西藏ACCA考试成绩查询时间

发布时间:2021-01-08

对于报考了ACCA考试的西藏考生来说,除了考试时间,也一定还想知道什么时候可以查询成绩吧?51题库考试学习网带您一起来看看ACCA考试成绩查询时间安排。

2020年12月ACCA考试成绩预计2021年1月18日左右公布,在此分享几点成绩查询后考生们比较关注的几点事项,以便大家查阅!

ACCA考试成绩合格标准:ACCA考试每科满分为100分,50分合格。ACCA考试不会控制一定的考试通过率,因此每门考试只要满足50分及以上即算作通过考试。

ACCA证书申请:

1、通过ACCA专业资格大纲13门课程的考试(其中9门根据学员的教育和专业背景可申请不同程度的免试);

2、完成职业道德与专业技能模块(EPSM);

3、至少三年的相关工作经验。

ACCA证书申请流程:

1、 符合会员的必要条件”3E”的准会员可以填写《ACCA会员申请表》。《ACCA会员申请表》可以直接登陆ACCA网站下载。对于暂时未满足会员的必要条件的准会员,可以在条件满足的任何时间向ACCA递交ACCA会员申请表;

2、 ACCA总部将对会员申请材料进行审核,完全符合条件者将被批准成为ACCA会员,并会收到ACCA英国总部颁发的ACCA会员证书。一般这个过程需要两个月的时间;成为会员约五年后,经申请和资格审查,可以成为资深会员(FCCA)。

3、 ACCA每年2月份和8月份会分别公布上一年12月份和本年6月份的考试成绩。每一个通过ACCA全部考试的学员随后会收到ACCA英国总部颁发的ACCA准会员证书,以确认学员成功通过所有考试。(一般收到时间是3月初和9月初)。

ACCA官方公布的以下情况下之一者,可以申请复议:

(1)参加了考试,并提交了答卷,却通知缺席考试;

(2)缺席考试,却收到考试成绩;

(3)对考试成绩有异议。

如果符合以上情况之一,ACCA学员必须在考试成绩发布日后的15个工作日内提出查卷申请。如果成绩有误,会在下次报考截止日期前收到改正后的成绩。

ACCA继续教育:为保持并更新专业知识和技能,ACCA要求所有会员必须每年参加累计不少于40学时的继续教育。

以上就是51题库考试学习网为大家带来的ACCA考试成绩查询时间相关信息汇总,希望可以带来帮助,祝大家顺利地通过考试,愉快地拿到证书!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(d) Sirus raised a loan with a bank of $2 million on 1 May 2007. The market interest rate of 8% per annum is to

be paid annually in arrears and the principal is to be repaid in 10 years time. The terms of the loan allow Sirus

to redeem the loan after seven years by paying the full amount of the interest to be charged over the ten year

period, plus a penalty of $200,000 and the principal of $2 million. The effective interest rate of the repayment

option is 9·1%. The directors of Sirus are currently restructuring the funding of the company and are in initial

discussions with the bank about the possibility of repaying the loan within the next financial year. Sirus is

uncertain about the accounting treatment for the current loan agreement and whether the loan can be shown as

a current liability because of the discussions with the bank. (6 marks)

Appropriateness of the format and presentation of the report and quality of discussion (2 marks)

Required:

Draft a report to the directors of Sirus which discusses the principles and nature of the accounting treatment of

the above elements under International Financial Reporting Standards in the financial statements for the year

ended 30 April 2008.

(d) Repayment of the loan

If at the beginning of the loan agreement, it was expected that the repayment option would not be exercised, then the effective

interest rate would be 8% and at 30 April 2008, the loan would be stated at $2 million in the statement of financial position

with interest of $160,000 having been paid and accounted for. If, however, at 1 May 2007, the option was expected to be

exercised, then the effective interest rate would be 9·1% and at 30 April 2008, the cash interest paid would have been

$160,000 and the interest charged to the income statement would have been (9·1% x $2 million) $182,000, giving a

statement of financial position figure of $2,022,000 for the amount of the financial liability. However, IAS39 requires the

carrying amount of the financial instrument to be adjusted to reflect actual and revised estimated cash flows. Thus, even if

the option was not expected to be exercised at the outset but at a later date exercise became likely, then the carrying amount

would be revised so that it represented the expected future cash flows using the effective interest rate. As regards the

discussions with the bank over repayment in the next financial year, if the loan was shown as current, then the requirements

of IAS1 ‘Presentation of Financial Statements’ would not be met. Sirus has an unconditional right to defer settlement for longer

than twelve months and the liability is not due to be legally settled in 12 months. Sirus’s discussions should not be considered

when determining the loan’s classification.

