内蒙古想要报考ACCA考试的萌新们,在报考之前你需要了解这些条件

发布时间:2020-01-09

众所周知,ACCA证书的含金量是十分高的,不仅仅国内认可,国际上也认可。据调查显示,目前持有ACCA证书的人尚且不多,而社会对这一部分人才的需求也是十分巨大的,因此使得越来越多的人来报考ACCA考试。对于这些尚未了解ACCA考试的萌新们,报考条件是什么呢?没关系,51题库考试学习网会一一解答萌新报名时的相关疑问:

(1)什么是ACCA?

ACCA全称为The Association of

Chartered Certified Accountants,是由国际性的会计师组织英国特许公认会计师公会设立的证书,国内也被称为国际注册会计师,是全球的财会金融领域的证书之一,更是国际认可的财务人员资格证书。

(2)ACCA考试科目内容

ACCA证书培养目标是培养综合性的高级财务管理人才。所以,对应试者的要求也是出奇的高的。ACCA证书一共包括13门考试科目,这些考试科目的设置从财务基础到高级的管理课程层层递进,由浅入深,即使是没有财务基础的人也能够轻松入门,授课内容和考试语言为英语,因此难度相对于本土证书的考试难度会有一定的提升。

(3)持有ACCA证书的就业前景

ACCA作为财会界含金量最高的证书之一,在全球企业中都有极高的认可度,在国内与超过400家认证雇主保持密切合作,使ACCA学员在就业时会获得优先录取的机会。这就是为什么近些年越来越多人来报考ACCA考试的原因,另外持有ACCA证书的学生进入四大会计师事务所时会被优先考虑,还会有除了工资外的Q-pay。目前中国ACCA人才缺口达到了20多万,所以ACCA学习人数正在逐步扩大,许多顶尖的财经院校也开始开设ACCA专业。

报考国际注册会计师的条件有哪些?

报名国际注册会计师ACCA考试,具备以下条件之一即可:

1)凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

2)教育部认可的高等院校在校生,顺利完成大一的课程考试,即可报名成为ACCA的正式学员;

3)未符合1、2项报名资格的16周岁以上的申请者,也可以先申请参加FIA(Foundations in Accountancy)基础财务资格考试。在完成基础商业会计(FAB)、基础管理会计(FMA)、基础财务会计(FFA)3门课程,并完成ACCA基础职业模块,可获得ACCA商业会计师资格证书(Diploma

in Accounting and Business),资格证书后可豁免ACCAF1-F3三门课程的考试,直接进入技能课程的考试。

看完这些,各位萌新们是不是更加了解ACCA考试了呢?51题库考试学习网在这里提醒一下大家:2020年3月份即将迎来ACCA新的一季考试,有参加的ACCAer们就建议大家可以开始着手准备复习了哦;俗话说,机会是留给有准备的人的,早点备考多学一些知识才能去攻克更多的困难。最后,51题库考试学习网预祝大家考试通过,成功上岸,ACCAer们,加油~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Explain Mintzberg’s five organisational components. (10 marks)

(b) The strategic apex is the highest level of the organisation and is therefore the highest level of management. This part ensures that the organisation’s mission is followed and manages the relationship with the environment.

The operating core is the part that represents the productive activity of the organisation, gathering inputs and, through conversion, turns them into outputs.

The middle line represents that part of the organisation where the middle managers operate. The role of this part is to turn the instructions of the strategic apex into activities for the operating core.

The technostructure includes the staff who provide a technical or supportive activity but which are not a part of the core activities. This part of the organisation includes the engineering, accounting and human resource departments.

The support staff carry out the ancillary activities that are neither part of the core nor the technostructure. Support staff have no role in the direct activities of the organisation: these activities include catering and public relations.(Students may draw the appropriate diagram)

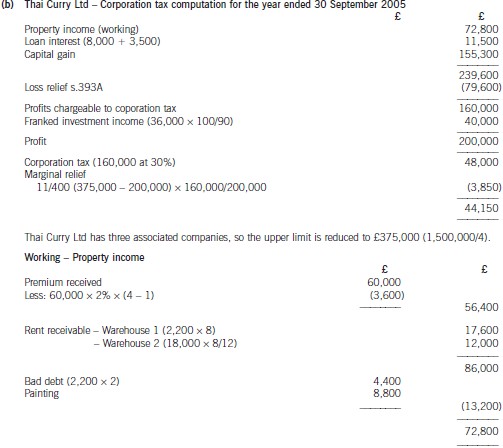

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

(b) Explain the advantages from a tax point of view of operating the new business as a partnership rather than

as a company whilst it is making losses. You should calculate the tax adjusted trading loss for the year

ending 31 March 2008 for both situations and indicate the years in which the loss relief will be obtained.

You are not required to prepare any other supporting calculations. (10 marks)

(b) The new business

There are two tax advantages to operating the business as a partnership.

(i) Reduction in taxable income

If the new business is operated as a company, Cindy and Arthur would both be taxed at 40% on their salaries. In

addition, employer and employee national insurance contributions would be due on £105 (£5,000 – £4,895) in respect

of each of them.

If the new business is operated as a partnership, the partners would have no taxable trading income because the

partnership has made a loss; any salaries paid to the partners would be appropriations of the profit or loss of the

business and not employment income. They would, however, each have to pay Class 2 national insurance contributions

of £2·10 each per week.

(ii) Earlier relief for trading losses

If the new business is operated as a company, its tax adjusted trading loss in the year ending 31 March 2008 would

be as follows:

(iii) State the value added tax (VAT) and stamp duty (SD) issues arising as a result of inserting Bold plc as

a holding company and identify any planning actions that can be taken to defer or minimise these tax

costs. (4 marks)

You should assume that the corporation tax rates for the financial year 2005 and the income tax rates

and allowances for the tax year 2005/06 apply throughout this question.

(iii) Bold plc will be making a taxable supply of services, likely to exceed the VAT threshold. It should therefore consider

registering for VAT – either immediately on a voluntary basis, or when its cumulative taxable supplies in the previous

twelve months exceed £60,000.

As an alternative, the new group can apply for a group VAT registration. This will simplify its VAT administration as intragroup

transactions are broadly disregarded for VAT purposes, and only one VAT return is required for the group as a

whole.

Stamp duty normally applies at 0·5% on the consideration payable in respect of transactions in shares. However, an

exemption is available in the case of a takeover, reconstruction or amalgamation where there is no real change in

ownership, i.e. the new shareholdings mirror the old shareholdings, and the transaction is for commercial purposes. The

insertion of a new holding company over an existing company, as proposed here, would qualify for this exemption.

There is no VAT on transactions in shares.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-06-27

- 2020-01-10

- 2020-01-10

- 2020-04-05

- 2019-01-06

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-03

- 2020-01-03

- 2020-02-22

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-02-23

- 2020-02-23

- 2020-04-28

- 2020-01-09

- 2020-01-10

- 2020-01-03

- 2020-01-10

- 2020-01-03

- 2020-01-09

- 2020-01-07

- 2020-01-09

- 2021-04-04

- 2020-01-10