美国哪些城市可以考ACCA呐?

发布时间:2021-05-12

美国哪些城市可以考ACCA呐?

最佳答案

ACCA作为国际注册会计,全球都会有考点的,美国纽约有设考点的,国内也有很多考点。如果是在美国读书或者工作,那么可以报考美国考点,如果在国内可以直接报考国内考点,考试内容均相同的。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) You are an audit manager in a firm of Chartered Certified Accountants currently assigned to the audit of Cleeves

Co for the year ended 30 September 2006. During the year Cleeves acquired a 100% interest in Howard Co.

Howard is material to Cleeves and audited by another firm, Parr & Co. You have just received Parr’s draft

auditor’s report for the year ended 30 September 2006. The wording is that of an unmodified report except for

the opinion paragraph which is as follows:

Audit opinion

As more fully explained in notes 11 and 15 impairment losses on non-current assets have not been

recognised in profit or loss as the directors are unable to quantify the amounts.

In our opinion, provision should be made for these as required by International Accounting Standard 36

(Impairment). If the provision had been so recognised the effect would have been to increase the loss before

and after tax for the year and to reduce the value of tangible and intangible non-current assets. However,

as the directors are unable to quantify the amounts we are unable to indicate the financial effect of such

omissions.

In view of the failure to provide for the impairments referred to above, in our opinion the financial statements

do not present fairly in all material respects the financial position of Howard Co as of 30 September 2006

and of its loss and its cash flows for the year then ended in accordance with International Financial Reporting

Standards.

Your review of the prior year auditor’s report shows that the 2005 audit opinion was worded identically.

Required:

(i) Critically appraise the appropriateness of the audit opinion given by Parr & Co on the financial

statements of Howard Co, for the years ended 30 September 2006 and 2005. (7 marks)

(b) (i) Appropriateness of audit opinion given

Tutorial note: The answer points suggested by the marking scheme are listed in roughly the order in which they might

be extracted from the information presented in the question. The suggested answer groups together some of these

points under headings to give the analysis of the situation a possible structure.

Heading

■ The opinion paragraph is not properly headed. It does not state the form. of the opinion that has been given nor

the grounds for qualification.

■ The opinion ‘the financial statements do not give a true and fair view’ is an ‘adverse’ opinion.

■ That ‘provision should be made’, but has not, is a matter of disagreement that should be clearly stated as noncompliance

with IAS 36. The title of IAS 36 Impairment of Assets should be given in full.

■ The opinion should be headed ‘Disagreement on Accounting Policies – Inappropriate Accounting Method – Adverse

Opinion’.

1 ISA 250 does not specify with whom agreement should be reached but presumably with those charged with corporate governance (e.g audit committee or

2 other supervisory board).

20

6D–INTBA

Paper 3.1INT

Content

■ It is appropriate that the opinion paragraph should refer to the note(s) in the financial statements where the matter

giving rise to the modification is more fully explained. However, this is not an excuse for the audit opinion being

‘light’ on detail. For example, the reason for impairment could be summarised in the auditor’s report.

■ The effects have not been quantified, but they should be quantifiable. The maximum possible loss would be the

carrying amount of the non-current assets identified as impaired.

■ It is not clear why the directors have been ‘unable to quantify the amounts’. Since impairments should be

quantifiable any ‘inability’ suggest a limitation in scope of the audit, in which case the opinion should be disclaimed

(or ‘except for’) on grounds of lack of evidence rather than disagreement.

■ The wording is confusing. ‘Failure to provide’ suggests disagreement. However, there must be sufficient evidence

to support any disagreement. Although the directors cannot quantify the amounts it seems the auditors must have

been able to (estimate at least) in order to form. an opinion that the amounts involved are sufficiently material to

warrant a qualification.

■ The first paragraph refers to ‘non-current assets’. The second paragraph specifies ‘tangible and intangible assets’.

There is no explanation why or how both tangible and intangible assets are impaired.

■ The first paragraph refers to ‘profit or loss’ and the second and third paragraphs to ‘loss’. It may be clearer if the

first paragraph were to refer to recognition in the income statement.

■ It is not clear why the failure to recognise impairment warrants an adverse opinion rather than ‘except for’. The

effects of non-compliance with IAS 36 are to overstate the carrying amount(s) of non-current assets (that can be

specified) and to understate the loss. The matter does not appear to be pervasive and so an adverse opinion looks

unsuitable as the financial statements as a whole are not incomplete or misleading. A loss is already being reported

so it is not that a reported profit would be turned into a loss (which is sometimes judged to be ‘pervasive’).

Prior year

■ As the 2005 auditor’s report, as previously issued, included an adverse opinion and the matter that gave rise to

the modification:

– is unresolved; and

– results in a modification of the 2006 auditor’s report,

the 2006 auditor’s report should also be modified regarding the corresponding figures (ISA 710 Comparatives).

■ The 2006 auditor’s report does not refer to the prior period modification nor highlight that the matter resulting in

the current period modification is not new. For example, the report could say ‘As previously reported and as more

fully explained in notes ….’ and state ‘increase the loss by $x (2005 – $y)’.

3 The managers of Daylon plc are reviewing the company’s investment portfolio. About 15% of the portfolio is represented by a holding of 5,550,000 ordinary shares of Mondglobe plc. The managers are concerned about the effect on portfolio value if the price of Mondglobe’s shares should fall, and are considering selling the shares. Daylon’s investment bank has suggested that the risk of Mondglobe’s shares falling by more than 5% from their current value could be protected against by buying an over the counter option. The investment bank is prepared to sell an appropriate six month option to Daylon for £250,000.

