你知道ACCA2021年报考条件是什么吗?

发布时间:2020-04-29

最近有一些小伙伴在关注ACCA考试,你们对ACCA了解多少呢?我们一起来看看吧!

ACCA资格被认为是"国际财会界的通行证",许多国家立法许可ACCA会员从事审计、投资顾问和破产执行工作。ACCA也在欧洲会计专家协会、亚太会计师联合会和加勒比特许会计师协会等会计组织中起着非常重要的作用。

ACCA为全世界有志投身于财务、会计以及管理领域的专才提供首选的资格认证。要想报考ACCA,需要满足以下条件之一:

1、教育部认可的高等院校在校生,顺利完成大一的课程考试;

2、凡具有教育部承认的大专以上学历;

3、未符合1、2项报名资格的申请者,年满16周岁的也可以申请。

那么,报考ACCA有哪些优势?

学员取得会员身份,便拥有一项国际认可的专业会计师资格。ACCA专业资格在英国、欧洲及世界上其他一些主要国家被认为具有法定会计师资格,会员可成为执业会计师,受法律许可从事审计、税务、破产执行及投资顾问等专业会计师的工作。此外,ACCA的会员可在政府机构、公用事业和工商业企业中从事财务工作。

目前,ACCA会员在世界各地担任有限公司的会计师、执业会计师行的合伙人、跨国公司或合资公司的财务经理、财务总监、总经理等职的均不乏其人。随着中国企业国际化进程的加快,对懂得国际财务准则并能够从事高级财务管理的人才需求将会呈现井喷式的增长,而ACCA会员正是这类人才的首选。现在大部分企业都会涉及到对外业务,只要会涉及到对外的业务,都是需要具有国际视野,熟悉国外准则的ACCA人才。

ACCA教材都采用了国际会计与审计准则,注重理论与实际相结合,大力培养学生分析解决实际问题的能力。通过ACCA的学习,学生不仅熟悉国际会计、审计准则知识,而且英语基础扎实,具备了成为国际化会计人才的良好素质,深受跨国公司、合资企业和其它有国际背景企业的欢迎。

此外,ACCA考试成绩得到境外大多数名校的认可,在满足一定的条件下可以申请攻读硕士学位,学生具备的良好英语水平及专业知识技能,能帮助其很快适应国外的学习、工作和生活,效率大大提高。

好了,相信小伙伴们对ACCA有了更多的了解,如果还想了解更多信息,欢迎来51题库考试学习网留言哦!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) In November 2006 Seymour announced the recall and discontinuation of a range of petcare products. The

product recall was prompted by the high level of customer returns due to claims of poor quality. For the year to

30 September 2006, the product range represented $8·9 million of consolidated revenue (2005 – $9·6 million)

and $1·3 million loss before tax (2005 – $0·4 million profit before tax). The results of the ‘petcare’ operations

are disclosed separately on the face of the income statement. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

■ The discontinuation of the product line after the balance sheet date provides additional evidence that, as at the

balance sheet date, it was of poor quality. Therefore, as at the balance sheet date:

– an allowance (‘provision’) may be required for credit notes for returns of products after the year end that were

sold before the year end;

– goods returned to inventory should be written down to net realisable value (may be nil);

– any plant and equipment used exclusively in the production of the petcare range of products should be tested

for impairment;

– any material contingent liabilities arising from legal claims should be disclosed.

(ii) Audit evidence

■ A copy of Seymour’s announcement (external ‘press release’ and any internal memorandum).

■ Credit notes raised/refunds paid after the year end for faulty products returned.

■ Condition of products returned as inspected during physical attendance of inventory count.

■ Correspondence from customers claiming reimbursement/compensation for poor quality.

■ Direct confirmation from legal adviser (solicitor) regarding any claims for customers including estimates of possible

payouts.

