请问全国考生ACCA国际会计师证书应该怎么注册呢?

发布时间:2020-01-09

首先,51题库考试学习网在这里告诉大家,ACCA国际会计师证书是不能够注册的,是需要通过一个难度较高的考试获得的,可以通过注册获得是ACCA会员资格,那么这个会员资格又是什么呢?其实这个ACCA会员资格是报考ACCA证书考试的一个条件之一,要成为ACCA会员才可以报考ACCA考试,那么接下来,51题库考试学习网就告诉大家关于ACCA会员注册资格的流程:

首先大家先了解一下ACCA会员的注册条件:

一、申请参加ACCA考试者,必须首先注册成为ACCA学员,注册需具备以下任一条件:

(1) 凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;(自考本科的学历也可以哦,只要有相应的学历证书)

(2) 教育部认可的高等院校在校生,顺利完成大一所有课程考试,即可报名成为ACCA的正式学员;(换句话说就是你在大一的时候成绩不挂科不重修,进入大二学期就可以报考ACCA了)

(3) 未符合1,2项报名资格的申请者,可以先申请参加FIA资格考试,通过FFA,FMA,FAB三门课程后,可以申请转入ACCA并且豁免F1-F3三门课程的考试,直接进入ACCA技能课程阶段的考试;需要注意的是在校大学生满足一些条件也可以申请免试哟,具体规定可以参考ACCA官网发布的相关文献。

温馨提示:注册报名成为ACCA的学员随时都可以进行,但注册时间的早晚,决定了第一次参加考试的

二、ACCA在注册时,需要准备和提交的资料:

在校学员所需准备的注册资料 (原件、复印件和译文)

(若有同学不清楚英文在读证明如何打印?在哪儿打印?建议自行在网上查询)

(1) 中英文在读证明(由学校教务部门开具,加盖公章,在读证明及成绩单加盖的公章必须一致),

(2) 中英文在校期间各年级成绩单,至少要提供大一成绩单,并加盖所在学校或学校教务部门公章(可先到学员辅导员处打印成绩单,再到学校的教务处盖章即可)

(3) 中英文个人身份证件或护照(护照办理一般和身份证办理在同一地点)

(4) 2寸彩色证件照一张 (建议多准备几张照片,以防出现意外情况)

(5) 注册报名费(现金代缴或信用卡支付)

非在校学员所需准备的注册资料 (原件、复印件和译文)

(1) 中英文个人身份证件或护照

(2) 中英文学历证明(毕业证及学位证) (大专及其以上的学历)

(3) 2寸彩色证件照一张(同样建议多备几张以备不时之需)

三、ACCA注册流程

第一步:准备注册所需材料(就是第二个步骤所准备的全部资料)

第二步:在全球官方网站进行注

(1) 在线注册地址http://www.accaglobal.com/en/qualifications/apply-now.html

(2) 填写相关个人信息(如姓名、性别、出生日期等)(注意:填写有效的信息,方便联系到你)

(3) 填写相关个人学历信息(如毕业院校、学历、专业等)

(4) 在线上传注册资料

(5) 若学员计划申请免试,在填写完毕Your Qualifications之后,系统便会自动显示学员有可能获得的免试科目,最终免试结果以注册成功后ACCA英国总部的审核结果为准;如需放弃免试,需点击相应科目Give Up选项(6) 若学员放弃牛津布鲁克斯大学的学位申请资格

需在Bsc Degree处勾选是否放弃第三步:支付注册费用

(1) 可使用VISA或MasterCard信用卡(见信用卡面logo)

(2) 可使用双币信用卡

(3) 双币信用卡可为人民币+美金,也可为人民币+英镑,美金版信用卡会将ACCA扣除的英镑自动转换为美金

(4) 卡面上无VISA或MasterCard的信用卡(如JCB、AmericanExpress等)皆不可用

(5) 可使用支付宝

(6) 可使用银联借记卡

四、到代表处办理报名注册程序

将填写完整的网上报名注册表(在英文网站上注册完成后可以打印出两页的PDF文件)、中文学员登记表请先打印再点击提交,以及其他相关材料交至代表处或直接寄往英国总部。北京、上海和广州的学员报名注册后,领取学员手册,外地学员通过邮寄到代表处注册的学员由当地代表处寄发。 (需要注意的事,因为相关注册表是寄往国外,因此花费的时间相对来说可能较长,请大家耐心等待)

怎么样?看了这么多,是不是感觉“国际注册会计师”资格证不容易获得呢?连注册一个会员都需要花费较长的时间。But,51题库考试学习网相信大家一定可以做到的。没有付出,哪来回报呢?证书再难,抵不过你一颗热情心,一双勤劳手。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) The percentage change in revenue, total costs and net assets during the year ended 31 May 2008 that

would have been required in order to have achieved a target ROI of 20% by the Beetown centre. Your

answer should consider each of these three variables in isolation. State any assumptions that you make.

