acca免考科目有什么利弊?一定越多越好吗?

发布时间:2021-04-23

许多同学都知道acca考试有免考的机会,有的可免考9门。使用acca免考具体有哪些优点、缺点呢?其实各有利弊。acca免考科目一定是越多越好吗?答案是否定的。今天就给大家介绍一下具体情况吧。

acca免试有哪些缺点?

以中外联合教学模式对接出去的学生为例,如果学生选择acca免考政策,那么在择校和选择专业上面就会受到许多约束。如果要想取得免考资格,就必须选择对接能享受免考的海外大学,同时只能选择享受免考政策的商科专业。

从海外大学专业课程的衔接来看,免考对会计类专业的学生帮助有限。以英国为例,英国的会计与金融专业和acca切合度很高,很多科目内容基本一致。学生如果通过了F阶段的9门科目,能力上相当于英国一个本土的会计与金融专业毕业生。如果学生在国内只是读了F阶段部分课程,就直接插读海外大学的大二大三还是有一定的难度;但学生如果在国内学习了F阶段的全部课程,这样就有更为扎实的专业知识和语言技能来胜任大二大三的专业课程。由于有了良好的专业基础,还有助于学生本科毕业获得一个较高的毕业等级,从而申请到更加优秀的硕士学校。

从课程深度上讲,acca免考对学习和应考P阶段的课程无实质性的帮助,而F阶段的考试会对后续的P阶段考试产生良好的推进作用。

国内阶段开设F阶段3-9门课程,有3+1模式和2+2模式。宣导acca9门免考但同时国内阶段不接受F阶段完整的课程体系的对接模式,实则对学生造成诸多不利,从国内中外联合教学(acca方向)教育现状来看,国内目前大部分中外联合教学(acca方向)模式的项目,大部分还是海外学历教育为主。

免考对F阶段来说,如果较多科目都没有学习过,就会直接导致学生基础没有打好,对整个课程体系也不了解,简单的来讲就是免考会让学生F阶段学不好。

acca免试的优点有哪些

考试科目的通过率高低不确定,acca免考不用担心通过率的问题,减轻了一部分的考试压力,可以让我们更好的投入到后面的学习。我们可以直接参加后面阶段的考试,加快了学习的进程。

由此可见acca的免考机会各有利弊,具体该如何选择,在于大家的实际情况和最终目的,选择适合自己的方式最重要,以上就是给大家更新分享的全部内容啦,更多后续可以关注51题库考试学习网,51题库考试学习网将持续为大家服务分享最新考试资讯。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) (i) Advise Andrew of the income tax (IT) and capital gains tax (CGT) reliefs available on his investment in

the ordinary share capital of Scalar Limited, together with any conditions which need to be satisfied.

Your answer should clearly identify any steps that should be taken by Andrew and the other investors

to obtain the maximum relief. (13 marks)

(b) (i) Andrew may be able to take advantage of tax reliefs under the enterprise investment scheme (EIS) provided the

necessary conditions are met. The conditions that have to be satisfied before full relief is available fall into three areas,

and broadly require that a ‘qualifying individual’ subscribes for ‘eligible shares’ in a ‘qualifying company’.

‘Qualifying Individual’

To be a qualifying individual, Andrew must not be connected with the EIS company. This means that he should not be

an employee (or, at the time the shares are issued, a director) or have an interest in (i.e. control) 30% or more of the

capital of the company. These conditions need to be satisfied throughout the period beginning two years before the share

issue and three years after the ‘relevant date’. Where the relevant date is defined as the later of the date the shares were

issued and the date on which the company commenced trading.

Andrew does not intend to become an employee (or director) of Scalar Limited, but he needs to exercise caution as to

how many shares he subscribes for. If only three investors subscribe for 100% of the shares, each will hold 33% of the

share capital. This exceeds the 30% limit and will mean that EIS relief (other than deferral relief) will not be available.

Therefore, Andrew and the other two investors should ensure not only that the potential fourth investor is recruited, but

that s/he subscribes for sufficient shares, such that none of them will hold 30% or more of the issued share capital, as

only then will they all attain qualifying individual status.

‘Eligible shares’

Qualifying shares need to be new ordinary shares which are subscribed for in cash and fully paid up at the time of issue.

