical advice on

financial reporting and tax services. Most recently you have been asked to conduct due diligence reviews on

potential acquisitions.

Required:

For these assignments, compare and contrast:

(i) the threats to independence;

(ii) the other professional and practical matters that arise; and

(iii) the implications for allocating staff.

(15 marks)

5 FOX & STEEPLE – THREE AUDIT ASSIGNMENTS

(i) Threats to independence

Self-interest

Tutorial note: This threat arises when a firm or a member of the audit team could benefit from a financial interest in, or

other self-interest conflict with, an assurance client.

■ A self-interest threat could potentially arise in respect of any (or all) of these assignments as, regardless of any fee

restrictions (e.g. per IFAC’s ‘Code of Ethics for Professional Accountants’), the auditor is remunerated by clients for

services provided.

■ This threat is likely to be greater for Huggins Co (larger/listed) and Gray Co (requires other services) than for Blythe Co

(audit a statutory necessity).

■ The self-interest threat may be greatest for Huggins Co. As a company listed on a recognised stock exchange it may

give prestige and credibility to Fox & Steeple (though this may be reciprocated). Fox & Steeple could be pressurised into

taking evasive action to avoid the loss of a listed client (e.g. concurring with an inappropriate accounting treatment).

Self-review

Tutorial note: This arises when, for example, any product or judgment of a previous engagement needs to be re-evaluated

in reaching conclusions on the audit engagement.

■ This threat is also likely to be greater for Huggins and Gray where Fox & Steeple is providing other (non-audit) services.

■ A self-review threat may be created by Fox & Steeple providing Huggins with a ‘thorough examination’ of its computerised

systems if it involves an extension of the procedures required to conduct an audit in accordance with International

Standards on Auditing (ISAs).

■ Appropriate safeguards must be put in place if Fox & Steeple assists Huggins in the performance of internal audit

activities. In particular, Fox & Steeple’s personnel must not act (or appear to act) in a capacity equivalent to a member

of Huggins’ management (e.g. reporting, in a management role, to those charged with governance).

■ Fox & Steeple may provide Gray with accounting and bookkeeping services, as Gray is not a listed entity, provided that

any self-review threat created is reduced to an acceptable level. In particular, in giving technical advice on financial

reporting, Fox & Steeple must take care not to make managerial decisions such as determining or changing journal

entries without obtaining Gray’s approval.

■ Taxation services comprise a broad range of services, including compliance, planning, provision of formal taxation

opinions and assistance in the resolution of tax disputes. Such assignments are generally not seen to create threats to

independence.

Tutorial note: It is assumed that the provision of tax services is permitted in the jurisdiction (i.e. that Fox and Steeple

are not providing such services if prohibited).

■ The due diligence reviews for Gray may create a self-review threat (e.g. on the fair valuation of net assets acquired).

However, safeguards may be available to reduce these threats to an acceptable level.

■ If staff involved in providing other services are also assigned to the audit, their work should be reviewed by more senior

staff not involved in the provision of the other services (to the extent that the other service is relevant to the audit).

■ The reporting lines of any staff involved in the audit of Huggins and the provision of other services for Huggins should

be different. (Similarly for Gray.)

Familiarity

Tutorial note: This arises when, by virtue of a close relationship with an audit client (or its management or employees) an

audit firm (or a member of the audit team) becomes too sympathetic to the client’s interests.

■ Long association of a senior member of an audit team with an audit client may create a familiarity threat. This threat

is likely to be greatest for Huggins, a long-standing client. It may also be significant for Gray as Fox & Steeple have had

dealings with this client for seven years now.

■ As Blythe is a new audit client this particular threat does not appear to be relevant.

■ Senior personnel should be rotated off the Huggins and Gray audit teams. If this is not possible (for either client), an

additional professional accountant who was not a member of the audit team should be required to independently review

the work done by the senior personnel.

