2020年ACCA考试,老考生需要更改照片吗?

发布时间:2020-02-27

随着新年的到来,ACCA考试报名也离我们更近了一步,一些小伙伴已经开始在网上查询相关报名信息。比如,2020年ACCA考试,老考生需要更改照片。鉴于此,51题库考试学习网在下面为大家带来有关2020年ACCA考试报名方法的相关情况,以供参考。

报考ACCA考试需要先在官网注册成为会员,ACCA学员注册一般有网上注册和代注册两种方式。在注册完成后,小伙伴们就无需在进行资料上传。但是,需要变更个人信息的学员可以在MyACCA账户进行修改。下面是具体注册流程:

首次申请注册ACCA学员可采取网上注册以及代注册方式。网上注册需要在ACCA官网申请,并提交材料以及缴纳注册费用,所需时间最长为15天。而代注册方式,则需要申请注册报名者从ACCA代表处索取报名表(IRForm)。填写完毕后,申请人员需要将报名表连同以下材料中的部分或全部材料(视各人资历及申请免试等不同情况)一起交到代表处,由代表处汇总整理后寄往英国ACCA总部办理注册手续。注册所需时间一般是在2至4周,各地情况略有差异。

所需材料:学历/学位证明(本科在校生需要提交学校出具的学生在校证明函)、身份证、英语水平证明、学历课程成绩单(加盖学校公章;本科在校生需要提交所有学年的课程考试的合格成绩单)等证件的原件、复印件和译文以及两张两寸照片、50英镑注册报名费的银行汇票。由于注册所需时间较长,因此小伙伴们在准备材料时一定要注意完整、有效。

另外,注册报名随时都可以进行,但注册时间的早晚,决定了第一次参加考试的时间。比如说,在七月三十一日前注册,有资格参加同年十二月份考试;如果是在十二月十五日前注册,则有资格参加翌年六月份考试。当然了,如果小伙伴们在准备不充分的情况下,51题库考试学习网建议大家还是尽量别急于报考

以上就是关于ACCA学员注册流程的相关情况。51题库考试学习网提醒:选择代注册方式的小伙伴们,要注意提前准备好材料并交到代表处哦。最后,51题库考试学习网预祝准备参加2020年ACCA考试的小伙伴都能顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

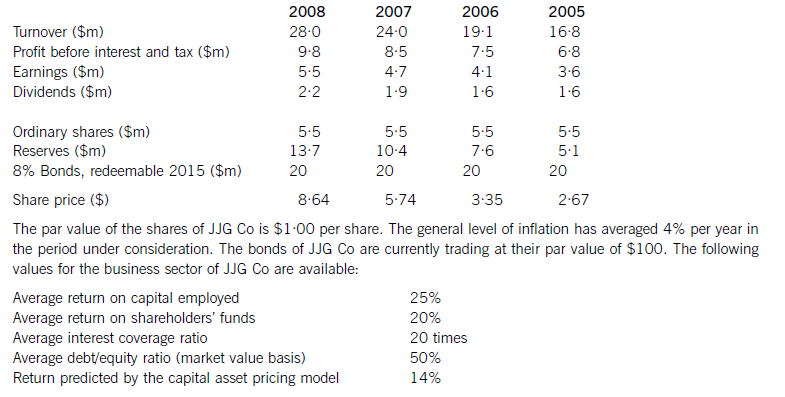

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.

You are an audit manager responsible for providing hot reviews on selected audit clients within your firm of Chartered

Certified Accountants. You are currently reviewing the audit working papers for Pulp Co, a long standing audit client,

for the year ended 31 January 2008. The draft statement of financial position (balance sheet) of Pulp Co shows total

assets of $12 million (2007 – $11·5 million).The audit senior has made the following comment in a summary of

issues for your review:

‘Pulp Co’s statement of financial position (balance sheet) shows a receivable classified as a current asset with a value

of $25,000. The only audit evidence we have requested and obtained is a management representation stating the

following:

(1) that the amount is owed to Pulp Co from Jarvis Co,

(2) that Jarvis Co is controlled by Pulp Co’s chairman, Peter Sheffield, and

(3) that the balance is likely to be received six months after Pulp Co’s year end.

The receivable was also outstanding at the last year end when an identical management representation was provided,

and our working papers noted that because the balance was immaterial no further work was considered necessary.

No disclosure has been made in the financial statements regarding the balance. Jarvis Co is not audited by our firm

and we have verified that Pulp Co does not own any shares in Jarvis Co.’

Required:

(b) In relation to the receivable recognised on the statement of financial position (balance sheet) of Pulp Co as

at 31 January 2008:

(i) Comment on the matters you should consider. (5 marks)

(b) (i) Matters to consider

Materiality

The receivable represents only 0·2% (25,000/12 million x 100) of total assets so is immaterial in monetary terms.

However, the details of the transaction could make it material by nature.

The amount is outstanding from a company under the control of Pulp Co’s chairman. Readers of the financial statements

would be interested to know the details of this transaction, which currently is not disclosed. Elements of the transaction

could be subject to bias, specifically the repayment terms, which appear to be beyond normal commercial credit terms.

Paul Sheffield may have used his influence over the two companies to ‘engineer’ the transaction. Disclosure is necessary

due to the nature of the transaction, the monetary value is irrelevant.

A further matter to consider is whether this is a one-off transaction, or indicative of further transactions between the two

companies.

Relevant accounting standard

The definitions in IAS 24 must be carefully considered to establish whether this actually constitutes a related party

transaction. The standard specifically states that two entities are not necessarily related parties just because they have

a director or other member of key management in common. The audit senior states that Jarvis Co is controlled by Peter

Sheffield, who is also the chairman of Pulp Co. It seems that Peter Sheffield is in a position of control/significant influence

over the two companies (though this would have to be clarified through further audit procedures), and thus the two

companies are likely to be perceived as related.

