ACCA考试成绩合格证书丢失了怎么补办?

发布时间:2020-02-29

近年来随着ACCA考试热度的不断上升,网上也增加了许多关于ACCA考试信息的询问。比如ACCA考试成绩合格证书丢失了怎么补办。鉴于此,51题库考试学习网在下面为大家带来2020年ACCA考试合格证书的相关信息,以供参考。

ACCA考试合格证书采用电子证书,考生在做完每个阶段的线上测试之后,等待三五天的时间,ACCA官方审核通过后,就会自动生成ACCA考试合格证书,证书为PDF版本,有需求的考生可自行下载打印。因此,如果证书丢失,那么再进入网站打印即可。具体打印流程为:

1.登录MYACCA,点击Exam Status&Results。

2.点击右边的Print a Certificate,会出现以下页面,点击View Certificate选择证书点击下载即可。

通过考试仅为第一步,想要成为ACCA会员还有其他要求:当你学完了ACCA的所有课程,且通过了考试,并在线完成相应的Professionalism and ethics学习和测试,还必须具备三年及以上的工作经验,才可以进行申请。提交申请后,需要通过审核才能正式成为ACCA会员。

具体申请流程为:登录ACCA网站下载并填写《ACCA会员申请表》,并在满足会员必要条件后向ACCA递交ACCA会员申请表。ACCA总部会对申请人进行资料审核,审核通过后,会为申请人颁发ACCA会员证书,一般这个过程需要两个月的时间。等拿到证书后,小伙伴们就是正式的ACCA会员了。

以上就是关于ACCA考试合格证书的相关情况。51题库考试学习网提醒:通过ACCA考试各阶段科目,可以获得ACCA官网颁发的证书,这些证书与最后的会员注册申请无关,请考生注意。最后,51题库考试学习网预祝准备参加2020年ACCA考试的小伙伴都能顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

The following information is available for a manufacturing company which produces multiple products:

(i) The product mix ratio

(ii) Contribution to sales ratio for each product

(iii) General fixed costs

(iv) Method of apportioning general fixed costs

Which of the above are required in order to calculate the break-even sales revenue for the company?

A.All of the above

B.(i), (ii) and (iii) only

C.(i), (iii) and (iv) only

D.(ii) and (iii) only

The method of apportioning general fixed costs is not required to calculate the break-even sales revenue.

(c) Explain the possible impact of RBG outsourcing its internal audit services on the audit of the financial

statements by Grey & Co. (4 marks)

(c) Impact on the audit of the financial statements

Tutorial note: The answer to this part should reflect that it is not the external auditor who is providing the internal audit

services. Thus comments regarding objectivity impairment are not relevant.

■ As Grey & Co is likely to be placing some reliance on RBG’s internal audit department in accordance with ISA 610

Considering the Work of Internal Auditing the degree of reliance should be reassessed.

■ The appointment will include an evaluation of organisational risk. The results of this will provide Grey with evidence,

for example:

– supporting the appropriateness of the going concern assumption;

– of indicators of obsolescence of goods or impairment of other assets.

■ As the quality of internal audit services should be higher than previously, providing a stronger control environment, the

extent to which Grey may rely on internal audit work could be increased. This would increase the efficiency of the

external audit of the financial statements as the need for substantive procedures should be reduced.

■ However, if internal audit services are performed on a part-time basis (e.g. fitting into the provider’s less busy months)

Grey must evaluate the impact of this on the prevention, detection and control of fraud and error.

■ The internal auditors will provide a body of expertise within RBG with whom Grey can consult on contentious matters.

Tutorial note: Appropriate credit will be given for arguing that less reliance may be placed on internal audit in this year of

change of provider.

(c) Without changing the advice you have given in (b), or varying the terms of Luke’s will, explain how Mabel

could further reduce her eventual inheritance tax liability and quantify the tax saving that could be made.

(3 marks)

The increase in the retail prices index from April 1984 to April 1998 is 84%.

You should assume that the rates and allowances for the tax year 2005/06 will continue to apply for the

foreseeable future.

(c) Further advice

Mabel should consider delaying one of the gifts until after 1 May 2007 such that it is made more than seven years after the

gift to the discretionary trust. Both PETs would then be covered by the nil rate band resulting in a saving of inheritance tax

of £6,720 (from (b)).

Mabel should ensure that she uses her inheritance tax annual exemption of £3,000 every year by, say, making gifts of £1,500

each year to both Bruce and Padma. The effect of this will be to save inheritance tax of £1,200 (£3,000 x 40%) every year.

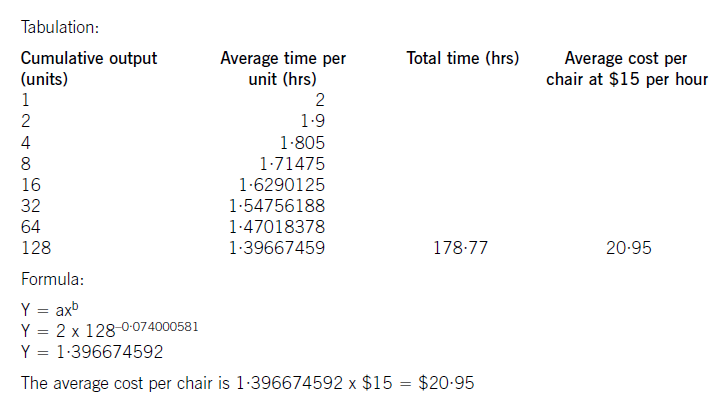

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

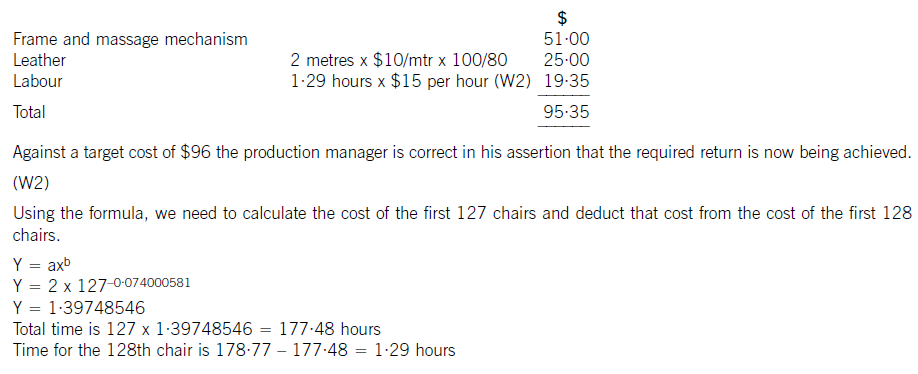

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-08

- 2019-07-20

- 2020-01-08

- 2020-03-04

- 2020-01-08

- 2021-02-25

- 2021-01-08

- 2021-04-09

- 2020-01-08

- 2020-01-08

- 2020-01-08

- 2020-01-08

- 2019-07-20

- 2020-01-08

- 2019-07-20

- 2020-02-29

- 2020-01-08

- 2020-01-08

- 2019-07-20

- 2020-01-08

- 2019-07-20

- 2020-01-08

- 2019-07-20

- 2020-01-08

- 2020-01-08

- 2020-01-08

- 2020-02-29

- 2020-01-08

- 2019-07-20

- 2019-07-20