■ The familiarity threat of using the same lead engagement partner on an audit over a prolonged period is particularly

relevant to Huggins, which is now a listed entity. IFAC’s ‘Code of Ethics for Professional Accountants’ requires that the

lead engagement partner should be rotated after a pre-defined period, normally no more than seven years. Although it

might be time for the lead engagement partner of Huggins to be changed, the current lead engagement partner may

continue to serve for the 2006 audit.

Tutorial note: Two additional years are permitted when an existing client becomes listed, since it may not be in the

client’s best interests to have an immediate rotation of engagement partner.

Intimidation

Tutorial note: This arises when a member of the audit team may be deterred from acting objectively and exercising

professional skepticism by threat (actual or perceived), from the audit client.

■ This threat is most likely to come from Blythe as auditors are threatened with a tendering process to keep fees down.

■ Peter may have already applied pressure to reduce inappropriately the extent of audit work performed in order to reduce

fees, by stipulating that there should not be an interim audit.

■ The audit senior allocated to Blythe will need to be experienced in standing up to client management personnel such as

Peter.

Tutorial note: ‘Correct’ classification under ‘ethical’, ‘other professional’, ‘practical’ or ‘staff implications’ is not as important

as identifying the matters.

(ii) Other professional and practical matters

Tutorial note: ‘Other professional’ includes quality control.

■ The experience of staff allocated to each assignment should be commensurate with the assessment of associated risk.

For example, there may be a risk that insufficient audit evidence is obtained within the budget for the audit of Blythe.

Huggins, as a listed client, carries a high reputational risk.

■ Sufficient appropriate staff should be allocated to each audit to ensure adequate quality control (in particular in the

direction, supervision, review of each assignment). It may be appropriate for a second partner to be assigned to carry

out a ‘hot review’ (before the auditor’s report is signed) of:

– Blythe, because it is the first audit of a new client; and

– Huggins, as it is listed.

■ Existing clients (Huggins and Gray) may already have some expectation regarding who should be assigned to their

audits. There is no reason why there should not be some continuity of staff providing appropriate safeguards are put in

place (e.g. to overcome any familiarity threat).

■ Senior staff assigned to Blythe should be alerted to the need to exercise a high degree of professional skepticism (in the

light of Peter’s attitude towards the audit).

■ New staff assigned to Huggins and Gray would perhaps be less likely to assume unquestioned honesty than staff

previously involved with these audits.

Logistics (practical)

■ All three assignments have the same financial year end, therefore there will be an element of ‘competition’ for the staff

to be assigned to the year-end visits and final audit assignments. As a listed company, Huggins is likely to have the

tightest reporting deadline and so have a ‘priority’ for staff.

■ Blythe is a local and private company. Staff involved in the year-end visit (e.g. to attend the physical inventory count)

should also be involved in the final audit. As this is a new client, staff assigned to this audit should get involved at every

stage to increase their knowledge and understanding of the business.

■ Huggins is a national operation and may require numerous staff to attend year-end procedures. It would not be expected

that all staff assigned to year-end visits should all be involved in the final audit.

Time/fee/staff budgets

■ Time budgets will need to be prepared for each assignment to determine manpower requirements (and to schedule audit

work).

(iii) Implications for allocating staff

■ Fox & Steeple should allocate staff so that those providing other services to Huggins and Gray (that may create a selfreview

threat) do not participate in the audit engagement.

Competence and due care (Qualifications/Specialisation)

■ All audit assignments will require competent staff.

■ Huggins will require staff with an in-depth knowledge of their computerised system.

■ Gray will require senior audit staff to be experienced in financial reporting matters specific to communications and

software solutions (e.g. in revenue recognition issues and accounting for internally-generated intangible assets).

■ Specialists providing tax services and undertaking the due diligence reviews for Gray may not be required to have any

involvement in the audit assignment.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-01-04

- 2019-01-04

- 2019-01-04

- 2019-01-04

- 2019-01-04

- 2019-01-04