注意查看:ACCA考试的打分标准你知道吗?

发布时间:2020-09-05

各位小伙伴注意了!大家了解ACCA考试吗?很多同学都想知道ACCA考试的评分标准,51题库考试学习网为大家带来了相关内容,让我们一起来看看吧!

学员必须了解What examiners want,以及每个requirements可划分多少个不同的tasks来完成。建议可以按照动词的方式来进行,ACCA官方的打分标准基本如下:

Identify

1 mark-要求学员show their knowledge

Explain or describe

1 mark-要求学员show their knowledge and give examples

Calculate

1/2 or 1 mark per calculation-要求学员show all workings, and layout and technique也许也会给分;并且不重复扣分

Discuss

2 marks/point-要求学员state a fact or idea and give examples或者link scenario中的点进行阐述finalise

Evaluate

2 marks/point-要求学员identify the fact or idea,但是此处需融入学员自己的想法,并且进行相应的陈述

Compare and contrast

2 marks/point-要求学员对已经给定的2 issues or facts进行描述,并给出自己的意见,包括阐述为何两者不同

Suggest or recommend

2 marks/point-要求学员give idea and explain why they are good idea(这点请P3的同学注意了,还记得recommend strategic option吗?不仅要给出方案,还要进行SFA test,即explain why)

Distinguish between

2 marks/point-要求学员陈述why they are different and give example

FINDING "EASY"MARKS

学员必须决定which parts should be done firstly,上述动词表中Identify,explain,calculate等都可划分为‘easy marks’。

PLANNING WELL-STRUCTURED ANSWERS

这可以帮助学员logically answer questions and get credits for all parts you wrote。这个部分对于P-Level的学员格外重要。

FOCUSING ON THE PARTS U CAN DO

ACCA 官方的考官反复强调,在阅卷过程中时常看见学员用大篇幅阐述了一段一分也不得的文章,由此得知学员似乎对某知识点并不熟悉,因此建议学员focus on they can do well, not the parts they find difficult.

建议:

1. 篇幅的问题:一般对于25分的Question,篇幅在1-1.5 pages。如答题合理会给到Pass分,要想拿到高分,建议篇幅在2-3 pages左右。

2. 答题顺序:学员可自行选择先回答容易拿分的题目,另外同一题目中不同requirements的回答也可不按顺序进行。

MANAGING TIME

学生应该更好的allocate time,建议1.8 mins for each mark。重复的Points不得分。

EXAMINAR\'S ANSWER VS STUDENT\'S ANSWER

学生准备复习的时候应该整理书写简单,得分又高的student answer,而不是考官答案。那样的答案在考试中并不可取。

PRESENTATION AND LAYOUT

1. 理想状况下,建议学员拿下8-10 marks/page written

2. 建议使用headings and sections

3. 建议学员书写答案的时候留下足够的空间,便于考官阅读,也有利于学员补充信息

4. 建议学员充分使用table或者diagram,这样可以获得更多的分数

5. 如果时间不够的情况下,建议学员罗列key words and points

6. 如要求学员写大篇幅的文章(如P Level科目),学员可书写Introduction(如没有特殊要求,此部分可写可不写)。

以上就是今天分享的全部内容了,各位小伙伴根据自己的情况进行查阅,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Explain whether or not Carver Ltd will become a close investment-holding company as a result of

acquiring either the office building or the share portfolio and state the relevance of becoming such a

company. (2 marks)

(ii) Close investment holding company status

Carver Ltd will not become a close investment-holding company if it purchases the office building as, although it will no

longer be a trading company, it intends to rent out the building to a number of tenants none of whom is connected to

the company.

Carver Ltd will become a close investment holding company if it purchases a portfolio of quoted shares as it will no

longer be a trading company. As a result it will pay corporation tax at the full rate of 30% regardless of the level of its

profits.

In 2014 Mr Yuan inherited an estate of RMB2 million from his uncle who had died two months earlier.

