2019ACCA这些免考福利政策你都清楚了吗?

发布时间:2019-07-19

据2019年ACCA官网信息了解到,2019-2020年部分财务相关专业大学在校或毕业学生,在参加ACCA考试注册时,将获得一定科目的免试权。ACCA对于参加专业会计师考试(ACCA)的中国学员的免试政策详情如下:

一、ACCA对中国教育部认可的全日制大学在读生(会计或金融专业)设置的免试政策

1. 会计学或金融学(完成第一学年课程):可以注册为ACCA正式学员,无免试

2. 会计学或金融学(完成第二学年课程):免试3门课程(F1-F3)

3. 会计学或金融学(完成第三学年课程):免试3门课程(F1-F3)

4. 其他专业(在校生完成大一后):可以注册但无免试

*大学在读考生准备时间相对充足,可以每次报考三门课程,不建议报考四门,科目可以以F5/F6/F7三门计算类科目为主,通过逐步的学习加强英文能力,然后再学习F4、F8、F9有文字写作要求的科目。

二、ACCA对中国教育部认可高校毕业生设置的免试政策

1. 会计学(获得学士学位):免试5门课程(F1-F5)

2. 会计学(辅修专业):免试3门课程(F1-F3)

3. 金融专业:免试5门课程(F1-F5)

4. 法律专业:免试1门课程(F4)

5. 商务及管理专业:免试1门课程(F1)

6. MPAcc专业(获得MPAcc学位或完成MPAcc大纲规定的所有课程、只有论文待完成):原则上免试九门课程(F1–F9),其中F6(税务)的免试条件:CICPA全科通过或MPAcc课程中选修了"中国税制"课程。

7. MBA学位(获得MBA学位):免试3门课程(F1-F3)

8. 非相关专业:无免试

高校毕业生(即:在职人士),可以每次报考两门课程,小编建议不要超过三门课程,科目可以F5/F6/F7三门计算类科目为主,通过逐步的学习加强英文能力,然后再学习F4、F8、F9有文字写作要求的科目。

三、注册会计师考生

1. 2009年CICPA"6+1"新制度实行之前获得CICPA全科通过的人员:免试5门课程(F1-F4和F6)

2. 2009年CICPA"6+1"新制度实行之后获得CICPA全科通过的人员:免试9们课程(F1-F9)

3. 如果在学习ACCA基础阶段科目的过程中获得了CICPA全科合格证(须2009年"6+1"制度实行后的新版证书),可以自行决定是否申请追加免试。

*通过注会考试的考生对于财务知识基础相对好,一般F7、F8、F9通过率比其他考生高很多,建议从这些科目入手,加强英语的阅读和写作能力,注会考试大纲与ACCA考试大纲类似,只其是在审计及财务管理类的科目上,基本上知识点是相通的。F7会计科目中国际会计准则会计处理上略有不同。

四、其他

1. CMA(美国注册管理会计师)全科通过并取得证书:免试F1-F5、F8、F9(共免7门)

2. USCPA(美国注册会计师)全科通过:免试F1-F6、F8、F9(共免8门)

五、注意事项

1.在校生只有顺利通过整学年的课程才能够申请免试。

2.针对在校生的部分课程免试政策只适用于会计学专业全日制大学本科的在读学生,而不适用于硕士学位或大专学历的在读学生。

3.已完成MPAcc学位大纲规定课程,还需完成论文的学员也可注册并申请免试。但须提交由学校出具的通过所有MPAcc学位大纲规定课程的成绩单,并附注"该学员已通过所有MPAcc学位大纲规定课程,论文待完成"的说明。

4.特许学位(即海外大学与中国本地大学合作而授予海外大学学位的项目)— 部分完成时不能申请免试。

5.政策适用于在中国教育部认可的高等院校全部完成或部分完成本科课程的学生,而不考虑目前居住地点。

6.欲申请牛津•布鲁克斯大学学士学位的学员需放弃F7-F9的免试。

综合以上就是关于2019ACCA免试政策的全部内容,希望对于正在备考的小伙伴么有帮助,小编将持续更新相关ACCA的相关资讯。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(d) Draft a letter for Tim Blake to send to WM’s investors to include the following:

(i) why you believe robust internal controls to be important; and

(ii) proposals on how internal systems might be improved in the light of the overestimation of mallerite at

WM.

Note: four professional marks are available within the marks allocated to requirement (d) for the structure,

content, style. and layout of the letter.

(16 marks)

You will be aware of the importance of accurate resource valuation to Worldwide Minerals (WM). Unfortunately, I have to

inform. you that the reserve of mallerite, one of our key minerals in a new area of exploration, was found to have been

overestimated after the purchase of a mine. It has been suggested that this information may have an effect on shareholder

value and so I thought it appropriate to write to inform. you of how the board intends to respond to the situation.

In particular, I would like to address two issues. It has been suggested that the overestimation arose because of issues with

the internal control systems at WM. I would firstly like to reassure you of the importance that your board places on sound

internal control systems and then I would like to highlight improvements to internal controls that we shall be implementing

to ensure that the problem should not recur.