The shares must not be redeemable for at least three years from the relevant date, and not carry any preferential rights

to dividends. On the basis of the information provided, the shares of Scalar Limited would qualify as eligible shares.

‘Qualifying Company’

The company must be unquoted, not controlled by another company, and engaged in qualifying business activities. The

latter requires that the company engage in a trading activity, which is carried on wholly or mainly in the UK, throughout

the three years following the relevant date. While certain trading activities, such as dealing in shares or trading in land,

are excluded, the manufacturing trade Scalar Limited proposes to carry on will qualify.

However, it is also necessary for at least 80% of the money raised to be used for the qualifying business activity within

12 months of the relevant date and the remaining 20% to be so used within the following 12 months. Andrew and the

other investors will thus have to ensure that Scalar Limited has not raised more funds than it is able to employ in the

business within the appropriate time periods.

Reliefs available:

Andrew can claim income tax relief at 20% income tax relief on the amount invested up to a maximum of £200,000

in any one tax year. The relief is given in the form. of a tax reducing allowance, which can reduce the investor’s income

tax liability to nil, but cannot be used to generate a tax refund. If the investment is made prior to 6 October in the tax

year, then 50% of the amount invested (up to a maximum of £25,000) can be treated as having been made in the

previous tax year.

Any capital gains arising on the sale of EIS shares will be fully exempt from capital gains tax provided that income tax

relief was given on the investment when made and has not been withdrawn. If the EIS shares are disposed of at a loss,

capital losses are still allowable, but reduced by the amount of any EIS relief attributable to the shares disposed of.

In addition, gains from the disposal of other assets can be deferred against the base cost of EIS shares acquired within

one year before and three years after their disposal. Such gains will, thus, not normally become chargeable until the EIS

shares themselves are disposed of. Further, for deferral relief to be available, it is not necessary for the investment to

qualify for EIS income tax relief, i.e. deferral is available even where the investor is not a qualifying individual. Thus,

Andrew could still defer the gain arising on the disposal of the residential property lease made in order to raise part of

the funds for his EIS investment, even if no fourth investor were to be found and his shareholding were to exceed 30%

of the issued share capital of Scalar Limited. Does not require the existence of income tax relief in order to be claimed.

Withdrawal of relief:

Any EIS relief claimed by Andrew will be withdrawn (partially or fully) if, within three year of the relevant date:

(1) he disposes of the shares;

(2) he receives value from the company;

(3) he ceases to be a qualifying individual; or

(4) Scalar Limited ceases to be a qualifying company.

With regard to receiving value from the company, the definition excludes dividends which do not exceed a normal rate

of return, but does include the repayment of any loans made to the company before the shares were issued, the provision

of benefits and the purchase of assets from the company at an undervalue. In this regard, Andrew and the other

subscribers should ensure that the £50,000 they are to invest in Scalar Limited as loan capital is appropriately timed

and structured relative to the issue of the EIS shares.

(b) Assess the likely strategic impact of the new customer delivery system on Supaserve’s activities and its ability

to differentiate itself from its competitors. (10 marks)

(b) Supaserve, through its electronic point of sale system (EPOS), is already likely to have useful information on the overall

patterns of buying behaviour in terms of products bought frequently, peak periods, etc. It is less likely to have detailed

information on individual customer purchase patterns, though it may be monitoring where its customers are living, travel

patterns, etc. The introduction of the new online system has the potential to have a major strategic impact on the company

and its relationship with its customers. Impact can be measured by assessing the significance of the change on the company’s

operations and the likelihood of its occurrence. In Michael Porter’s words, ‘the basic tool for understanding the influence of

information technology on companies is the value chain . . . and how it affects both a company’s cost and the value delivered

to buyers’.

Clearly the investment in Internet based technology will affect both the cost and revenue sides of the business. In terms of

operations the company will need to decide the way in which to integrate the new method of customer buying with its

traditional methods. Does it create a separate ‘dedicated’ warehouse operation solely involved with the online business or does

it integrate it within its existing operations? The customer will have immediate access to information on whether goods are in

stock or not, and this may have a significant impact on the procurement systems Supaserve has with its suppliers and the

inbound logistics which get the products to where they are needed for dispatch to the customers.

