看过来:2020年西藏ACCA考试成绩查询相关事宜

发布时间:2020-10-19

好消息,好消息!2020年9月ACCA考试成绩查询入口已经开通了,趁着空闲时间,先来了解一下成绩查询事项再完成查询工作吧。

2020年9月ACCA考试成绩已公布,考生现在登录ACCA官网即可查询。

ACCA考试成绩查询方式一共有三种,分别是:手机短信通知、邮件通知、在线查询。

(一)手机短信通知

(二)邮件通知

ACCA官方会根据所有考生的预留手机号和注册邮箱地址,通过短信和电子邮件的形式将成绩单发送给各位考生。不过,要实现这一功能,需要学员自行登录My ACCA账户中,设置邮件或短信通知成绩这一选项。

(三)在线查询

1. 进入ACCA官网http://www.accaglobal.com/hk/en.html 点击右上角My ACCA进行登录;

2. 输入账号、密码登录后进入主页面,点击Exam

status & Results;

3. 跳转页面后选择View your

status report;

ACCA成绩查询结果显示:

到ACCA全球官方网站http://www.accaglobal.com/hk/en.html;点击Myacca登陆,点左面框架里的“EXAMS”进入页面,中间有一段:

EXAM STATUS REPORT Your status report

provides details of the ACCA exams you have already passed and those you have

still to complete EXAM STATUS REPORT Your status report provides details of the

ACCA exams you have already passed and those you have still to complete View

your status report——这个是超级链接,点击进入就可以查看学员全部的考试分数记录。

9月ACCA考试成绩常见问题:

1、ACCA成绩有效期

ACCA 应用知识和技能课程阶段的成绩永久有效,但战略阶段课程成绩仅7年内有效。即:从学员通过战略阶段的第一门科目开始,7年内需完成战略阶段所要求的所有科目,否则从第8年开始第1年所考过的战略阶段科目成绩将会被视为过期作废。

此政策实行滚动式废除,也就是说不会在第8年时把之前7年所有考过的P阶段科目成绩都废除,只会废除第1年考过的战略阶段科目成绩,第9年会废除前2年所通过的战略阶段科目成绩,以此类推。

2、何时申请成绩复议,具体步骤

学员须在考试成绩发布日后的15个工作日内提出复议申请,具体申请的步骤为:

(1):登录进入Myacca;

(2):点击“Exam Status

and Results”里面有“Administrative Review”;

(3):填写和提交表格即可。

一旦成绩有误,那么学员会在下次报考截止日期前收到改正后的考试成绩。

说明:因考试政策、内容不断变化与调整,51题库考试学习网提供的考试信息仅供参考,如有异议,请考生以权威部门公布的内容为准!

以上就是今天51题库考试学习网分享的全部内容,各位小伙伴可以开始查询成绩了,是不是很激动,同时如对成绩结果有疑问及时申请复议。如需了解更多ACCA考试的相关内容,记得关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

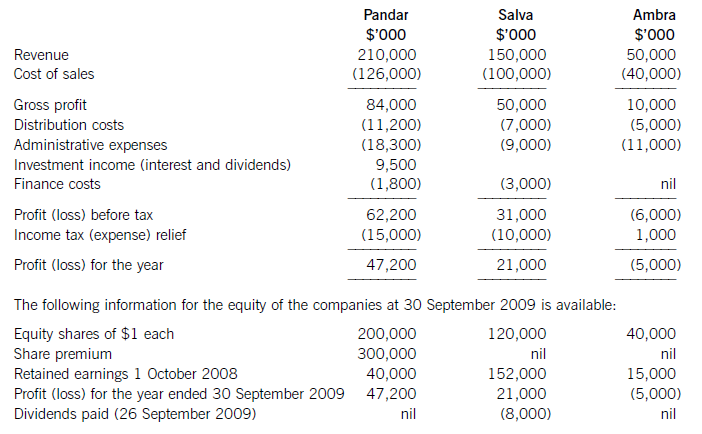

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

3 Susan Paullaos was recently appointed as a non-executive member of the internal audit committee of Gluck and

Goodman, a public listed company producing complex engineering products. Barney Chester, the executive finance

director who chairs the committee, has always viewed the purpose of internal audit as primarily financial in nature

and as long as financial controls are seen to be fully in place, he is less concerned with other aspects of internal

control. When Susan asked about operational controls in the production facility Barney said that these were not the

concern of the internal audit committee. This, he said, was because as long as the accounting systems and financial

controls were fully functional, all other systems may be assumed to be working correctly.

