ACCA免费退考日期通常是什么时候?了解一下!

发布时间:2020-03-21

关于ACCA免费退考日期通常是什么时候?很多小伙伴还不清楚,没关系,今天来51题库考试学习网告诉你!

ACCA考试需要我们至少提前一个月进行报考,相信很大一部分ACCA考生都可能会因为生活或工作等方面的临时原因而无法参加考试,那是不是就白白浪费了ACCA考试报名费用?其实不一定。ACCA官方是可以提供考期的更改或推考的。

ACCA退考流程:

1.进入myACCA账户

Step 1 登录到你的myacca账户,进入“Exam Entry”页面中,点击“View/ Amend Exam Entry”进入报考更改页面

。

Step 2 进入页面后,点击“Amend

Exam Entry”进行考试报名更改。

Step 3 更改报考的页面中,会出现初始报名的页面,如需删减考试科目,请将科目的“√” 去除;如需增加科目,请直接在需报考的科目后打勾。

Step 4 更改考试报名后,会显示出哪门科目被取消,哪门科目已报考成功,相应的费用也会在此页面中进行调整和更改。点击“Proceed to payment”进入支付页面进行付费。

2.申请退考

然后,之前缴纳的考试费,ACCA退考后成功后,会返回到你的ACCA账户里,可以用来缴年费和下次考试。

成为ACCA会员会享受哪些福利?

ACCA会员因其国际视野、高端专业技能和高标准的职业操守广受认可。

近年来,为吸引和培养国际化高端财会人才,北京、上海、深圳、成都、广州等不少地方注册会计师协会纷纷将ACCA纳入行业发展专项基金的奖励范畴,为ACCA人才提供数额可观的现金奖励。

除了注协,不少地方政府也纷纷把ACCA纳入紧缺人才目录、高端金融人才发展规划之中,给与不同程度的财政支持和福利待遇。

ACCA与国内外优秀商学院强强联手,推出专属项目及奖学金计划,汇集众多优质学习资源及平台支持,满足会员终身职业发展的需求。

1、伦敦大学专业会计硕士项目

2、牛津布鲁克斯大学MBA项目

3、中欧FMBA-ACCA专项奖学金计划

4、香港中文大学高等金融研究院ACCA专项奖学金计划

5、中山大学岭南学院中美EMBA(CHEMBA)ACCA专项奖学金计划

6、上海交大上海高级金融学院“SAIF-前沿金融管理课程ACCA专项奖学金”

7、上海国家会计学院EMPAcc-ACCA奖学金计划

以上就是51题库考试学习网带给大家的内容,如果还有其他不清楚的问题,请及时反馈给51题库考试学习网,我们会尽快帮您解答。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) the recent financial performance of Merton plc from a shareholder perspective. Clearly identify any

issues that you consider should be brought to the attention of the ordinary shareholders. (15 marks)

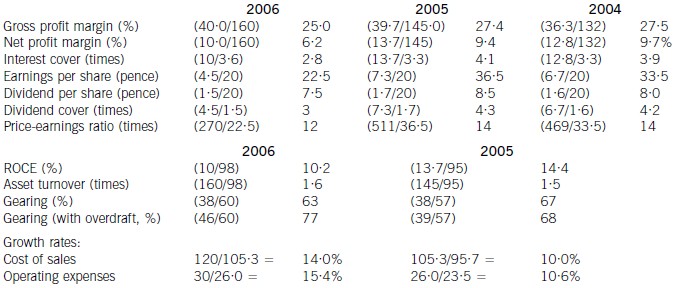

(ii) Discussion of financial performance

It is clear that 2006 has been a difficult year for Merton plc. There are very few areas of interest to shareholders where

anything positive can be found to say.

Profitability

Return on capital employed has declined from 14·4% in 2005, which compared favourably with the sector average of

12%, to 10·2% in 2006. Since asset turnover has improved from 1·5 to 1·6 in the same period, the cause of the decline

is falling profitability. Gross profit margin has fallen each year from 27·5% in 2004 to 25% in 2006, equal to the sector

average, despite an overall increase in turnover during the period of 10% per year. Merton plc has been unable to keep

cost of sales increases (14% in 2006 and 10% in 2005) below the increases in turnover. Net profit margin has declined

over the same period from 9·7% to 6·2%, compared to the sector average of 8%, because of substantial increases in

operating expenses (15·4% in 2006 and 10·6% in 2005). There is a pressing need here for Merton plc to bring cost

of sales and operating costs under control in order to improve profitability.