IAS 24 requires full disclosure of the following in respect of related party transactions:

– the nature of the related party relationship,

– the amount of the transaction,

– the amount of any balances outstanding including terms and conditions, details of security offered, and the nature

of consideration to be provided in settlement,

– any allowances for receivables and associated expense.

There is currently a breach of IAS 24 as no disclosure has been made in the notes to the financial statements. If not

amended, the audit opinion on the financial statements should be qualified with an ‘except for’ disagreement. In

addition, if practicable, the auditor’s report should include the information that would have been included in the financial

statements had the requirements of IAS 24 been adhered to.

Valuation and classification of the receivable

A receivable should only be recognised if it will give rise to future economic benefit, i.e. a future cash inflow. It appears

that the receivable is long outstanding – if the amount is unlikely to be recovered then it should be written off as a bad

debt and the associated expense recognised. It is possible that assets and profits are overstated.

Although a representation has been received indicating that the amount will be paid to Pulp Co, the auditor should be

sceptical of this claim given that the same representation was given last year, and the amount was not subsequently

recovered. The $25,000 could be recoverable in the long term, in which case the receivable should be reclassified as

a non-current asset. The amount advanced to Jarvis Co could effectively be an investment rather than a short term

receivable. Correct classification on the statement of financial position (balance sheet) is crucial for the financial

statements to properly show the liquidity position of the company at the year end.

Tutorial note: Digressions into management imposing a limitation in scope by withholding evidence are irrelevant in this

case, as the scenario states that the only evidence that the auditors have asked for is a management representation.

There is no indication in the scenario that the auditors have asked for, and been refused any evidence.

(b) A summary of the information needed to satisfy our obligations under the money laundering legislation and

any action that should be taken before agreeing to become tax advisers to the Saturn Ltd group. (5 marks)

(b) Before agreeing to become tax advisers to the Saturn Ltd group

Information needed:

– Proof of incorporation and primary business address and registered office.

– The structure, directors and shareholders of the company.

– The identities of those persons instructing the firm on behalf of the company and those persons that are authorised to

do so.

Action to take:

– Consider whether becoming tax advisers to the Saturn Ltd group would create any threats to compliance with the

fundamental principles of professional ethics, for example integrity and professional competence. Where such threats

exist, we should not accept the appointment unless the threats can be reduced to an acceptable level via the

implementation of safeguards.

– Contact the existing tax adviser in order to ensure that there has been no action by the Saturn Ltd group that would, on

ethical grounds, preclude us from accepting appointment.

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

(a)Whilstprofitaftertax(anditsgrowth)isausefulmeasure,itmaynotgiveafairrepresentationofthetrueunderlyingearningsperformance.Inthisexample,userscouldinterpretthelargeannualincreaseinprofitaftertaxof80%asbeingindicativeofanunderlyingimprovementinprofitability(ratherthanwhatitreallyis:anincreaseinabsoluteprofit).Itispossible,evenprobable,that(someof)theprofitgrowthhasbeenachievedthroughtheacquisitionofothercompanies(acquisitivegrowth).Wherecompaniesareacquiredfromtheproceedsofanewissueofshares,orwheretheyhavebeenacquiredthroughshareexchanges,thiswillresultinagreaternumberofequitysharesoftheacquiringcompanybeinginissue.ThisiswhatappearstohavehappenedinthecaseofBarsteadastheimprovementindicatedbyitsearningspershare(EPS)isonly5%perannum.ThisexplainswhytheEPS(andthetrendofEPS)isconsideredamorereliableindicatorofperformancebecausetheadditionalprofitswhichcouldbeexpectedfromthegreaterresources(proceedsfromthesharesissued)ismatchedwiththeincreaseinthenumberofshares.Simplylookingatthegrowthinacompany’sprofitaftertaxdoesnottakeintoaccountanyincreasesintheresourcesusedtoearnthem.Anyincreaseingrowthfinancedbyborrowings(debt)wouldnothavethesameimpactonprofit(asbeingfinancedbyequityshares)becausethefinancecostsofthedebtwouldacttoreduceprofit.ThecalculationofadilutedEPStakesintoaccountanypotentialequitysharesinissue.Potentialordinarysharesarisefromfinancialinstruments(e.g.convertibleloannotesandoptions)thatmayentitletheirholderstoequitysharesinthefuture.ThedilutedEPSisusefulasitalertsexistingshareholderstothefactthatfutureEPSmaybereducedasaresultofsharecapitalchanges;inasenseitisawarningsign.InthiscasethelowerincreaseinthedilutedEPSisevidencethatthe(higher)increaseinthebasicEPShas,inpart,beenachievedthroughtheincreaseduseofdilutingfinancialinstruments.Thefinancecostoftheseinstrumentsislessthantheearningstheirproceedshavegeneratedleadingtoanincreaseincurrentprofits(andbasicEPS);however,inthefuturetheywillcausemoresharestobeissued.ThiscausesadilutionwherethefinancecostperpotentialnewshareislessthanthebasicEPS.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-09-03

- 2020-01-10

- 2021-01-22

- 2021-01-08

- 2020-02-18

- 2020-04-19

- 2020-05-09

- 2021-02-26

- 2020-01-09

- 2019-12-29

- 2020-01-09

- 2020-01-14

- 2020-01-09

- 2020-02-11

- 2020-01-09

- 2020-01-10

- 2021-01-13

- 2020-04-08

- 2020-05-09

- 2020-09-03

- 2020-01-10

- 2020-01-09

- 2020-01-09

- 2020-03-14

- 2021-01-13

- 2020-02-28

- 2021-02-26

- 2020-07-15

- 2021-04-22

- 2021-04-04