acca考试是必须F阶段都过了才能报名P阶段吗...

发布时间:2021-03-10

acca考试是必须F阶段都过了才能报名P阶段吗?

最佳答案

是的,ACCA考试必须按照模块顺序来进行,即知识模块-技能模块-核心模块-选修模块。必须按照这个顺序来报考,但是各个模块内部的科目是可以打乱顺序考的。例如:F1-F3,可以先考F3,再考F2,再考F1,后面的依此类推。ACCA每一次考试最多可以报满4科,那么可以把前面模块的都报上,报完以后还有剩余科目可以给后面模块的再报上后面模块的科目。例如,可以一次把F1、F2、F3、F4都报上,考试结束后,F4、F3、F2都通过了,F1没通过,那么下次报F678等科目时,必须先把F1报上,如果考完了F4-F9的科目,F1还是没通过,报P阶段时,F1也必须先报上。就是说前一个模块没有考完的科目,必须在下一次报考下一个模块考试时都带上继续报考,直到通过。后面的依此类推。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Write a letter to Donald advising him on the most tax efficient manner in which he can relieve the loss

incurred in the year to 31 March 2007. Your letter should briefly outline the types of loss relief available

and explain their relative merits in Donald’s situation. Assume that Donald will have no source of income

other than the business in the year of assessment 2006/07 and that any income he earned on a parttime

basis while at university was always less than his annual personal allowance. (9 marks)

Assume that the corporation tax rates and allowances for the financial year 2004 and the income tax rates

and allowances for 2004/05 apply throughout this question.

Relevant retail price index figures are:

January 1998 159·5

April 1998 162·6

(ii) [Donald’s address] [Firm’s address]

Dear Donald [Date]

I understand that you have incurred a tax loss in your first year of trading. The following options are available in respect

of this loss.

1. The first option is to use the trading loss against other forms of income in the same year. If such a claim is made,

losses are offset against income before personal allowances.

Any excess loss can still be offset against capital gains of the year. However, any offset against capital gains is

before both taper relief and annual exemptions.

(b) One of the hotels owned by Norman is a hotel complex which includes a theme park, a casino and a golf course,

as well as a hotel. The theme park, casino, and hotel were sold in the year ended 31 May 2008 to Conquest, a

public limited company, for $200 million but the sale agreement stated that Norman would continue to operate

and manage the three businesses for their remaining useful life of 15 years. The residual interest in the business

reverts back to Norman after the 15 year period. Norman would receive 75% of the net profit of the businesses

as operator fees and Conquest would receive the remaining 25%. Norman has guaranteed to Conquest that the

net minimum profit paid to Conquest would not be less than $15 million. (4 marks)

Norman has recently started issuing vouchers to customers when they stay in its hotels. The vouchers entitle the

customers to a $30 discount on a subsequent room booking within three months of their stay. Historical

experience has shown that only one in five vouchers are redeemed by the customer. At the company’s year end

of 31 May 2008, it is estimated that there are vouchers worth $20 million which are eligible for discount. The

income from room sales for the year is $300 million and Norman is unsure how to report the income from room

sales in the financial statements. (4 marks)

Norman has obtained a significant amount of grant income for the development of hotels in Europe. The grants

have been received from government bodies and relate to the size of the hotel which has been built by the grant

assistance. The intention of the grant income was to create jobs in areas where there was significant

unemployment. The grants received of $70 million will have to be repaid if the cost of building the hotels is less

than $500 million. (4 marks)

Appropriateness and quality of discussion (2 marks)

Required:

Discuss how the above income would be treated in the financial statements of Norman for the year ended