What is the correct treatment of the estate income for individual income tax purposes?

A.The estate income is not taxable

B.The estate income will be taxed as occasional (ad hoc) income

C.The estate income will be taxed as other income

D.The estate income will be taxed as service income

3 (a) Discuss why the identification of related parties, and material related party transactions, can be difficult for

auditors. (5 marks)

3 Pulp Co

(a) Identification of related parties

Related parties and associated transactions are often difficult to identify, as it can be hard to establish exactly who, or what,

are the related parties of an entity. IAS 24 Related Party Disclosures contains definitions which in theory serve to provide a

framework for identifying related parties, but deciding whether a definition is met can be complex and subjective. For example,

related party status can be obtained via significant interest, but in reality it can be difficult to establish the extent of influence

that potential related parties can actually exert over a company.

The directors may be reluctant to disclose to the auditors the existence of related parties or transactions. This is an area of

the financial statements where knowledge is largely confined to management, and the auditors often have little choice but to

rely on full disclosure by management in order to identify related parties. This is especially the case for a close family member

of those in control or having influence over the entity, whose identity can only be revealed by management.

Identification of material related party transactions

Related party transactions may not be easy to identify from the accounting systems. Where accounting systems are not

capable of separately identifying related party transactions, management need to carry out additional analysis, which if not

done makes the transactions extremely difficult for auditors to find. For example sales made to a related party will not

necessarily be differentiated from ‘normal’ sales in the accounting systems.

Related party transactions may be concealed in whole, or in part, from auditors for fraudulent purposes. A transaction may

not be motivated by normal business considerations, for example, a transaction may be recognised in order to improve the

appearance of the financial statements by ‘window dressing’. Clearly if the management is deliberately concealing the true

nature of these items it will be extremely difficult for the auditor to discover the rationale behind the transaction and to consider

the impact on the financial statements.

Finally, materiality is a difficult concept to apply to related party transactions. Once a transaction has been identified, the

auditor must consider whether it is material. However, materiality has a particular application in this situation. ISA 550

Related Parties states that the auditor should consider the effect of a related party transaction on the financial statements.

The problem is that a transaction could occur at an abnormally small, even nil, value. Determining materiality based on

monetary value is therefore irrelevant, and the auditor should instead be alert to the unusual nature of the transaction making

it material.

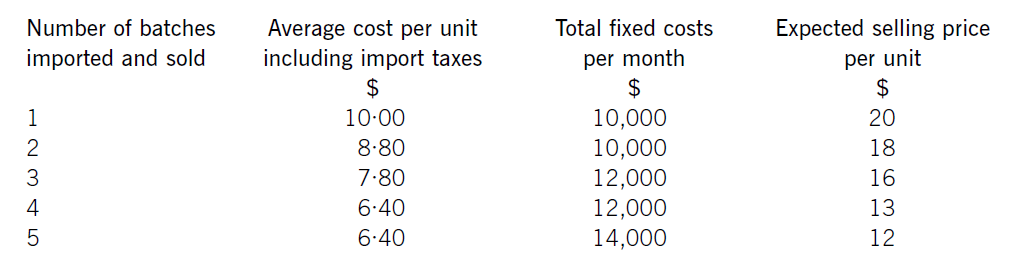

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-09-05

- 2020-10-18

- 2020-10-10

- 2021-02-13

- 2021-02-21

- 2021-05-29

- 2019-06-22

- 2021-05-29

- 2021-05-29

- 2021-02-13

- 2020-10-10

- 2021-05-29

- 2020-10-10

- 2020-09-05

- 2021-02-21

- 2020-10-10

- 2020-10-18

- 2021-05-29

- 2020-09-05

- 2020-09-05

- 2021-05-29

- 2021-05-29

- 2020-10-21

- 2020-10-10

- 2021-05-29

- 2020-10-10

- 2020-09-05

- 2021-02-13

- 2020-10-10

- 2021-02-13