速看!ACCA考试成绩查询方式以及申请成绩复核

发布时间:2021-05-14

许多考完ACCA的小伙伴近期问到如何查询考试成绩?成绩复核应该怎么申请复核?今天51题库考试学习网就为大家带来了相关信息,一起来了解一下吧!

成绩查询:

(一)在线查询:

1.进入ACCA官网http://www.accaglobal.com/hk/en.html

2.点击右上角My ACCA进行登录:

3.输入账号、密码登录后进入主页面,点击Exam status&Results:

4.跳转页面后选择View your status report:

进入后就可以查看自己的所有科目的考试通过情况了。

(二)通过邮件、手机信息接收成绩:

可在MY ACCA内选择通过E-mail或SMS接收考试成绩。

如何申请成绩复核?

在评卷之前,ACCA评分团队要与考官开会,讨论试卷并确定统一详细的评分表。验卷团队会对每一份试卷进行仔细检查,确保每一道试题都没有漏评分,且每份试卷的总分是正确。在整个评卷过程中验卷团队总共要检查8次。在考试成绩发布之前,ACCA会再进行一次检查,以确保学员的ACCA考试成绩准确无误。

然而,ACCA也意识到有时候学员会对他们所获得的考试结果有所怀疑。因此,在以下情况下,您可以要求查卷。

1.参加了考试,并提交了答卷,却说缺席考试。

2.缺席考试,却收到考试成绩。

3.对自己的考试成绩有所怀疑。

必须在考试成绩发布日后的15个工作日内提出查卷申请。如果ACCA成绩有误,会在下次报考截止日期前收到改正了的成绩,但是ACCA的复核工作也要收取相应的费用(52英镑)。

ACCA考试成绩什么时候出?

ACCA考试可分为随机机考、分季机考与笔试三大部分,其中F阶段所有的科目都已经进入机考时代,F1-F4是随机机考,对于参加随机机考的同学来说,在考完之后,立刻就可以看到自己的成绩。F5-F9是分季机考,对于参加分季机考的同学来说,考试成绩通常会在结束考试的一个月后可以知道自己的成绩。而P阶段笔试考试成绩通常也是考试一个月后可以知道。

ACCA的有效期:

ACCA学员有七年的时间通过专业阶段的考试。如果学员不能在七年内通过所有专业阶段考试,那么超过七年的已通过专业阶段科目的成绩将作废,须重新考试。七年时限从学员通过第一门专业阶段考试之日算起。

说明:因考试政策、内容不断变化与调整,51题库考试学习网提供的考试信息仅供参考,如有异议,请考生以权威部门公布的内容为准!

以上就是今天分享的全部内容了,各位小伙伴根据自己的情况进行查阅,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Explain Kohlberg’s three levels of moral development and identify the levels of moral development

demonstrated by the contributions of Gary Howells, Vanda Monroe and Martin Chan. (12 marks)

(b) Kohlberg’s levels of moral development

Description of levels

Kohlberg described human moral development in terms of three consecutive levels.

Preconventional moral responses view morality in terms of rewards, punishments and whether or not the act will be

penalised, found out or rewarded.

Conventional moral responses view morality in terms of compliance with the agreed legal and regulatory frameworks relevant

at the time and place in which the decision is taking place.

Postconventional responses go beyond the other two and frame. morality in terms of the effects of the action on oneself and

others, on how it will affect one’s own moral approach and how it will accord with wider systems of ethics and social norms.

Three people in the case

The three people mentioned in the case exhibit different levels of moral development.

Gary Howells is demonstrating the preconventional in that he sees the decision to disclose or not in terms of whether WM

can get away with it. He was inclined to conceal the information because of the potential impact on the company’s share

price on the stock market. His suggestion was underpinned by his belief that the concealment of the incorrect valuation would

not be ‘found out’.

Vanda Monroe demonstrates conventional behaviour, reminding the WM board of its legal and regulatory obligations under

the rules of its stock market listing. In particular, she reminded the board about the importance of the company’s compliance

with corporate governance and ethics codes by the stock market. To fail to disclose would, in Vanda’s view, be a breach of

those stock market expectations. Rather than rewards and punishments, Vanda was more concerned with compliance with

rules and regulations.

Martin Chan is demonstrating postconventional morality by referring to consistency of treatment and the notion of ‘do as you

would be done by’. He said that he wouldn’t want to be deceived if he were an outside investor in the company. His response

was underpinned neither by rewards or punishments, nor by compliance with regulations, but rather than a persuasion that

moral behaviour is about doing what one believes to be right, regardless of any other factors.

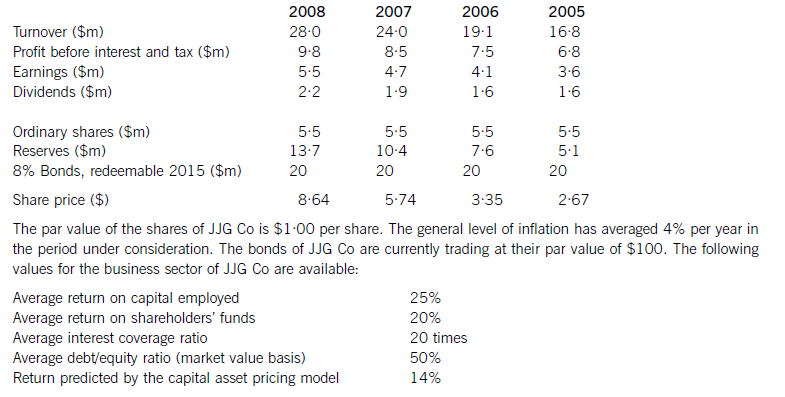

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.

(c) Identify TWO QUALITATIVE benefits that might arise as a consequence of the investment in a new IT system

and explain how you would attempt to assess them. (4 marks)

(c) One of the main qualitative benefits that may arise from an investment in a new IT system by Moffat Ltd is the improved level

of service to its customers in the form. of reduced waiting times which may arise as a consequence of better scheduling of

appointments, inventory management etc. This could be assessed via the introduction of a questionnaire requiring customers

to rate the service that they have received from their recent visit to a location within Moffat Ltd according to specific criteria

such as adherence to appointment times, time taken to service the vehicle, cleanliness of the vehicle, attitude of staff etc.

Alternatively a follow-up telephone call from a centralised customer services department may be made by Moffat Ltd

personnel in order to gather such information.

Another qualitative benefit of the proposed investment may arise in the form. of competitive advantage. Improvements in

customer specific information and service levels may give Moffat Ltd a competitive advantage. Likewise, improved inventory

management may enable costs to be reduced thereby enabling a ‘win-win’ relationship to be enjoyed with its customers.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-04-18

- 2019-07-21

- 2020-03-07

- 2020-01-10

- 2020-03-22

- 2020-03-07

- 2020-03-20

- 2020-04-22

- 2020-01-10

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-03-04

- 2020-03-04

- 2020-01-10

- 2020-04-23

- 2020-03-26

- 2020-01-09

- 2020-03-13

- 2020-03-22

- 2020-02-22

- 2020-03-12

- 2020-04-19

- 2020-03-12

- 2020-01-09

- 2020-08-15

- 2021-04-23

- 2020-01-09

- 2020-03-12