6月ACCAF6考试真题在哪下载?

发布时间:2021-01-01

6月ACCAF6考试真题在哪下载?

最佳答案

ACCA官网下载真题

F6 CHN

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) With reference to CF Co, explain the ethical and other professional issues raised. (9 marks)

(b) There are several issues that must be addressed as a matter of urgency:

Extra work must be planned to discover the extent of the breakdown in internal controls that occurred during the year. It is

important to decide whether the errors were isolated, or continued through the accounting period and whether similar errors

have occurred in other areas e.g. cash receipts from existing customers or cash payments. A review of the working papers of

the internal audit team should be carried out as soon as possible. The materiality of the errors should be documented.

Errors discovered in the accounting systems will have serious implications for the planned audit approach of new customer

deposits. Nate & Co must plan to expand audit testing on this area as control risk is high. Cash deposits will represent a

significant class of transaction in CF Co. A more detailed substantive approach than used in prior year audits may be needed

in this material area if limited reliance can be placed on internal controls.

A combination of the time spent investigating the reasons for the errors, their materiality, and a detailed substantive audit on

this area means that the audit is likely to take longer than previously anticipated. This may have cost and recoverability

implications. Extra staff may need to be assigned to the audit team, and the deadline for completion of audit procedures may

need to be extended. This will need to be discussed with CF Co.

Due to the increased audit risk, Nate & Co should consider increasing review procedures throughout the audit. In addition CF

Co is likely to be a highly regulated company as it operates in financial services, increasing possible attention focused on the

audit opinion. These two factors indicate that a second partner review would be recommended.

A separate issue is that of Jin Sayed offering advice to the internal audit team. The first problem raised is that of quality control.

A new and junior member of the audit team should be subject to close direction and supervision which does not appear to

have been the case during this assignment.

Secondly, Jin Sayed should not have offered advice to the internal audit team. On being made aware of the errors, he should

have alerted a senior member of the audit team, who then would have decided the action to be taken. This implies that he

does not understand the limited extent of his responsibilities as a junior member of the audit team. Nate & Co may wish to

review the training provided to new members of staff, as it should be made clear when matters should be reported to a senior,

and when matters can be dealt with by the individual.

Thirdly, Jin Sayed must be questioned to discover what exactly he advised the internal audit team to do. Despite his academic

qualification, he has little practical experience in the financial information systems of CF Co. He may have given inappropriate

advice, and it will be crucial to confirm that no action has been taken by the internal audit team.

The audit partner should consider if Nate & Co are at risk because of the advice that has been provided by Jin Sayed. As he

is a member of the audit team, his advice would be considered by the client as advice offered by Nate & Co, and the partner

should ascertain by discussion with the client whether this advice has been acted upon.

Finally Nate & Co should consider whether as a firm they could provide the review of the financial information technology

system, as requested by CF Co. IFAC’s Code of Ethics, and ACCA’s Code of Ethics and Conduct places restrictions on the

provision of non-audit services. Nate & Co must be clear in what exactly the ‘review’ will involve.

Providing a summary of weaknesses in the system, with appropriate recommendations is considered part of normal audit

procedures. However, given the errors that have arisen in the year, CF Co may require Nate & Co to design and implement

changes to the system. This would constitute a self-review threat and should only be considered if significant safeguards are

put in place, for example, using a separate team to provide the non-audit service and/or having a second partner review of

the work.

(b) Explain the advantages and the disadvantages of:

(i) the face to face interview between two people; (6 marks)

(b) (i) The face to face interview is the most common form. of interview. In this situation the candidate is interviewed by a single representative of the employing organisation.

The advantages of such interviews are that they establish an understanding between the participants, are cost effective for the organisation (only one member of the organisation’s staff is involved) and, because of the more personal nature, ensure that candidates feel comfortable.

The disadvantages are that the selection interview relies on the views and impression of a single interviewer that can be both subjective and biased. In addition, the interviewer may be selective in questioning and it is easier for the candidate to hide weaknesses or lack of ability.