It is hoped that the above report clarifies matters.

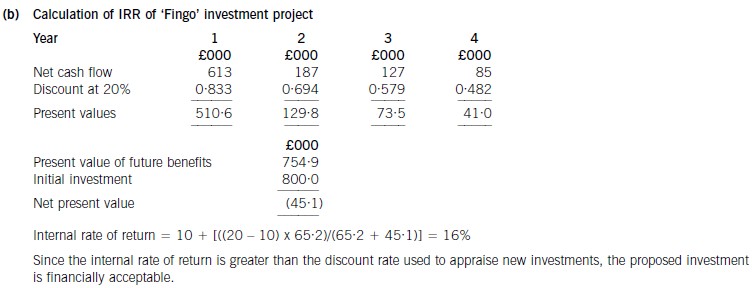

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

(c) non-consolidated entities under common control. (4 marks)

(c) Non-consolidated entities under common control

■ Horizontal groups of entities under common control were a significant feature of the Enron and Parmalat business

empires.

■ Such business empires increase audit risk as fraud is often disguised through labyrinthine group structures. Hence

auditors need to understand and confirm the economic purpose of entities within business empires (as well as special

purpose entities (SPEs) and non-trading entities).

■ Horizontal groups fall outside the requirement for the preparation of group accounts. It is not only finance that is offbalance

sheet when controlled entities are excluded from consolidated financial statements.

■ In the absence of consolidated financial statements, users of accounts of entities in horizontal groups have to rely on the

disclosure of related party transactions and control relationships for information about transactions and arrangements

with other group entities. Difficulties faced by auditors include:

? failing to detect related party transactions and control relationships;

? not understanding the substance of transactions with entities under common control;

? excessively creative tax planning;

? the implications of transfer pricing (e.g. failure to recognise profits unrealised at the business empire level);

? a lack of access to relevant confidential information held by others;

? relying on representations made in good faith by those whom the auditors believe manage the company when

control rests elsewhere.

■ Audit work is inevitably increased if an auditor is put upon inquiry to investigate dubious transactions and arrangements.

However, the complexity of business empires across multiple jurisdictions with different auditors may deter auditors from

liaising with other auditors (especially where legal or professional confidentiality considerations prevent this).

(iii) A statement on the importance of confidentiality in the financing of the early stage working capital needs

and an explanation of how this conflicts with the duty of transparency in matters of corporate

governance. (6 marks)

Professional marks for layout, logical flow and persuasiveness of the statement. (4 marks)

(iii) Importance of confidentiality in the financing of the project and the normal duty of transparency.

I have been asked to include a statement in my remarks on the balance between our duty to be transparent whenever

possible and the need for discretion and confidentiality in some situations. In the case of our initial working capital needs

for the Giant Dam Project, the importance of confidentiality in financing is due to the potential for adverse publicity that

may arise for the lender. It is important that R&M have the project adequately financed, especially in the early stages

before the interim payments from the client become fully effective.

In general, of course, we at R&M attempt to observe the highest standards of corporate governance and this involves

adopting a default position of transparency rather than concealment wherever possible. We recognise that transparency

is important to underpin investor confidence and to provide investors with the information they need to make fund

allocation decisions.

Whilst it is normal to disclose the amount of debt we carry at any given point (on the balance sheet), it is rarely normal

practice to disclose the exact sources of those loans. In the case of the financing of initial working capital for the Giant

Dam Project, I’m sure you will realise that in this unique situation, disclosure of the lender’s identity could threaten the

progress of the project. For this reason we must resist any attempts to release this into the public domain. We are aware

of one pressure group that is actively seeking to discover this information in order to disrupt the project’s progress and

we shall be taking all internal measures necessary to ensure they do not obtain the information.

Thank you for listening.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-09-05

- 2021-01-06

- 2019-03-20

- 2021-05-22

- 2020-09-05

- 2020-01-10

- 2019-01-05

- 2021-01-06

- 2020-02-23

- 2019-01-05

- 2020-01-10

- 2020-08-12

- 2020-01-10

- 2020-02-23

- 2021-01-08

- 2020-10-18

- 2021-04-04

- 2019-01-05

- 2021-01-08

- 2020-08-12

- 2020-08-12

- 2020-09-05

- 2019-03-20

- 2019-03-20

- 2020-10-19

- 2021-04-07

- 2020-09-05

- 2021-01-08

- 2020-10-19

- 2019-03-20