(6 marks)

(ii) The ROI of Beetown is currently 13·96%. In order to obtain an ROI of 20%, operating profit would need to increase to

(20% x $3,160,000) = $632,000, based on the current level of net assets. Three alternative ways in which a target

ROI of 20% could be achieved for the Beetown centre are as follows:

(1) Attempts could be made to increase revenue by attracting more clients while keeping invested capital and operating

profit per $ of revenue constant. Revenue would have to increase to $2,361,644, assuming that the current level

of profitability is maintained and fixed costs remain unchanged. The current rate of contribution to revenue is

$2,100,000 – $567,000 = $1,533,000/$2,100,000 = 73%. Operating profit needs to increase by $191,000

in order to achieve an ROI of 20%. Therefore, revenue needs to increase by $191,000/0·73 = $261,644 =

12·46%.

(2) Attempts could be made to decrease the level of operating costs by, for example, increasing the efficiency of

maintenance operations. This would have the effect of increasing operating profit per $ of revenue. This would

require that revenue and invested capital were kept constant. Total operating costs would need to fall by $191,000

in order to obtain an ROI of 20%. This represents a percentage decrease of 191,000/1,659,000 = 11·5%. If fixed

costs were truly fixed, then variable costs would need to fall to a level of $376,000, which represents a decrease

of 33·7%.

(3) Attempts could be made to decrease the net asset base of HFG by, for example, reducing debtor balances and/or

increasing creditor balances, while keeping turnover and operating profit per $ of revenue constant. Net assets

would need to fall to a level of ($441,000/0·2) = $2,205,000, which represents a percentage decrease

amounting to $3,160,000 – $2,205,000 = 955,000/3,160,000 = 30·2%.

4 Hogg Products Company (HPC), based in a developing country, was recently wholly acquired by American Overseas

Investments (AOI), a North American holding company. The new owners took the opportunity to completely review

HPC’s management, culture and systems. One of the first things that AOI questioned was HPC’s longstanding

corporate code of ethics.

The board of AOI said that it had a general code of ethics that HPC, as an AOI subsidiary, should adopt. Simon Hogg,

the chief executive of HPC, disagreed however, and explained why HPC should retain its existing code. He said that

HPC had adopted its code of ethics in its home country which was often criticised for its unethical business behaviour.

Some other companies in the country were criticised for their ‘sweat shop’ conditions. HPC’s adoption of its code of

ethics, however, meant that it could always obtain orders from European customers on the guarantee that products

were made ethically and in compliance with its own highly regarded code of ethics. Mr Hogg explained that HPC had

an outstanding ethical reputation both locally and internationally and that reputation could be threatened if it was

forced to replace its existing code of ethics with AOI’s more general code.

When Ed Tanner, a senior director from AOI’s head office, visited Mr Hogg after the acquisition, he was shown HPC’s

operation in action. Mr Hogg pointed out that unlike some other employers in the industry, HPC didn’t employ child

labour. Mr Hogg explained that although it was allowed by law in the country, it was forbidden by HPC’s code of

ethics. Mr Hogg also explained that in his view, employing child labour was always ethically wrong. Mr Tanner asked

whether the money that children earned by working in the relatively safe conditions at HPC was an important source

of income for their families. Mr Hogg said that the money was important to them but even so, it was still wrong to

employ children, as it was exploitative and interfered with their education. He also said that it would alienate the

European customers who bought from HPC partly on the basis of the terms of its code of ethics.

Required:

(a) Describe the purposes and typical contents of a corporate code of ethics. (9 marks)

(a) Purposes of codes of ethics

To convey the ethical values of the company to interested audiences including employees, customers, communities and

shareholders.