(i) Importance of internal control

Internal control systems are essential in all public companies and Worldwide Minerals (WM) is no exception. If anything,

WM’s strategic position makes internal control even more important, operating as it does in many international situations

and dealing with minerals that must be guaranteed in terms of volume, grade and quality. Accordingly, your board

recognises that internal control underpins investor confidence. Investors have traditionally trusted WM’s management

because they have assumed it capable of managing its internal operations. This has, specifically, meant becoming aware

of and controlling known risks. Risks would not be known about and managed without adequate internal control

systems. Internal control, furthermore, helps to manage quality throughout the organisation and it provides

management with information on internal operations and compliance. These features are important in ensuring quality

at all stages in the WM value chain from the extraction of minerals to the delivery of product to our customers. Linked

to this is the importance of internal control in helping to expose and improve underperforming internal operations.

Finally, internal control systems are essential in providing information for internal and external reporting upon which, in

turn, investor confidence rests.

(ii) Proposals to improve internal systems at WM

As you may be aware, mineral estimation and measurement can be problematic, particularly in some regions. Indeed,

there are several factors that can lead to under or overestimation of reserves valuations as a result of geological survey

techniques and regional cultural/social factors. In the case of mallerite, however, the issues that have been brought to

the board’s attention are matters of internal control and it is to these that I would now like to turn.

In first instance, it is clear from the fact that the overestimate was made that we will need to audit geological reports at

an appropriate (and probably lower) level in the organisation in future.

Once a claim has been made about a given mineral resource level, especially one upon which investor returns might

depend, appropriate systems will be instituted to ask for and obtain evidence that such reserves have been correctly and

accurately quantified.

We will recognise that single and verbal source reports of reserve quantities may not necessarily be accurate. This was

one of the apparent causes of the overestimation of mallerite. A system of auditing actual reserves rather than relying

on verbal evidence will rectify this.

The purchase of any going concern business, such as the mallerite mine, is subject to due diligence. WM will be

examining its procedures in this area to ensure that they are fit for purpose in the way that they may not have been in

respect of the purchase of the mallerite mine. I will be taking all appropriate steps to ensure that all of these internal

control issues can be addressed in future.

Thank you for your continued support of Worldwide Minerals and I hope the foregoing goes some way to reassure you

that the company places the highest value on its investors and their loyalty.

Yours faithfully,

Tim Blake

Chairman

12 Which of the following statements are correct?

(1) Contingent assets are included as assets in financial statements if it is probable that they will arise.

(2) Contingent liabilities must be provided for in financial statements if it is probable that they will arise.

(3) Details of all adjusting events after the balance sheet date must be given in notes to the financial statements.

(4) Material non-adjusting events are disclosed by note in the financial statements.

A 1 and 2

B 2 and 4

C 3 and 4

D 1 and 3

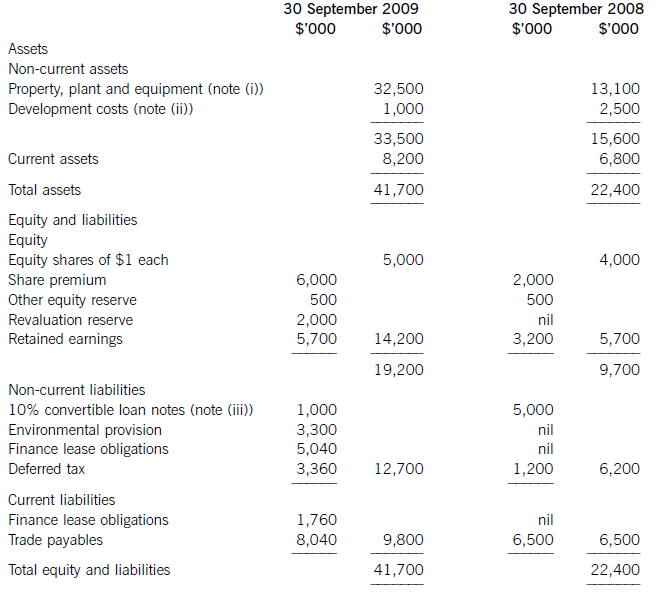

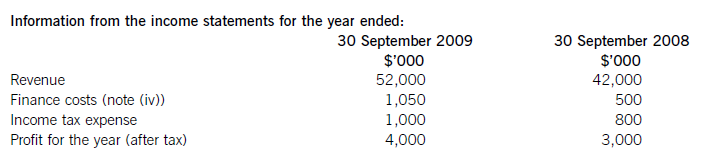

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

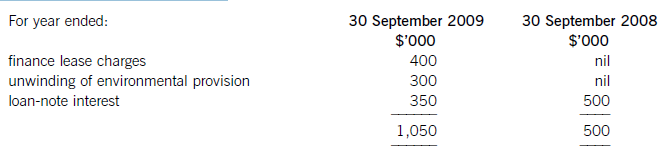

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced.

2 Your firm was appointed as auditor to Indigo Co, an iron and steel corporation, in September 2005. You are the

manager in charge of the audit of the financial statements of Indigo, for the year ending 31 December 2005.