31 May 2008.

(b) Property is sometimes sold with a degree of continuing involvement by the seller so that the risks and rewards of ownership

have not been transferred. The nature and extent of the buyer’s involvement will determine how the transaction is accounted

for. The substance of the transaction is determined by looking at the transaction as a whole and IAS18 ‘Revenue’ requires

this by stating that where two or more transactions are linked, they should be treated as a single transaction in order to

understand the commercial effect (IAS18 paragraph 13). In the case of the sale of the hotel, theme park and casino, Norman

should not recognise a sale as the company continues to enjoy substantially all of the risks and rewards of the businesses,

and still operates and manages them. Additionally the residual interest in the business reverts back to Norman. Also Norman

has guaranteed the income level for the purchaser as the minimum payment to Conquest will be $15 million a year. The

transaction is in substance a financing arrangement and the proceeds should be treated as a loan and the payment of profits

as interest.

The principles of IAS18 and IFRIC13 ‘Customer Loyalty Programmes’ require that revenue in respect of each separate

component of a transaction is measured at its fair value. Where vouchers are issued as part of a sales transaction and are

redeemable against future purchases, revenue should be reported at the amount of the consideration received/receivable less

the voucher’s fair value. In substance, the customer is purchasing both goods or services and a voucher. The fair value of the

voucher is determined by reference to the value to the holder and not the cost to the issuer. Factors to be taken into account

when estimating the fair value, would be the discount the customer obtains, the percentage of vouchers that would be

redeemed, and the time value of money. As only one in five vouchers are redeemed, then effectively the hotel has sold goods

worth ($300 + $4) million, i.e. $304 million for a consideration of $300 million. Thus allocating the discount between the

two elements would mean that (300 ÷ 304 x $300m) i.e. $296·1 million will be allocated to the room sales and the balance

of $3·9 million to the vouchers. The deferred portion of the proceeds is only recognised when the obligations are fulfilled.

The recognition of government grants is covered by IAS20 ‘Accounting for government grants and disclosure of government

assistance’. The accruals concept is used by the standard to match the grant received with the related costs. The relationship

between the grant and the related expenditure is the key to establishing the accounting treatment. Grants should not be

recognised until there is reasonable assurance that the company can comply with the conditions relating to their receipt and

the grant will be received. Provision should be made if it appears that the grant may have to be repaid.

There may be difficulties of matching costs and revenues when the terms of the grant do not specify precisely the expense

towards which the grant contributes. In this case the grant appears to relate to both the building of hotels and the creation of

employment. However, if the grant was related to revenue expenditure, then the terms would have been related to payroll or

a fixed amount per job created. Hence it would appear that the grant is capital based and should be matched against the

depreciation of the hotels by using a deferred income approach or deducting the grant from the carrying value of the asset

(IAS20). Additionally the grant is only to be repaid if the cost of the hotel is less than $500 million which itself would seem

to indicate that the grant is capital based. If the company feels that the cost will not reach $500 million, a provision should

be made for the estimated liability if the grant has been recognised.