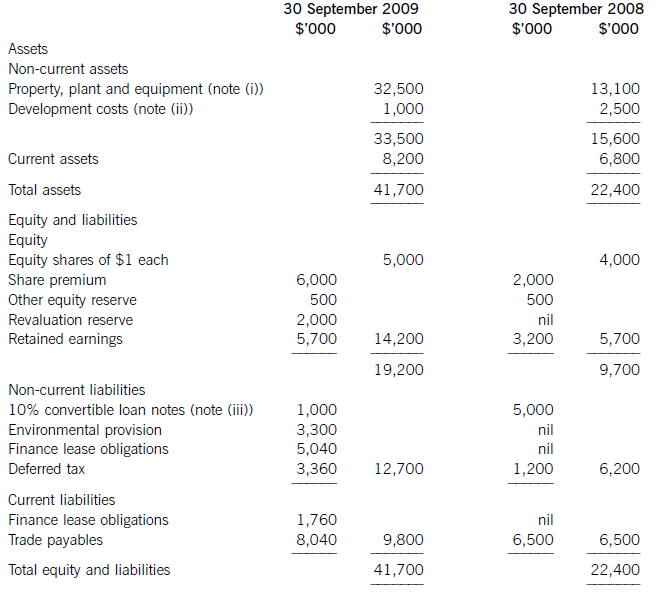

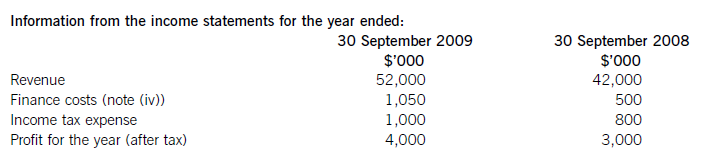

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

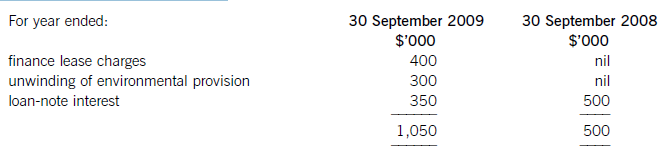

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced.

(c) State the specific inquiries you should make of Robson Construction Co’s management relevant to its

accounting for construction contracts. (6 marks)

(c) Specific inquiries – accounting for construction contracts

Tutorial note: This answer is illustrative of the types of inquiry that should be made. Other relevant answer points will be

awarded similar credit. For each full mark to be earned an inquiry should address the specifics of Robson (e.g. that its

accounting policies are ‘generally less prudent’). The identification of asset overstatement/liability understatement may

reduce the purchase price offered by Prescott.

■ Are any constructions being undertaken without signed contracts?

Tutorial note: Any expenditure on constructions without contracts (e.g. of a speculative nature, perhaps to keep the

workforce employed) must be accounted for under IAS ‘Inventories’; revenue cannot be recognised nor profit taken.

■ Is full provision made for future losses foreseen on loss-making contracts?

Tutorial note: The information in the brief is that ‘provisions are made’. The level of provision is not indicated and

could be less than full.

■ Which contracts started during the year are likely to be/have been identified as loss-making (for which no provision has

yet been made)?

Tutorial note: Profits and losses are only determined by contract at each financial year end.

■ What are management’s assumptions and judgments on the likely future outcome on the Sarwar contract (and other

actual and contingent liabilities)?

Tutorial note: Robson would be imprudent if it underestimates the probability of an unfavourable outcome (or

overestimates the likelihood of successful recourse).

■ What claims history has Robson experienced? (What proportion of contracts have been subject to claims? What

proportion of claims brought have been successful? How have they been settled? Under insurance? Out-of-court

settlement?) How effective are the penalty clauses? (Is Robson having to pay penalties for overrunning on contracts?)

■ What are the actual useful lives of assets used in construction? What level of losses are made on disposal?

Tutorial note: If such assets are depreciated over useful lives that are estimated to be too long, depreciation costs

incurred to date (and estimated depreciation to be included in costs to completion) will be understated. This will result

in too much profit/too little loss being calculated on contracts.

■ What is the cause of losses on contracts? For example, if due to theft of building supplies Robson’s management is not

exercising sufficient control over the company’s assets.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-05-13

- 2021-01-05

- 2021-03-11

- 2021-01-01

- 2021-12-27

- 2021-11-06

- 2021-06-09

- 2021-03-10

- 2021-03-12

- 2021-04-24

- 2021-04-14

- 2021-03-12

- 2021-05-07

- 2021-03-12

- 2021-05-07

- 2021-03-11

- 2021-07-27

- 2021-03-10

- 2021-03-10

- 2021-06-02

- 2021-03-12

- 2021-04-14

- 2021-03-11

- 2021-06-09

- 2021-04-14

- 2021-03-11

- 2021-05-28

- 2021-06-08

- 2021-06-02

- 2021-03-12