To control unethical practice within the organisation by placing limits on behaviour and prescribing behaviour in given

situations.

To be a stimulant to improved ethical behaviour in the organisation by insisting on full compliance with the code.

[Tutorial note: other purposes, if relevant, will be rewarded]

Contents of a corporate code of ethics

The typical contents of a corporate code of ethics are as follows:

Values of the company. This might include notes on the strategic purpose of the organisation and any underlying beliefs,

values, assumptions or principles. Values may be expressed in terms of social and environmental perspectives, and

expressions of intent regarding compliance with best practice, etc.

Shareholders and suppliers of finance. In particular, how the company views the importance of sources of finances, how it

intends to communicate with them and any indications of how they will be treated in terms of transparency, truthfulness and

honesty.

Employees. Policies towards employees, which might include equal opportunities policies, training and development,

recruitment, retention and removal of staff. In the case of HPC, the policy on child labour will be covered by this part of the

code of ethics.

Customers. How the company intends to treat its customers, typically in terms of policy of customer satisfaction, product mix,

product quality, product information and complaints procedure.

Supply chain/suppliers. This is becoming an increasingly important part of ethical behaviour as stakeholders scrutinise where

and how companies source their products (e.g. farming practice, GM foods, fair trade issues, etc). Ethical policy on supply

chain might include undertakings to buy from certain approved suppliers only, to buy only above a certain level of quality, to

engage constructively with suppliers (e.g. for product development purposes) or not to buy from suppliers who do not meet

with their own ethical standards.

Community and wider society. This section concerns the manner in which the company aims to relate to a range of

stakeholders with whom it does not have a direct economic relationship (e.g. neighbours, opinion formers, pressure groups,

etc). It might include undertakings on consultation, ‘listening’, seeking consent, partnership arrangements (e.g. in community

relationships with local schools) and similar.

[Tutorial note: up to six points to be identified and described but similar valid general contents are acceptable]

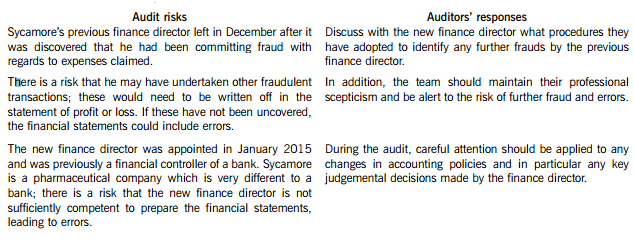

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

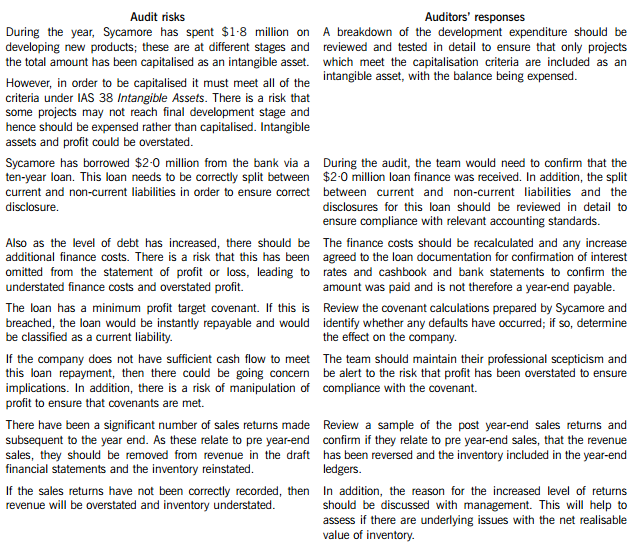

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-09-04

- 2019-07-20

- 2019-07-20

- 2020-01-09

- 2020-02-29

- 2020-01-09

- 2019-07-20

- 2020-01-02

- 2020-02-29

- 2020-01-03

- 2019-07-20

- 2020-02-29

- 2019-07-20

- 2020-01-09

- 2020-01-09

- 2020-02-27

- 2020-01-09

- 2019-07-20

- 2019-07-20

- 2020-05-20

- 2020-02-29

- 2019-07-20

- 2020-09-04

- 2019-07-20

- 2019-07-20

- 2020-01-09

- 2019-12-06

- 2020-03-04

- 2019-07-20