5 You are an audit manager in Dedza, a firm of Chartered Certified Accountants. Recently, you have been assigned

specific responsibility for undertaking annual reviews of existing clients. The following situations have arisen in

connection with three client companies:

(a) Dedza was appointed auditor and tax advisor to Kora Co, a limited liability company, last year and has recently

issued an unmodified opinion on the financial statements for the year ended 30 June 2005. To your surprise,

the tax authority has just launched an investigation into the affairs of Kora on suspicion of underdeclaring income.

(7 marks)

Required:

Identify and comment on the ethical and other professional issues raised by each of these matters and state what

action, if any, Dedza should now take.

NOTE: The mark allocation is shown against each of the three situations.

5 DEDZA CO

(a) Tax investigation

■ Kora is a relatively new client. Before accepting the assignment(s) Dedza should have carried out customer due

diligence (CDD). Dedza should therefore have a sufficient knowledge and understanding of Kora to be aware of any

suspicions that the tax authority might have.

■ As the investigation has come as a surprise it is possible that, for example:

– the tax authority’s suspicions are unfounded;

– Dedza has failed to recognise suspicious circumstances.

Tutorial note: In either case, Dedza should seek clarification on the period of suspicion and review relevant procedures.

■ Dedza should review any communication from the predecessor auditor obtained in response to its ‘professional inquiry’

(for any professional reasons why the appointment should not have been accepted).

■ A quality control for new audits is that the audit opinion should be subject to a second partner review before it is issued.

It should be considered now whether or not such a review took place. If it did, then it should be sufficiently well

documented to evidence that the review was thorough and not a mere formality.

■ Criminal property includes the proceeds of tax evasion. If Kora is found to be guilty of under-declaring income that is a

money laundering offence.

■ Dedza’s reputational risk will be increased if implicated because it knew (or ought to have known) about Kora’s activities.

(Dedza may also be liable if found to have been negligent in failing to detect any material misstatement arising in the

2004/05 financial statements as a result.)

■ Kora’s audit working paper files and tax returns should be reviewed for any suspicion of fraud being committed by Kora

or error overlooked by Dedza. Tax advisory work should have been undertaken and/or reviewed by a manager/partner

not involved in the audit work.

■ As tax advisor, Dedza could soon be making disclosures of misstatements to the tax authority on behalf of Kora. Dedza

should encourage Kora to make necessary disclosure voluntarily.

■ Dedza will not be in breach of its duty of confidentiality to Kora if Kora gives Dedza permission to disclose information

to the tax authority (or Dedza is legally required to do so).

■ If Dedza finds reasonable grounds to know or suspect that potential disclosures to the tax authority relate to criminal

conduct, then a suspicious transaction report (STR) should be made to the financial intelligence unit (FIU) also.

Tutorial note: Though not the main issue credit will be awarded for other ethical issues such as the potential selfinterest/

self-review threat arising from the provision of other services.

(d) Wader has decided to close one of its overseas branches. A board meeting was held on 30 April 2007 when a

detailed formal plan was presented to the board. The plan was formalised and accepted at that meeting. Letters

were sent out to customers, suppliers and workers on 15 May 2007 and meetings were held prior to the year

end to determine the issues involved in the closure. The plan is to be implemented in June 2007. The company

wish to provide $8 million for the restructuring but are unsure as to whether this is permissible. Additionally there

was an issue raised at one of the meetings. The operations of the branch are to be moved to another country

from June 2007 but the operating lease on the present buildings of the branch is non-cancellable and runs for

another two years, until 31 May 2009. The annual rent of the buildings is $150,000 payable in arrears on

31 May and the lessor has offered to take a single payment of $270,000 on 31 May 2008 to settle the

outstanding amount owing and terminate the lease on that date. Wader has additionally obtained permission to

sublet the building at a rental of $100,000 per year, payable in advance on 1 June. The company needs advice

on how to treat the above under IAS37 ‘Provisions, Contingent Liabilities and Contingent Assets’. (7 marks)

Required:

Discuss the accounting treatments of the above items in the financial statements for the year ended 31 May

2007.

Note: a discount rate of 5% should be used where necessary. Candidates should show suitable calculations where

necessary.