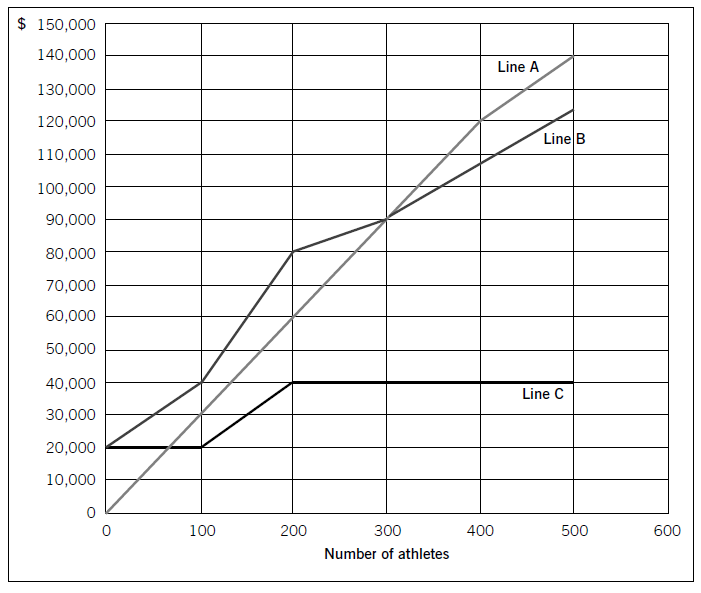

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

(a)ThebreakevensalesrevenueforSwimCois$90,000.Thecompany’sprofit,tothenearest$10,000,if500athletesattendthecourseis$20,000($140,000–$120,000).(Fromthegraph,itisclearthatthepreciseamountwillbenearer$17,000,i.e.$140,000–approximately$123,000.)(b)CoststructureFromthechart,itisclearthatLineCrepresentsfixedcosts,LineBrepresentstotalcostsandLineArepresentstotalrevenue.LineCshowsthatinitially,fixedcostsare$20,000evenifnoathletesattendthecourse.Thisleveloffixedcostsremainsthesameif100athletesattendbutoncethenumberofattendeesincreasesabovethislevel,fixedcostsincreaseto$40,000.LineBrepresentstotalcosts.If100athletesattend,totalcostsare$40,000($400perathlete).Since$20,000ofthisrelatestofixedcosts,thevariablecostperathletemustbe$200.Whenfixedcostsstepupbeyondthispointatthelevelof200athletes,totalcostsobviouslyincreaseaswellandLineBconsequentlygetsmuchsteeper.However,sincetherearenow200athletestoabsorbthefixedcosts,thecostperathleteremainsthesameat$400perathlete($80,000/200),eventhoughfixedcostshavedoubled.If300athletesattendthecourse,totalcostperathletebecomes$300each($90,000/300).Sincefixedcostsaccountfor$40,000ofthistotalcost,variablecoststotal$50,000,i.e.$166·67perathlete.So,economiesofscaleariseatthislevel,asdemonstratedbythefactthatLineBbecomesflatter.At400athletes,thegradientofthetotalcostslineisunchangedfrom300athleteswhichindicatesthatthevariablecostshaveremainedthesame.Thereisnofurtherchangeat500athletes;fixedandvariablecostsremainsteady.RevenuestructureAsregardstherevenuestructure,itcanbeseenfromLineAthatfor100–400athletesthepriceremainsthesameat$300perathlete.However,if500athletesattend,thepricehasbeenreducedasthetotalrevenuelinebecomesflatter.$140,000/500meansthatthepricehasgonedownto$280perathlete.Thiswasobviouslynecessarytoincreasethenumberofattendeesandatthispoint,profitismaximised.1

(c) Describe the purposes for which a person specification might be used. (4 marks)

Part (c):

The person specification might be used for a number of purposes:

In recruitment, to provide an illustration of the type of candidate sought prior to the selection stage.

In selection, the most obvious and popular use of this document, is to assess whether an individual’s personality, abilities and

experience match the organisation’s requirements.

For promotion, to evaluate whether an individual has the necessary ability and personality to move within the organisation.

In evaluation of performance to assess whether the person has demonstrated the necessary skills to do the job effectively.

In disciplinary procedures through demonstrating that the person specification required to do a particular job for which some one

was appointed are not evident or being applied. For example, where an employee required to be discrete is discovered to have

disclosed confidential information to third parties.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-03-10

- 2021-05-06

- 2021-03-11

- 2021-03-10

- 2021-03-11

- 2021-12-31

- 2021-03-12

- 2021-05-13

- 2021-04-15

- 2021-03-12

- 2021-03-10

- 2021-04-14

- 2021-01-23

- 2021-04-16

- 2021-05-06

- 2021-05-13

- 2021-03-11

- 2021-03-11

- 2021-05-07

- 2021-01-04

- 2021-05-25

- 2021-06-10

- 2021-12-30

- 2021-01-01

- 2021-03-10

- 2021-03-11

- 2021-01-01

- 2021-01-06

- 2021-03-10

- 2021-12-31