Susan, however, was concerned with the operational and quality controls in the production facility. She spoke to

production director Aaron Hardanger, and asked if he would be prepared to produce regular reports for the internal

audit committee on levels of specification compliance and other control issues. Mr Hardanger said that the internal

audit committee had always trusted him because his reputation as a manager was very good. He said that he had

never been asked to provide compliance evidence to the internal audit committee and saw no reason as to why he

should start doing so now.

At board level, the non-executive chairman, George Allejandra, said that he only instituted the internal audit committee

in the first place in order to be seen to be in compliance with the stock market’s requirement that Gluck and Goodman

should have one. He believed that internal audit committees didn’t add materially to the company. They were, he

believed, one of those ‘outrageous demands’ that regulatory authorities made without considering the consequences

in smaller companies nor the individual needs of different companies. He also complained about the need to have an

internal auditor. He said that Gluck and Goodman used to have a full time internal auditor but when he left a year

ago, he wasn’t replaced. The audit committee didn’t feel it needed an internal auditor because Barney Chester believed

that only financial control information was important and he could get that information from his management

accountant.

Susan asked Mr Allejandra if he recognised that the company was exposing itself to increased market risks by failing

to have an effective audit committee. Mr Allejandra said he didn’t know what a market risk was.

Required:

(a) Internal control and audit are considered to be important parts of sound corporate governance.

(i) Describe FIVE general objectives of internal control. (5 marks)

3 (a) (i) FIVE general objectives of internal control

An internal control system comprises the whole network of systems established in an organisation to provide reasonable

assurance that organisational objectives will be achieved.

Specifically, the general objectives of internal control are as follows:

To ensure the orderly and efficient conduct of business in respect of systems being in place and fully implemented.

Controls mean that business processes and transactions take place without disruption with less risk or disturbance and

this, in turn, adds value and creates shareholder value.

To safeguard the assets of the business. Assets include tangibles and intangibles, and controls are necessary to ensure

they are optimally utilised and protected from misuse, fraud, misappropriation or theft.

To prevent and detect fraud. Controls are necessary to show up any operational or financial disagreements that might

be the result of theft or fraud. This might include off-balance sheet financing or the use of unauthorised accounting

policies, inventory controls, use of company property and similar.

To ensure the completeness and accuracy of accounting records. Ensuring that all accounting transactions are fully and

accurately recorded, that assets and liabilities are correctly identified and valued, and that all costs and revenues can be

fully accounted for.

To ensure the timely preparation of financial information which applies to statutory reporting (of year end accounts, for

example) and also management accounts, if appropriate, for the facilitation of effective management decision-making.

[Tutorial note: candidates may address these general objectives using different wordings based on analyses of different

study manuals. Allow latitude]

(ii) ‘job description’. (4 marks)

(ii) On the other hand, the job description is based on information gathered from a job analysis and defines the position and role

that has to be fulfilled. It is a statement of the component tasks, duties, objectives and standards. It describes the purpose

and relationships of the specific job together with the physical, social and economic factors which affect it. Fundamentally, it

describes the job to be done.

(c) Outline the problems with references. (7 marks)

(15 marks)

Part (c)

There can be significant problems with references, these include the fact that most referees are well known to the applicant and

hesitate to say anything critical. However, the more skilful reference reader learns to look for what is conspicuous by omission

although there is always the risk that the writer merely forgot.

Often there are glowing tributes designed to aid the candidate on their way and some can be too ambiguous to be useful.

It is also important to note that references are poor predictors of future performance, are time consuming for the referee and the

subsequent reader. A particular problem is that employers who want to rid themselves of unsatisfactory employees could write an

enthusiastic reference, or at best one which leaves a lot unsaid.

However, care should be taken when providing references. Potentially, there can be legal consequences if a reference is misleading

or misrepresents the person for whom the reference is provided.

In addition, problems can arise when references are sought too early in the recruitment process and therefore breach confidentiality.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-04-07

- 2021-04-07

- 2020-01-10

- 2020-03-20

- 2020-08-12

- 2020-09-05

- 2020-09-05

- 2021-05-22

- 2021-04-07

- 2020-01-10

- 2020-09-05

- 2020-01-01

- 2020-08-12

- 2020-01-10

- 2020-09-05

- 2020-08-12

- 2020-09-05

- 2020-10-18

- 2020-10-18

- 2020-10-18

- 2021-01-08

- 2021-04-04

- 2020-09-05

- 2020-08-12

- 2020-01-10

- 2021-04-08

- 2020-09-05

- 2021-04-07

- 2021-04-07

- 2021-04-08