Other information:

(i) The current market price of Mondglobe’s ordinary shares is 360 pence.

(ii) The annual volatility (variance) of Mondglobe’s shares for the last year was 169%.

(iii) The risk free rate is 4% per year.

(iv) No dividend is expected to be paid by Mondglobe during the next six months.

Required:

(a) Evaluate whether or not the price at which the investment bank is willing to sell the option is a fair price.(10 marks)

3 (a) The investment bank is offering to sell to Daylon plc an option to sell Mondglobe ordinary shares at a price no worse than 5% below the current market price of 360 pence. This is a put option on Mondglobe shares at a price of 342 pence. The Black-Scholes option pricing model may be used to estimate whether or not the option price is a fair price. The value of a put option may be found by first estimating the value of a call option and then using the put-call parity theorem.

Basic data:

Share price 360 pence

Exercise price 342 pence

Risk free rate 4% (0·04)

Volatility is measured by the standard deviation. The variance is 169% therefore the standard deviation, σ is 13% (0·13)

The relevant period is six months (0·5)

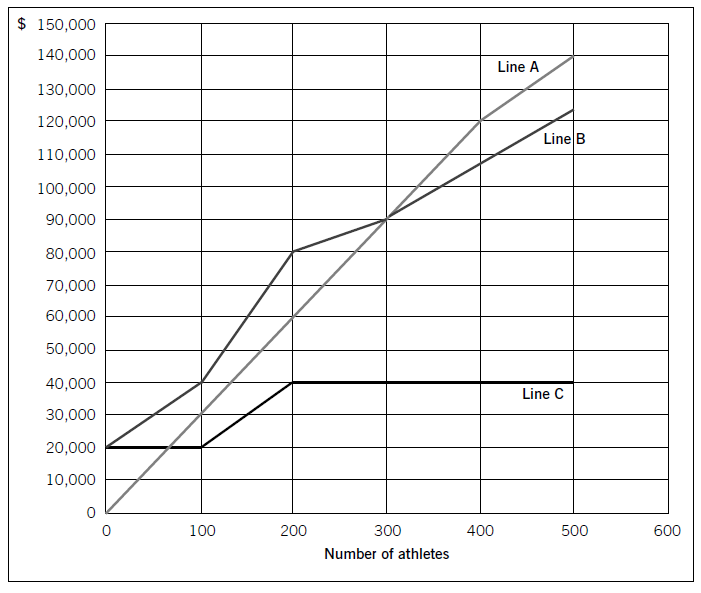

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

(a)ThebreakevensalesrevenueforSwimCois$90,000.Thecompany’sprofit,tothenearest$10,000,if500athletesattendthecourseis$20,000($140,000–$120,000).(Fromthegraph,itisclearthatthepreciseamountwillbenearer$17,000,i.e.$140,000–approximately$123,000.)(b)CoststructureFromthechart,itisclearthatLineCrepresentsfixedcosts,LineBrepresentstotalcostsandLineArepresentstotalrevenue.LineCshowsthatinitially,fixedcostsare$20,000evenifnoathletesattendthecourse.Thisleveloffixedcostsremainsthesameif100athletesattendbutoncethenumberofattendeesincreasesabovethislevel,fixedcostsincreaseto$40,000.LineBrepresentstotalcosts.If100athletesattend,totalcostsare$40,000($400perathlete).Since$20,000ofthisrelatestofixedcosts,thevariablecostperathletemustbe$200.Whenfixedcostsstepupbeyondthispointatthelevelof200athletes,totalcostsobviouslyincreaseaswellandLineBconsequentlygetsmuchsteeper.However,sincetherearenow200athletestoabsorbthefixedcosts,thecostperathleteremainsthesameat$400perathlete($80,000/200),eventhoughfixedcostshavedoubled.If300athletesattendthecourse,totalcostperathletebecomes$300each($90,000/300).Sincefixedcostsaccountfor$40,000ofthistotalcost,variablecoststotal$50,000,i.e.$166·67perathlete.So,economiesofscaleariseatthislevel,asdemonstratedbythefactthatLineBbecomesflatter.At400athletes,thegradientofthetotalcostslineisunchangedfrom300athleteswhichindicatesthatthevariablecostshaveremainedthesame.Thereisnofurtherchangeat500athletes;fixedandvariablecostsremainsteady.RevenuestructureAsregardstherevenuestructure,itcanbeseenfromLineAthatfor100–400athletesthepriceremainsthesameat$300perathlete.However,if500athletesattend,thepricehasbeenreducedasthetotalrevenuelinebecomesflatter.$140,000/500meansthatthepricehasgonedownto$280perathlete.Thiswasobviouslynecessarytoincreasethenumberofattendeesandatthispoint,profitismaximised.1

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-04-22

- 2021-04-02

- 2021-03-11

- 2021-07-01

- 2021-03-12

- 2021-03-11

- 2021-06-15

- 2021-03-11

- 2021-03-11

- 2021-04-15

- 2021-04-14

- 2021-03-11

- 2021-06-11

- 2021-04-23

- 2021-03-12

- 2021-04-22

- 2021-04-23

- 2021-01-01

- 2021-03-12

- 2021-06-29

- 2021-03-12

- 2021-03-12

- 2021-03-12

- 2021-01-04

- 2021-05-08

- 2021-04-16

- 2021-03-11

- 2021-06-20

- 2021-01-01

- 2021-02-15