Gearing and financial risk

Gearing as measured by debt/equity has fallen from 67% (2005) to 63% (2006) because of an increase in

shareholders’ funds through retained profits. Over the same period the overdraft has increased from £1m to £8m and

cash balances have fallen from £16m to £1m. This is a net movement of £22m. If the overdraft is included, gearing

has increased to 77% rather than falling to 63%.

None of these gearing levels compare favourably with the average gearing for the sector of 50%. If we consider the large

increase in the overdraft, financial risk has clearly increased during the period. This is also evidenced by the decline in

interest cover from 4·1 (2005) to 2·8 (2006) as operating profit has fallen and interest paid has increased. In each year

interest cover has been below the sector average of eight and the current level of 2·8 is dangerously low.

Share price

As the return required by equity investors increases with increasing financial risk, continued increases in the overdraft

will exert downward pressure on the company’s share price and further reductions may be expected.

Investor ratios

Earnings per share, dividend per share and dividend cover have all declined from 2005 to 2006. The cut in the dividend

per share from 8·5 pence per share to 7·5 pence per share is especially worrying. Although in its announcement the

company claimed that dividend growth and share price growth was expected, it could have chosen to maintain the

dividend, if it felt that the current poor performance was only temporary. By cutting the dividend it could be signalling

that it expects the poor performance to continue. Shareholders have no guarantee as to the level of future dividends.

This view could be shared by the market, which might explain why the price-earnings ratio has fallen from 14 times to

12 times.

Financing strategy

Merton plc has experienced an increase in fixed assets over the last period of £10m and an increase in stocks and

debtors of £21m. These increases have been financed by a decline in cash (£15m), an increase in the overdraft (£7m)

and an increase in trade credit (£6m). The company is following an aggressive strategy of financing long-term

investment from short-term sources. This is very risky, since if the overdraft needed to be repaid, the company would

have great difficulty in raising the funds required.

A further financing issue relates to redemption of the existing debentures. The 10% debentures are due to be redeemed

in two years’ time and Merton plc will need to find £13m in order to do this. It does not appear that this sum can be

raised internally. While it is possible that refinancing with debt paying a lower rate of interest may be possible, the low

level of interest cover may cause concern to potential providers of debt finance, resulting in a higher rate of interest. The

Finance Director of Merton plc needs to consider the redemption problem now, as thought is currently being given to

raising a substantial amount of new equity finance. This financing choice may not be available again in the near future,

forcing the company to look to debt finance as a way of effecting redemption.

Overtrading

The evidence produced by the financial analysis above is that Merton plc is showing some symptoms of overtrading

(undercapitalisation). The board are suggesting a rights issue as a way of financing an expansion of business, but it is

possible that a rights issue will be needed to deal with the overtrading problem. This is a further financing issue requiring

consideration in addition to the redemption of debentures mentioned earlier.

Conclusion

Ordinary shareholders need to be aware of the following issues.

1. Profitability has fallen over the last year due to poor cost control

2. A substantial increase in the overdraft over the last year has caused gearing to increase

3. It is possible that the share price will continue to fall

4. The dividend cut may warn of continuing poor performance in the future

5. A total of £13m of debentures need redeeming in two year’s time

6. A large amount of new finance is needed for working capital and debenture redemption

Appendix: Analysis of key ratios and financial information

(b) (i) Calculate Amanda’s income tax payable for the tax year 2006/07; (11 marks)

3 An organisation has decided to compare the benefits of promoting existing staff with those of appointing external

candidates and to assess whether the use of external recruitment consultants is appropriate.

Required:

(a) Describe the advantages of internal promotion. (5 marks)

3 All organisations rely upon their staff for success. However, recruitment of staff can be time consuming; a drain on resources and the necessary expertise may not exist within the organisation.

(a) Internal promotion describes the situation where an organisation has an explicit policy to promote from within and where there is a clear and transparent career structure. This is typical of many professional bodies, large organisations and public services.

The advantages of internal promotion are that it acts as a source of motivation, provides good general morale amongst employees and illustrates the organisation’s commitment to encouraging advancement. Recruitment is expensive and internal promotion is relatively inexpensive in terms of time, money and induction costs and since staff seeking promotion are known to the employer, training costs are minimised. Finally, the culture of the organisation is better understood by the individual.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-07-19

- 2020-01-09

- 2020-04-22

- 2020-04-07

- 2020-03-18

- 2020-05-08

- 2020-03-22

- 2020-01-09

- 2020-04-07

- 2020-09-04

- 2020-05-10

- 2020-01-09

- 2020-03-21

- 2020-03-13

- 2020-01-09

- 2020-04-14

- 2020-03-14

- 2020-04-20

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-09-04

- 2020-01-29

- 2020-04-19

- 2020-01-04

- 2020-04-28

- 2019-07-19

- 2020-01-09