Online shopping will have a major impact on outbound logistics in that a totally new distribution process will have to be

created. The extent to which this new service is provided in-house by setting up a new activity within Supaserve, or

alternatively is outsourced to specialist distributors is a key decision affecting costs and efficiency. Supaserve’s delivery

performance will be both measurable and potentially available to competitors and a real source of competitive advantage or

disadvantage.

The new online system will have an immediate impact on marketing and sales. Can customers pay over the Internet?

Opportunities for direct marketing to individual customers are opened up and customisation becomes a real possibility.

Customers can link into after-sales services and provide insights into customer satisfaction. On the support side of the value

chain the impact on human resources may be profound and technology lies at the heart of the change. Above all there is a

key need to link the new strategy to the operational systems needed to deliver it.

Clearly, the introduction of the online shopping system offers an opportunity for Supaserve to differentiate itself from its

aggressive competitors. The online service, as suggested above, is likely to appeal to a limited but growing segment of its

customers. In strategic terms it is a focus differentiation strategy enabling Supaserve to provide an improved level of service

to its customers. For this customers are willing to pay a small premium. Perhaps the more significant impact on its profit

margins will be derived from improved levels of customer retention and the attraction of customers who formerly shopped

with its competitors. The ability to sustain its competitive advantage will be measured by the impact on its competitors and

their ability to introduce a similar service.

There are a number of useful models for assessing the impact of an IT related change. These could include the five forces

model and the frameworks developed by Michael Earl assessing the strategic impact of IT. Michael Earl argues persuasively

for the correct alignment between business strategy and IT strategy. Indeed he sees a need for a ‘binary approach’ with the

alignment of IT investment activities in existing ways of doing business as having to be accommodated with the IT investments

associated with more radical change to the ways business is conducted.

Cherry Blossom Co (Cherry) manufactures custom made furniture and its year end is 30 April. The company purchases its raw materials from a wide range of suppliers. Below is a description of Cherry’s purchasing system.

When production supervisors require raw materials, they complete a requisition form. and this is submitted to the purchase ordering department. Requisition forms do not require authorisation and no reference is made to the current inventory levels of the materials being requested. Staff in the purchase ordering department use the requisitions to raise sequentially numbered purchase orders based on the approved suppliers list, which was last updated 24 months ago. The purchasing director authorises the orders prior to these being sent to the suppliers.

When the goods are received, the warehouse department verifies the quantity to the suppliers despatch note and checks that the quality of the goods received are satisfactory. They complete a sequentially numbered goods received note (GRN) and send a copy of the GRN to the finance department.

Purchase invoices are sent directly to the purchase ledger clerk, who stores them in a manual file until the end of each week. He then inputs them into the purchase ledger using batch controls and gives each invoice a unique number based on the supplier code. The invoices are reviewed and authorised for payment by the finance director, but the actual payment is only made 60 days after the invoice is input into the system.

Required:

In respect of the purchasing system of Cherry Blossom Co:

(i) Identify and explain FIVE deficiencies; and

(ii) Recommend a control to address each of these deficiencies.

Note: The total marks will be split equally between each part.

