震惊!2020ACCA会费又涨了!你一定要知道!

发布时间:2020-04-14

还没有缴纳年费的同学看这里,你知道你今年要缴纳多少年费吗?今天51题库考试学习网将带大家了解一下2020ACCA的费用问题。

考ACCA的同学注意了,ACCA费用主要包括:注册费,年费,报名费。

下面根据2020年ACCA官网公布的费用来计算:

1、注册费:79£,一次性。

2、年费:112£,每年。每年5月8号前注册缴纳,5月8号之后注册次年1月1号缴纳。51题库考试学习网建议5月8号以后注册。

3、ACCA注册费,年费说明:注册费79£为一次性费用,由于ACCA考试课程繁多,考虑到大部分ACCA学员一般都需要三到四年时间学习,按照四年年费来计算,为112*4=448英镑,约等于4121RMB。

4、ACCA考试费用:(注:所有考试费用都以早期缴费为准。)F1-F3因为是随即机考,价格为各个机考中心定价,不会很贵,就按整数算:100£*3=300£,F4-F9一共6门,114*6=684£,SBL为188£,SBR为147£,P4-P7选二为147*2£,所有费用加起来为300+684+188+147*2≈13487元。注:汇率取1£=¥9.2,请同学们随时关注汇率变化。

5、ACCA教材费用:13科科目的教材,每科以350元计算,共4550元。

6、可能产生的额外费用:全部一次通过ACCA科目概率较低,挂科在所难免,尽量少挂科,减少挂科产生的额外费用。

注:每年ACCA的考试费,年费,注册费都可能上涨,以上计算的ACCA考试费用是2020年6月最新的计算费用。

所以,在不参加培训的情况下,ACCA注册费+年费+ACCA考试费用+ACCA教材费用+额外可能遇到的费用就为4121+13487+4550约等于22158元。

由此看来,ACCA考试的相关费用还是很高的,但这算大学期间可以考出来含金量较高的财会证书了。

总体上说,ACCA通过之后还是要交年费的,而且准会员和以后申请成为会员所要交的年费比ACCA学员更多,51题库考试学习网建议大家还是继续交纳年费比较好。有些同学觉得自己已经学成科就不缴纳年费,这会导致ACCA学员/准会员/会员的头衔就会被取消,要知道ACCA头衔带给大家的并不仅仅只是一张证书,更重要的是,ACCA官方会定期组织各种活动,这能够使大家获得与财会界许多同行一起交流的机会,同样是财会人拓宽自己视野和交际比较好的机会,最好不要错过。

如果一直缴纳会费,在成为ACCA会员 5年以后可以申请成为ACCA资深会员,即FCCA,缴纳会费还是带来很多好处的。

以上就是51题库考试学习网带来的有关ACCA费用的信息,虽然费用相对较高,但ACCA带给大家的不只是一张通行证,更是广阔的视野和人脉。更多资讯请关注51题库考试学习网。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) The sales director has suggested to Damian, that to encourage the salesmen to accept the new arrangement,

the company should increase the value of the accessories of their own choice that can be fitted to the low

emission cars.

State, giving reasons, whether or not Damian should implement the sales director’s suggestion.

(2 marks)

(ii) Damian should not agree to the sales director’s suggestion. The salesmen will each make a significant annual income

tax saving under the proposal, whereas the company will also be offset (at least partly) by the reduction in the dealer’s

bulk discount. Further, 100% first year allowance tax incentive for low emission cars is not guaranteed beyond 31 March

2008, and it is unlikely that any change in policy with regards to the provision of additional accessories will, once

implemented, be easily reversible.

(ii) Illustrate the benefit of revising the corporate structure by calculating the corporation tax (CT) payable

for the year ended 31 March 2006, on the assumptions that:

(1) no action is taken; and

(2) an amended structure as recommended in (i) above is implemented from 1 June 2005. (3 marks)

Note: requirement (a) includes 4 professional marks.

A central feature of the performance measurement system at TSC is the widespread use of league tables that display

each depot’s performance relative to one another.

Required:

(b) Evaluate the potential benefits and problems associated with the use of ‘league tables’ as a means of

measuring performance. (6 marks)

(b) A central feature of many performance measurement systems is the widespread use of league tables that display each

business unit’s performance relative to one another. In the case of service organisations such as TSC the use of league tables

emphasises the company’s critical success factors of profitability and quality of service by reporting results on a weekly basis

at the depot level. The fact that such league tables are used by management will actively encourage competition, in terms of

performance, among depots. The individual position of a business unit in the league table is keenly observed both by the

manager of that unit and his/her peers.

In theory, performance is transparent. In practice although each depot performs essentially the same function and is subject

to the same modes of measurement, circumstances pertaining to different business units may vary significantly. Some depots

may be situated near to the hub (main distribution centre), some may be located far away and some may be in urban zones

with well developed road networks whilst others may be in remote rural areas. Measuring performance via a league table

makes no allowance whatsoever for these relative differences, hence, inequality is built into the performance measurement

system.

Moreover, depot managers might be held responsible for areas over which they have no formal control. The network nature

of the business suggests that there will be a high degree of interdependence of depots; the depot responsible for collection

will very often not be the depot responsible for delivery. Therefore, it is frequently the case that business may be gained for

which the collecting depot receives the revenue, but for which the delivering depot bears the cost. Obviously this impacts

upon the profit statements of both depots. The formal system might not recognise such difficulties, the corporate view being

that ‘the business needs to be managed’; the depots should therefore see any such anomalies as mild constraints to work

around rather than barriers to break down. In such circumstances delivering depots and collecting depots should discuss such

problems on an informal basis. Such informal discussions are aided by close communications between depots recognising

the interdependencies of the business.

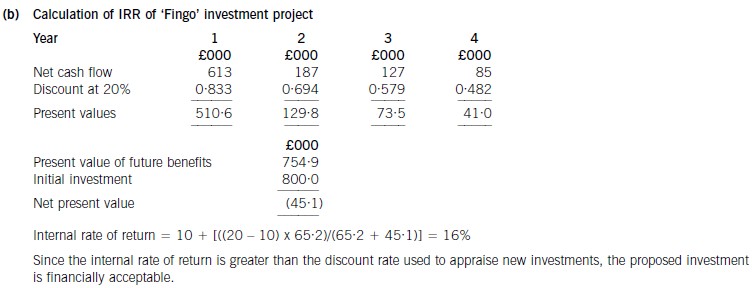

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-03-27

- 2020-01-09

- 2020-02-06

- 2020-04-21

- 2020-05-15

- 2020-01-09

- 2020-04-17

- 2020-05-13

- 2020-03-18

- 2019-07-19

- 2020-01-09

- 2020-05-20

- 2020-03-11

- 2020-01-09

- 2020-02-06

- 2020-03-28

- 2020-02-01

- 2020-05-13

- 2020-01-09

- 2020-04-01

- 2020-05-16

- 2020-03-18

- 2020-01-09

- 2020-01-09

- 2020-02-02

- 2020-01-09

- 2020-04-14

- 2020-04-11

- 2019-12-30