(d) A provision under IAS37 ‘Provisions, Contingent Liabilities and Contingent assets’ can only be made in relation to the entity’s

restructuring plans where there is both a detailed formal plan in place and the plans have been announced to those affected.

The plan should identify areas of the business affected, the impact on employees and the likely cost of the restructuring and

the timescale for implementation. There should be a short timescale between communicating the plan and starting to

implement it. A provision should not be recognised until a plan is formalised.

A decision to restructure before the balance sheet date is not sufficient in itself for a provision to be recognised. A formal plan

should be announced prior to the balance sheet date. A constructive obligation should have arisen. It arises where there has

been a detailed formal plan and this has raised a valid expectation in the minds of those affected. The provision should only

include direct expenditure arising from the restructuring. Such amounts do not include costs associated with ongoing business

operations. Costs of retraining staff or relocating continuing staff or marketing or investment in new systems and distribution

networks, are excluded. It seems as though in this case a constructive obligation has arisen as there have been detailed formal

plans approved and communicated thus raising valid expectations. The provision can be allowed subject to the exclusion of

the costs outlined above.

Although executory contracts are outside IAS37, it is permissible to recognise a provision that is onerous. Onerous contracts

can result from restructuring plans or on a stand alone basis. A provision should be made for the best estimate of the excess

unavoidable costs under the onerous contract. This estimate should assess any likely level of future income from new sources.

Thus in this case, the rental income from sub-letting the building should be taken into account. The provision should be

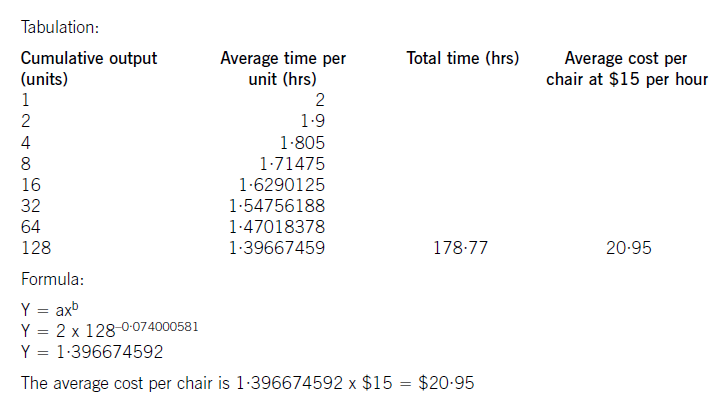

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

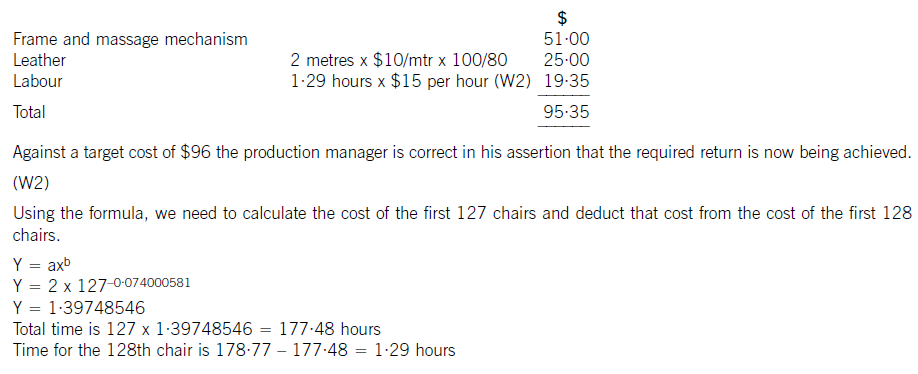

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-02-26

- 2020-01-10

- 2020-01-10

- 2020-02-23

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-01-03

- 2020-02-23

- 2020-01-09

- 2020-01-09

- 2020-01-10

- 2021-06-27

- 2020-01-10

- 2020-02-26

- 2020-01-03

- 2020-02-26

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2020-02-23

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-02

- 2020-02-23

- 2020-01-09