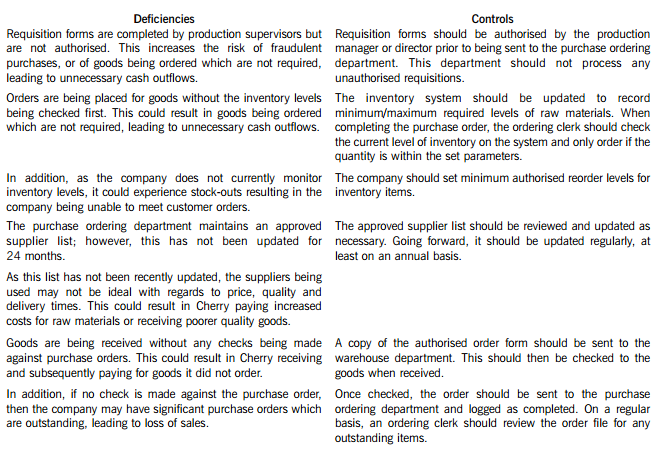

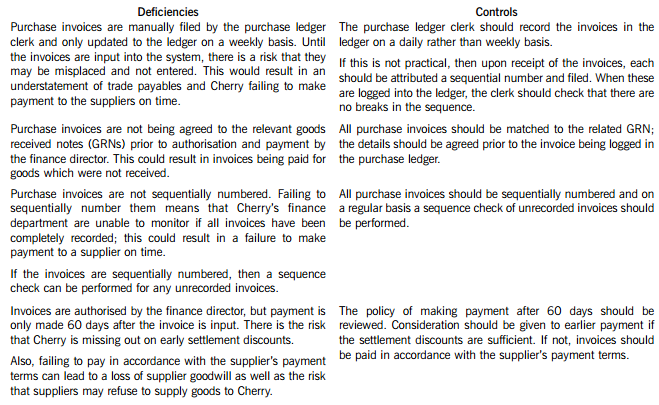

Cherry Blossom Co’s (Cherry) purchasing system deficiencies and controls

(c) At a recent meeting of the board of directors, the managing director of Envico Ltd said that he considered it

essential to be able to assess the ‘value for money’ of each seminar. He suggested that the quality of the speakers

and the comfort of the seminar rooms were two assessment criteria that should be used in order to assess the

‘value for money’ of each seminar.

Required:

Discuss SIX separate and distinct assessment criteria (including those suggested by the managing director),

that would enable the management of Envico Ltd to assess the ‘value for money’ of each seminar.

(6 marks)

(c) The following are six separate and distinct assessment criteria (including those suggested by the managing director), that

would enable the management of Envico Ltd to assess the ‘value for money’ of each seminar. The assessment criteria are

presented as questions that would comprise the contents of a questionnaire but other presentations would have been equally

acceptable.

(1) Did the course meet your objectives?

‘Value for money’ may, in part, be assessed by reference to the ‘effectiveness’ of the service provision. Effectiveness may

be viewed in this context as meeting the objectives of attendees. All attendees have similar but varying objectives and

hence it is vital that Envico Ltd meets the objectives of all attendees if seminars are to constitute ‘value for money’.

(2) How would you rate the quality of the speakers?

A primary resource of Envico Ltd is its speakers and thus it is important to gauge how they were perceived to perform

by the attendees.

(3) How would you rate comfort, cleanliness and facilities of the seminar rooms?

Again, a principal resource, which is consumed when providing the service, is the seminar room and the facilities

contained within it. Attendees will find a clean and ergonomically designed room more conducive for education and

training activities.

(4) How would you assess the quality of the course materials?

Since Envico Ltd undertakes the provision of educational and training seminars then the quality of course materials

provided assumes critical significance as they represent the ‘raison d’être’ of Envico Ltd. If they are perceived to be of

high quality they may act as a good advertisement for the company. Conversely, poor quality course materials will cause

Envico Ltd to be perceived poorly.

(5) How strongly would you recommend Envico courses to friends and colleagues?

This is a very important consideration since ‘word of mouth’ may represent the best means of advertising the services

provided by Envico Ltd and is indicative of whether attendees consider that they have received ‘value for money’ from

Envico Ltd.

(6) Do you consider that you could have achieved your objectives in attending the course in a more expedient manner? If

so, please detail below.

This question acknowledges that the time of attendees is a scarce resource and hence there may well be an opportunity

cost in attending seminars in addition to the explicit costs such as course fees, travel and subsistence costs etc. It is

essential that Envico Ltd is flexible in its approach to meeting the needs of clients where attendance at seminars is either

impracticable or undesirable. Perhaps a series of interactive CDs and/or video tuition may be more appropriate in certain

instances.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-08

- 2019-03-23

- 2020-04-18

- 2020-03-04

- 2020-03-08

- 2020-03-05

- 2020-03-05

- 2020-04-11

- 2021-05-02

- 2020-03-14

- 2020-01-10

- 2020-01-10

- 2020-04-28

- 2019-07-21

- 2021-05-14

- 2019-07-21

- 2020-01-10

- 2020-01-10

- 2020-01-08

- 2020-04-11

- 2020-04-29

- 2020-01-10

- 2020-01-09

- 2020-03-12

- 2020-03-04

- 2020-08-05

- 2020-01-04

- 2020-02-19

- 2019-07-21