Indigo owns office buildings, a workshop and a substantial stockyard on land that was leased in 1995 for 25 years.

Day-to-day operations are managed by the chief accountant, purchasing manager and workshop supervisor who

report to the managing director.

All iron, steel and other metals are purchased for cash at ‘scrap’ prices determined by the purchasing manager. Scrap

metal is mostly high volume. A weighbridge at the entrance to the stockyard weighs trucks and vans before and after

the scrap metals that they carry are unloaded into the stockyard.

Two furnaces in the workshop melt down the salvageable scrap metal into blocks the size of small bricks that are then

stored in the workshop. These are sold on both credit and cash terms. The furnaces are now 10 years old and have

an estimated useful life of a further 15 years. However, the furnace linings are replaced every four years. An annual

provision is made for 25% of the estimated cost of the next relining. A by-product of the operation of the furnaces is

the production of ‘clinker’. Most of this is sold, for cash, for road surfacing but some is illegally dumped.

Indigo’s operations are subsidised by the local authority as their existence encourages recycling and means that there

is less dumping of metal items. Indigo receives a subsidy calculated at 15% of the market value of metals purchased,

as declared in a quarterly return. The return for the quarter to 31 December 2005 is due to be submitted on

21 January 2006.

Indigo maintains manual inventory records by metal and estimated quality. Indigo counted inventory at 30 November

2005 with the intention of ‘rolling-forward’ the purchasing manager’s valuation as at that date to the year-end

quantities per the manual records. However, you were not aware of this until you visited Indigo yesterday to plan

your year-end procedures.

During yesterday’s tour of Indigo’s premises you saw that:

(i) sheets of aluminium were strewn across fields adjacent to the stockyard after a storm blew them away;

(ii) much of the vast quantity of iron piled up in the stockyard is rusty;

(iii) piles of copper and brass, that can be distinguished with a simple acid test, have been mixed up.

The count sheets show that metal quantities have increased, on average, by a third since last year; the quantity of

aluminium, however, is shown to be three times more. There is no suitably qualified metallurgical expert to value

inventory in the region in which Indigo operates.

The chief accountant disappeared on 1 December, taking the cash book and cash from three days’ sales with him.

The cash book was last posted to the general ledger as at 31 October 2005. The managing director has made an

allegation of fraud against the chief accountant to the police.

The auditor’s report on the financial statements for the year ended 31 December 2004 was unmodified.

Required:

(a) Describe the principal audit procedures to be carried out on the opening balances of the financial statements

of Indigo Co for the year ending 31 December 2005. (6 marks)

2 INDIGO CO

(a) Opening balances – principal audit procedures

Tutorial note: ‘Opening balances’ means those account balances which exist at the beginning of the period. The question

clearly states that the prior year auditor’s report was unmodified therefore any digression into the prior period opinion being

other than unmodified or the prior period not having been audited will not earn marks.

■ Review of the application of appropriate accounting policies in the financial statements for the year ended 31 December

2004 to ensure consistent with those applied in 2005.

■ Where permitted (e.g. if there is a reciprocal arrangement with the predecessor auditor to share audit working papers

on a change of appointment), a review of the prior period audit working papers.

Tutorial note: There is no legal, ethical or other professional duty that requires a predecessor auditor to make available

its working papers.

■ Current period audit procedures that provide evidence concerning the existence, measurement and completeness of

rights and obligations. For example:

? after-date receipts (in January 2005 and later) confirming the recoverable amount of trade receivables at

31 December 2004;

? similarly, after-date payments confirming the completeness of trade and other payables (for services);

? after-date sales of inventory held at 31 December 2004;

? review of January 2005 bank reconciliation (confirming clearance of reconciling items at 31 December 2004).

■ Analytical procedures on ratios calculated month-on-month from 31 December 2004 to date and further investigation

of any distortions identified at the beginning of the current reporting period. For example:

? inventory turnover (by category of metal);

? average collection payment;

? average payment period;

? gross profit percentage (by metal).

■ Examination of historic accounting records for non-current assets and liabilities (if necessary). For example:

? agreeing balances on asset registers to the client’s trial balance as at 31 December 2004;

? agreeing statements of balances on loan accounts to the financial statements as at 31 December 2004.

■ If the above procedures do not provide sufficient evidence, additional substantive procedures should be performed. For

example, if additional evidence is required concerning inventory at 31 December 2004, cut-off tests may be

reperformed.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-09

- 2020-02-21

- 2019-12-28

- 2020-01-09

- 2019-12-27

- 2020-04-22

- 2020-01-09

- 2020-01-09

- 2020-05-20

- 2020-01-09

- 2020-03-15

- 2020-02-13

- 2020-01-09

- 2019-12-28

- 2020-03-21

- 2020-01-30

- 2019-07-19

- 2020-01-09

- 2020-03-07

- 2020-04-29

- 2020-01-09

- 2020-05-02

- 2020-04-22

- 2020-01-30

- 2020-04-24

- 2020-05-07

- 2019-07-19

- 2020-05-14

- 2020-04-10